Despite positive economic growth of Bangladesh’s economy over recent years, there is a significant increase in tax evasion within the country. Mohammad Nurunnabi (Prince Sultan University, Saudi Arabia) interviewed tax officials, business leaders, civil society members and taxpayers to find out what they thought of the problem of tax evasion and what steps could be taken to decrease corruption in the country and lower such widespread levels of tax evasion.

According to the World Bank, “[the] Bangladesh economy continues to be among the fastest growing economies in the world.” Despite strong levels of growth however “private sector investments remain insufficient along with declines in Foreign Direct Investment (FDI). To sustain growth, the country needs continuity in priority reform areas: the financial sector, fiscal, infrastructure, human capital and business regulation.” To reap the benefits from such strong growth, Bangladesh therefore must urgently reform key areas of its economic environment – a good place to start would be with its tax system and institutional framework to counter corruption.

Bangladesh’s government revenue is highly dependent on tax revenues. For instance, tax revenues for 1987/1988 accounted for 84.9% of all state revenue; and this figure has remained large in recent years: 81.6% in 1990/1991; 80.4% in 2011/2012; and 76.5% in 2014/2015. The lowest figure for tax revenue as a percentage of total revenue was 75.4% in 1998/1999. Over the last 18 years however tax revenues were below 80% each year, except for 2011/2012 and 2012/2013.

Tax in Bangladesh

There are two types of taxes in Bangladesh: Direct taxes and Indirect taxes. Direct taxes include a tax on income and profit; indirect taxes include VAT, Import duty, Export duty, Excise duty, Supplementary duty and other taxes and duties.

Notably, indirect taxes account for most of the tax revenue in Bangladesh. For example, direct taxes contributed 20.2% of total tax revenue, while indirect taxes contributed 79.8% in 2005/2006. In 2010/11, the contributions of direct taxes were 29.2% and indirect taxes were 70.8%. In 2014/15 these figures were 38.9% and 61.1%. The gap however between the contribution of direct and indirect taxes towards total tax revenue has been narrowing in recent years (Nurunnabi 2019b).

Strikingly, Bangladesh has experienced the lowest total tax revenue as a percentage of GDP in South Asia over the past 17 years: tax revenue as percentage of GDP in Bangladesh was 6.61% in 2001 and 7.83% in 2010. Importantly, in 2016, the tax revenue to GDP was 8.77% in Bangladesh, 12.29% in Sri Lanka, 12.29% Nepal 18.69% in Nepal and 8.84% in Afghanistan.

Tax evasion

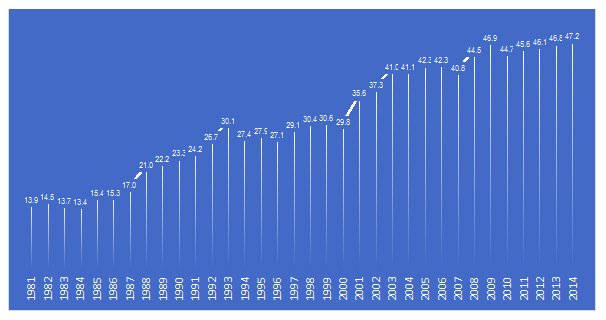

But what about tax evasion in Bangladesh? Tax evasion (as a % of GDP) in Bangladesh has a mean of 31.02% between 1981–2014 (see Figure 1). Figure 1 also shows that between 2003–2014, this figure was consistently above 40%. This figure was 41% in 2003, 42.34% in 2006, 46.85% in 2009, 46.79% in 2013, and 47.20% in 2014. Interestingly, tax evasion for 2007 was 40.78% during the military-backed government.

Figure 1. Tax evasion (% of GDP) in Bangladesh (1981–2014) Source: Author.

By speaking to tax officials, business leaders, civil society members, and taxpayers from eight administrative divisions in Bangladesh (Rangpur Division, Rajshahi Division, Mymensingh Division, Khulna Division, Dhaka Division, Chittagong Division, Sylhet Division, and Barisal Division), I saw how many different factors contribute to the growth of these levels of tax evasion.

The National Board of Revenue (NBR), established under the President’s Order No. 76 of 1972, is the central authority for tax administration in Bangladesh. Administratively, the NBR is under the control of the Internal Resources Division (IRD) of the Ministry of Finance. The NBR has four key departments: the Board Administration, Customs, VAT, and Income Tax; there are also three tax-related wings: the Customs Wing, VAT Wing and Income Tax Wing. What was clear from my interviews was that that there is a lack of manpower and skilled manpower in the NBR.

The majority of the interviewees also highlighted that there is widespread corruption in Bangladesh. According to Global Financial Integrity, the illicit financial flows (including tax evasion) in Bangladesh is increasing significantly (in US$ million) from 2004 to 2013. The illicit financial flows from Bangladesh amounted to US$3347 million in 2004; US$6127 million in 2008; US$7225 million in 2012; and US$9666 million in 2013. Furthermore, 81% of interviewees perceived that political influence is the major determinants of tax evasion.

Tackling tax evasion

The Bangladesh government have taken action to combat tax evasion over the last few years. The Finance Act (2011) is one example of this action which has incorporated alternative dispute resolution provisions to help resolve income tax, VAT and customs disputes. Through this, it is expected that tax payers would be able to gain more help and guidance from the NBR. I found however that interviewees perceived the tax authority as a highly politicised institution. They therefore had significant doubts about the power of NBR to take real action in fighting tax evasion.

New ways to tackling tax evasion

It’s clear that further action needs to be taken in Bangladesh to tackle tax evasion. Many policy changes came up frequently during my interviews, which could begin to lower the levels in Bangladesh. They included a policy to ensure that the tax authority (the NBR) is independent and adequately empowered to carry out their duties, that corrupt tax officials and tax evaders should be identified and subject to enforcement, and that the tax authority should not be politicised and any undue political influence should be immediately stopped. Perhaps with these new measures Bangladesh’s government could take a positive step to ridding the country of corruption and ensuring that no individual or business can avoid tax.

This piece originally appeared on the International Journal of Public Administration and can be read here.

This article gives the views of the author and not the position of South Asia @ LSE blog, nor of the London School of Economics. Please read our comments policy before posting. Photo: Calculator and Pen, Credit: Pexels, Pixabay.

Dr Mohammad Nurunnabi, PhD, CMA, SFHEA FRSA FAIA (Acad), is the Aide to the Rector on Research and Internationalization, and Chair of the Department of Accounting at Prince Sultan University, Riyadh, Saudi Arabia. He is an Academic Visitor (Senior Member) of St Antony’s College, University of Oxford. His most recent book is The Role of the State and Accounting Transparency. He has over 60 publications in international journals He has received numerous prestigious research and teaching awards including the IMA Faculty Leadership Award from Institute of Management Accountants (IMA), USA in 2017. His research primarily focuses on policy and practices.He can be contacted at: mnurunnabi@psu.edu.sa

References

Nurunnabi, M. (2019a, forthcoming). Political influence and tax evasion in Bangladesh: What went wrong? Advances in Taxation, Vol. 26.

Nurunnabi, M. (2019b). Tax Evasion and the Role of the State Actor(s) in Bangladesh. International Journal of Public Administration, Vol. 42, No. 10, pp. 823-839.