According to recent estimates, more than one third of Americans are now classified as obese, with correspondingly higher risks of developing a chronic illness. The greater prevalence of these illnesses puts a great deal of pressure on healthcare services, and imposes costs on both public and private health insurance systems. In new research, Joanna MacEwan, Julian Alston, and Abigail Okrent estimate that in 2009 over $166 billion in U.S. public medical expenditure could be attributed to obesity. They also find that an increase of one unit of BMI for every adult in the United States would increase public medical expenditure by $4.35 per pound, or approximately $6 billion annually.

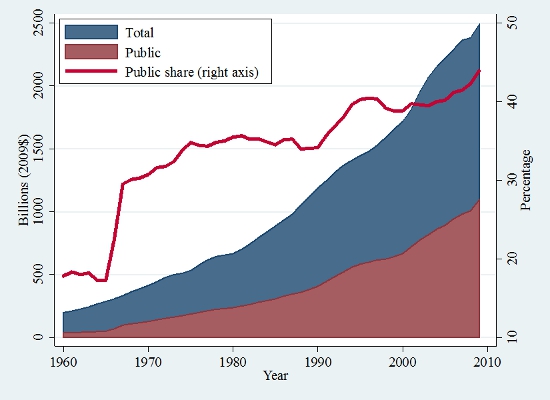

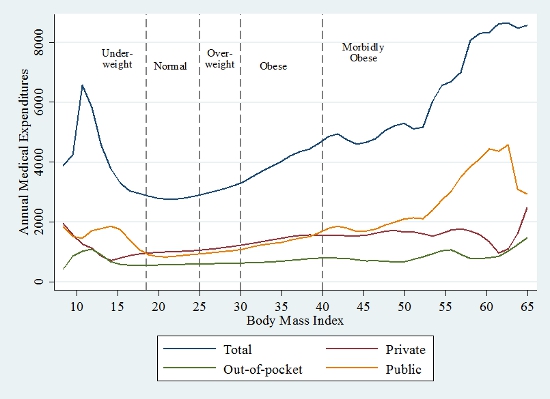

Over the past five decades in the United States both total medical expenditures and the proportion financed with public funds have increased significantly (see Figure 1). Over the same period the prevalence of obesity among adults in the United States nearly tripled, increasing from 13.4 percent to 35.9 percent. Obesity is associated with increased risk of developing several chronic illnesses (e.g., diabetes, colon cancer, heart disease, stroke) and thus increases in expenditure on preventive, diagnostic, and treatment services associated with these chronic diseases (see Figure 2). As Figure 2 illustrates, the relationships are significantly nonlinear, suggesting that the greatest savings in medical expenditures would be made by reducing the body weight of the most obese.

Figure 1 – Public Share of Total U.S. Medical Expenditures, 1960–2009

Source: Created by the authors using data from the Centers for Medicare and Medicaid

Figure 2 – Kernel Estimate of Annual Medical Expenditures by Payer and BMI

Source: Created by the authors using data from the Medical Expenditure Panel Survey (MEPS) 2007–2009.

Public health officials have cited increased public health-care costs as a rationale for policies aimed at reducing the prevalence of obesity. It is well established that an increasingly obese population adds significantly to public and private medical expenditures, but this may not be sufficient grounds to justify government intervention. Economic rationales for obesity policies rest on the presumption that obese individuals do not bear all of the costs of being obese, and that they impose an externality on the non-obese, as can arise through cost pooling. For instance, hospitals may need special equipment to accommodate heavier people and, unless hospitals charge prices for services that reflect individual costs, all patients will face higher prices for medical procedures.

Health-care systems that pool costs, both through private insurance and through Medicare and Medicaid, have the greatest potential for externalities. However, such cost pooling alone might not involve significant distortions in behavior or in total costs of obesity, and therefore might not justify intervention by the government on economic efficiency grounds. The size of these distortions is an empirical question that had not been addressed until now.

In recent research, we measure the external or publicly funded cost of obesity and estimate the associated deadweight loss (DWL) conditional on alternative assumptions about the socially optimal prevalence of obesity. We predict that a one-unit increase in Body Mass Index (BMI) for every adult in the United States would increase annual public medical expenditures by $6.0 billion, a marginal annual public cost of $27 per unit of BMI or $4.35 per pound on average across the U.S. adult population.

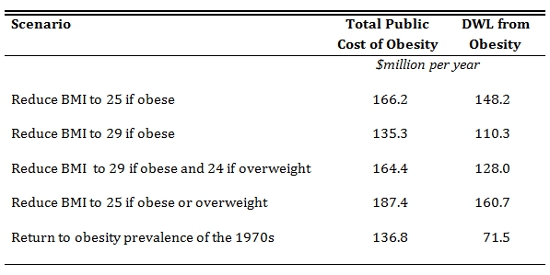

Under a range of alternative assumptions about the socially optimal BMI, we separately quantify the size of the externality and the net social cost of the current prevalence of obesity (see Table 1). The results suggest that greater benefits would come from moving the obese to the non-obese category than from moving the overweight to the normal category. Specifically, we estimate that if every U.S. adult who is now obese (BMI ≥ 30) had a BMI of 25 instead, annual public medical expenditures would decline by $166.2 billion (in constant 2009$), or 15.2 percent of annual public medical expenditures in 2009. Assuming a socially optimal BMI of no more than 25, we estimate that the prevalence of obesity in 2009 resulted in a DWL of $148.2 billion in 2009. As noted above, even though the existence of this externality is a necessary condition in an economic efficiency justification for government intervention, it had not previously been quantified.

Table 1 – Estimated Public Cost and DWL from Obesity, U.S. Adults, 2009

Source: Created by the authors using data from the Medical Expenditure Panel Survey (MEPS) 2007–2009.

Source: Created by the authors using data from the Medical Expenditure Panel Survey (MEPS) 2007–2009.

While we have demonstrated that the current prevalence of obesity potentially entails a significant externality in the form of increased public medical expenditures, we did not attempt to quantify the cost of reducing the prevalence of obesity. This is arguably a much more difficult task. Our results imply that the current prevalence of obesity results in an annual net social cost that is nearly as large as the public medical expenditures attributable to obesity.

This article is based on the paper, ‘The Consequences of Obesity for the External Costs of Public Health Insurance in the United States’ in Applied Economic Perspectives and Policy.

Featured image credit: Juber Al-haddad (Flickr, CC-BY-NC-SA-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics. The findings and conclusions reported here do not necessarily represent the views of the U.S. Department of Agriculture Economic Research Service.

Shortened URL for this post: http://bit.ly/1zR9oHd

______________________

Joanna MacEwan – Precision Health Economics

Joanna MacEwan – Precision Health Economics

Joanna P. MacEwan is an associate research economist with Precision Health Economics, LLC. Her research covers a broad range of health economics topics including the economics of nutrition and obesity and the returns to medical research and development.

_

_

Julian Alston – University of California, Davis

Julian Alston – University of California, Davis

Julian M. Alston is a professor in the Department of Agricultural and Resource Economics of the University of California, Davis. He also serves as a member of the Giannini Foundation of Agricultural Economics, director of the Robert Mondavi Institute Center for Wine Economics, and associate director for science and technology policy at the University of California Agricultural Issues Center. At UC Davis, Julian leads a wide-ranging research program on the economics of public policies related to food and agriculture and related issues.

Abigail Okrent – USDA Economic Research Service

Abigail Okrent – USDA Economic Research Service

Abigail Okrent is a research economist in the Food Economics Division at the US Department of Agriculture’s Economic Research Service. The primary goal of her research is to evaluate the effectiveness of food and agricultural policies on food consumption, obesity, and nutrition.