Background

The Greek economy went through a steep recession for ten years in the aftermath of the global financial crisis of 2007-2008. What started as a unique episode of a sovereign debt crisis in a monetary union, triggered a banking sector crisis and a sequence of adjustment programmes aiming at macroeconomic stabilization and economic recovery. A proliferation of articles, books and official publications is already available addressing either what caused the crisis or the guiding principles for adjustment.

The Covid-19 pandemic in 2020 interrupted the economic recovery, sending the economy once again into a deep recession, but a strong bounce-back has taken place in the subsequent three years. Now that the post-Covid dust is settling and normality returns, it is timely to look at the current state of the Greek economy and prospects ahead. We bring a market-oriented lens to the analysis, focusing primarily on the private sector as the key driver of future growth and informed by our common experience at the EBRD, which in recent years has become a significant investor in the Greek economy. Our analysis draws on the EBRD experience and analytical framework, using both EBRD-sponsored surveys of the business environment and the EBRD’s “transition qualities” approach to benchmarking economies across desirable features of a market economy.

We start with an evidence-based assessment of the trajectory from crisis to recovery with an emphasis on corporate sector adjustment. The international experience of recessions and recovery points to the importance of policy capacity and firm-level response to reforms. Therefore, in the second part of the book we incorporate empirical insights from the first phase of post-crisis recovery into an explanatory framework of what drives the investment process after a special case of deep recession under constrained policy options.

There is extensive literature on reforms sequencing and relevant growth and welfare implications during economic transition. We enrich this debate in three directions. First, we propose an empirical approach on recovery growth drivers that builds on modern growth theory and international best practise. Second, we apply the concept of binding constraints as the guiding principle for the design of the direction of reforms. Finally, we introduce six qualities of market conditions for the calibration of a revamped policy capacity framework.

Recent economic developments

Greece has made a solid, if not spectacular, recovery since the depths of the crisis in 2015. Covid-19 hit the economy hard, as would be expected for a mainly service-oriented economy, but a strong recovery has taken place since then. The steady fall in unemployment, from 25%+ at the height of the crisis to around 10% now is testament to the steady recovery – in fact labour shortages are a problem in some industries. Fiscal discipline has been an important part of the recovery under successive administrations since 2015 and business confidence and economic sentiment have been robust. At the same time, ongoing weaknesses in the economy are reflected in a widening current account deficit over 2021-22, and consumer confidence has taken a knock recently, possibly reflecting gloom about the wider regional and global economy.

Constraints on growth

A major EBRD-EIB-World Bank enterprise survey was carried out soon after the end of the third economic adjustment programme: 600 firms were randomly chosen across the whole of Greece. Respondents found the most problematic business environment obstacles to be tax rates and administration, access to electricity and finance, and corruption. Political instability was also cited as a major problem, though the situation has clearly improved since then. A regression analysis shows that innovating firms are particularly concerned about regulations, inadequately educated workforce and the poor functioning of the court system. Meanwhile, exporting firms find it easier than locally oriented ones to navigate tax administration, licensing, corruption, and courts, but access to finance is problematic for non-exporting domestic manufacturing companies.

Benchmarking Greece against its peers

The EBRD’s six qualities framework is a useful way of thinking about the features of a successful and sustainable market economy. Greece scores near the bottom among EU countries in the sample across all six qualities. Among the reasons for the poor scores are: difficulties in doing business and low complexity of goods; weak contract enforcement and effectiveness of the courts; vulnerability to climate change; poor representation of females in the labour force and especially senior management, and high youth unemployment; poor corporate governance in banks and weak energy connectivity; and high costs of trading across borders, especially services.

This approach provides a sobering reminder that, despite recent progress and optimism, Greece’s business environment remains beset by deep-rooted problems that hold back productivity, investment, and global integration. Moving Greece to a sustainable growth path and prosperous future will require targeted reforms to boost investment and integration, and hence productivity.

Four pillars for boosting economic growth

Greece’s gross financing needs are expected to be low in the medium term due to primary surpluses, limited debt maturities (and extended grace periods) and low interest expenditure. The amortisation of the deferred interests on the EFSF loans is expected to commence in 2033, while the amortisation of the ESM loans will start in 2034. This favourable macroeconomic context provides a unique starting point for a sustainable economic growth trajectory.

The focus in the second half of the book is on key drivers of the post-crisis trajectory, having in mind the business environment constraints and quality gaps referred to above. We present four challenges for economic growth: investment, productivity, export orientation and policy capacity. There is broad consensus that in these areas the scarring effect of the crisis has been severe and long lasting. The views diverge on the way forward, with policy recommendations emphasizing either the continuation of reforms in anticipation of substantial efficiency gains or the need of extensive sectoral reallocation for growth rebalancing.

Our perspective is eclectic, benefitting from a data-driven assessment of the first phase of post-crisis economic recovery. We provide evidence of an incremental investment recovery at the backdrop of persistent obstacles for new investment, sectoral concentration of new investment and strong volatility of consumer and business sentiment.

The crisis legacy is profound in the case of productivity divergence from other Eurozone crisis countries. We elaborate on structural obstacles and emerging opportunities and recommend specific areas for policy initiatives, e.g., SME digitalization, coordinated action for underutilized fixed capital and enhanced mobility of firms.

We then revisit policy challenges for the improvement of export performance, and hence the international integration of the Greek economy, with an assessment of remaining weaknesses. We identify a number of much-needed easy wins to boost and diversify exports of tradable services.

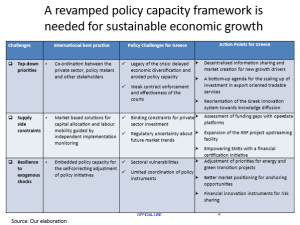

Finally, we propose a framework for policy capacity initiatives for the absorption and the successful implementation of large-scale investment incentives provided by the Recovery and Resilience Facility and green transition.

In summary, the economic recovery that is underway in Greece is confronted with new challenges for sustainability and resilience. Greece is confronted with a unique opportunity to accelerate reforms and take advantage of external funds by focusing on reforms to boost investment, productivity, and trade for long-term sustainable growth in parallel to a policy capacity revamp in line with best international practice.

*The Hellenic Observatory hosted a research seminar on the topic on 5 March 2024. For more information please visit the event page.

*The authors are writing in a personal capacity. This blog post draws on a forthcoming book by Anthony Bartzokas and Peter Sanfey (2024). Macroeconomic adjustment and investment recovery in Greece: the economics of a special case. Palgrave Macmillan

Note: This article gives the views of the author, not the position of Greece@LSE, the Hellenic Observatory or the London School of Economics.