Still affected by the cost-of-living crisis, the self-employed are struggling to recover their finances and mental health. Many of them would leave for a salaried job, yet they appear to be stuck in self-employment due to lack of skills and suitable opportunities. Their discontent will show in the next general election, write Robert Blackburn and Maria Ventura.

More than three years since the world was first hit by the COVID-19 shock, the UK economy has barely grown from its pre-pandemic levels. The consequences on the labour market are visible, with self-employed workers struggling the most to recover. Together with Stephen Machin, Director of the Centre for Economic Performance at LSE, we collected new survey data in June and July 2023 to investigate how the self-employed are faring in this troubled economic context. This follows on from six earlier surveys between May 2020 and November 2022, allowing us to track the progress in their situation since the outbreak of the COVID-19 pandemic until today.

A long way to recovery

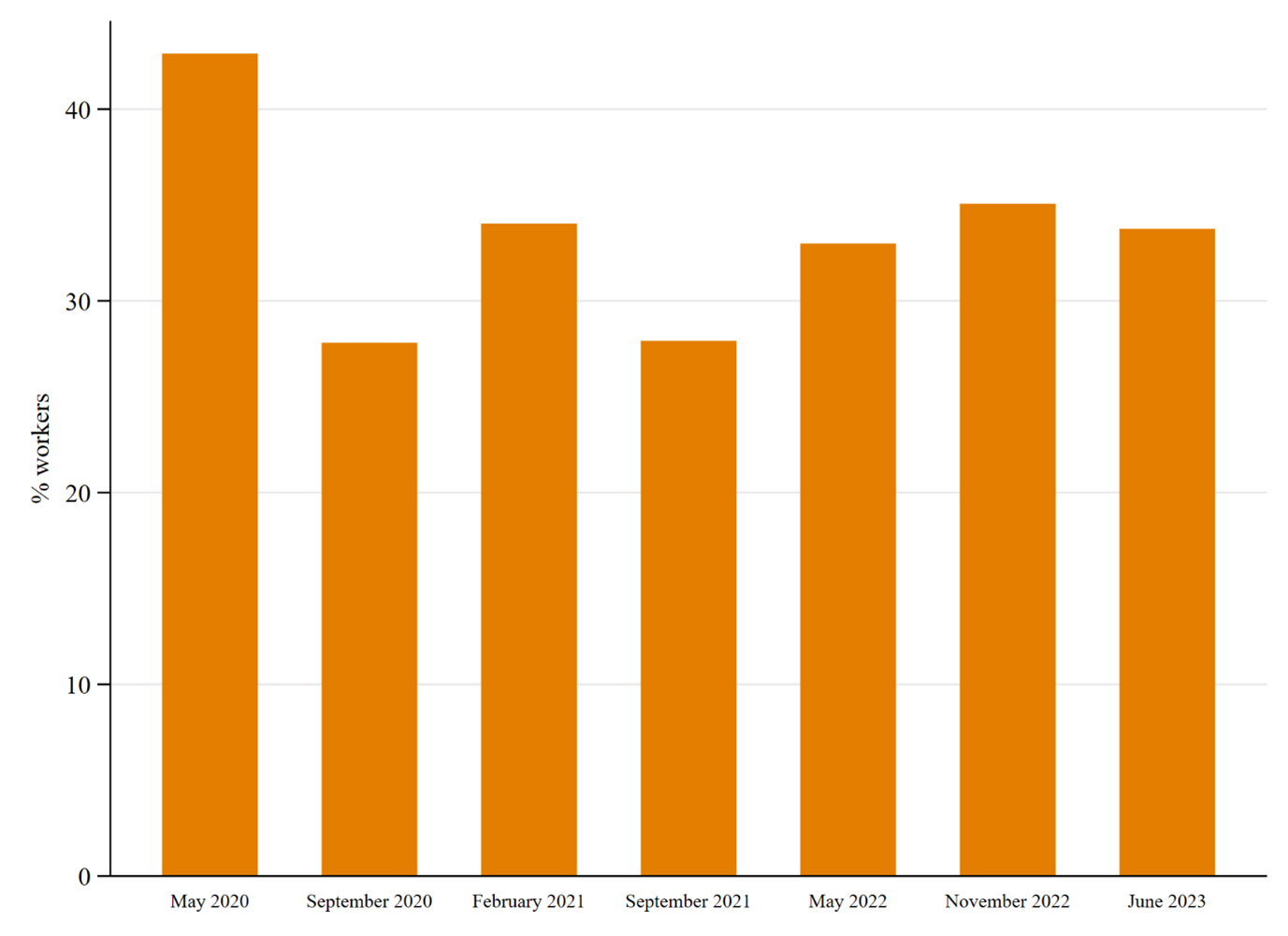

Since the beginning of COVID-19, the self-employed have been hit particularly hard. Inflows into self-employment have somewhat permanently dropped from pre-pandemic levels. This is likely to reflect the decrease in financial stability experienced by this group. Our survey has found that the share of self-employed experiencing difficulties paying for basic expenses has remained around a third (34 per cent). Figure 1 illustrates the comparison with previous rounds of the survey, revealing that the share has indeed tightly fluctuated around the same level in the past two and a half years, after a first drop from over 40 per cent during the first lockdown. In this light, it does not come as a surprise that many self-employed workers are expected to have missed the 31 July tax deadline, with the consequent HM Revenue and Custom penalties associated with a delay.

Figure 1. Share of self-employed experiencing financial difficulties

Source: LSE-CEP Surveys of UK Self-employment May 2020, September 2020, February 2021, September 2021, May 2022, November 2022 and June 2023

The cost-of-living crisis, which has substantially affected the self-employed in the last year, has been further exacerbated by the rises in the Bank of England’s interest rate and subsequent increase in borrowing costs. This has affected mortgages in particular, with 48 per cent of self-employed seeing their interest rate increase in the last months. Nevertheless, the impact of this rise may be uneven among the self-employed population as men and limited company directors are more likely to be homeowners and have a mortgage.

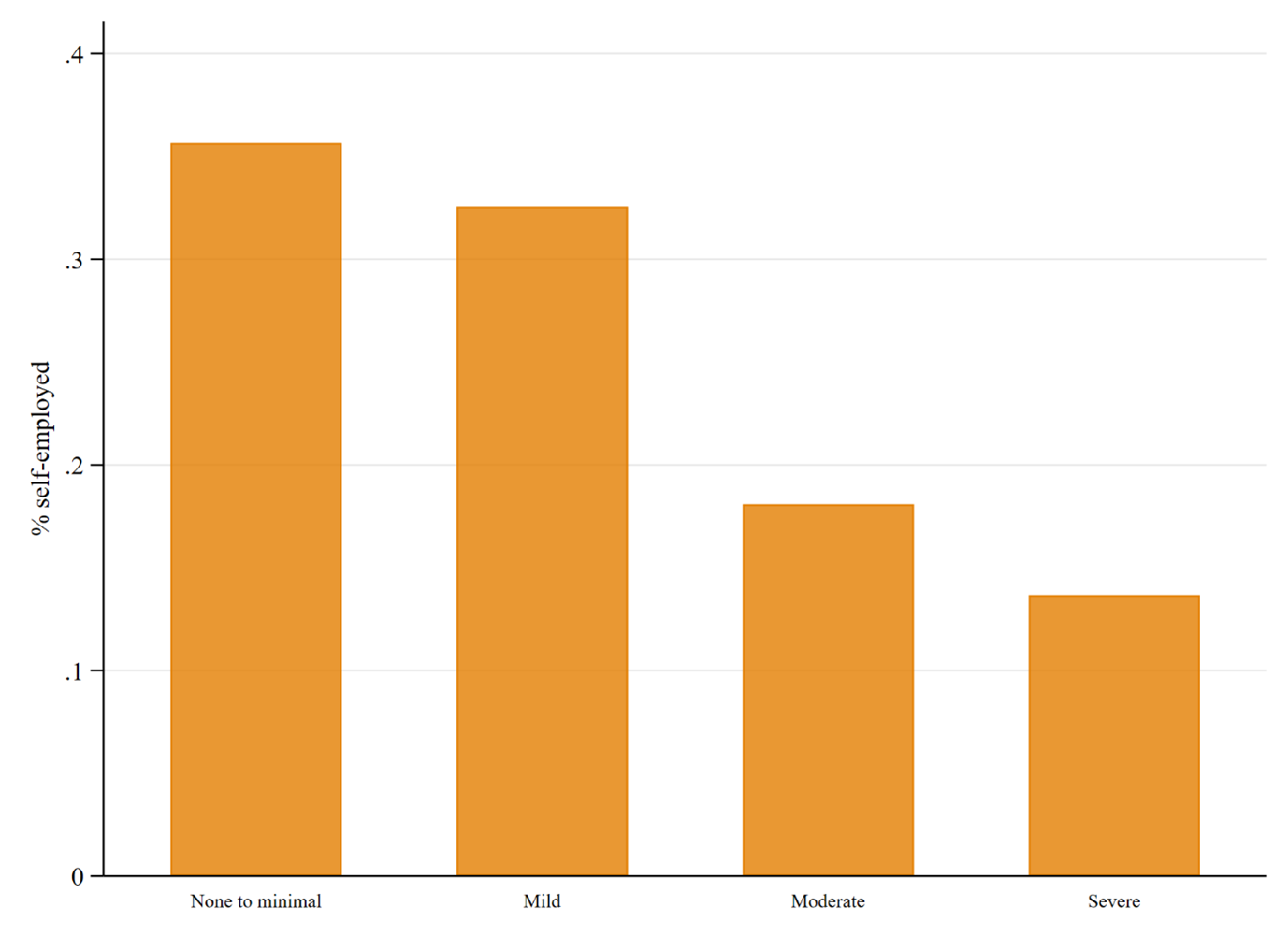

Understandably, the economic issues experienced by the self-employed are also affecting their health. Even though the wellbeing of this category of workers has in the past been considered higher than for employees, we find evidence of strong deterioration of their mental health. Figure 2 presents mental health scores of the interviewed self-employed, according to the Patient Health Questionnaire (PHQ-4), a common survey instrument employed by researchers to measure mental health in terms of anxiety and depression. The plot reveals that 31 per cent of self-employed are currently suffering from “moderate” or “severe” mental health issues. This amounts to roughly twice the average of 16 per cent for the general population, highlighting once again the evident disadvantage of self-employed individuals. As expected, when asked about the factors causing them distress, financial issues were mentioned by 27 per cent of individuals, closely followed by work, family and health concerns.

Figure 2. Mental health scores

Source: LSE-CEP Surveys of UK Self-employment June 2023. The scores are measured according to the PHQ-4 standard.

Why don’t the self-employed move out?

Given the hardships self-employed are going through, we may wonder whether there is desire among them to move towards less troubled waters – more stable forms of employment. In our survey, we elicited respondents’ willingness to pay for a move to a job in salaried employment through an income sacrifice or for an enhanced income. The results highlight a high willingness to change their employment status, even when this is associated with a pay cut. For example, about 1 in 8 respondents would sacrifice 20 per cent of their income for a move, and 4 in 10 would switch to an employee job if they could secure the same income level. Moreover, the solo self-employed would be more prepared to move than the ones with employees in case of an increase in earnings (around 70 per cent would move to get a 30 per cent increase in their current earnings). On the other hand, younger self-employed would be more prepared to switch to salaried employment when this entails an earnings drop.

If most self-employed would be willing to move to an employee job, why don’t they? For a third of the self-employed the issue appears to be the lack of similarly paid employee jobs, but more so for the self-employed with employees, whose baseline earnings are usually higher. For solo self-employed this is closely followed by the lack of adequate skills or training, which confirms how the lower level of human capital, which is often characteristic of this category of workers, may contribute to their being trapped in an undesirable situation. Older workers and those who have recently suffered financial issues are more pessimistic regarding their chances of moving to employment, in spite of their higher willingness to do so.

Parties shouldn’t ignore the self-employed

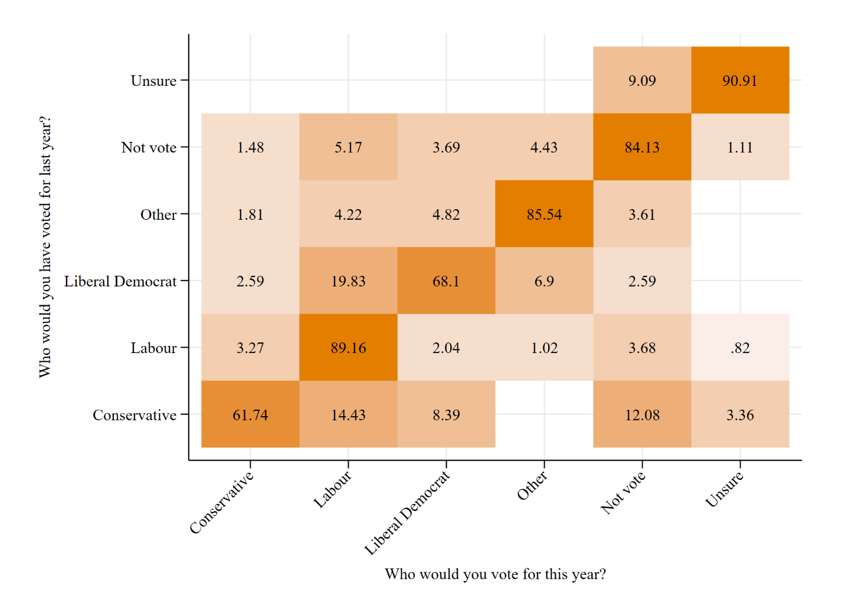

With little more than a year ahead of the next general election, it is natural to ask whether the current discontent of the self-employed will be reflected in their voting intentions. While these workers have been historically identified as supporters of free-market policies and conservatism, we have previously documented how their current political views favour the Labour Party. Our newly collected data allows us to compare their voting intentions one year go, with their current ones, and infer how their preferences have shifted amid the recent economic challenges.

We do so in Figure 3. Strikingly, only about 62 per cent of individuals who would have voted Conservative last year still would, as opposed to 89 per cent for the Labour Party. Of those who have moved away from the Conservative Party, 38 per cent would now vote Labour, and 32 per cent would not vote. Unusually, older self-employed are more likely than young ones to have moved their allegiance from the Conservative Party. This wind of change has been fostered by a general discontent concerning the Tories policy around self-employment as well as a renewed attention towards these more precarious workers from the Labour Party, who earlier this year committed to extending health and safety protections to self-employed workers. It is worth noting that one in five self-employed (around one million workers) still displays scepticism and claims they would not vote in a general election. Should these abstaining voters be swung into favouring one of the parties, they could well be very influential in the election’s outcome.

Figure 3. Past and future voting intentions

Source: LSE-CEP Surveys of UK Self-employment June 2023. Numbers in the plot refer to % of workers.

- This blog post is based on The Self-employment trap, CEP analysis paper.

- The post represents the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image provided by Shutterstock

- When you leave a comment, you’re agreeing to our Comment Policy.