The year 2022 marks 20 years since the first introduction of euro banknotes and coins, as legal tender for 12 countries of the European Union. Greece joined the euro area in 2000, two years later than the other 11 countries that joined from the beginning, but early enough to adopt the euro as legal tender in January 2002.

Due to its deeply rooted structural problems and the weaknesses of its convergence policy, Greece joined the euro area with particularly large fiscal imbalances and very low and deteriorating international competitiveness. Obviously, the decision to join was made on political grounds and not on the strict interpretation of the economic criteria of the Maastricht Treaty. This proved to be decisive for the subsequent course of the Greek economy.

Joining the euro area did indeed lead to tackling Greece’s problem of high inflation, but it eventually resulted in a significant worsening of the performance of the real economy.

The sharp decline in real interest rates and the sense of euphoria created after joining the euro area, initially led to a significant increase in domestic investment as well as an increase in private consumption and a reduction in national savings. The result of the increase in investment and the decrease in savings was initially the large increase in domestic aggregate demand and GDP growth, the decrease in unemployment, but also the unprecedented expansion of private debt and the current account deficit. The economic euphoria created in the first years after accession was largely due to easy access to cheap international borrowing.

The increase in the external deficit was reinforced by the further increase in the already high budget deficits, immediately after joining the euro area in 2000, but also by the continuing deterioration of the international competitiveness of the Greek economy, through excessive wage increases relative to productivity growth.

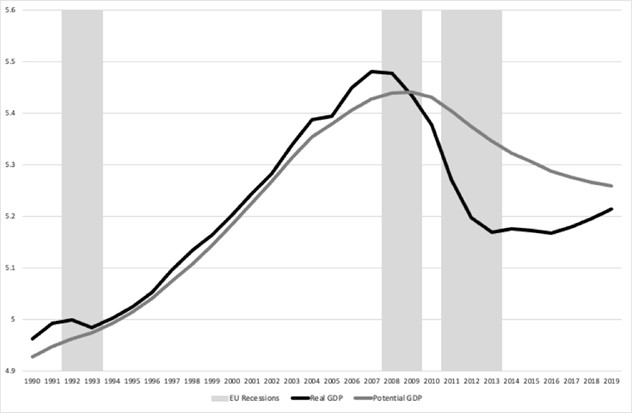

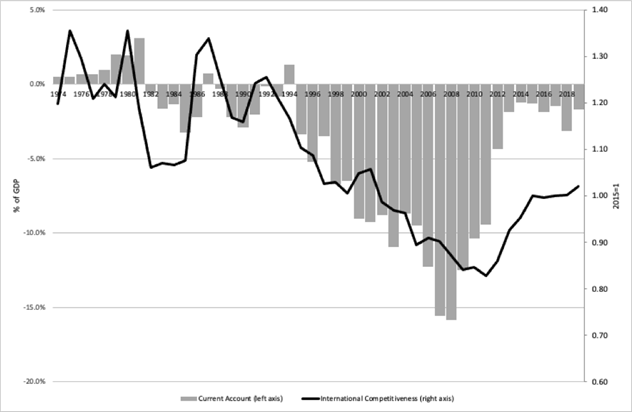

These were the factors that, in the first decade after joining the euro area, led to a prolonged widening of the gap between aggregate demand and Greece’s productive capacity, with a negative reflection on the current account deficit, which widened significantly, leading to excessively high international borrowing (see Figures 1 and 2).

For almost ten years, before the 2010 crisis, the country financed much of its consumption, investment and economic growth through private and public borrowing from international financial markets. International lending was the tool that on the one hand sustained high domestic demand and on the other hand facilitated the postponement of the necessary reforms.

Following accession to the euro area, and the large widening of the current account and budget deficit, the only adjustment effort was the 2005-2007 stabilization program, following the Olympic Games of 2004. However, even this program could only temporarily slow the trends in the twin deficits, as, inevitably, it was a program of gradual adjustment, that sought to balance the pursuit of,

Figure 1: Actual and Potential GDP in Greece

Figure 1: Actual and Potential GDP in Greece

employment and economic growth, on the one hand, and, on the other hand, the reduction of the twin deficits, the current account deficit and the deficit of the general government.

When the international financial crisis and the great recession of 2007-2009 broke out, the twin deficits inevitably became much wider due to the decline in Greek exports and the transmission of the recession. When the ‘sudden stop’ in Greece’s international borrowing in 2010 took place, the political balance that had prevailed in the country since the restoration of democracy in 1974, and which determined the main choices of economic policy, was violently turned upside down. In 2010, the country was forced to adopt an economic policy mix based on a sharp decline in domestic aggregate demand, through fiscal austerity, a credit crunch and real wage cuts.

The adjustment programs implemented after 2010 were based almost exclusively on a contraction of aggregate demand and led to a catastrophic, deep and prolonged economic downturn. Very few structural and institutional reforms were implemented, that could, over time, lead to an economic recovery based on increased national savings and investment. Hence the recovery after 2017 was particularly weak and by no means sufficient to offset the large losses of the Great Depression of 2010-2016.

What can one say, therefore, about the last twenty years in which Greece has been participating in the euro area?

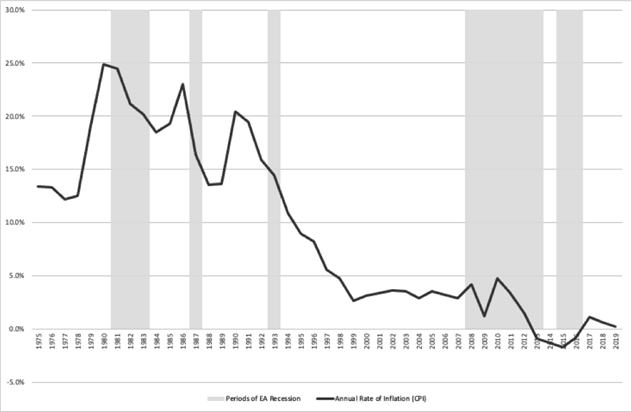

Undoubtedly, joining the euro area helped to address the problem of high inflation, which has been inherent in the Greek economy since the early 1970s. In the twenty years 2000-2019, the average annual inflation rate (based on the consumer price index) was at 1.9%, compared to 15.3% in the previous twenty years, 1980-1999 (see Figure 3).

Figure 2: The Current Account and International Competitiveness

However, for the real economy, the results of joining the euro area were anything but positive, even

before the recent coronavirus crisis.

In the twenty years 2000-2019, the average annual growth rate of real GDP per capita, which measures the evolution of the standard of living of the average Greek, was only 0.4%, compared to 0.8% in the previous twenty years, 1980-1999. It is worth noting that during the twenty years 1960-1979 the average growth rate of real GDP per capita was 6.0%, almost fifteen times the growth rate during the period of Greece’s euro area participation.

The results of the accession on the evolution of real wages were also disappointing. In the twenty years 2000-2019, the average annual growth rate of the average real earnings of employees was slightly negative, -0.04%, almost zero, compared to a positive rate of 0.4% in the previous twenty years, 1980-1999. It is worth noting that during the twenty years 1960-1979 the average annual growth rate of real wages was 6.0%.

Even worse euro area participation is associated with a large increase in the unemployment rate (see Figure 4). In the twenty years 2000-2019, the average annual unemployment rate was 15.7%, compared to 7.6% in the previous twenty years, 1980-1999. The average unemployment rate has doubled in the period of euro area participation. It is worth noting that during the twenty years 1960-1979 the average annual unemployment rate was only 3.7%.

There is little doubt that the great depression of 2010-2016, which was the main determinant of the negative effects of twenty years of euro area participation on the real economy, came as a result of the persistent and large macroeconomic and fiscal imbalances in Greece before 2010. These were created mainly in the 1980s and persisted because of the significant weaknesses of the adjustment

Figure 3: The Annual Rate of Inflation

Figure 3: The Annual Rate of Inflation

efforts undertaken since the early 1990s. As a result, Greece joined the euro area with major structural and fiscal problems and particularly low international competitiveness.

Adjustment efforts after 1990, but also after joining the euro area, had been ineffective and short lived, due to strong social and political pressures to protect the living standards of the middle class. These social pressures, as well as the ability of organized minority interests to thwart reforms that would be detrimental to them, often led to ineffective government choices, postponements, and changes in the direction of socially beneficial reforms.

The institutional weaknesses and asymmetries of the euro area itself and the lack of European crisis management mechanisms also played an important role in the Greek crisis.

The euro area has significant weaknesses as a monetary union. It is characterized by significant economic asymmetries between its Member States and low cross-border mobility of workers. In addition, it does not have a sufficient federal budget to be able to absorb some of the asymmetric economic and financial shocks in its constituent countries, and it also does not allow its central bank, the European Central Bank (ECB), to operate freely as a lender of last resort in times of crisis. The euro area was not even a full banking union. The adoption of the Resilience and Recovery Fund, following the recent coronavirus crisis, is a positive development, but it remains to be seen whether it will be institutionalized and strengthened on a more permanent basis.

What can Greece do today to ensure a sufficiently strong recovery and a period of faster economic growth? Leaving the euro area is not a solution, as it carries great risks of economic collapse in the process of transition to a de facto weaker national currency, and, in the medium term, the risk of a return to the policy mix that led to the stagflation, destabilization and other problems of the 1980s.

Figure 4: The Unemployment Rate

Greece has no choice but to accept that its best option is to remain in the euro area and reform itself.

It will have to adjust its institutions and its structural and fiscal policies in a way that combines a sustained economic recovery with current account and fiscal balance.

Unfortunately, this was not achieved before the 2010 crisis, nor during the post-crisis adjustment period. The effective stabilization, adjustment and recovery of the Greek economy within the euro area requires significant and wide-ranging further reforms that would enhance the competitiveness and dynamism of the Greek economy. These reforms should be pursued within the stability oriented euro area, despite the constraints of participation in a monetary area with many inherent weaknesses and asymmetries.

*The author is Professor and Head of the Department of Economics at the Athens University of Economics and Business and a Research Associate of the Hellenic Observatory, London School of Economics. This article is based on his research reported in Chapters 3 and 15 of the ebook, Greece and the Euro: From Crisis to Recovery, edited by George Alogoskoufis and Kevin Featherstone (Hellenic Observatory, 2021).

Note: This article gives the views of the author, not the position of Greece@LSE, the Hellenic Observatory or the London School of Economics.