The dramatic collapse of Sri Lanka’s economy in 2021 and the attendant misery it has wrought for her citizens has alerted other countries in the region, as well as international observers, to the possibility of such developments in other countries as well. In this cautionary post, Kamal Uddin Mazumder presents a comparative view, with Bangladesh in focus.

With global inflation rising and the fear of fuel and food crisis looming large, clouds are gathering over the economic horizon of South Asian countries. The Covid–19 pandemic, followed by the Russia–Ukraine war, have disrupted the global economy and trade, which has shaken Europe as well as South Asia. Meanwhile, Sri Lanka’s financial and political crisis reached a critical point last year, driven by the country’s mix of high debt, soaring inflation, and poor economic management. Worryingly, the global headwinds — rising inflation and interest rate, depreciating currencies, high levels of debt and dwindling foreign currency reserves, have pushed several other nations to the brink of economic collapse, leading crisis experts to raise an important question: which South Asian country is likely to go the Sri Lankan way?

The Tragedy of the Lankan Disaster

In Sri Lanka, inflation soared to almost 54 per cent, with the price of food being almost 80 per cent higher than a year ago; until recently, 22 million people of the island nation faced an acute shortage of fuel, food, and medicine as it battled a foreign exchange crisis; schools, public transport and businesses had to be shut down. The Lankan rupee has slumped dramatically in value against the US dollar.

As hundreds of thousands of anti-government protesters occupied/stormed/seized the Presidential Palace and torched the Prime Minister’s home last year, President Gotabaya Rajapaksa flew to the Maldives and then to Singapore to escape a popular uprising against his government, and was forced to resign as President. A national emergency was declared, and a curfew was imposed in the Western Province to stabilise the situation. In Rajapaksa’s resignation letter, he indicated Sri Lanka’s years of poor economic management caused by initiating largescale mega projects based on foreign loans, reduction of remittance through legal channels, the negative impact of the Covid–19 pandemic on tourism and a plethora of other factors that contributed to this ill fate.

A Cautionary Tale for South Asia

Once upon a time, Sri Lanka was projected to become the Singapore of South Asia; it became the first country in the Asia–Pacific region in 20 years to default on foreign debt.

Pakistan is on the brink of a balance of payments crisis, with billions owed to international creditors. The country is facing huge debt amid depleting foreign currency reserves and soaring inflation. Its foreign currency reserves have plunged to just over US$ 9 million recently, hardly enough for few weeks of imports, while at one point last year the Pakistani rupee touched a record of about PKR 233 to the US Dollar. On the other hand, amid the heavy energy crisis in Pakistan and subsequent suspension of gas supply, 400 textile mills have been closed leading to shocks in the export sector.

The most concerning issue is that the Shehbaz Sharif government has decided to sell national assets to foreign countries without any checks in a desperate attempt to prevent the country from debt default, raising concerns of transparency. Pakistan’s new government, which narrowly averted a debt default, also struck a crucial IMF deal to resume a bailout programme, a way that offers economic pain relief but no panacea because true economic revival is threatened by poor policy decisions as well as the volatile political system, similar to Sri Lanka.

Thus, the public may lose patience and take to the streets at any time against the government’s unpopular steps, leading the country up the Sri Lanka pathway.

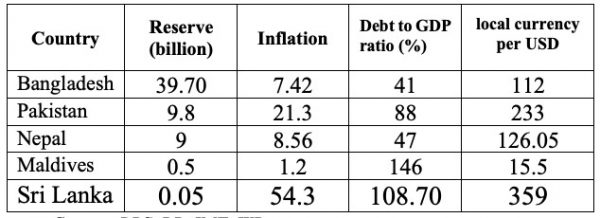

Source: Data collated by author for 2022 from Bangladesh Bureau of Statistics, Bangladesh Bank, International Monetary Fund and World Bank data reports.

Source: Data collated by author for 2022 from Bangladesh Bureau of Statistics, Bangladesh Bank, International Monetary Fund and World Bank data reports.

Like Sri Lanka, the Maldivian economy is heavily reliant on tourism — which suffered a big blow after the outbreak of the Covid–19 pandemic. Like Sri Lanka and Pakistan, Maldives is indebted to heavy loans and investments from foreign nations, especially China, and facing low foreign currency reserves. Its public debt is already on the red line, and is now well above 100 per cent of its GDP. US investment bank JPMorgan has warned that the country is at risk of defaulting on its debts by the end of 2023. Economic rationality instead of political interests should be given priority to stave off anypotential economic meltdown, like in Sri Lanka.

Panic has gripped Nepal over the growing likelihood of a Sri Lanka-type economic collapse after the country saw a rise in imports even as its foreign exchange reserves have shrunk sharply and inflation has soared. Moreover, foreign debt has escalated as the country continues to sign up for more and more Chinese-funded infrastructure projects in its Covid–19 pandemic battered economy. The Himalayan nation is also facing a liquidity crunch and, as a result, banks and other financial institutions are struggling to extend loans to productive sectors like the agriculture, tourism, manufacturing and energy sectors. Nepal’s trade deficit is ever-increasing, and now leading to import shocks. There is therefore no reason to disregard the suspicions that Nepal will not meet Sri Lanka’s fate in time if the government continues to ignore warning signs.

The Bangladesh Case

Having observed the depleting foreign exchange reserves, falling Bangladeshi Taka against the US dollar, plus widening trade and current account deficits, it is fair to say that the situation is alarming. The most immediate challenge for Bangladesh on the economic front is to reduce inflationary pressures and keep its foreign exchange reserves at a satisfactory level. Goods imports jumped by 39 per cent in the first 11 months of the past fiscal year (FY22) over the same period (FY21), creating pressure on the dollar reserve. It is undoubtedly an alarming sign for Bangladesh’s economy as the country is considerably dependent on imports for both domestic consumption and export-oriented industries.

Another concerning issue is that Bangladesh is feeling the consequences of the Russo-Ukraine war that is causing an energy crisis across the world, limiting global growth, manufacturing activity and employment prospects. Despite these warning signs, Bangladesh’s economic managers continue to give assurances that Bangladesh’s economy is far from becoming Sri Lanka, analysing overall macroeconomic parameters.

It is true — like Sri Lanka, Bangladesh has failed to diversify its export basket; nonetheless, it has a lot of room to continue to grow in the garments sector. It is now among the top three apparel exporters in the world, and is gradually taking market share from China. Bangladesh’s export story, which recently touched a landmark by crossing US$50 billion for the first time despite headwinds blowing from the global crunch, is very impressive. Direct Foreign Investments (FDIs) hit a three-year high in 2021 and according to an UNCTAD report; Bangladesh has become the second favoured investment destination in South Asia after India, thanks to Bangladesh’s initiatives to implement 100 economic zones to attract FDI.

It is important to note that, while Sri Lanka, Pakistan, Maldives and Nepal are overwhelmed by foreign debts, Bangladesh should not be concerned because its external debt is still lower than the red line at 21.8 per cent of GDP. Additionally, the majority of its external debts are held by bilateral or multilateral organisations like the World Bank. Bangladesh’s strong macro-economic base, loan management, and debt repayment capability have led the World Bank’s International Development Association (IDA) to continue lending more than US$35 billion at the lowest interest rates — the highest amount given to a single country.

Needless to say, while Sri Lanka implemented lots of unnecessary mega projects using Chinese loans — like the Hambantota Sea Port, Mattala Rajapaksa International Airport, Lotus Square and Chinese Colombo City to serve political and private interests, Bangladesh’s Prime Minister Sheikh Hasina has been careful to not take up projects without a high economic and social return. And significantly, in recent years, Bangladesh’s political system has shown resilience without any major political turmoil.

Moreover, the government adopted a conservative approach to deal with the early signs of the ‘Sri Lanka Syndrome’. Bangladesh sought a US$4.5 billion loan from the International Monetary Fund (IMF) for its balance of payment and budgetary needs amid increasing pressure on their economies. To save dollars and increase foreign currency reserves, the government has restricted foreign tours of civil servants, imposed higher import tax on luxury items, relaxed restrictions to draw in remittances from millions of migrants, boosted exports, reduced the expenditure on the development budget, introduced austerity measures in power expenditure and so on. Although these do not seem to be long-term solutions to economic woes, it is expected to avoid wasting huge amounts of money, positively influencing macro-economic stability.

Currently, Bangladesh is not in danger of a Sri Lanka-like catastrophe, but the country needs to be cautious and learn from the experiences of the island nation, as Hans Timmer, the South Asia Regional Economist of the World Bank remarked recently. According to a report based on data from the IMF, Bangladesh is the 41st largest economy in the world with a GDP of US$397 billion, and its position is second in South Asia after India. Even a recent Bloomberg Report pressed alarm bells for 25 countries that are exposed to the default risk, but which excluded Bangladesh from the list although several developing nations like Pakistan, South Africa, Brazil and Turkey are on the list.

To conclude, then, while Bangladesh is in a far more comfortable position than some other South Asian countries right now, there is a need for defining a repayment strategy including rescheduling imminent payments as an economic shock is looming from debt repayment pressure in the coming years. The Sri Lankan example, however, presents an alarming case study for other South Asian & developing countries, with troubling echoes of the crisis that has gripped the island nation. Leaders in power ought to show far-sightedness to create buffers and reject subversive economic policies; it is essential to steer the countries’ major economic drivers on the right course before it is too late.

*

The views expressed here are those of the author and not of the ‘South Asia @ LSE’ blog, the LSE South Asia Centre or the London School of Economics and Political Science.

Banner image © Sadhin Mahmud, ‘Mawa, Bangladesh’, 2022, Unsplash.