Could this Nordic State be a guiding light for countries as they try to rise from the devastation of coronavirus?

Photo by Vidar Nordli-Mathisen on Unsplash

Photo by Vidar Nordli-Mathisen on Unsplash

As COVID-19 continues to grip the planet, the catastrophic effects are being felt by industries and governments the world over. The Chinese GDP officially dipped for the first time since 1976, a drop of 6.6% this quarter. With Global growth contracting 3%, the International Monetary Fund has predicted the “steepest recession since the Great Depression”. As states look to one another for possible routes out of this crisis, Norway, the Scandinavian state at the top of Europe, is often forgot about as its 5.3 million population quietly handles the changing state of affairs.

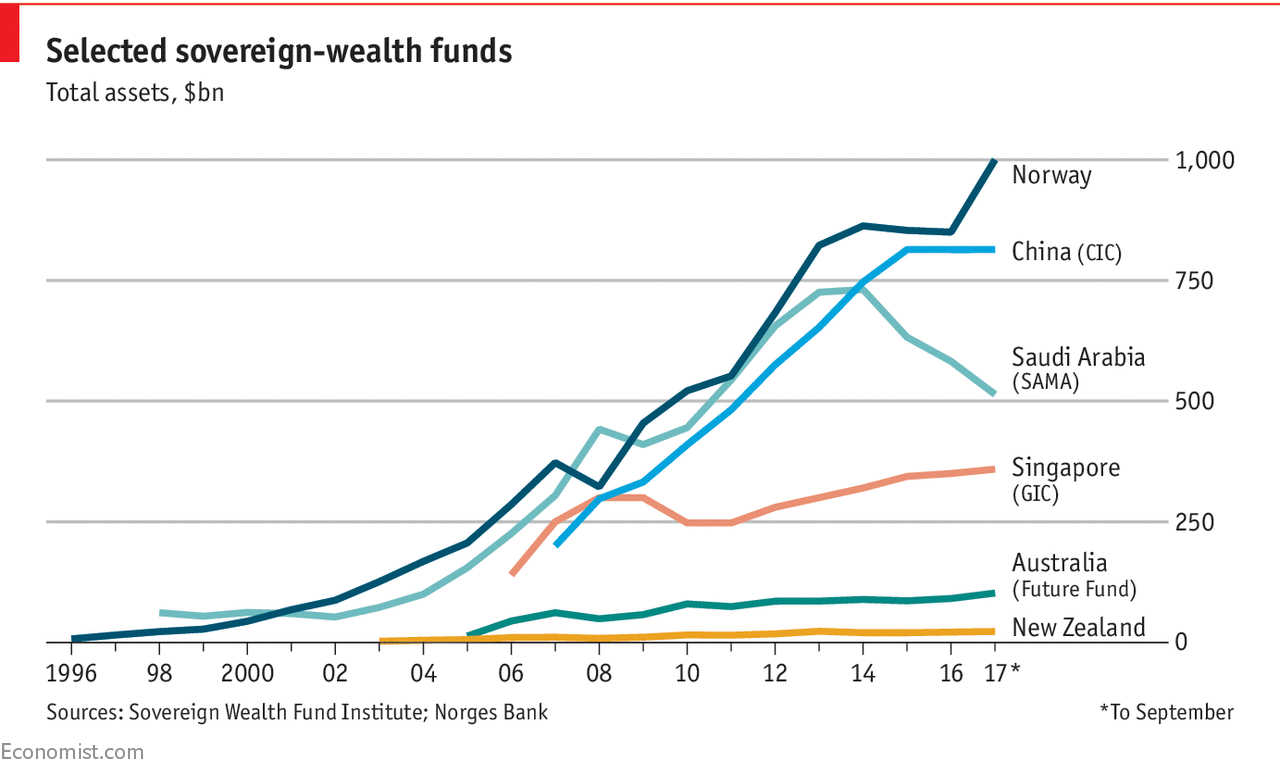

Famous for its breath-taking fjords and the northern lights, Norway is equally renowned for managing the world’s biggest sovereign wealth fund, with assets of around $945 billion (USD). Whilst other resource rich countries like Russia or the Gulf States have suffered from the ‘Dutch Disease’ of stagnant commodity-dependent economies; Norway’s well managed and ethically invested sovereign wealth fund, created from 80% taxes on profits from the oil industry, has led it to be leading in the world. In February 2020, the fund added a 19.9% increase on investments from the previous year, seeing it make $180 billion. By April this year, however, a record $113bn (14.6%) was lost on the funds stocks this quarter as the coronavirus outbreak has sent shocks through the global stock markets. This slump is worse than the 10.3% lost in the 2008 financial crisis. Unprecedented government stimulus packages combined with demand for oil being at its lowest since 1995, and prices down by 40%, has seen the Norwegian sovereign wealth fund needing to sell bonds in order to cover losses. There is light at the end of the tunnel, however, as Norway’s ethical investing may reap rewards in the post-coronavirus world. As the rest of the investing market tackles with the need to allocate capital into broader environmental and social aims whilst sustaining profitability, Norway’s decision to exclude companies that have damaging effects on the environment and on societies has boosted its returns by 0.8% since 2006.

www.economist.com

www.economist.com

Source: The Economist

“We are a fund for future generations” says Carine Smith Ihenacho of Norges Bank Investment Management, and investment bans include removing tobacco companies, coal producing companies and businesses with corruption charges or human rights abuses from their portfolio. Including the November 2019 ban on British security firm G4S after finding it violated minority workers human rights in the Middle East. This pandemic has been noted as “the crisis that will define a generation” and so now is the time to look at the trailblazers of the past for routes to follow.

Coronavirus has exposed the weak links in supply chains, the vulnerability of high-risk investments, and the selfish self-serving outlook of many governments. The markets do not operate in a vacuum, and recent events have highlighted the importance of sustainability in investment. Possible points where the global markets will follow suit from their Norwegian counterparts include; the focus on climate change, the International Panel on Climate Change have stated that if we do not move away from fossil fuels and halve global greenhouse gases, irreversible physical damage to the environment will occur within the next decade. Norway’s investment ban on coal producing companies is one to watch. Similarly, public health and human security has shaped the political agenda of 2020 and will continue to do so, investments wary of harmful products, like tobacco, will surely rise as the risks forever tilt out of their favour. Finally, social discontent puts political systems, and therefore economic stability, at risk, as evidenced in the recent Black Lives Mater protests seen across the globe. Pressures are building in both developed and emerging economies, and the calls to redress the imbalances from economic gains is stronger than ever. Norway’s investment bans on companies with corruption charges and direct investment into developing corporate sustainability provides not only a beacon of hope, but a shining example of how to emerge stronger and more sustainable from this pandemic.

As the post-Coronavirus world begins to emerge, what is clear is that change is on the horizon. The problems of homelessness in the West and the shortcomings of the gig-economy have forced governments to, as Pankaj Mishra wrote, “assume their original responsibility to protect citizens”. Hargreaves Lansdown also predicts that “the cyclical stocks are not going to return to the way that they used to be”, which will force corporations and capital investors to undoubtedly have to follow suit. One thing is clear, we will never go back to business as usual.

Individualism and corporate profits could not surmount this crisis alone, it was through increased togetherness and unprecedented regional and international cooperation that societies have stayed afloat. The advantages of ethical investing have been well documented and researched, with many FTSE 100 companies and wealth management firms having Socially Responsible Investment strategies devoted to creating a positive social impact. The coronavirus may become another locomotive of history, moving society along a fairer and more sustainable route, and Norway’s beacon could help guide us down this uncertain path.