Does the health of banks on Wall Street affect economic outcomes on Main Street? After the 2008-09 financial crisis, bank lending to nonfinancial firms declined significantly, with effects on employment and incomes. Drawing on data from over 2,000 firms, Gabriel Chodorow-Reich finds that credit restrictions accounted for between one-third and one-half of the employment decline at small and medium firms in the year following the Lehman bankruptcy. He also finds that the ‘stickiness’ of bank-borrower relationships meant that many firms that that had pre-crisis links with less healthy lenders suffered more than those that had relationships with healthier ones.

Does the health of banks on Wall Street affect economic outcomes on Main Street? After the 2008-09 financial crisis, bank lending to nonfinancial firms declined significantly, with effects on employment and incomes. Drawing on data from over 2,000 firms, Gabriel Chodorow-Reich finds that credit restrictions accounted for between one-third and one-half of the employment decline at small and medium firms in the year following the Lehman bankruptcy. He also finds that the ‘stickiness’ of bank-borrower relationships meant that many firms that that had pre-crisis links with less healthy lenders suffered more than those that had relationships with healthier ones.

How much did the collapse of the financial sector contribute to the decline in employment during the 2008-09 financial crisis and recession? In recent research, I investigated the link between firms’ ease of getting credit and employment. I found firms that had pre-crisis relationships with less healthy lenders had a lower likelihood of obtaining a loan following the Lehman bankruptcy, paid a higher interest rate if they did borrow, and reduced employment by more compared to pre-crisis clients of healthier lenders.

Moreover, the effects vary importantly by firm type. Lender health has an economically and statistically significant effect on employment at small and medium firms, but the data shows no effect on the largest or most transparent firms. Under plausible assumptions, the withdrawal of credit accounts for between one-third and one-half of the employment decline at small and medium firms in the sample in the year following the Lehman bankruptcy.

My methodology relies on two key facts. First, bank-borrower relationships are sticky. The likelihood of a borrower using its previous lender for a loan exceeds by a factor of seven the counterfactual likelihood if relationships didn’t exist. Hence, firms that borrowed before the crisis from banks that did less lending during the crisis had greater difficulty obtaining bank financing than firms that had borrowed from healthier lenders. Second, the origins of the 2008 crisis lay outside of the corporate loan sector, meaning cross-sectional variation in banks’ loan supply was plausibly unrelated to the characteristics of each banks’ pre-crisis borrowers. I then compared employment outcomes at firms that had borrowed before the crisis from relatively healthy financial institutions with otherwise similar firms that had borrowed from lenders more adversely affected during the crisis.

To perform this comparison, I constructed a new data set of over 2,000 firms, linking firm lending relationships to their employment histories. The data set merges the Dealscan syndicated loan database, which contains the borrowing history of both public and private firms that have accessed the syndicated loan market, with confidential employment data from the Bureau of Labor Statistics Longitudinal Database. In a syndicated loan, the “lead arrangers” set up the loan deal with the borrower and provide most of the financing, and recruit other “participant” lenders to provide the remainder of the funds. The merged dataset contains information on employment outcomes and banking relationships at two thousand nonfinancial firms, ranging in size from fewer than fifty employees to more than ten thousand.

I measured the relative health of banks using four metrics. The first uses the amount of lending to other borrowers during the crisis by the firm’s pre-crisis syndicate. The second measures exposure to Lehman Brothers through the syndicated market. The third captures exposure to mortgage backed securities through the loading of each bank’s stock return on the ABX index. The fourth contains selected items from banks’ balance sheet and income statement items chosen to avoid concerns of reverse causality coming through the corporate loan portfolio.

I then ran regressions of the effect of the health of a firm’s pre-crisis syndicate on the growth rate of firm employment from just before the Lehman bankruptcy in the third quarter of 2008 to the third quarter of 2009. In all specifications, lender health has a statistically and economically significant effect on employment outcomes. For example, using the Lehman exposure, ABX exposure, and bank statement items as instruments for the total change in lending by the pre-crisis syndicate, a two standard deviation improvement in lender health results in an average employment gain of 4.75 percentage points one year after the Lehman bankruptcy. Standard diagnostic exercises reveal the lender health measures to be strong instruments for a bank’s change in lending, and cannot reject exogeneity of the measures.

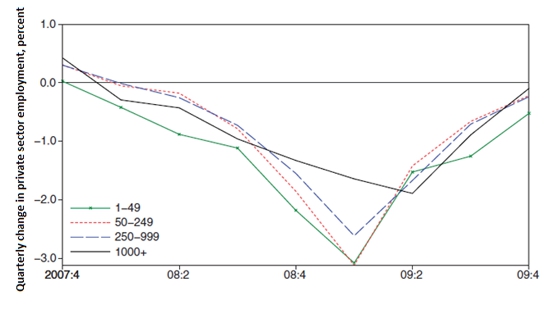

Separating by firm type, credit supply had a large effect on employment at small and medium firms, but the data cannot reject no effect on employment at the largest firms. The finding that banking relationships matter more to smaller borrowers provides evidence of asymmetric information in lending markets. The concentration of loan supply effects at small and medium firms may also help explain why employment fell disproportionately at these firms during the immediate post-Lehman banking crisis period, as shown in Figure 1. During the heart of the banking crisis in the fourth quarter of 2008 and the first quarter of 2009, smaller firms reduced employment by much more than did the largest. The differential then disappears in the summer of 2009, coincident with the timing of the stabilization of interbank lending markets.

Figure 1 – Employment Losses by Firm Size 2007 – 2009

Note: The figure shows the percent change in employment by firm size class. The numerator is the change in employment using a dynamic sizing methodology. The denominator is the average level of employment during the two quarters. The BLS only reports employment levels for the first quarter of each year; the denominators for intervening quarters are linearly interpolated. Source: Bureau of Labor Statistics (Business Employment Dynamics).

I conducted extensive robustness exercises to address the concern of borrowers of healthy and less healthy lenders differing along other unobserved dimensions. To begin, borrowers of different banks appear very similar on many observable dimensions, including operating in industries and counties experiencing nearly identical employment declines. Next, I used a within-firm estimator to show that the estimated effect of lender health on the likelihood of borrowing does not change in specifications with and without borrower fixed effects. Intuitively, the difference between these two specifications captures exactly the unobserved characteristics of the borrowers, and absence of a differential effect directly addresses the concern of unobserved borrower characteristics. Third, placebo regressions corresponding to employment changes near the end of the last business cycle expansion and during the 2001 recession indicated that employment at firms that had pre-crisis relationships with less healthy lenders did not differ systematically from employment at other firms during the placebo periods. Finally, the different measures of bank health yield quantitatively similar estimated effects on employment despite relatively weak correlations with each other..

Overall, the results provide new evidence of the importance of banking relationships. If all firms had access to the healthiest lender and assuming zero spillover effects, the decline in credit availability accounts for one-third to one-half of the decline in employment at small and medium firms in the year following the collapse of Lehman Brothers.

This article is based on the paper The Employment Effects of Credit Market Disruptions: Firm-level Evidence from the 2008–9 Financial Crisis in the Quarterly Journal of Economics.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/P981RQ

_________________________________________

Gabriel Chodorow-Reich – Harvard University

Gabriel Chodorow-Reich – Harvard University

Gabriel Chodorow-Reich is an associate of the department of economics at Harvard, where he will begin as an assistant professor in 2014. His research focuses on macroeconomics, finance, and labor economics. He is currently the Julis-Rabinowitz Associate Research Scholar at Princeton University.