There is growing recognition in government and business that the transition from a carbon-intensive to a green economy must be just, addressing the social dimensions of the process. However, investment in activities that respond to both the climate and human dimensions of net zero is still not sufficient. Lily Burge, Magali Van Coppenolle, Brendan Curran and Nick Robins consider what role bonds could play in the financing solution.

The transition to net zero will cost US$4.5 trillion globally per year by 2030, according to estimates by the International Energy Agency. For this investment to be effective, it must be just, addressing the social implications of the transition to low-carbon economies.

The transition to net zero will cost US$4.5 trillion globally per year by 2030, according to estimates by the International Energy Agency. For this investment to be effective, it must be just, addressing the social implications of the transition to low-carbon economies.

The European farmers’ protests are a recent reminder of the challenges that can arise when people are not put at the centre of climate policies. And anger over job losses from the closure of steel facilities at Port Talbot in South Wales can be attributed to a transition plan that did not adequately address the impacts for workers and communities.

While there is growing recognition among policymakers, investors and real economy actors of the need for a just transition, this has not been accompanied by sufficient levels of investment in activities that respond to both the climate and human dimensions of net zero.

Over the past decade, fixed income instruments have been a successful source of financing for environmental and social goals, but they have not yet been explicitly harnessed for the just transition. Could bonds, with a global market of significant size and liquidity, provide a way to drive more financing towards a just transition?

Space for financial innovation

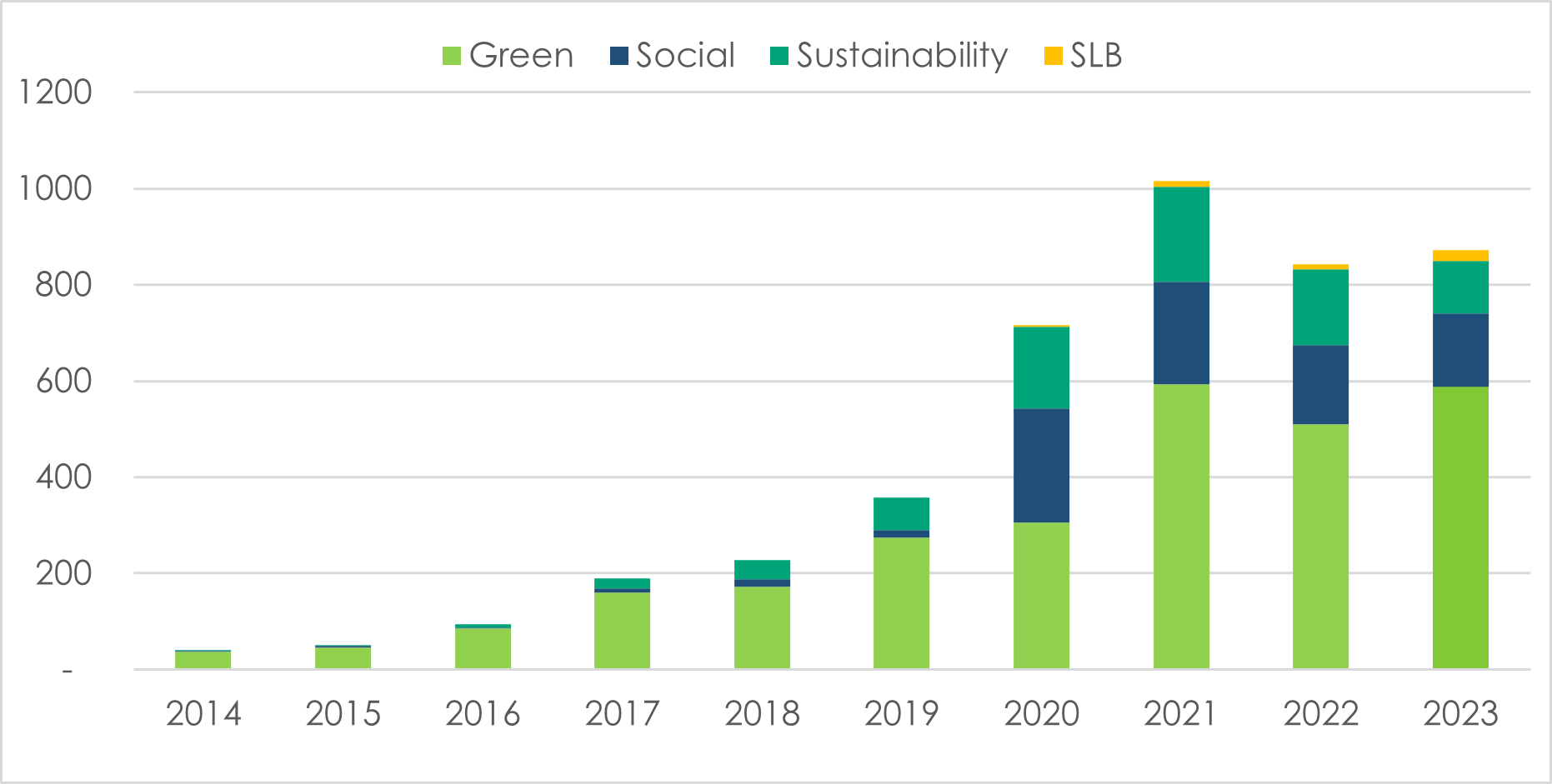

Innovative approaches to the structuring of debt instruments include designating the use of proceeds for specific projects in the case of green or social bonds and adjusting coupon rates based on the issuer’s achievement of impact targets in the case of sustainability-linked bonds (SLBs). These approaches attach specific environmental and social outcomes to the sale of green, social, sustainable and sustainability-linked (GSS+) bonds. The GSS+ bond market has grown significantly as investors have sought to deploy their capital sustainably: cumulative issuances to the end of 2023 totalled US$4.5 trillion in labelled bonds (see Figure 1).

Figure 1. Annual issuance of green, social, sustainable and sustainability-linked (GSS+) bonds, 2014–2023 (US$ billions)

Source: Climate Bonds Initiative

Innovation can also come in the form of what is to be financed through bond issuances. Sovereign issuers, for example, have started to issue debt to finance the delivery of emissions reduction targets stated in their nationally determined contributions (NDCs).

In 2022, Chile became the first government to link its NDC to a sovereign bond framework in the form of a sustainability-linked bond. This allowed the country to raise US$2 billion in its first issuance. The bond structure provides Chile with a financial incentive to deliver on their NDC’s social and climate commitments: if it fails, it faces an increased interest rate on its borrowing. The coupon price is linked to sustainability performance targets of reducing emissions and increasing renewable electricity generation. An additional gender equality target was added to Chile’s sustainability-linked bond framework in 2023. Failure to meet any one target in the stated timeframe will result in a coupon step-up of 12.5 basis points for the remainder of the life of the bond, bringing the coupon up to 4.465 per cent from a starting point of 4.34 per cent.

Earlier this year, Japan issued its debut labelled bond, the first ever sovereign transition bond, to finance decarbonisation subsidies and R&D spending as part of its Green Transformation Plan. As climate-related sovereign issuance grows, there is ample room for further innovation to jointly address environmental and social aspects of the transition.

Across sectors and geographies

The wide spectrum of potential GSS+ bond issuers is promising for the just transition because it encompasses many of the actors that must be involved in this systemic change, including national and sub-national entities, development banks, supranational institutions, educational and health authorities, and non-governmental organisations.

Furthermore, labelled bonds enable issuers in emerging markets and developing economies (EMDEs) to access international capital while providing assurance to investors of the green and social credentials of their investments. Such bonds are also well suited to risk-sharing mechanisms such as guarantees and blending that can improve risk–return profiles to investment-grade profiles, thereby reducing the cost of capital for issuers.

Annual net-zero investment needs to increase by four to eight times from current levels by 2030, with investment needs greatest in EMDEs. While it is crucial for capital to flow from the Global North to the Global South, this is not happening at sufficient speed or scale. GSS+ bond issuances can play a vital role in channelling international climate finance to where it is most needed and supporting these countries to invest in their own transitions.

Just transition bonds could support emerging markets to advance their dual climate and social objectives, including the Sustainable Development Goals, thereby tying investments in the low-carbon transition to those that ensure positive social outcomes. Such bonds could also ensure affordable and long-term access to capital for sovereign, sub-sovereign and private issuers. Indeed, data suggests that more emerging market actors are issuing such bonds.

Are bonds already in place?

Initial research findings from Climate Bonds Initiative and the Just Transition Finance Lab show that a small but not insignificant portion of existing GSS+ bonds already show potential to support a just energy transition in the energy sector.

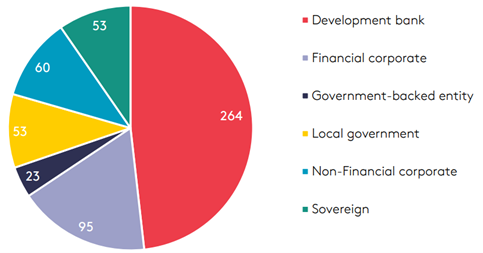

Using the Climate Bonds Social and Sustainable Bond Database, we identified issuances that finance both energy spending and employment, education or equality. This subset of just energy transition-related bonds was used in the analysis as a proxy for issuance with potential just energy transition characteristics. Most of these bonds were issued by development banks, reflecting their social, climate and development policy goals (see Figure 2). However, despite financing just transition-related expenditures, none of the issuances identified referenced the just transition explicitly in their use of proceeds.

Figure 2. Share of bond issuers in the just energy transition dataset by total volume (US$ billions)

Source: Climate Bonds Initiative

GSS+ issuance can help demonstrate the issuer’s commitment to a just transition – even in the absence of (just) transition plans – through the information provided in bond frameworks and related documentation. As robust transition plans will play a key role in safeguarding the just transition and as the number of transition plans increase, there is an opportunity for bond issuers to design bonds linked to the plans to finance outcomes aligned with a just transition.

The just transition remains a nascent theme for both issuers and investors in the GSS+ bond market. Given the potential for these bonds to scale up financing of low-carbon investments that support social outcomes, it is vital to tackle market barriers to their issuance and support market leaders to integrate just transition factors into their sustainable financing frameworks.

* The authors would like to thank Antonina Scheer for her review of this blog post.

- This blog post is part of a joint series with LSE’s Just Transition Finance Lab.

- It is based on Mobilising global debt markets for a just transition, the first report of a research collaboration between Climate Bonds Initiative and the Just Transition Finance Lab at LSE to assess how bond markets can support the just transition to net-zero emissions around the world.

- The post represents the views of the author(s), not the position of LSE Business Review or the London School of Economics and Political Science.

- Featured image provided by Shutterstock

- When you leave a comment, you’re agreeing to our Comment Policy.