When new technology leads to a dramatic change in the availability of information, how do firms and markets respond? In a unique historical ‘experiment’, Claudia Steinwender evaluates the trade impact of the submarine transatlantic telegraph cable that connected Europe and North America in the mid-nineteenth century.

When new technology leads to a dramatic change in the availability of information, how do firms and markets respond? In a unique historical ‘experiment’, Claudia Steinwender evaluates the trade impact of the submarine transatlantic telegraph cable that connected Europe and North America in the mid-nineteenth century.

How do exporters gather information about overseas markets and forecast consumer demand for their products? What do they do if technology suddenly makes it possible to get access to better and more timely information? And what is the overall impact on prices, market integration and trade flows? These are challenging questions in the modern world of the internet and ‘big data’, where the vast amount of new information that firms can collect on consumers could have a significant impact on global economic interactions.

In a recent study, I have looked back to Victorian times to see what can be learned from the introduction of the transatlantic telegraph cable that connected Europe and North America. Before the cable was in place, steam ships were used to transmit information back and forth across the Atlantic: on average, a crossing took ten days, but it could be quicker or slower depending on the weather during the voyage. Once the cable was fully operational on 28 July 1866, there was almost real-time communication between the two continents.

Cotton was the most important traded good across the Atlantic in those days, and the telegraph cable was immediately used to exchange information about the cotton markets on each side of the ocean. I have collected data from newspapers of the time to understand the impact of this change in information technology on prices and trade flows. Cotton was produced in the United States and shipped over to Britain, where it was spun into yarn and woven into textiles. Lancashire, notably the hinterland of Liverpool and ‘Cottonopolis’ Manchester, was the centre of worldwide textile manufacturing.

How did cotton get to Britain? American cotton farmers would sell their raw cotton to merchants at cotton exchanges at the ports, of which New York was the most important. The merchants then shipped the cotton over to Liverpool, where there was another organised exchange, and where they would sell the cotton to textile manufacturers from Lancashire.

Since shipping the cotton took time, when making the decision to buy cotton from farmers on any given day in New York, merchants had to forecast how large the demand for cotton would be when their shipment arrived. The telegraph brought more recent and up-to date information about the Liverpool market. As a result, merchants were able to make better forecasts, and adjust exports better to the demand of textile manufacturers.

The historical data show that the telegraph led to a better integration of cotton markets. The ‘law of one price’ states that in efficient markets, the price for the identical good should be the same in different locations (after accounting for transport costs). If prices were to differ, there would be arbitrage opportunities for merchants to buy in one market and sell in the other.

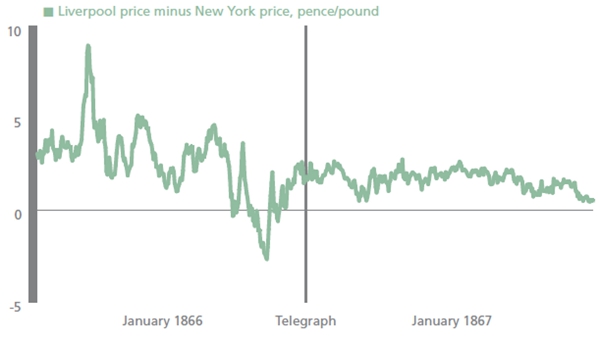

Market integration can therefore be assessed by looking at the price difference of the same type of US cotton between New York and Liverpool. As Figure 1 shows, the volatility in the price difference was much larger before the telegraph and much less volatile afterwards. What’s more, the average price difference was smaller after the telegraph. Overall, the cotton markets were better integrated after the telegraph. My analysis confirms that this holds taking account of shipping times, transport costs and other alternative explanations.

Figure 1: The price difference of US cotton between New York and Liverpool before and after the telegraph

My research also shows that the smaller and less volatile price difference was a result of changing exports. After the telegraph, merchants were more aware of arbitrage opportunities, because they had more recent information when they were forecasting Liverpool demand, reducing their forecast error. As a result, overall exports actually became more volatile and, on average, larger. They became more volatile because with better information, exports could follow actual demand shocks more closely.

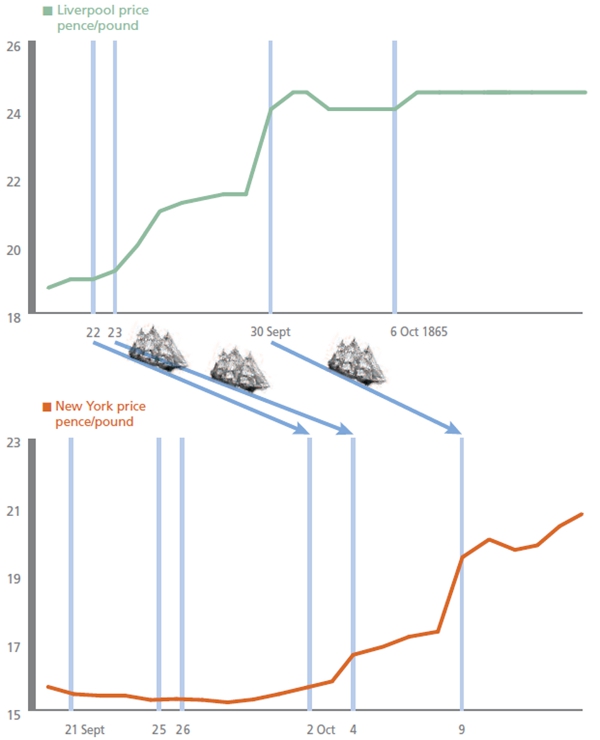

An anecdotal episode illustrates how information affected exports before the transatlantic telegraph got established. The upper panel of Figure 2 shows the price of US cotton in Liverpool. On 30 September, 1865, the price shot up because of increased demand from cotton millers. On the same day, nothing happened in New York, as the lower panel of Figure 2 shows – this was simply because New Yorkers weren’t aware of the high demand for cotton in Liverpool.

Figure 2: How information affected prices before the transatlantic telegraph was established

Note: It took about nine days for a ship to sail the Atlantic, so a cotton price increase in Liverpool on 30 September 1865 did not result in a similar increase in New York until 9 October, when a ship arrived with the news.

On 2 and 4 October, steam ships arrived with news from Liverpool, but the ‘news’ that they carried was old and didn’t yet incorporate the large demand shock. It was only on 9 October, when a steam ship arrived with the news about the demand shock that the market in New York reacted. The New York Times reported on that day: ‘Cotton has been in decidedly more request, and, under the favorable advices from England…, prices have advanced materially.’ Prices in New York went up because of increased export demand from merchants. The newspaper reported an ‘unusually large quantity’ of cotton being exported.

This episode illustrates how information affects the exporting behaviour of merchants and how it is necessary for market integration. Price shocks are transmitted faster across markets because export flows adjust – so information has real effects on the economy.

I estimate the efficiency gains from the telegraph to have been around 8 percent of the annual export value of cotton, a quite substantial number. Most of these efficiency gains came from better alignment of supply and demand: when millers wanted more cotton, the cotton was there, and there was no need to wait for the information to reach the other side of the Atlantic. A quarter of the efficiency gains came from the trade-inducing effect of the telegraph.

In other words, the introduction of the telegraph was equivalent to abolishing a 6 percent trade tariff. As a modern comparison, this is twice the average effect of the North American Free Trade Agreement (NAFTA), but it covers only half of the industry that was most affected by NAFTA: textiles.

The historical example of the transatlantic telegraph can be generalized to any setting in which exporters or producers have to make decisions in advance about production and/or exporting and face uncertainty about demand. In this setting, information technologies can improve the ability of firms to forecast demand. The forecast error of exporters becomes smaller and less volatile the better the available information. This leads firms to decide on production or export quantities that are better matched with consumer demand, which benefits everyone.

Identifying and reacting to demand changes are still critical in today’s world. Demand fluctuates more rapidly and widely than in the past, as new trends appear and disseminate via social media networks. Global supply chains and outsourced stages of production make it more difficult to communicate demand changes across the different firms involved in the production process.

Newly emerging information technologies, such as the real-time analysis of ‘big data’, have the potential to affect trade in a similar and probably even more drastic way than the telegraph. The smart phone era has generated an enormous amount of real-time data on consumer behaviour.

The technologies for analyzing these large amounts of data are still being developed, but they have the potential to provide firms with much more accurate demand forecasts. It is likely that the economic mechanism behind big data and the transatlantic telegraph cable is very similar.

This article originally appeared in the Spring 2014 issue of CentrePiece, the magazine of the Centre for Economic Performance (CEP) at LSE, and summarises ‘Information Frictions and the Law of One Price: When the States and the Kingdom became United’ by Claudia Steinwender.

Please read our comments policy before commenting.

Note: This article gives the views of the authors, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1kAJZXP

_________________________________

About the author

Claudia Steinwender – LSE Centre for Economic Performance

Claudia Steinwender – LSE Centre for Economic Performance

Claudia Steinwender is a PhD candidate in Economics at the LSE and a Research Assistant at the Centre for Economic Performance. She will spend the 2014/2015 academic year as IES Fellow at the International Economics Section at Princeton University.

1 Comments