Since the 1990s, public sector outsourcing has evolved through competitive tendering, partnership working (particularly via Public Finance Initiatives), strategic-commissioning and prime-contracting. Each of these iterations has promised better public goods and services for less cost. Their practice, however, has frequently been marked by rising costs and lower service quality. Abby Innes explains why.

Since the 1990s, public sector outsourcing has evolved through competitive tendering, partnership working (particularly via Public Finance Initiatives), strategic-commissioning and prime-contracting. Each of these iterations has promised better public goods and services for less cost. Their practice, however, has frequently been marked by rising costs and lower service quality. Abby Innes explains why.

The logic of outsourcing is that market-based production is better than public production because the governance of private organisations is more transparent, flexible, efficiency focused and disciplined by owners. But this idea is problematic on two fronts. In the first place the presumption of market superiority is an artefact of public choice theory; it’s not rooted in historical assessment of which regime, public or private, has better produced public goods. In the second, this logic is dependent on ‘first-best-world’ economic theorising: it assumes an efficient market for simple goods, or for goods that can be somehow simplified. Hence for outsourcing to work those archetypal conditions have to exist. While they typically can exist for simple goods and services (the NHS doesn’t grow its own food), the outsourcing markets for complex goods and services characteristically fulfil none of the necessary conditions.

The neoclassical microeconomic logic behind outsourcing operates according to purely deductive-theoretic reasoning: i.e. in chains of logical reasoning that flow from explicit axioms to necessary outcomes, like Pythagoras’s theorem. This method allows for the valuable modelling of ‘small-world’, repetitive and simple transactions but around the essential, complex and interdependent services of the state it introduces some heinous sins of analytical omission. This is a form of argument that does not calibrate itself against observable reality as in other social sciences, including more critical neoclassical economics, but with the axiomatic reasoning or maths that ‘proves’ it. Around complex goods and services, however, reality conspires to render an efficient market impossible.

When we put the market rhetoric of New Public Management to one side outsourcing constitutes the central planning of private businesses, and the success of this venture hinges on the viability of the outsourcing contract as an effective junction of instruction and control. What contract theory tells us is that the more complex the service or good, the longer the duration of the contract and the greater the contingencies or uncertainties that the supplier might face, the less the outsourced tasks are amenable to codification and hence to robust contracts that can adequately protect the buyer.

Such ‘incomplete’ contracts create unanticipated and destined to be high costs for the management and supervision of the ‘non–contractible’ elements relating to service delivery. Frequent contractual failures require repeated (and given a poor bargaining position) expensive renegotiation. Complexity, shifting needs and interdependency are conditions endemic within public service goods and services.

The economics of Soviet central planning tells us that the resulting asymmetries in information and leverage between state and producer are just the start of bargaining games that the state cannot win. Given public funding the state remains both the only partner in the market relationship however numerous the ‘end users’ or rhetorical ‘customers’ may be, but also the continuous bearer of the contractual obligations and financial, legal and political liabilities and costs of a failed supplier: a position unique to the state.

The following market failures are rife in public service markets: high barriers to entry leave public service markets dominated by monopoly or oligopoly firms which render the provider relatively immune from the self–correcting mechanisms of market competition; uncertainty and complexities in contractual requirements create huge information asymmetries between buyer and seller; relationship–specific investments encourage the producer to exploit the loss of bargaining power entailed by sunk costs (i.e. ‘hold-up’ problems); and finally, negative spillovers, that is to say, damaging external effects not reflected in the original price of the transaction are particularly problematic given systemic interdependencies, for example between NHS and social care systems.

The negative spillovers from incomplete contracts in public service outsourcing are exceptionally socially damaging. The hard to codify tasks often intrinsic to a given public service – like ‘care’ – are rationally sloughed off by private providers and left to families, volunteers, charities and other public services to answer. As interdependent services come under satisficing corporate performance, systemic failures become inevitable.

The GCHQ building in Cheltenham was built and maintained by Carillion, which went into compulsory liquidation in 2018, Credit: GCHQ (Crown Copyright)

The almost completely compromised nature of the marketplace for services is not the only problem, however. As Accounting Professor Adam Lever and Gil Plimmer’s coverage at the Financial Times have shown, large public service industry (PSI) firms are a particularly striking example of ‘financialised’ corporations: they are not the productive innovators of the neoclassical imaginary. Rather than reinvesting their profits, these quoted companies redirect earnings into ever increasing dividend payouts and share buybacks to further hike share prices, and debt-funded mergers and acquisitions are relied on to create new income streams. On the verge of bankruptcy in 2013, the new CEO of Serco found it had no single coherent register documenting its 700 businesses, suggesting the operating values of a Ponzi scheme more than a value-creating corporate strategy.

With few tangible assets and high borrowing against intangible assets, (like brand recognition and, presumably, the financial market expectation of an ever-expanding non-competitive sector under doctrinaire governments) these firms carry no residual value if the business fails. Failure is also hard to anticipate since due diligence is hampered by major conflicts of interest in the ‘Big Four’ accountancy companies, KPMG, Pricewaterhouse Coopers, Deloitte and Ernst and Young. Leaver describes the standard financial model as “leveraged gambling on future income flows”. The policy is thus booby-trapped against governments keen to reverse it.

When it comes to prevailing incentives, public service industry firms as ‘firms’ bear an uncanny resemblance to Soviet state-owned enterprises (SOEs) and why wouldn’t they? As within planning for the Soviet SOEs, the outsourcing contract operates as a form of planning instruction and as an imperative to be realised, not as a forecast or ‘indicative plan’ to be considered; prices are predominantly administrative and ‘soft’ (i.e. negotiable); contracts are typically long, incomplete and exit is punitively expensive financially, organisationally and politically; the continuation of production is essential, hence government operates under risks of a chronically ‘soft’ budget per contract (so-called ‘soft budget constraints’).

The relationship is intrinsically and institutionally politicised: in the UK case, following repeated failures, the Cabinet Office operates as the direct interface with major outsourcing companies. Demand for the good or service is typically guaranteed (disabled citizens seeking their independence allowance aren’t shopping for a handbag). Like Soviet SOEs then, public service industry firms operate in a doom loop of low incentives for consummate performance, high incentives for satisficing performance, plus a lack of effective disciplinary mechanisms.

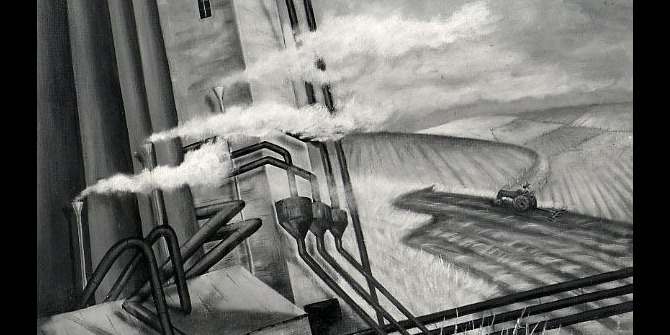

As a result, the typical multinational PSI firm looks more like the separated-at-birth twin of the Soviet ‘Kombinat’ business group than either a prizewinning public corporation like the BBC or an archetypal plucky, innovative, value-creating enterprise (characteristic of actual small and medium sized enterprises far more than today’s financialised quoted companies). As of 2016 the vast majority of UK outsourcing contracts had nevertheless been awarded to large public service industry multinational firms – some 73% of procurement spending. Under doctrinaire governments, PSI firms, like Soviet SOEs, benefit from an increasingly all-embracing nomenclature of commodities to be produced. In contrast to the Soviet system, however, money is anything but passive within the outsourcing production regime.

From the taxpayer’s point of view, the contemporary outsourcing architecture is more dysfunctional in framing corporate incentives than the Soviet system. Soviet SOEs had poor incentives to fulfil targets because wages were flat and target fulfilment prompted an increased target in the following year for no additional reward. PSI firms are incentivised by their stock-holding executive pay and financing structures and by the incompleteness of contractual specifications to actively ‘sweat’ a contract, since beyond creative accounting measures, their profit margins originate in its strictly legal, plain text reading.

The tougher any government tries to be in contract pricing within incomplete contracts the more damaging the consequences of margin-seeking by the firm are likely to prove. The risk under austerity is of chronic adverse selection. Given the objective difficulty of establishing accurate pricing under incomplete contracting, only the most reckless firms with least regard for service quality and those most determined to deploy later strategies of ‘hold up’ will rationally underbid for contracts with no guarantee they can stay within the initial margins. The collapsed Carillion was just such a repeat ‘winner’. Carillion’s management acted rationally under prevailing incentive structures: they were aberrant only in misjudging the moment when the financial markets would baulk at the unsustainability of their value extraction.

The standard counter-argument to ‘the problem of monopoly’ is that the reputational effect on dominant firms acts as a disciplining guarantee against poor contractual behaviour. But in monopoly/duopoly public service industry markets with high barriers to entry under doctrinaire governments who are increasingly structurally dependent on the survival of the dominant firms, the reputational damage to even atrocious providers is apparently nil. A Public Accounts Select Committee investigation found that Serco and G4S were awarded fourteen new contracts by five Departments worth £350 million even as they were being investigated by the Serious Fraud Office for defrauding the Ministry of Justice and after the then Justice Minister, Chris Grayling, publicly committed to withhold awards until the case was resolved: the MoJ was among the five.

The current UK government nevertheless continues to drive outsourcing into the state’s most complex and socially essential service domains. It’s enough to make Leonid Brezhnev blush.

This article is based on the author’s recent LEQS working paper

Please read our comments policy before commenting.

Note: This article gives the views of the author, not the position of EUROPP – European Politics and Policy or the London School of Economics.

_________________________________

Abby Innes – LSE

Abby Innes – LSE

Abby Innes is an Assistant Professor of Political Economy at the LSE. Her research interests include the changing role and function of the state in the political economy of communist, post-communist and advanced capitalist countries, as well as party political competition. Recent publications include ‘The new crisis of ungovernability’, in Brexit and Beyond: Rethinking the Futures of Europe, Benjamin Martill and Uta Staiger (eds) UCL Press, 2018; Draining the swamp: understanding the crisis in mainstream politics as a crisis of the state Slavic Review, 2017 and Corporate state capture in open societies: the emergence of corporate brokerage party systems. East European Politics and Societies, 2015. She currently holds a British Academy Mid-Career Fellowship to research the supply-side revolution and the crisis of the liberal democratic state.

Excellent article

There are numerous examples of local authorities which have outsourced transport, refuse collection and care services at increased costs, when it would have been cheaper to continue providing them “in house” and ensured that the recipients of those services did not see the subsequent chaotic deterioration of their services.

Nor did these Councils charge the new providers for all of the HR services (TUPE, HR advice etc.), Finance services, Project Management etc that the Authorities provided pre and post outsourcing to prospective and subsequent providers.

The private sector began this in the early nineties when the phrase “core competence” came into vogue, i.e. if it isn’t a so-called core competence why are WE, i.e. Shell, doing it? Outsourcing was totally not thought through, but the Big Five jumped on it (Arthur Anderson was still around then) and touted the concept around – as they do.

In my book all that has happened is that the risk factor has shot up and so has the total cost of delivery, except where it has been utilities management and the like. I have to read of a politician who understands outsourcing, just as they did not understand PFI, with the honorable exception of Jesse Norman.

I think it was Max Weber who commented on the syndrome of understanding something at the level of description, but not at the level of meaning. That about sums up our government when it comes to microeconomics.

Some great insights. Thank you.

Doesn’t this just boils down to politicians being essentially “bribed” by big corporations in the form of donations or just outright bought fraud that outsourcing continues to happen and the government will not touch it? And of course, the lowest costs and highest profits beats anything.

Strange. Who would have thought, introducing private profit makes services more expenseive and/or worst quality. I mean, the profit for the private firm does have to come from SOMEWHERE….

Anyone who claims outsourcing of public sector is good for the economy is a bought shill. Anyone and everyone. It is not a matter of opinion, one has to be a total idiot to not understand this.

An outstanding aritlce. This extract I thought could be applied to the electricity network and their “relationship” with Ofgem:

“The economics of Soviet central planning tells us that the resulting asymmetries in information and leverage between state and producer are just the start of bargaining games that the state cannot win. ”

The info asymmetry is particularly relevant in this contexct. The UK, on the basis of ideology has been taken for a ride, both by the Tories and Blair’s Labour bunch. it remains to be seen if things will ever change.

The argument seems at odds with the ability of private companies to deliver massive construction projects – UK rail network (much of which was closed by Beeching) was built by private companies, all London skyscrapers are built by same companies that government uses for PFIs. Why can Battersea area redevelopment can be done on time and budget, but much smaller Scottish parliament building runs over both? For services too – why is London’s Harley Street and it’s environs the destination for health tourism unlike, despite politician’s claims, NHS? Who services all the building in Canary Wharf – banks themselves or outside contractors?

So outsourcing can be done well, but I think part of the problem is politicisation of failure of private enterprise. Carrillion (and now possibly Kier) has failed, but is the country littered with abandoned construction sites taken over by tumbleweeds? Hardly. However, the ideological angle is just too attractive not to press, and pressed it is. This ideological fight diverts attention from reality of large scale contracts. What happened when government ran Crossrail asked for more money and time? It got it. What happened when publicly owned Network Rail ran over budget on electrification project? The project was scaled down. When a government ran projects fail it’s usually presented as ineptitude of the government of the day, but when government let’s a contractor fail – it’s a failure of the PFI system even though the two events are essentially the same.

Second major issue is public sectors lack of ability in contract negotiations. Having seen both private and public sector outsourcing contract negotiations, I can say governments of all levels lack both firmness and savviness. Given it’s near massive bargaining power, on many contracts government can specify very strong contractual terms. For example, it can stipulate that contractor gets no funding from state until project completion and that project deadline overrun has a severe financial penalty and that in case of insolvency government takes possession of project free of charge. It would be up to the private contractor to secure funding from private sector. This would be a more expensive project, but one with built in insurance against budget and time overruns and arguably more reflective of the project costs. But such contingency planning in government contracts gives way to KPIs which, as the writer points out, are easily circumvented.