by Dr Hessah Al-Ojayan

On 27 January 2015, The Kuwaiti Finance Minister, Anas Al-Saleh, released to the press the official annual budget of the state of Kuwait for the year 2015/2016. Numbers indicate an expected deficit of KD 8.2 billion (US$27.5 billion). The Minister stated that the deficit is planned to be funded through either borrowing from the General Reserve Fund (GRF) or issuing public debt. The ultimate decision will depend on comparing the rate of return the GRF earns with the cost of issuing public debt (cost of bonds), and choosing the least costly option.

The goal of this article is to elaborate on the consequences of the Minister’s proposed solutions, but before we proceed, it would be beneficial to explain the structure of the government reserve funds and try to estimate the GRF rate of return. The State of Kuwait allocates reserves to two major government funds, the General Reserve Fund (GRF) and the Future Generation Fund (FGF). The GRF receives all government revenues and pays all national expenditures. The GRF also holds government assets, including Kuwait’s participation in public enterprises such as the Kuwait Fund for Arab Economic Development and the Kuwait Petroleum Corporation, as well as Kuwait’s participation in multilateral and international organizations such as the World Bank, the IMF and the Arab Fund. The FGF was established in 1976 under law number 106; the law states that 10% (increased to 25% during each of the last 3 years) shall be deducted from annual revenues and shall be transferred to the FGF for the purpose of supporting future generations. Furthermore no assets can be withdrawn from the FGF unless sanctioned by law. The KIA manages the surpluses of the GRF and the entire portfolio of FGF assets; KIA financial statements are confidential and reported annually to the Ministers Council and to the State Audit Bureau (which reports to the national assembly).

The government of Kuwait can only use GRF assets to try to solve any immediate national financial problem. For example, between 2009 and 2013, the KIA intervened in Kuwait Stock Exchange (KSE) and tried to rescue the market from the financial crises by pumping in KD 450 million. Also, the government paid KD 10 billion to plug the actuarial deficit in the Public Social Security Scheme.

KIA does not disclose the strategy and location of the GRF assets; and therefore it is hard to estimate the rate of return on their investments. We know however that the GRF serves the government’s immediate needs; and therefore we would expect it to mainly invest in highly liquid assets like; eg U.S treasury bills which earn between 1.5% -2% and the shares of a few companies listed on the Kuwait Stock Exchange, which earn an annual total rate of return close to 15% .

If the government decided to pursue the alternative of liquidating the GRF assets then it will clearly loose the rate of return currently earned on such investments. In fact KIA may have to liquidate GRF assets at below their fair values and may oversupply the KSE with stocks which will affect the market negatively. The decision will also reduce the government funds available to face financial contingencies.

The other mechanism the mistier proposed to use to plug the deficit is borrowing from the market through issuing bonds. The Central Bank of Kuwait (CBK) is responsible for selling, purchasing and retiring government bonds. Currently, only banks can invest in CBK bonds.

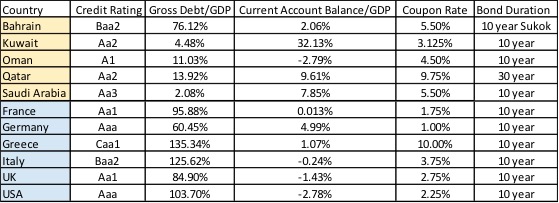

The size and price of the bond/bill depends on the country’s credit rating as it provides a benchmark for other issuers of debt. There are independent institutions that asses a country’s credit worthiness. Moody’s, Standard & Poor and Fitch are among the 3 largest rating agencies in the world. Moody’s sovereign credit worthiness evaluation depends on four main factors: the country’s economic strength, institutional strength, fiscal strength, and susceptibility to event risk. Generally, the greater the risk of default the higher the yield investors will require when investing in bonds (ie the more expensive the borrowing cost for governments).

Kuwait currently has a relatively high rating of Aa2 and a low percentage of debt to national GDP, close to 4.5%. Kuwait should not have problem issuing bonds for a low cost (See table1). If Kuwait continued to borrow over the long run then its credit rating will decline which will affect its cost of borrowing. However, Issuing bonds may be advantageous.

Table (1) Credit Worthiness and Coupon Rate

One advantage of issuing sovereign bonds would be an increase in the government’s financial transparency and reporting, more disclosure will decrease risk and the cost of borrowing. Another advantage is that bonds would discipline the government and make it more forward looking and fiscally responsible, any poor performance will indicate higher risk and will result in higher cost of borrowing and may block the government’s future access to funds. Issuing bonds may also be risky.

Kuwaiti sovereign debt is currently only offered to banks; if the government decided to offer them to the public then we would expect a demand coming from investors with lower appetite for risk; if this is the case then we would expect less liquidity pumping into the KSE and real-estate, especially if the government decided on another front to cut down expenses by terminating the expats’ contracts which would leave some residential buildings empty. Another disadvantage would be that depositors in banks may find the rate of return on bonds more desirable than what they earn on the certificates of deposits (CDs), depositors may relocate their fund to bonds which will eventually reduce banks’ ability to lend given the current CBK reserve requirement.

The officials in Kuwait have to weigh the benefits and costs of each alternative, and decide to either go with one of them or use them simultaneously…. Alternatively, the future may prove that the current deficit to be an overestimation; ie actual revenues at the end of the year (2015/2016) may be sufficient to cover or even exceed government expenses in which case borrowing would be unnecessary. However, being proactive and planning for the worst is essential to minimize disruption.

Dr Hessah Al-Ojayan is Kuwait Programme Visiting Fellow at the MEC. She is also Assistant Professor of Finance at Kuwait University. Her research interests include Islamic finance and economics, GCC and emerging capital market, SMEs, and the history of finance and economics in the Middle East.

Dr Hessah Al-Ojayan is Kuwait Programme Visiting Fellow at the MEC. She is also Assistant Professor of Finance at Kuwait University. Her research interests include Islamic finance and economics, GCC and emerging capital market, SMEs, and the history of finance and economics in the Middle East.