Beppe Grillo’s Five Star Movement riding high in the polls in Italy has led to speculation over the prospect of the country leaving the euro. Lorenzo Codogno and Giampaolo Galli argue that an ‘Italexit’ would be a catastrophic scenario, with incommensurable economic, social, and political costs lasting for many years. They note that redenomination, and a likely default on debt obligations, would not be a solution to the problem of a high public debt and would produce significant financial and economic instability. A far better and less costly solution would be to address Italy’s underlying problems, allowing the country to survive and thrive within the euro by enhancing potential growth and economic resilience.

Beppe Grillo’s Five Star Movement riding high in the polls in Italy has led to speculation over the prospect of the country leaving the euro. Lorenzo Codogno and Giampaolo Galli argue that an ‘Italexit’ would be a catastrophic scenario, with incommensurable economic, social, and political costs lasting for many years. They note that redenomination, and a likely default on debt obligations, would not be a solution to the problem of a high public debt and would produce significant financial and economic instability. A far better and less costly solution would be to address Italy’s underlying problems, allowing the country to survive and thrive within the euro by enhancing potential growth and economic resilience.

In recent times, there has been a rising populist mood in Europe against the European Union (EU), the European Economic and Monetary Union (EMU), and the euro. Italy is no exception. Brexit and the rise of anti-establishment movements have bolstered this trend across the continent. Exit from the EU is doable, although hugely disruptive and complex, as the United Kingdom is now discovering the hard way. However, exit from the monetary union would be disruptive on a very different scale and could negatively affect the involved country’s economy for a number of years. Moreover, it may simply not solve the problems some people claim it would solve. Putting aside political motivations, some commentators, such as the authors of a recent Mediobanca Securities paper, have argued that leaving the euro is doable and that there are costs and benefits that need to be considered. They concluded that Italy would even reap a small benefit (8 billion euros) by getting out and also provided technical arguments on the effects of debt redenomination, arguing that redenomination in the future would be too costly and thus, the sooner the better. We strongly disagree.

First, the economic argument. The European Economic and Monetary Union is a huge project that has revealed numerous fragilities and problems during the financial crisis. Many of these problems are still wide open. Italy’s economy has performed badly since the launch of the euro and even in the convergence process that preceded monetary union. This is undeniable. Still, it is far less clear if this has much to do with monetary union itself or the strength of the euro. Many global phenomena occurred almost at the same time, starting from China’s entry into the World Trade Organisation, the surge of global supply chains, deep technological changes in communication, logistics, and many other sectors, as well as profound changes in the organisation of labour, with machines replacing workers and the ‘Uberisation’ of services. All these phenomena have very little to do with the euro. In fact, it can be argued that Italy missed the opportunities offered by the Single Market and European integration. Hence, the underlying problems may well be unrelated to the euro and have more to do with Italy’s inability to adapt to the structural changes in the global economy. Therefore, if the euro was not the problem, Italexit would not be the solution.

Political will vs. economic logic

Italexit may happen for three reasons: (1) political will overcoming economic logic; (2) continuing poor economic performance, with those unable to remain competitive calling for devaluation and departure from the single currency, combined with the inability to curb public deficits resulting in unsustainable public debt-to-GDP dynamics; and (3) financial market participants spotting the above two factors and producing a self-fulfilling prophecy. The second argument is weak, in our view, as Italexit would probably create more damage than benefits, and it would thus be much better to address the underlying problems instead. The latter argument is clearly a danger—if the perceived risk of (1) and (2) rises and pushes Italy’s government bond spreads up, Italexit would indeed become a self-fulfilling prophecy.

Political will may certainly counter economic logic, especially if we take some of the Five Star Movement’s statements at face value. Here is one example:

“The Euro is the heist of the century: it is not irrevocable, as Mario Draghi decided. Break the cage; regain the sovereignty sold off to kleptocrats, technocrats, and oligarchs. Rebuild from the rubble the Europe of people, calling upon citizens to express themselves with a referendum.”

Other statements openly suggest that Italexit would go hand in hand with a default on debt obligations. If these statements are taken seriously and the perceived risk of the Five Star Movement taking power increases, then what is now an extremely low probability event may turn into a self-fulfilling prophecy, even before any political shift actually happens. Moreover, in the next section, we argue that the suggested arithmetic of redenomination is misleading and self-defeating. We will then turn to the more general theme of exit from a monetary union.

Redenomination is not a solution

We start with the redenomination theme because it has recently attracted attention even among rather sophisticated economists and policy makers (e.g. Mediobanca Securities paper).

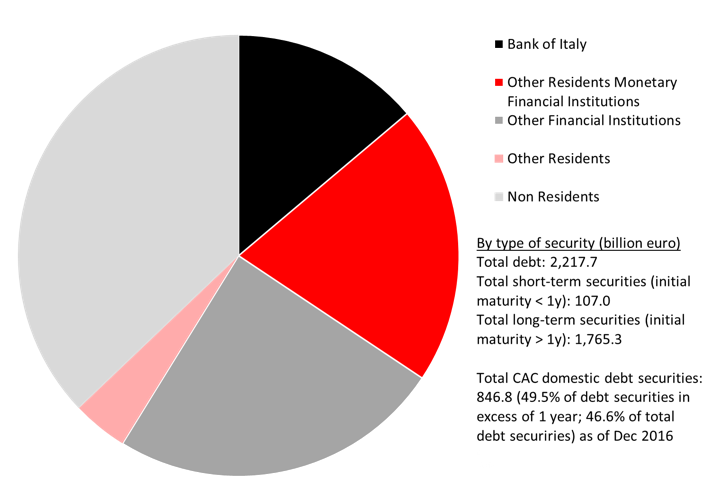

Their argument goes as follows. In the case of an exit, the Italian government could not redenominate the bonds issued after 1 January 2013 with initial maturities exceeding one year because such bonds are subject to the Collective Action Clause (CAC). According to our estimates, at the end of 2016, there were 847 billion euros in outstanding domestic bonds subject to CAC, equivalent to 49.5% of outstanding debt securities in excess of one year or 46.6% of total debt securities (see Figure 1). According to the authors of the Mediobanca Securities paper, Italy could still redenominate the bonds issued before 1 January 2013. Following exit and a 30% devaluation, the government would lose 280 billion euros on the portion of debt that cannot be redenominated (including bonds issued under foreign law and derivatives) and would ‘gain’ 191 billion euros on the portion of debt that would be redenominated.

The authors made three wrong assumptions:

(1) The mere existence of CAC de iure does not prevent a sovereign state from redenominating its debt (although redenomination triggers CAC). What matters the most is the legislation under which the securities were issued, i.e. Italian legislation for all domestic securities. As a result, at least in theory, all domestic obligations could be redenominated. Also, please note that, if there is no redenomination, the debt-to-GDP ratio would go to 190% under the assumption of a 30% devaluation, making default very likely.

(2) Moreover, derivatives are all under national legislation and can thus be redenominated.

(3) Finally, of the debt denominated in other currencies, which amounts to about 48 billion euros, only 9 billion falls under foreign legislation (USD bonds under New York legislation and a few EMTN under German legislation, i.e. Shuldschein). This also implies the possibility of redenomination.

Under the further—and indeed, quite bold—assumption that EU partners agree to inflate the QE bonds away, the authors conclude that Italexit would imply a gain of 8 billion euros. This is, of course, a very small sum, but this is not the point. The point is that this whole exercise conveys the impression that (a) the fear of an increase in the already very large burden of Italian debt following an exit is misplaced, and, more importantly, (b) the cost-benefit analysis for leaving the euro can be confined to direct short-term financial costs or benefits for the Treasury.

The former is clearly flawed reasoning because the redenomination of non-CAC government bonds produces no financial gain whatsoever for the government. It simply eliminates the loss incurred on the bonds that are not redenominated when exit from monetary union occurs. The elimination of loss is, of course, very different from the emergence of gain. On the liabilities side of the government balance sheet, expressed in the new domestic currency, there would be a loss on the portion of debt not redenominated and no change on the portion that is redenominated. Hence, the redenomination would cap the loss, but it would certainly not lead to gain.

In order to reap the gains that the authors claim would stem from redenomination, the government would effectively have to partly or entirely renege on the debt, and, following redenomination, some form of default would indeed look very likely. In that case, the liabilities side of the government balance sheet would record a loss on the portion of debt that is neither redenominated nor reneged and a gain on the portion that is reneged.

Figure 1: Holders of Italian debt

Source: Bank of Italy

It is also important to recall that not adhering to the contractual obligations to its creditors, including payment in the currency stipulated, would trigger a declaration of default by rating agencies. Needless to say, whatever problems one can see with redenominating the debt (in terms of reputation, future access to markets, etc.) would be compounded by a deliberate debt write-off on top of redenomination.

So far, we have considered the balance sheet expressed in the new domestic currency (let us say the new lira). Alternatively, we can look at the balance sheet expressed in euros. In this case, there would be no change in the event of no redenomination and there would actually be a gain in the event of partial or complete redenomination, with the value in euros diminished by the devaluation amount of the new currency. Perhaps, this is the “gain” that the authors had in mind. The problem is that, in this event, one should also consider the depreciation of domestic income or of the taxable base—valued in euro—that would occur following the devaluation of the new currency. If one goes through this simple arithmetic, the conclusion is that the ratio of the public debt-to-GDP (or to the taxable base) is invariant to the choice of the currency unit and must always rise after a devaluation.

The practical consequences of this reasoning are the following:

- There is no tipping point before which Italexit is financially convenient, as the Mediobanca Securities report suggests.

- Moreover, one cannot say that, as time goes by, exit from the euro becomes more expensive because the share of the debt that can be redenominated becomes smaller and smaller. In fact, even bonds with CAC can be redenominated at any time.

- There is no meaningful way for one to say that, if Italy were to exit now, there would be a gain of 8 billion euros. Indeed, following the assumptions of the Mediobanca paper—including a devaluation of the new lira by 30%—exiting now would have a cost of about 468 billion lire, i.e. the quantity of debt that cannot be redenominated (1,092 billion) multiplied by the appreciation of the euro vis-á-vis of the new currency. The public debt-to-GDP ratio would rise by 27 percentage points, from 133% to 160%.

- Therefore, Italexit would cause the debt burden to rise, making a default, i.e. a haircut on the redenominated or non-redenominated value of the bond, much more likely. This may even be a sought after outcome, as suggested by the statements of the Five Star Movement.

A possible interpretation of the idea that there could be financial gain from a devaluation stems from the notion that once a country regains monetary sovereignty, it can pay for the debt with paper money that its own central bank can print at essentially zero cost. We will not dwell on this issue from a general perspective. We just note that, if this were the case, the public debt of a sovereign country would never be a burden. What is more troublesome is that even the debt incurred by non-residents would not be a burden. As an example, Italy in 1992 was a sovereign country and most of its debt, even with non-residents, was denominated in the domestic currency. Yet, the debt was widely considered a serious problem for the government and for the country as a whole.

The costs of redenomination

So far, we have accepted the assumption that a country can redenominate its non-CAC foreign debt at no cost. This assumption is highly simplistic for the following reasons:

First, it is not a given that foreign jurisdictions would recognise the so-called Lex Monetae, i.e. Italy’s right to redenominate the bonds, and there would thus be a risk of foreign judges challenging the decision to redenominate and asking Italy to compensate bondholders for the losses incurred.

A redenomination by an international debtor such as Italy would have major consequences on the stability of the global financial system, as well as on individual intermediaries or companies holding Italian debt. Such consequences would occur in addition to those that are associated in the literature on a breakup of the common currency (which we consider in the next section of this paper), including:

- Bankruptcies of banks stemming from panicking depositors in the run up to the decision (in fact, the depositors’ rational decision to withdraw deposits from domestic banks).

- Loss of access to financial markets by both the government and private companies.

- Bankruptcies stemming from foreign liabilities held by private companies not matched by equivalent foreign assets. Private companies and banks could also try to redenominate, but they would be highly discouraged by the reputational effects of such a decision.

In this scenario, it is difficult to imagine ‘business as usual’ reactions by foreign countries, in financial as well as political terms. Italy’s exit from the euro would trigger a breakup of the euro itself and the European Union could hardly survive. Each country would try to insulate itself from contagion effects of other countries. As ECB President Mario Draghi recently stated, the Single Market would disappear. Beggar-thy-neighbours policies of the 1930s would become likely. The country at the origin of such an unhappy state of affairs would hardly have any status in international matters for quite some time.

From an economic perspective, in this scenario, the government deciding to exit would lose access to financial markets for a long time. This would be a tremendous problem for Italy given that the country needs to access markets to finance its budget deficit (estimated at about 40 billion euros or 2.4% of GDP in 2016) and, more importantly, to refinance its huge debt (estimated at 132.8% of GDP in 2016). Overall, Italy raised about 399 billion euros (net of exchange offerings) in 2016 and the amount may be in the order of 440 billion euros in 2017, due to higher redemptions. To eliminate the need to access markets, Italy would have to write off its entire debt (or postpone any payment for many years) and run a balanced budget thereafter. This is, of course, a doomsday scenario, implying an unprecedented dose of austerity with a dramatic fall in domestic demand and a huge rise in unemployment, only partly compensated by a rise in exports. Yet, it would be a realistic scenario under the assumption that Italy exits the euro. For many years to come, investors would avoid buying Italian paper.

We conclude that redenominating the debt or part of it would add momentum to a catastrophic scenario that would occur anyway because of a decision to leave the single currency. In the next section, we show why the basic scenario would be massively negative, by reviewing arguments that are not new for economists, but, given the political importance of the issue, ought to be brought to public attention.

Exit: a catastrophic scenario

One can discuss whether the euro was a good idea or not. Discussion on this point is wide open, as has the debate between supporters of fixed and flexible exchange rates. However, there is hardly any question that, once a country is in the single currency, exiting would create enormous problems. Indeed, problems are likely to arise even before exit is actually implemented.

From the viewpoint of both policy makers and market participants, this is really the key issue today. It points to the fact that even a populist government elected on an exit platform (for example, the Front National in France or the Five Star Movement in Italy) may change its attitude once in power, as concrete financial problems would pile up. Nevertheless, their stance may cause severe problems even before they get to power, as financial markets start discounting such an event.

This is the reason why we think that a breakup of the euro is unlikely to happen willingly anytime soon, but it may happen unwillingly and messily. It is often true that political will prevails over economic logic. However, when economic problems become dramatic and tangible, economic logic may become a matter of political survival, as was the case in Greece.

Yanis Varoufakis convincingly explained the reason why problems are likely to arise much earlier. He is certainly a man with no sympathy for the European establishment. He did try, until the very last possible moment, to design an exit strategy for his country. This is what he said: “Exiting the euro means creating a new currency, which would require at least a year to introduce it, in order to then devalue it. This would be catastrophic, because, with such advance notice, investors—and even ordinary citizens—would liquidate anything, and would take money out in the period before the devaluation, and in the country nothing would be left”.

Indeed, this is what happened in Greece in July 2015, when a popular referendum rejected the austerity measures of the so-called Troika, which would have made exit very likely, even though exit was not part of the government programme. At that point, the financial crisis became unbearable as even ordinary citizens started to withdraw their deposits and sell domestic assets. The fall in financial asset prices eroded the capital of Greek banks, thus making it even more necessary for Greece to ask for urgent foreign support. At that point, in a matter of just a few days, the prime minister was essentially obliged to accept what had been rejected by the referendum in order to make it clear that Greece would not leave the euro.

The conclusion is that “once a nation has taken the path into the Eurozone, that path disappeared after the euro’s creation and any attempt to reverse along that, now non-existent, path could lead to a great fall off a tall cliff.”.

As for the international consequences of such a fall, Varoufakis envisions sharp conflicts among nations. “[A breakup of the euro] may even cause a war. In any case, nations would lash out against each other… Europe would once again cause the sinking of the world economy. China would be devastated by this and the US recovery would vanish. We would condemn the entire world to a lost generation”. The point is that contagion effects from even a small country exiting the euro are very large.

Do Plan Bs exist?

For most people, the considerations put forward above are sufficient for ruling out exiting the euro as a reasonable policy option. However, political parties that promote it would argue that there are ways around these problems, the so-called Plan Bs. To the best of our knowledge, no one has thus far been able to put forward a real plan to exit the euro without incurring dramatic costs. However, no-euro parties have put forward a number of arguments that are worth exploring further in some detail.

Secrecy: Some no-euro parties (e.g. the Northern League in Italy) claim that exit is doable as long as the intention to do so is maintained rigorously secret. The decision should hence be announced as a surprise on a Sunday evening, a day in which financial markets are closed. Secrecy would prevent all the problems from the above-mentioned investor panic. The difficulty with this theory is that it is not clear how the intention could possibly be kept secret in a democracy with a free press. Political parties who want to leave the euro (including the Northern League itself) are already campaigning against the euro, and everybody knows that this is their intention. In addition, once a political decision is made, it would take several months to produce the new currency and distribute it in the whole country. Moreover, the payment system is fully integrated in the Eurozone, and Italexit would thus be followed by massive technical problems, which would likely lead to a sudden stop in transactions for a long while, with inevitable damage to economic activity. It is effectively impossible to keep this plan entirely secret. Moreover, it would be incompatible with the democratic process.

Direct democracy: Some other no-euro parties (e.g. the Five Star Movement) have the exact opposite position. The people should be free to decide in a referendum on the euro. This is, of course, not an answer to the problem and in fact, would make the problem even worse since investors would be given even more time to take everything out of the country. However irrational, we record this position because, for some no-euro parties, the myth of direct democracy is the solution to every problem.

Bank holiday: Banks should be closed for some time following exit to prevent people from taking out deposits or changing their financial portfolios. In some sense, a partial closing of banks was implemented in both Cyprus and Greece. The problem is that this can be done for a few days, not for several months. In addition, as we argued above, such a closing should be implemented many months before the government makes the decision to start the exit process. However, this is clearly impossible since the closing itself would signal the government’s intention.

Capital controls: In order to check capital flight from the country, the government would have to implement very strict capital controls. Authorities should forbid or authorise on a case-by-case basis the purchase of foreign financial and real assets by residents. It is not clear how one can prevent foreign residents from divesting domestic assets. In any event, many countries have experienced prolonged capital controls, and Italy itself went through a very harsh regime during the 1970s and much of the 1980s. Experience shows that such controls may slow down capital movement in normal times, but they cannot prevent them. During crises, when investors feel that their money is seriously at risk, money flows abroad very rapidly. In Italy, for instance, this happened in January 1976 when, in a matter of days, foreign exchange reserves were depleted and the central bank was obliged to let the lira depreciate. Most of the capital flight was hidden inside the current account balance, in the form of leads and lags on foreign payments or under/over invoicing. Some of them took the form of outright illegal exports of banknotes. In any event, a system of capital controls is a very complex bureaucratic machine that cannot possibly be set up in one night. In addition, as far as bank holidays are concerned, such controls should be put in place long before the exit decision is made public.

The printing press: Recourse to the central bank’s printing press is essential in all the plans, or quasi-plans, of no-euro parties. The idea is that this would solve the problems of all private and public debt that cannot be redenominated. The debt of Italian entities with non-residents is estimated at 2,767 billion euros, i.e. almost 165% of GDP. Since this is irrelevant information as long as the euro exists, no one knows how much is implicitly hedged, i.e. the same agent holds assets matched by liabilities vis-á-vis non-residents. However, certainly, there would be many banks, companies, and individuals whose balance sheets would suffer from a currency mismatch. A small example of what could happen is provided by the case of ECU-denominated mortgages held by many Italian households in 1992, when the lira devalued. At the time, this was a major social problem and gave rise to an enormous amount of litigation, with the plaintiffs claiming that banks were violating anti-usury laws. All these problems would be solved, according to the no-euro camp, with the printing press. The basic difficulty with this argument is that the printing press would have to be used as a fiscal policy instrument, with the government reimbursing entities and individuals with balance sheet mismatches. It is not clear what criterion the government could use to give such reimbursements immediately, in order to prevent chain bankruptcies. In addition, once again, markets would anticipate the mismatch problem and would stop granting credit to the banks or companies affected by the problem. The problem would show up long before the exit decision. The printing press is also deemed necessary by the no-euro camp for preventing the government from going bankrupt.

Inflation and interest rates: One of the leitmotifs of the pro-euro camp is that the exit of a country such as Italy would cause high inflation and high interest rates, thus negatively affecting wage earners and borrowers. Here, the no-euro camp does not foresee a Plan B instrument to skirt the problem. They simply deny its existence by showing cases in which a large devaluation of some major currency, such as the dollar or the euro, has not been associated with running inflation. These examples miss the point for two reasons. First, devaluation in a small open economy with rigid imports of raw materials has a much greater impact on domestic prices than, say, a devaluation in a country like the US. Second, and more important, inflation would inevitably be on the rise due to the use of the printing press to monetise public debt and prevent chain bankruptcies in the private sector. Once again, this would be anticipated by markets, thus putting further upward pressure on interest rates long before the exit event.

The conclusion is that: (a) to the best of our knowledge, no serious Plan B has ever been presented, and (b) the arguments that have been put forward by no-euro parties are effectively flawed and cannot refute exit being a catastrophic event.

The myth of monetary sovereignty

A frequent objection to our previous conclusions is that the status quo is so unbearable that, for many people, it would be better to go through a short period of chaos than to continue with high unemployment and low wage jobs. If Italy were to regain monetary sovereignty, it would soon be able to offer better standards of living to most of its citizens. This idea is based on a myth, which has little in common with scientific thinking and, in particular, with the long-standing dispute over flexible versus fixed exchange rates. So, one might agree with Milton Friedman on the superior performance of flexible rates and nonetheless disagree with most of the arguments put forward by no-euro parties. One might also think, as Friedman did, that the euro was a bad idea and nonetheless disagree with the arguments put forward by the myth of monetary sovereignty. These distinctions are important because, in order to argue that the disruptions caused by exit are worthwhile, one needs to depict a post-euro world as a sort of Nirvana, which has never been the position of Milton Friedman or any other serious scholar. Hence, we must evaluate some of the key fake arguments of the no-euro parties.

Devaluation and real wages: One of the key false arguments has to do with the effect of devaluations on real wages. The following argument is repeated over and over again: “With the euro, Italy can only regain competitiveness through internal devaluation, i.e. a reduction in wages, while there is an easier solution—Italexit and devaluation”. This is a wonderful fake argument because it conveys the idea that, with a devaluation, an economy can regain competitiveness at no cost. At the same time, it conveys the poisonous idea that the euro was created exactly for devaluing labour. The point is, of course, that an external depreciation has the effect of boosting net exports and GDP only in so far as it reduces the purchasing power of wages. If wages are fully indexed, or if the unions try to avoid any loss in the purchasing power of their members, the devaluation would have no effect on real variables, such as exports and GDP and only affect the level of prices. Therefore, to set things straight, one should say that, before the euro, countries could recoup competitiveness by reducing real wages through the deceitful instrument of external devaluation. With the euro, companies and governments have to negotiate with workers. In his famous paper on exchange rates, Milton Friedman clarified this point. An external devaluation is equivalent to adjusting the clocks for daylight savings time in the summer, while an internal devaluation forces individuals to change their habits, go to the office one hour earlier, have lunch an hour earlier, etc. The difference is quite small although, as is well known, Friedman thought that it is much easier to change the clock, preferring flexible rates for this reason.

“German mercantilism uber alles”: Another fake argument of no-euro populists in peripheral countries is that the euro is a tool for a sort of new German imperialism. The narrative is that Germany wanted the euro in order to prevent depreciations by peripheral countries and to accumulate an enormous current account surplus. The purpose was to create a depression in neighbouring countries, a classic beggar-thy-neighbour policy, so as to become the dominant regional power. In this context, European institutions are nothing but a tool for German supremacy. By regaining sovereignty, countries would, at last, be freed from dependence on Germany. This narrative runs against history. It is true that, in an ideal cooperative setting, Germany would somewhat expand its domestic demand to reduce the surplus. Nevertheless, it is false that Germany follows mercantilist policies. On the contrary, Germany has always favoured a strong currency (a strong Deutsche mark first and then a strong euro), which is the opposite of mercantilism. At the euro’s inception, Germany and Italy were similar in terms of (high) GDP per capita and (low) rates of growth. Germany implemented deep reforms and managed to obtain an inflation rate consistent with the agreed ECB target of below, but close to two per cent. Other countries, Italy among them, have experienced somewhat higher inflation and lagged behind in productivity (in addition to increasing taxation on labour until 2011), thus creating the problem of asymmetric economic performances with which we are confronted today. In addition, Germany accepted the EMU for political reasons (having a European Germany rather than a German Europe), but all economic arguments by the German establishment at the time were against monetary union and the participation of countries, such as Italy and Greece, with a rather weak record in terms of macroeconomic stability.

“Before the euro, individual countries enjoyed monetary sovereignty”: This idea is not correct. Before the euro, Italy’s monetary policy was essentially dominated by the decisions of the main central banks, and especially the Bundesbank, and by alternating sentiments in financial markets. One of the reasons behind the decision to build a monetary union was to regain some control over monetary policy, by sharing the decision-making process with other Eurozone partners. Indeed, the accommodating monetary stance now implemented in Europe by the ECB is appropriate for the euro area as a whole and would be unthinkable without the union.

“Before the euro, individual countries had stability and growth”: This is a myth for two reasons. First, Italy did not have stability. At various times, high and variable inflation, rising public debt, and repeated devaluations were the symptoms of a society that was not able to find an equilibrium and did create major social problems. Second, growth has fallen everywhere over the past 15 to 20 years, especially in countries with low or zero growth in total factor productivity. To grow more, there is no alternative but to increase productivity, through reforms and innovation. The idea that monetary sovereignty would have a positive impact on productivity has no basis in economic theory or common sense.

“With monetary sovereignty, a country cannot default”: There is a grain of truth in this statement, as a sovereign state can repay public debt by printing its own currency. However, this is only a small part of the story, for two reasons. First, even a sovereign state can default, and this occurs when inflation is so high that printing new money reduces seigniorage, as has occurred in many countries after major events such as wars or regime changes. Second, and most important, using the printing press to monetise debt does not come without economic and social costs. Such costs are essentially represented by the inflation tax, which is a particularly unfair tax since rich individuals can avoid it through appropriate investments, while most ordinary people end up paying it. No-euro populists are usually opposed to any tax and view taxes as a bizarre and perverse imposition by eurocrats. Nonetheless, they propose a solution that, in the end, implies the imposition of a tax unanimously considered as one of the most unjust. However, of course, they live in an imaginary world in which there are no trade-offs and benefits can be obtained at no cost.

Italexit would not result in exit from the European Union: Unless the European framework changes, exiting the Monetary Union would automatically imply exit from the European Union, and thus the Single Market. This would compound the negative economic implications and further exacerbate problems.

Conclusions

The euro is irrevocable. It was designed as Hotel California: “you can check out any time you like, but you can never leave!” However, we know that it would be wrong to take it for granted. Italexit could still happen as the unwilling and messy result of an unbearable deterioration in public finances and economic performance, combined with misguided political will and financial market turmoil. It would be a huge mistake. Much better, and less costly, would be to address the underlying problems, allowing Italy to survive and thrive within the euro by enhancing potential growth and economic resilience.

It would be wrong to conclude that Italexit, or exit from the monetary union by any other Member State, is going to be an easy process that can be evaluated with a straight cost-benefit analysis and smoothly managed in an orderly way. While Roger Bootle, one of the advocates of the return to national currencies, came to somewhat different conclusions, he acknowledged that the exit merely being the reverse of the construction process does not make it easy: “it would be the equivalent of unscrambling an omelette”.

In the case of Italexit, redenomination and default would become very likely and would cause a number of side effects and negative spillovers into the economy. Exit without redenomination would lead the debt-to-GDP ratio to reach 190%, assuming 30% devaluation, making default even more likely. Hence, Italexit would not address the issues its proponents claim it would address, while producing significant financial instability. Just mentioning it as a viable solution as part of a political platform would imply risks of making it a self-fulfilling prophecy. The economic, social, and political consequences would be enormous and last for a number of years.

Please read our comments policy before commenting.

Note: This article is based on a policy brief published by LUISS. The article gives the views of the authors, not the position of EUROPP – European Politics and Policy, nor of the London School of Economics. Featured image credit: Don Carlier (CC-BY-SA-2.0)

_________________________________

Lorenzo Codogno – LSE

Lorenzo Codogno – LSE

Lorenzo Codogno is Visiting Professor in Practice at the European Institute of the London School of Economics and founder and chief economist of his own consulting vehicle, LC Macro Advisors Ltd. Prior to joining the LSE, he was chief economist and director general at the Treasury Department of the Italian Ministry of Economy and Finance (May 2006-February 2015) and head of the Italian delegation at the Economic Policy Committee of the EU, which he chaired from January 2010 to December 2011, thus attending Ecofin/Eurogroup meetings with Ministers. He joined the Ministry from Bank of America, where he was managing director, senior economist, and co-head of European Economics based in London over the previous eleven years.

Giampaolo Galli

Giampaolo Galli

Giampaolo Galli is an MP in the Italian Chamber of Deputies where he is a member of the Budget Committee. In 1975, he graduated in Economics from Bocconi University in Milan. In 1980, he obtained a Ph.D. in Economics from MIT (Cambridge, MA). From 1980 to 1995, he worked at the Bank of Italy and represented it in many international institutions, including the European Union Monetary Committee, the OECD Economic Policy Committee, and the G10. From 1995 to 2003, he was Chief Economist of Confindustria. From 2003 to 2009, he was Director General of the National Association of Italian Insurance Companies (ANIA). From 2009 to 2012, he was General Director of Confindustria. He has taught Econometrics, Monetary Policy, and Economic Policy at Bocconi University (Milan), La Sapienza University (Rome), and LUISS Guido Carli University (Rome).

I disagree entirely with the only apparently plausible arguments of the paper, which seems to ignore a whole bunch of high-level scientific literature demonstrating the opposite of what the two distinguished europhiles hold. With apparently no sense of humor, they continue to evoke the spectre of inflation and debt whilst the problems of the country in question (and of the eurozone in general) are structural unemployment, lack of investments, a lost generation etc.

Incidentally, the statement according to which ” it is false that Germany follows mercantilist policies. On the contrary, Germany has always favoured a strong currency (a strong Deutsche mark first and then a strong euro), which is the opposite of mercantilism” is so true that Merkel has shown herself to be extremely glad for the ongoing depreciation of the US dollar… saying herzlichen Dank, Mr. President.

Argumentations of this kind (“the euro is irrevocable”) sounds like the epitaphs of a failing project: they resemble the words of the Soviet apparačik just before the collapse, unburdening themselves of the deathless claims that the ‘the hour of Socialism’ had dawned.