The impact of new housing development on surrounding areas

Christine Whitehead and Emma Sagor, LSE London

Many people fear that new housing development will worsen local amenities, reduce their wellbeing and perhaps even undermine the capital values of their home – often regardless the quality of the development envisaged or whether there is a shortage of homes to meet local needs.

The question of the impact on house prices is never directly addressed during the planning process as price impacts are not a material consideration in planning decisions. Yet prices can be expected to adjust to changes in amenity and local services arising from the development as well as simply to the numbers of dwellings on the market. Uncertainty about potential price reductions, or even just slower capital appreciation is undoubtedly often part of people’s objections to change, not only in the immediate neighbourhood but also in the general locality.

It was in this context that LSE London was asked by the NHBC Foundation and Barratt to address an apparently straightforward question: ‘Does new housing development always reduce the value of existing properties around that development?’ The question was put this starkly because the project was seen as a pilot – perhaps leading to a more detailed examination of the impact of development in different contexts.

Last month we published the research which used statistical and qualitative evidence to look at the impact of eight average sized (60 – 280 units) new developments completed within the last five years on their immediate neighbourhoods and wider local areas (Whitehead et al, 2015). The evidence offered a clear answer to our research question: no, house prices do not always decline around new housing developments, at least not for a sustained period of time. Sometimes there were short term price reductions during or immediately after the construction period. More generally prices in the wider area continued to follow existing upward trends. In the immediate locality—within a 0.3 mile radius of the new development—prices in some cases rose more quickly than in the wider area once the development was completed.

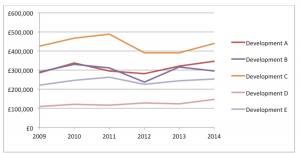

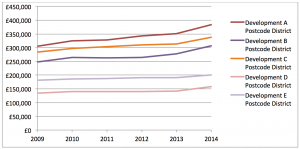

Looking in more detail at the chosen sites, three were on brownfield land where existing buildings had become obsolete. In these cases there were few or no local objections, the impact on prices was generally positive and everyone seemed comfortable with the resultant development which had helped raise housing standards in the neighbourhood. The other five on the other hand had been the subject of considerable objection based on concerns around loss of amenity, the provision of affordable housing and increased use of local services. Figures 1 and 2 show trends in prices for the immediate locality and the wider area around these five developments. Even though the numbers of transactions are often small they suggest that, once completed, the developments generally had a positive impact on the immediate neighbourhood and blended into the wider local market. Objections generally fell away and in some cases objectors actually bought some of the new homes.

Figure 1: Average house price trends in areas immediately neighbouring (0.3 mile radius) development on greenfield/high amenity land

Figure 2: Average house price trends in wider areas (postcode districts) around new development on greenfield/high amenity land

Some commentators have argued that these findings refute the argument that large scale new investment will stabilise or even lower house prices in general. But this is to mix macro and micro effects. Here we were looking only at local impacts where the new homes are purchased both by locals and incomers and in some cases may actually have generated additional demand. The core implication is that the ‘chain’ of transactions arising from buyers selling their own homes appears to have been easily absorbed. The effect on local prices is more about the quality of the development, the numbers of additional households able to find a home they want and the extent to which planners and developers manage to maintain and improve the immediate locality. Any downward pressure on prices is spread across the whole housing market – and in that context a few hundred new homes is a drop ocean in terms of its effect on house prices overall.

Are these results important? They certainly show that house prices do not always decline as a result of new development despite widely held fears that they do, which fuels much opposition to new house building. Importantly the research did not look at very large scale developments which disrupt the area for long periods, but at the more usual types of development outside central urban areas. And even in this context it should be stressed that this was very much a pilot study and far more research needs to be done on exactly what enables new development to be integrated into local markets The findings suggest that those living in the area should not generally be concerned that they will lose out just because new development occurs in their neighbourhood. They also imply that local planners often do a good job in offsetting the negative impacts of development through the requirements they place when giving planning permission.

Thank you for sharing this information about local prices with residential development. It is good to know that the impact on price was generally positive and that people were comfortable with the change. Something to consider would be to talk to the realtor of the residential land to get more detail of what the process should entail.

Comfortably, the post is actually the sweetest on this deserving topic. I concur with your conclusions and will eagerly look forward to your upcoming updates. Saying thanks will not just be adequate, for the phenomenal lucidity in your writing. I will right away grab your rss feed to stay informed of any updates. Pleasant work and much success in your business endeavors!

=================

New residential developments

===================

Your article is very informative. It’s a welcome change from other supposed informational content. Your points are unique and original in my opinion. I agree with many of your points.

I’d be concerned with the timing of new estates being built right now because short term house price drops coupled with the economic self harm of Brexit will lead to people defaulting on homes due to job losses and negative equity caused by lower house prices.

It looks as if new developments actually drive the prices in local areas up. Good for home owners in the area bad for people lookin to buy their first home