For many of us, purchasing a house is one of the most important financial decisions that we will ever make. But does when we buy or sell a house matter? In new research, Silvana Tenreyro and Liwa R. Ngai find that housing markets are seasonal, with prices rising in the spring and summer, and declining in the fall and winter. They argue that this is due to a self-reinforcing pattern where a ‘hot season’ leads to more choice for buyers, who are in turn willing to pay more for houses that are a better quality match.

For many of us, purchasing a house is one of the most important financial decisions that we will ever make. But does when we buy or sell a house matter? In new research, Silvana Tenreyro and Liwa R. Ngai find that housing markets are seasonal, with prices rising in the spring and summer, and declining in the fall and winter. They argue that this is due to a self-reinforcing pattern where a ‘hot season’ leads to more choice for buyers, who are in turn willing to pay more for houses that are a better quality match.

Looking to buy or sell a house? Most real estate agents will tell you that the time of year can be a very important factor in the deal that you’ll get. But just how important is the season to the way the housing market moves? In new research, we find that in many countries house prices and the number bought and sold, rise quite dramatically above trend in the second and third quarters of the calendar year and stagnate or fall below trend in the fourth and first quarters. The sharp seasonal swings in housing prices explain why house-price indices in most countries are typically presented in seasonally adjusted form by statistical agencies.

For anyone interested in housing prices’ trends, this is of course a clean way to look at the data. But for actual sellers and buyers, seasonal fluctuations can make a big difference. If a buyer spent $500,000 on a house in the U.S. in a typical February, they should expect to pay $515,000 if they wait until April—in addition to the rent paid for the property in which they live while waiting, if they are letting, or the rent forgone, if they could have let it. (The corresponding April price in the UK, would be £520,000 for a house sold at £500,000 in February.) Those tens of thousands of dollars or pounds, informally speaking, look like money left in the sidewalk.

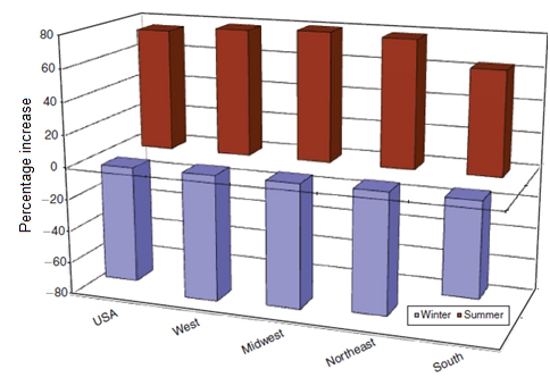

For the United States as a whole, we find that differences in annualized growth rates between hot and cold seasons are above 4.6 percent for nominal (and real) prices and 146 percent for transactions, as shown in Figures 1 and 2. US cities tend to display higher seasonality, with differences in growth rates across seasons of 6.7 percent for (real) prices and 152 percent for transactions.

Figure 1 – Average Annualized US House Price Increases in Summer and Winter by Region

Source: National Association of Realtors (1991 – 2012)

Figure 2 – US Average Annualized Percentage Increases in Transactions in Summer and Winter, by Region

Source: National Association of Realtors (1991 – 2012)

This raises a natural question: If house prices are typically higher in the spring and summer, why don’t more buyers try to buy in the fall or winter? Clearly for some people it is more convenient to move in the summer; in particular, young families may find it easier to search before sending their children to new schools and the summer is of course the season of marriages. But parents of school children and newlyweds are only a small fraction of the pool of buyers. And, moreover, it is not clear that the convenience of the timing will be worth so much money.

In our research, we began by systematically documenting the existence, quantitative importance, and cross-regional variation in these seasonal booms and busts. We then argue that the surprising size and predictability of seasonal fluctuations in house prices poses a challenge to standard macroeconomic models of durable-good markets. In those models, anticipated changes in prices cannot be large: If prices are expected to be much higher in April than in February, then buyers will shift their purchases to the beginning of the year, narrowing down price differentials. We show, more concretely, that seasonal differences in prices are inconsistent with standard asset-market equilibrium conditions. Of course no-arbitrage conditions may become irrelevant when transaction costs are very high, as is likely to be the case here. But the question still remains for why (presumably informed) buyers systematically try to buy in the high-price season.

We offer a new explanation by resorting to a search-and-matching framework. The model starts from the premise that every house is a little different and families have different housing needs. In that context, buyers are more likely to find a better-quality match (and thus their willingness to pay is more likely to increase) when there are more houses for sale. Hence, in a thick market (or hot season), sellers can charge higher prices. Because prices are higher, more sellers put their houses up for sale in the hot season; thus, better matches are formed, and more buyers seek to buy in the hot season, and so on. This self-reinforcing dynamic leads to higher number of transactions and prices in the hot season.

Even a slightly higher predicted propensity of moving in a given season can trigger thick-market externalities that make it appealing to a large number of agents to buy and sell during that season. This amplification mechanism can create substantial seasonality in transactions. The extent of seasonality in prices depends crucially on the bargaining power of sellers. The higher their bargaining power, the higher the share of the transaction’s surplus they can extract and the more prices fluctuate over the seasons.

This article is based on the paper ‘Hot and Cold Seasons in the Housing Market’ in the American Economic Review.

Featured image credit: nathan esguerra (Flickr, CC-BY-2.0)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1DPh0tC

_____________________________________

Silvana Tenreyro – LSE Department of Economics

Silvana Tenreyro – LSE Department of Economics

Silvana Tenreyro is Professor in Economics at the London School of Economics. She is Board Member of the Review of Economic Studies and serves as Associate Editor for the Journal of the European Economic Association, the Journal of Monetary Economics, the Economic Journal, and Economica. Tenreyro is an external MPC member for the Central Bank of Mauritius, Member at Large of the European Economic Association (EEA), Leading academic at the Centre for Macroeconomics, Research Associate at the CEP Macroeconomics program, and Research Affiliate at CEPR. In the past, she acted as Panel Member for Economic Policy, Director of the IGC Macroeconomics Programme, and she chaired the Women in Economics Committee of the EEA. Her main research interests are Macroeconomic Development and Monetary Policy. Recent publications include “Technological Diversification” (AER), “The Timing of Monetary Policy Shocks” (AER), and “Volatility and Development” (QJE).

Liwa R. Ngai – LSE Department of Economics

Liwa R. Ngai – LSE Department of Economics

Liwa Rachel Ngai is an Associate Professor of Economics at the LSE. Her research interests include macroeconomics, labor, and growth and development.