The financial sector in South East Europe (SEE) has a history of vulnerabilities triggered by deeply rooted transition challenges and exogenous shocks. Countries in the region are weathering the implications of the pandemic and the war in Ukraine from a better position. Nevertheless, these twin crises will trigger long lasting challenges for the financial sector in SEE. Recent crisis management experience offers valuable lessons learned for the direction of adjustment towards resilience and recovery.

Legacy issues

Although the SEE countries are different in terms of history, their banking systems went through a similar deep transition process which included restructuring, expansion, rebalancing, and adaptation. The financial systems of the region were restructured with the support of foreign banks (from Austria, Italy, France, Greece, and Hungary). However, this growth pattern was driven by domestic demand and was externally financed, hence was hampered significantly by the global financial and Eurozone crises. Before the global financial crisis, credit markets in SEE had experienced several years of overperforming credit growth. This rapid growth was well above its fundamental levels in most countries of the region and overshot the equilibrium level. Non-performing loans (NPLs) became a long-standing structural problem; however, the rebalancing has been successful and NPLs have been brought under control. As of the first half of 2021, only Bosnia and Herzegovina, Albania and Montenegro had NPLs slightly above the level of 5%, defined by the European Banking Authority as a threshold for high-level ratio. The European integration process has, to a large extent, closed the cost efficiency gap, especially in EU Member States in the region. A final common characteristic is that the countries in the region are still lagging in the development of capital markets.

Before the financial crisis, the region’s banking system was characterised by large capital inflows, as banks used imported capital to finance both the retail and the public sector. After the financial crisis – and before the pandemic – the banking system was based more on domestic sources of funding rather than imported capital. This made the growth of the banking system and financial deepening more modest and resilient. Three important lessons have been learnt in the past decade. Firstly, too much sophistication and innovation can lead to a crisis more easily than the less sophisticated and more traditional ways of lending. Secondly, macroeconomic stability is crucial for the banking sector, as the Greek case showed during the Eurozone crisis. Similarly, banking sector stability is important for macroeconomic stability, as the Irish example demonstrated in the same period. The third important lesson from the period after the financial crisis is that banks may become more stable, productive, and resilient with a lower number of branches. These lessons have been valuable during the Covid-19 crisis and will remain so for the future

New Challenges

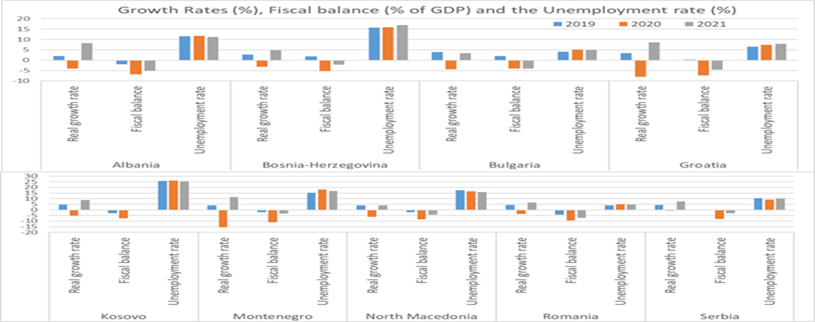

In terms of recent challenges, the pandemic impact in SEE was strong, but the recession was not at the level of other parts in the world. The impact on employment was limited due to fiscal expansion. In addition, while the region’s GDP dropped considerably by 4.2% in 2020, economic rebound was quite robust as GDP expanded by 6.4% in 2021.

Figure 1: Covid-19 and economic activity in SEE

The SEE region performed better than expected during the pandemic, while in 2021 both supply and demand conditions were starting to relax again. The strong policy support to firms affected by the Covid-19 crisis was towards the right direction. This allowed firms to start their transformation process and respond to challenges. However, there are potential risks to these trends due to the ongoing pandemic waves and the recent geopolitical situation with Russia’s invasion of Ukraine. When it comes to foreign banks, they are determined to stay in the SEE region and in some cases expand their operations. Profitability in terms of return on assets and equity differs substantially across countries. Investment recovery is also lagging due to inadequate governance structures for risk mitigation and risk hedging. Finally, Green Transition is an important challenge and policy objective at the same time, with a divergence between the Western Balkans and EU Member States. All countries in the region face the challenge of adopting and using the additional reporting and accountability mechanisms that come with Green Transition investments. What will be important is the firms’ resilience in the recovery stage when policy support is removed. Combined with the new energy shock, aggravated by current geopolitics, an abrupt removal of policy support may lead to an increase of NPLs and defaults.

Using the EBRD methodology, which assesses development of sustainable market economies through six qualities (competitive, well-governed, green, inclusive, resilient, and integrated), we can identify the challenging areas for SEE economies. Out of these six qualities, most SEE countries and the Western Balkans score low on the green and well-governed.

The poor performance on green can be attributed to dependency on coal, large energy losses, and low share of renewables. Green Transition is both a challenge and an opportunity at the same time. The challenge is the protracted and expected energy shock, which is having an immediate impact on households and firms. The temptation to compensate for this price shock may demotivate households and companies from investing in green energy, although partial compensation remains a correct tool. It is important that the EU moves to the next step of energy security and sends the right signal in terms of national policies that should be adopted. This transition is going to be a multi-year process but now is the right time and opportunity to create the necessary infrastructure and incentives.

The weaknesses in governance are mainly due to a large share of state firms, but also gaps in digitalisation. Digital innovation is an important area, where there has been divergence between smaller and larger markets. Large players are less willing to invest in smaller markets because market scale is lacking. Nevertheless, the pandemic has worked as a catalyst for the advancement of the digital agenda in the whole region and further efforts to spread digital innovation are required in the post-pandemic period.

The economic shock generated by the war on Ukraine is far from being localised and represents a major geopolitical transformation, with long lasting consequences. The SEE region is very much concentrated in terms of banks operating, with a few banks playing a central role in the financial system. Five of these banks are present in the Russian market and face associated risks. Even if the size of the exposure is not a systemic issue, the new geopolitical context is likely to affect these banks profitability and possibly their overall strategy in Central East and South East Europe. The big concern is whether there will be further spillovers and what their effect will be on the banks’ strategies after the war and sanctions. In many cases, it is not the agreed sanctions that force companies or banks to stop doing business in Russia (or Belarus), but a general tendency of financial institutions to enforce their own broader and informal limitations on Russian economic actors. When it comes to the SEE region, exposure to Russia varies – for instance, Romania has relatively limited exposure while, Serbia is more exposed to potential spillovers. The positive outlook for EU banks, which were set for a growth trajectory after the pandemic, may now look less certain after the war on Ukraine. The persistent high inflation rates may cause a moderate – but equally persistent – increase in the operating costs of banks.

Lessons learned

The significant efforts made by policymakers in the last few years, combined with the above-listed lessons learnt, helped the financial systems of SEE countries to overcome the first shock of the pandemic. However, the recent war on Ukraine has posed serious challenges for the region, with the supply shock and increased cost of commodities threating post-pandemic recovery. The Green Transition and the advancement of the digital agenda (core pillars of the EU’s Recovery and Resilience Facility) must remain priorities for these countries in the years ahead, despite the expected protracted crisis especially in the energy sector. At the same time, EU membership for the Western Balkan countries and broader political and economic cooperation, supported by the presence of Multilateral Development Banks, will be important steps for an optimistic scenario in the wider SEE region.

Note: This article reflects the views of the authors, not the position of any institution, of Greece@LSE, the Hellenic Observatory or the London School of Economics.

*This article is based on conclusions drawn from the panel discussion held at the Hellenic Observatory (LSE) on 30 March 2022 titled “Weathering the Pandemic: the emerging financial landscape in South East Europe” with contributions from Fokion Karavias (CEO, Eurobank), Francis Malige (MD for Financial Institutions, EBRD), Dr Debora Revoltella (Chief Economist, EIB), and Professor Boris Vujcic (Governor, Croatian National Bank). More information about the event can be found here . A video and podcast are also available.