Disasters like cyclones and wildfires and slow-onset events, such as ocean acidification and desertification, affect livelihoods and make micro, small and medium-sized enterprises and vulnerable households even higher-risk customers for financial services providers. Ulrich Volz and Peter Knaack write that well-designed inclusive green finance policies could reduce the financial exclusion of vulnerable groups while driving a virtuous cycle of growing resilience and a just transition to a low-carbon, sustainable economy.

Climate and environmental change can have profound economic impacts, which may disproportionately affect financially excluded groups and may translate into micro- and macro-financial risks that need to be addressed by central banks and financial supervisors. Yet green finance and financial inclusion have mostly been treated by these institutions as two distinct and largely unrelated agendas, despite significant overlaps between them.

Climate change and environmental degradation

Micro, small and medium-sized enterprises (MSMEs) and lower-income households are two groups that tend to be disproportionately exposed to the physical risks and effects of local and global environmental change – from disasters like cyclones and wildfires with immediate impacts, to so-called ‘slow-onset’ events including ocean acidification and desertification, which affect livelihoods such as fishing and agriculture. These phenomena affect firm productivity and the reliability of collateral, which makes MSMEs and vulnerable households even higher-risk customers for financial services providers. Concerned with the profitability in terms of risk-adjusted returns, financial institutions may offer these groups services at higher rates, or not offer them at all. In other words, increased physical risk may drive financial institutions away from low-margin and high-risk customers. Such financial sector retrenchment can lead to financial exclusion, leaving vulnerable segments of the economy without any access to formal financial services.

Transition risk – the risk posed by the process of transitioning to a low-carbon economy – may also have a negative impact on financial inclusion. Environmental policies, new technologies and changes in consumer and investor sentiment may discourage the financial sector from serving ‘dirty’, polluting sectors. While divestment from environmentally harmful activities is important and welcome in principle, it may affect MSMEs more than large firms that have better access to private equity and other sources of funding that can support them to transition to cleaner models of operation.

Moreover, financial sector policies designed to advance the transition to a low-carbon economy can have unintended consequences. New environmental standards requiring businesses to adopt clean technology may threaten the survival of MSMEs that are not able to make such investments without access to affordable financial services. Similarly, agricultural producers may not be able to adopt climate-resilient and sustainable production methods unless they obtain credit to finance this. Furthermore, financial institutions may grant preferential treatment to the financing of ‘green’ companies and projects and punish ‘dirty’ ones. MSMEs struggle to pay for green credentials such as a sustainability assessment by third parties, meaning they might not qualify for access to green financing channels even when their activities are environmentally sound. Thus, despite being well-intentioned, green finance policies may exacerbate financial exclusion.

Avoiding an unjust transition

Financial services are essential to the processes of adapting to and mitigating climate- and nature-related risks and shocks. Vulnerable households and companies can climate-proof their property or business and invest in sustainable technology, but only with the help of financial services or public support such as government grants. Financial exclusion not only limits the capacity of vulnerable groups to protect themselves from the effects of environmental change and boost their resilience, but also limits the scope for effective mitigation strategies. If a significant share of the population and economy is excluded, unwilling or unable to adapt to and mitigate climate change and environmental degradation, vulnerability to economic shocks is heightened, with potentially material negative repercussions for financial stability. In this ‘unjust transition’ scenario, social inequity and exclusion from economic opportunities may also breed political dissatisfaction and opposition to environmental policies.

Through an integrated inclusive green finance (IGF) approach, governments, central banks and financial supervisors can combine green finance and financial inclusion policies. For instance, policymakers should seek to mitigate some of the financial risk involved in adaptation and mitigation finance by providing guarantees to vulnerable sectors, making sustainable finance affordable for exposed segments, and investing in public information infrastructure to assess and certify the sustainability of farmers and MSMEs. By accounting for equity concerns in the design of green financial policies, this policy approach can avoid potential adverse effects on economically vulnerable groups and enable the financial sector to support a just transition to an environmentally sustainable economy.

Central banks and financial supervisors have various tools at their disposal to translate the concept of IGF into actionable policies. By bringing together the complementary aims of green finance and financial inclusion, they can help to improve the livelihoods of low-income households and the business prospects of MSMEs while simultaneously contributing to climate change adaptation and mitigation, minimising associated risks for the financial sector.

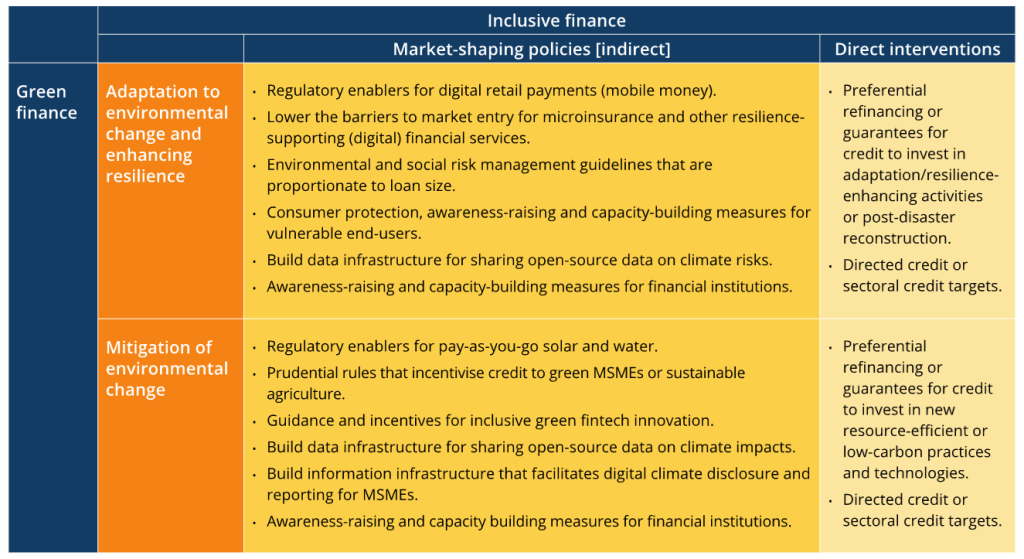

The instruments that central banks and financial supervisors can use to leverage IGF for climate change adaptation and mitigation can be divided into market-shaping [indirect] policies and direct interventions (see Table 1). In a recent INSPIRE policy briefing paper published by the Grantham Research Institute and the SOAS Centre for Sustainable Finance, we provide an overview of IGF policies that have already been adopted by the banks and supervisors, and highlight emerging examples of best practice.

Table 1: A policy approach for inclusive green finance

Source: Compiled by authors, building on Volz et al (2020)

A virtuous cycle of resilience

Well-designed IGF policies can drive a virtuous cycle of growing resilience. If economic actors at the margins of the financial system can afford the services necessary to insure themselves against shocks, invest in green technology and adapt to climate change and environmental degradation, they will increase their resilience. Clients that are more resilient to climate-related and environmental shocks pose lower credit, market and liquidity risk for the financial institutions that serve them. Carefully articulated inclusive green regulations and policies can help reduce the vulnerability of a larger part of the economy to climate shocks. A more resilient real economy in turn reduces the risks facing the financial sector, enhancing financial stability. Because this means higher risk-adjusted returns for financial institutions, inclusive green regulations and policies promise to be cost-effective.

While IGF policies are no panacea, they can be one important element in financing a just transition, helping to generate wider political support for the much-needed move to a low-carbon and sustainable economy.

For more information, see the authors’ accompanying policy briefing

Note: This article originally appeared at our sister site, LSE Business Review. It gives the views of the authors, not the position of EUROPP – European Politics and Policy or the London School of Economics. Featured image credit: Etienne Martin on Unsplash