The energy industry needs to transition to a low-carbon paradigm to stay consistent with net-zero targets. However, a high degree of carbon lock-in persists and developments such as hydraulic fracturing raise questions on whether the innovation system is moving decisively enough. Sugandha Srivastav assesses how feasible the pivot from dirty to clean innovation is and uses a data-driven approach to challenge the implicit assumption that this shift is always difficult.

Economic activity must transition to a low-carbon paradigm to limit the impacts of climate change. However, fossil fuel firms make up a quarter of the total value of global equity markets, account for more than half of the non-financial corporate bond market and play a prominent role in some of the world’s largest economies such as India, China, the US and Russia (Hayes, 2014; Jamasmie, 2020). A high degree of carbon lock-in coexists with an imperative to transition to clean sectors and innovate for a net-zero future.

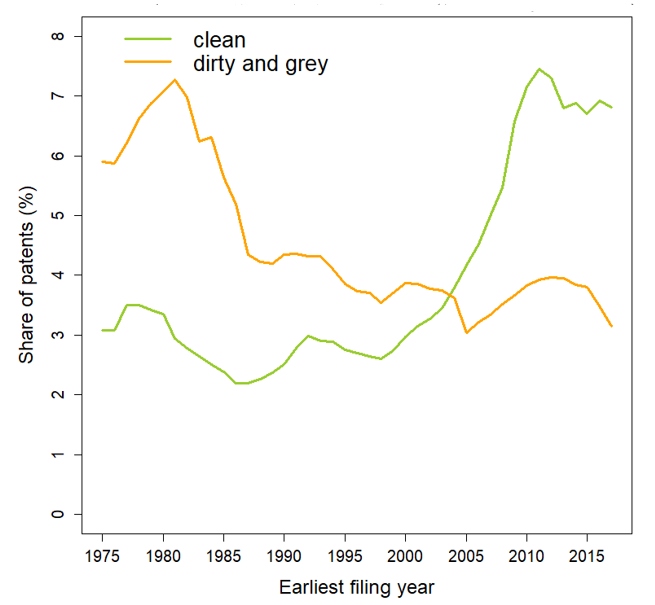

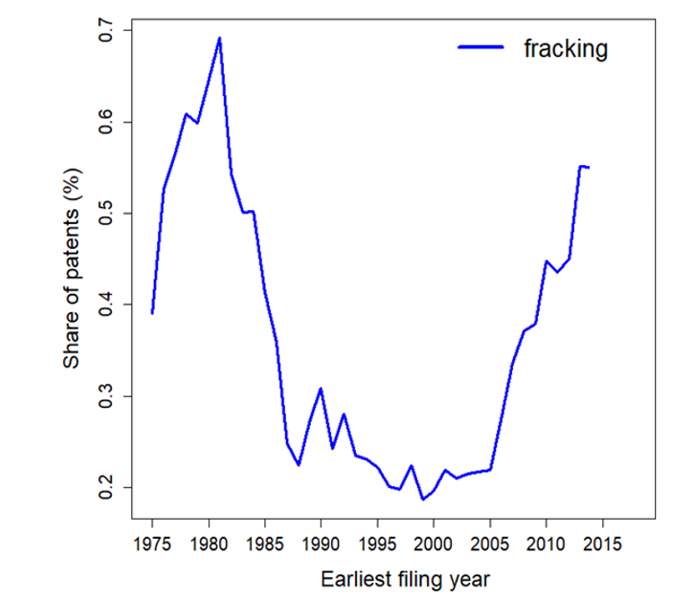

Yet the direction of innovation, even today, is uncertain. Clean patenting grew in the 1970s due to the Arab oil crisis and experienced significant acceleration from the late 1990s and early 2000s (Figure 1). However, it peaked around 2010 and has subsequently fallen due to the burst of the clean tech bubble, challenges in venture capital as a source of finance, and the rise of hydraulic fracturing (Dechezleprêtre, 2017; Gaddy et al., 2017; Popp et al., 2020). The rise of dirty patenting in 2005, after years of decline, was due to innovation in horizontal drilling, which resulted in natural gas becoming the primary fuel for electricity generation in the US (Popp et al., 2020). This revival of dirty innovation underscores the need to think about policy to steer the direction of innovation.

Figure 1. Trends in clean and dirty patenting

Source: Jee, S.J. and Srivastav, S., 2022. Knowledge spillovers between clean and dirty technologies.

Models of environment and directed technical change state that there is a high degree of path dependency in the innovation system or, in other words, that it is difficult to pivot from dirty to clean research and development (R&D) (Acemoglu et al., 2012; Aghion, et al., 2016; Acemoglu et al. 2016; Acemoglu et al. 2019). However, the calibrations in these models are based on an implicit assumption that clean and dirty technologies do not learn from each other, which is not empirically validated.

In a recent paper, we test this claim, which is important because if clean technology can learn from dirty technology, then we may be overstating the extent of path dependency in the system. For example, if clean and dirty technologies are not as dissimilar as conventionally assumed, there is more scope for transferring existing knowledge, skills, competencies, and even machinery from dirty to clean applications. This can reduce the risk of stranded labour and capital. If this is the case, then the challenge is less about path dependencies and more about coordination and expectations (i.e. do firms believe that there will be a net zero transition, and how do we deal with free-riding firms that want to simply leverage others’ low-carbon innovation).

Using patents granted by the US Patent and Trademark office (USPTO) from 1976 to 2020, we assess the extent to which clean technologies cite dirty technologies, with the assumption that citations reflect areas of shared skills and knowhow (an assumption we vet systematically). Since patents are legal instruments, much care is taken in ensuring prior art is appropriately cited. For example, after the inventor has listed citations, an external examiner checks the relevance of listed citations and adds further references that connect fundamentally to the new proposed invention.

We define clean technologies as those that mitigate greenhouse gas emissions, dirty technologies as those that contribute to emissions and grey technologies as energy-efficient versions of dirty technologies. To identify clean, dirty, and grey technologies, we leverage existing classifications schemes in the literature and supplement these with our own tagging efforts.

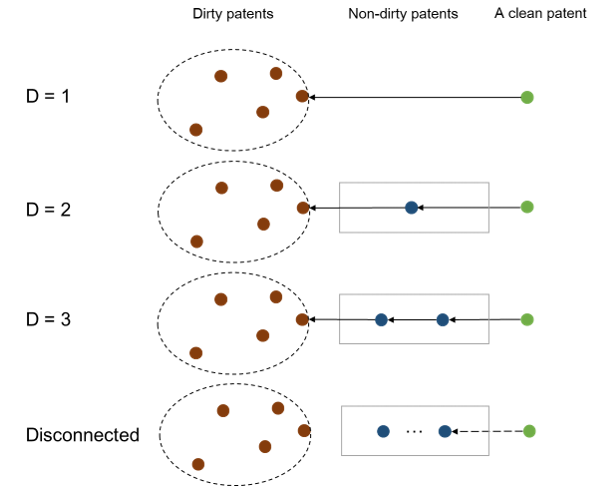

We measure the minimum distance at which all clean patents are connected to a dirty patent in the citation network. Our measure of distance is intuitively similar to the concept of “degrees of separation” where, if a clean patent directly cites a prior dirty patent, it has a distance of 1. If a clean patent cites an intermediary patent, which in turn cites a dirty patent, the distance is 2, and so on (Figure 2).

Figure 2. Measuring distance in the citation network

Source: Jee, S.J. and Srivastav, S., 2022. Knowledge spillovers between clean and dirty technologies.

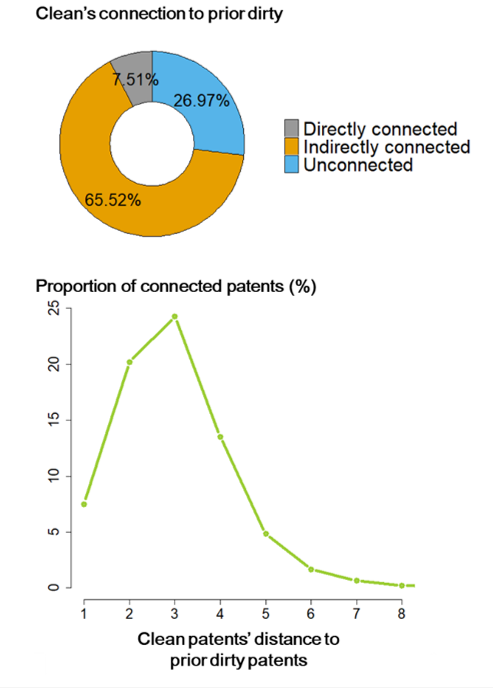

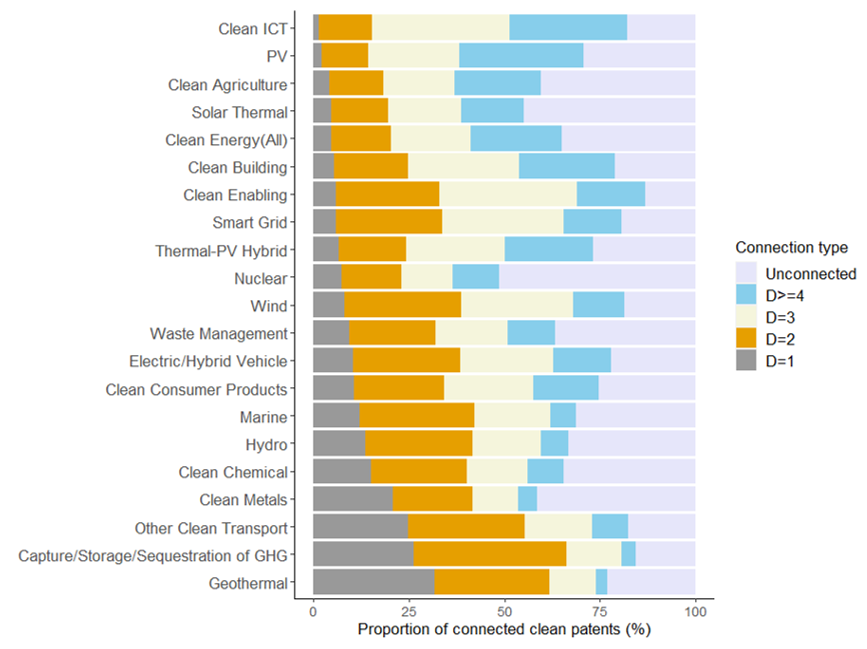

We find that less than one-tenth of clean technologies directly cite dirty prior art. However, the vast majority (65%) of the connections between clean and dirty technologies are indirect. Most clean patents are connected to a dirty one at distance equal to 3 (Figure 3). By comparison, the average distance between any two randomly selected patents in the US Patent Office is 8.5 (Mostafavi et al., 2012).

Figure 3. Direct and indirect connections between clean and dirty technologies in the patent citation network

Source: Jee, S.J. and Srivastav, S., 2022. Knowledge spillovers between clean and dirty technologies.

However, aggregate results conceal significant heterogeneity. More granular analysis reveals, for example, that geothermal energy, carbon capture and storage, and offshore wind learn significantly from dirty technologies, where commonalities such as the need for drilling, geological surveying, pollution control, seabed engineering and operating in offshore contexts create shared knowhow (Figure 4).

Offshore wind and tidal energy, for example, require knowledge inputs that are common to dirty technologies such as offshore oil. This includes seabed engineering, constructing offshore platforms, placing undersea cables, using undersea robots and finding materials that can withstand biofouling (when microorganisms attach themselves to the cables). This perhaps explains why offshore oil companies like British Petroleum put in bids for seabed rights in the North Sea to develop offshore wind farms, as they can leverage existing capital, skills and knowhow (King, 2021).

Geothermal energy and carbon capture & storage (CCS) are among the most reliant on the hydrocarbon knowledge paradigm, with at least one-fifth of patents directly citing prior dirty patents. Geothermal energy relies on geological surveying, drilling techniques, field development and the construction of wells, pipelines and other infrastructure, which require knowledge inputs that are commonly used by fossil fuel firms. CCS, for its part, is a complement to coal-fired power plants, gas stations and other point-sources of carbon dioxide emissions. The use of CCS naturally requires understanding how equipment can be fitted to these.

Figure 4. Sectoral level connections between clean and dirty technologies

Source: Jee, S.J. and Srivastav, S., 2022. Knowledge spillovers between clean and dirty technologies.

Clean innovation in transport, metals and chemicals is also more closely linked to dirty knowledge. This is because much of the innovation in these fields is incremental in nature and still embedded in the dirty production paradigm. Clean information and communication technology (ICT) and solar photovoltaic technologies (PV) are on the other end of the spectrum and have very low direct connections to prior dirty technologies.

Areas of high intellectual proximity may offer potentially promising diversification options for hydrocarbon incumbents, at least on an research and development (R&D) basis. Existing work has illustrated how knowledge relatedness is often a key factor in firms’ diversification choices because it can reduce switching costs (Breschi, Lissoni and Malerba 2003). Our analysis may also have relevance for countries that are locked into hydrocarbons and are looking for clean “adjacent” sectors to pivot into to avoid stranded skills, capital and labour.

In reality, diversification depends not only on knowledge relatedness but also on other factors such as supply chains, strategic fit, access to markets, etc. Yet, since knowledge is a key input into the production process, it is worth studying.

- This blog post is based on Knowledge Spillovers between Clean and Dirty Technologies, by Su Jung Jee and Sugandha Srivastav (2022).

- The post represents the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image provided by Shutterstock

- When you leave a comment, you’re agreeing to our Comment Policy.