The COVID-19 pandemic is an unprecedented human and economic tragedy. To date, there have been over 124 million cases and 2.7 million deaths recorded worldwide, with nearly 30 million cases and over 540 thousand deaths in the United States alone, although these figures are growing on a daily basis. But not everyone is suffering to the same degree. While the economically vulnerable are experiencing vanishing jobs, reduced income, rising household debt and the increasing risk of evictions, wealthy investors are reaping financial gains from opportunistic investments.

Despite these dire health and economic conditions, U.S. financial markets are soaring as investors plough capital into financial markets in anticipation of substantial profits on investments that can exploit the pandemic. This upswing in stock values illustrates how a tiny proportion of the population can use their financial capital to profit from the crisis.

While the vast majority of people face unprecedented health and economic heartache and hardship, U.S. billionaires increased their wealth by $1 trillion, over one-third, from March to December of 2020. The S&P 500 surged throughout 2020, closing the year at a record high with an increase of 16.3% over 2019, despite dramatic rises in unemployment and business closures nationwide. Wealthy individuals and institutional investors (such as pension funds and university endowments) are actively investing their capital, and in particular, are flocking to shadow banks, which can provide high-return investments during crises.

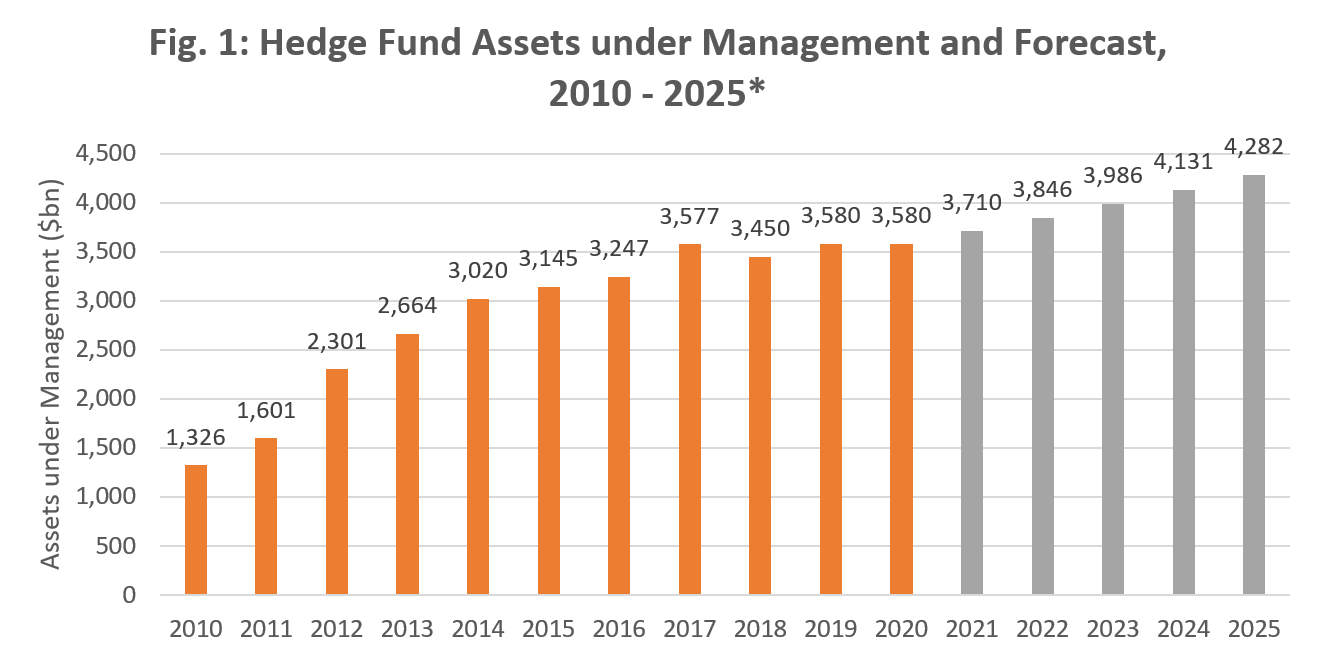

Shadow banks refer to less regulated, private credit intermediaries such as private equity, venture capital, and hedge fund firms. While the general public is mostly unaware of shadow banking, it has been one of the fastest growing areas of finance since the early 1980s. For example, the volume of global hedge fund AUM (assets under management) is expected to grow by 19.6% over the next five years, reaching an estimated US $4.3 trillion (Figure 1) in 2025.

In our recent article in American Behavioral Scientist, we examine how U.S. shadow banks are extracting profit by investing in ways that benefit from the misfortunes of exploited workers, struggling companies, and distressed sectors. The pandemic has caused a number of sectors to struggle, such as the airline, energy, and hospitality sectors. As a result, many companies in these sectors have seen their share prices sharply drop as their revenue plummets and investors sell off their shares. This is where shadow banks come in: Hedge funds, in particular, have swooped in to short-sell—bet against—these companies’s stocks as they decrease in value (which is what hedge funds did that sparked the “GameStop Rebellion”).

As you read this, shadow banks are scouring the economy for flailing companies to short-sell the stock and pocket substantial profits. For example, hedge fund investor Carl Icahn garnered a remarkable $1.3 billion profit by short-selling stocks in shopping malls hit hard by COVID-19 restrictions. And the hedge fund Woodson Capital Management shorted bricks-and-mortar retail businesses, and invested in e-commerce companies. The assets in their portfolio have since skyrocketed from $675 million to $1.7 billion.

In addition to shorting hard-hit company stocks, hedge funds capitalized on the stock market crash following the emergency shutdowns in response to the pandemic. In mid-February of 2020, hedge fund manager Bill Ackman anticipated stocks would free-fall at the onset of the pandemic and took out insurance on various bond indexes. (These insurance contracts pay out when the indexes, pegged to a section of the bond market, fail). Ackman invested $27 million on March 3rd. Then, betting that the markets would rally when the federal government intervened, he divested on March 23rd, the day the U.S. Federal Reserve announced new programs to support the plummeting economy. Ackman turned a $2.6 billion profit! And he was not alone. Miami-based hedge fund Universa Investments made over a 4,000% return.

Although many economic sectors are suffering during the pandemic, others are exploding because of pandemic-induced demand. Investors are profiting from vaccine-related stocks and “work from home” stocks—such as Zoom (online conferencing), Amazon (online sales) and Staples (home office products), along with other companies in the healthcare, technology and communications industries. For example, Amazon founder Jeff Bezos’ wealth grew by an estimated $71 billion from March to December of 2020, thanks to his ballooning stock holdings.

While the most economically vulnerable have suffered the brunt of the pandemic’s devastation (in ways that have worsened gender, racial, and social class inequalities), those with financial capital have gleaned profits from struggling and booming sectors alike. This has created a financialized caste system in which some workers carry out the difficult and risky work of fighting the pandemic, while another group simultaneously funds and exploits these efforts from the safety of their homes, reaping the rewards because it holds the capital in a rentier capitalist system.

How can we, as a society, curb the predatory investments of those with substantial capital that exploit the wellbeing and livelihoods of the rest of society? Tax and regulatory reforms are a possible avenue, including U.S. Senator Elizabeth Warren’s proposals for new controls on private equity firms. Another way forward includes enhanced democratization of corporate decision-making and expanded representation of stakeholders such as workers, consumers, and communities on U.S. corporate boards. But as long as shadow banks can operate with minimal oversight, the exploitative and speculative nature of predatory finance will continue to capitalize on future crises.

This post draws on: Neely, M. T. and Carmichael, D. (2021), ‘Profiting on Crisis: How Predatory Financial Investors Have Worsened Inequality in the Coronavirus Crisis’, American Behavioral Scientist. doi: 10.1177/00027642211003162.

It looks like an analogy of the slave trade where the wealthy take advantage of the poor (disadvantaged) and exploit these victims for cheap labour who have no other choice.

Gaining at the expense of victims by adding insult to injury for selfish desires such as greed and control is evil and because they are delivering the inferiority of their inner-selves into the lives of the poor by replacing whatever good the poor have with bad, they are Demons of Inferiority.

Many wealthy people who gain by forcing others especially their subordinates to suffer and go without can also be seen as Demons of Inferiority. Why? Because a chain is only as strong as its weakest link, and this means the weakest link (inferiority) is in control.

All abuse, evil, greed, domination, control, wrongdoing, exploitation, etc is driven by inferiority.