By Saoud A.M. Al-Furaih

Oil refinery plant. Source: Avigator Fortuner, Shutterstock

In January 2020, during an event to reveal Kuwait’s budget forecast for 20/21, the Finance Minister was asked why $55/bbl was used in the country’s budget while oil was trading at around $65 a barrel. She responded by saying that ‘geopolitical events can increase oil prices, but we need to be on the conservative side’. Three months later, oil was trading at around $20/bbl.

The price drop may have been unpredictable but when will a sovereign nation with an extraordinary amount of natural and financial resources take bold actions to curb its dependency on oil?

In 1976, after acquiring enormous amounts of wealth due to the oil embargo, a law was passed in Kuwait that enforces a 10% transfer of the state’s revenues to the Future Generation Fund (FGF). Due to the passing of the law, the fund is worth $533 billion today.

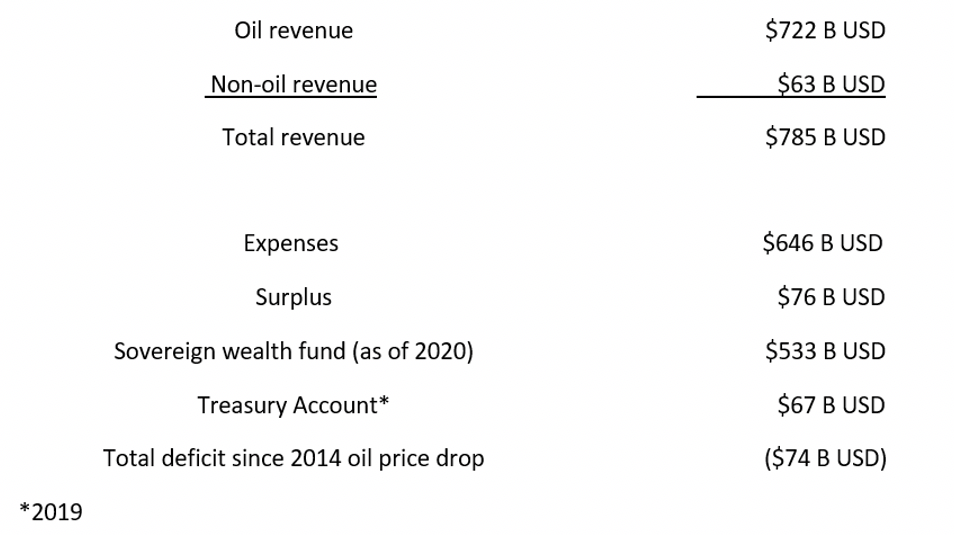

Kuwait’s Financial Position, 2008–2018

Source: Kuwait Ministry of Finance, 2008-2018

From 2014 until 2018, Kuwait has been running a fiscal deficit every year totaling $73.8 billion. To finance this deficit, Kuwait had two sources; the General Reserves Fund (GRF) and debt.

The GRF is the state’s treasury account, which was worth $205 billion in 2014, but with annual withdrawals due to mounting deficits, it decreased to $67 billion in 2019.

A Blessing or a Curse?

The discovery of oil in Kuwait was a blessing; GDP per capita is among the highest in the world. Kuwait currently has one of the largest sovereign wealth funds and a say in the energy market, despite having a population of just under 1.5 million. Access to free health and education is a birthright of the state’s citizens.

However, oil has been a curse too. Kuwait suffers from the ‘Dutch disease’. Kuwait’s currency has become relatively expensive and crushed the nations’ non-oil exporters.

The private sector’s lack of competitiveness with the public sector in attracting labour is another curse. This is still the case despite the government introducing a subsidy to incentivise Kuwaiti private sector employees with a monthly transfer of $1,480 to $2,910. This means that most citizens’ jobs payments are financed by the government. As a result, as of 2017, 82.6% of Kuwaitis were employed by the public sector.

Oil Economics

Oil prices are affected by two factors: supply and demand. Electric cars powered by wind, solar, natural gas and renewable energies is a factor that decreases the demand for oil.

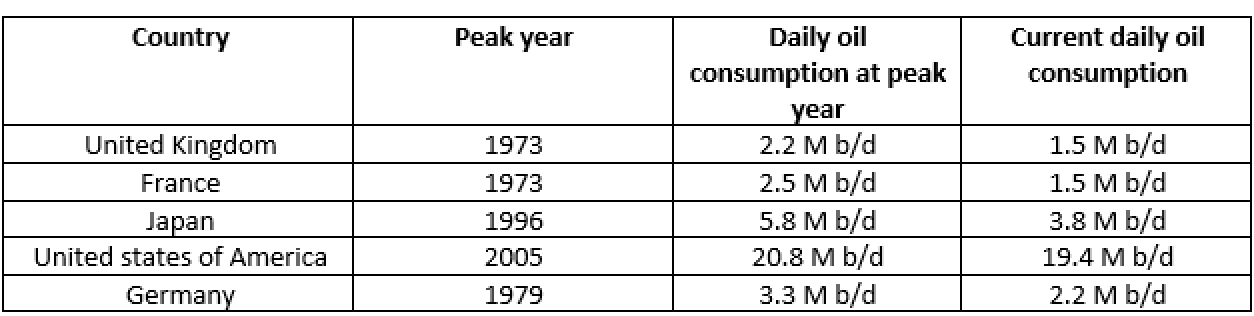

Developed countries have come to realise this and started to shift away from oil. Most developed countries’ demand for oil already peaked decades ago. However, demand has not peaked for global oil thanks to developing economies’ increased demand for fossil fuel as their nations become more civilised.

Developed countries’ oil demand peak per year:

The fear of new technology emerging and replacing the need for oil has always been there although its effect has only gradually become noticeable. In the last 10 years, though, a new factor has affected the oil market in a way that could be devastating: oil oversupply.

Since 2008, the USA has added around 8M b/d (around 70% of Saudi Arabia’s production or about 3 times that of Kuwait). A large part of that was due to the shale revolution. Oil prices have fallen by 75% from $115 a barrel in late 2014 to $28 a barrel over 18 months. In that same period, we saw Kuwait’s oil revenues drop from KD 29.2 billion to KD 12 billion.

The oil industry is not as important as it once was (for example, Exxon in 2013 was the largest listed company in the world, today it is number 55).

Kuwait should use wealth now to help finance the diversification of its economy rather than expand its welfare state. By not doing so, Kuwait will have to face the music one day with a weaker fiscal wallet.

What Needs to be Addressed

First, and the most obvious, its dependency on oil. In 2018, 89% of Kuwait’s revenue came from oil production.

Secondly, the state cannot resist raising its welfare spending through salaries and subsidies whenever oil prices pass the $80 mark. In 2010, Kuwait’s total annual expenses were $36 billion. When oil prices jumped to $100+ a barrel from 2010–2014, Kuwait’s spending reached $70 billion, equivalent to a 90% jump in just four years. However, when oil prices dropped below $35 a barrel in 2015 and 2016 or 75% from its highs, the state’s spending dropped only 17%. This implies it is hard to decrease spending even when oil revenues slide.

Lastly, there is no clear path of redemption from the Future Generation Fund. If the fiscal deficit doesn’t narrow, the government will end up opening up the FGF’s coffers. The move will be an easier approach than the mindful but politically gruesome approach of fiscal reform.

Over the last ten years, we saw big moves in the oil market that should concern oil dependent countries. We saw the sale of Saudi Arabia’s national oil company by the Saudi government; we saw the US surpassing the Saudis in oil production; we saw 11 European countries banning the sale of fossil fuel cars by 2040. The future is uncertain. Shale production could fall due to profitability concerns and the power could shift back to OPEC countries. Europe and China could fail in their push to electrify their cars by 2040; we could see huge growth in demand for oil in the next decades. No one is certain of what might happen but the welfare of any state should not depend on one commodity with an unpredictable future.

Kuwait needs bold moves to escape this risk of being dependent on oil. That is why Kuwait needs to take tough decisions like privatising Kuwait Petroleum Company and using the proceeds to create an even larger FGF with a diversified asset base while, at the same time, hedging the risks from oil price swings before it is too late. It is the only possible path: to diversify away from oil.

This article was published in Arabic in Al-Qabas newspaper on 7 September 2020.

2 Comments