The development of a housing bubble in the United States is generally regarded as one of the root causes of the financial crisis that began in 2007, but what causes housing bubbles to occur? Alison Johnston and Aidan Regan write that while the bubble leading to the financial crisis has tended to be blamed on the spread of cheap credit, the fact that house price rises were far larger in some countries than others suggests there were other factors at play. They argue that although credit plays a role in housing bubbles, an increase in income appears to be far more closely linked to the price rises that occurred across the OECD prior to 2007.

The development of a housing bubble in the United States is generally regarded as one of the root causes of the financial crisis that began in 2007, but what causes housing bubbles to occur? Alison Johnston and Aidan Regan write that while the bubble leading to the financial crisis has tended to be blamed on the spread of cheap credit, the fact that house price rises were far larger in some countries than others suggests there were other factors at play. They argue that although credit plays a role in housing bubbles, an increase in income appears to be far more closely linked to the price rises that occurred across the OECD prior to 2007.

Housing bubbles have significant implications for economic stability and wealth inequality, as the US subprime crisis so emphatically demonstrated. Economists largely cite global financial trends (financial liberalisation, the removal of capital controls, interest rate convergence in the developed world, securitisation and permissive lending) as the culprits of bubble formation.

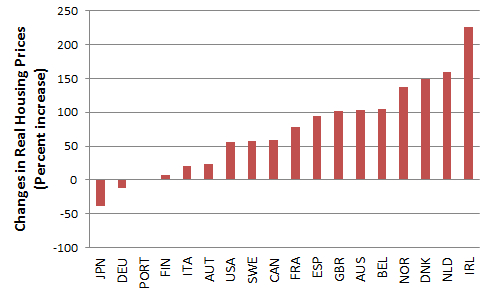

There is one major problem with this explanation, however. All countries in the OECD were subject to common global credit shocks. This made (mortgage) credit more widely available to households, and cheaper. But despite this common “supply-side” shock, not every country experienced a house price boom, as shown in Figure 1 below.

Figure 1: Changes in Real Housing Prices in the OECD (1990-2007)

Source: OECD and the Bank of International Settlements

If the rise of global capital fails to fully account for the variation in housing prices across developed economies, then what can? In a recent LEQS working paper, we propose a comparative political economy perspective, focusing on (wage-setting) institutional factors that shape mortgage “demand” in the wider OECD.

Recent credit-as-welfare literature, which focuses largely on (mortgage) credit expansion in the United States, treats income and credit as substitutes: repressed income growth requires households to take on more debt to maintain a given level of consumption. According to this narrative, income growth and housing prices should share a negative correlation – low incomes are associated with housing inflation as the former is supplemented with an expansion in household credit demand.

However, the US and UK, whose credit regulatory policies are heavily lax, are an empirical outlier. They do not adequately represent housing demand dynamics across other developed economies. Looking beyond the United States, housing price increases may be more reflective of the complimentary relationship between income and credit. Higher income growth enables households to take on more (mortgage) debt, which in turn places upward pressures on housing prices.

Institutions governing wage setting in national labour markets play an important role in income expansion. Countries with institutions that favour the export sector (Austria, Germany, and Japan) are more likely to produce more systemic wage moderation, and in turn low inflation, than countries with wage-setting institutions that favour sheltered sectors (Spain and Ireland) or those which favour the market (the US and UK).

Building upon the complementary nature of income and credit, we argue that economies with export-favouring institutions that moderate income growth may be less exposed to housing bubbles for two reasons. First, repressed income growth reduces domestic demand for all goods, including home mortgages. Second, since wage-setting institutions, and the sectoral politics that underpin them, are “sticky”, they may influence households’ future expectations of income growth, and adjust their demand for mortgages accordingly.

Our empirical results largely support the primacy of income growth in shaping housing inflation. But they also emphasise the unique relationship between income stagnation, credit expansion and housing bubbles in the US. In an instrumental variable panel analysis of 17 OECD economies from 1980 to 2007, we find that only real income growth and changes in real interest rates have significant effects on housing bubbles, while other credit variables (private credit supply and capital controls) and political variables (government partisanship and central bank independence) display minimal impact.

However, income matters more than real interest rate changes. While a one standard deviation decrease in real interest rates is associated with a 0.5-0.7 per cent increase in real housing prices, a one standard deviation increase in real income growth is associated with a 1.7-2.4 per cent real housing price increase. This relationship does not hold forthe US, which is the only country in our panel where the income/housing price relationship does not exist.

To tease out the impact of how wage bargaining regimes impact on housing inflation we supplement our panel analysis with a qualitative case study of Ireland and the Netherlands. During the 1990s, both countries had the highest increases in housing prices in the OECD. But during the 2000s, Dutch housing prices flat-lined while Ireland’s house price boom turned into a bubble. Credit supply factors cannot explain this divergence. The Netherlands had generous policies governing households’ mortgage credit accumulation. They had the highest maximum loan-to-value ratio and the most generous tax subsidies for home mortgages within the OECD. Real interest rate declines in the Netherlands during the 1990s were also roughly on par with those in Ireland.

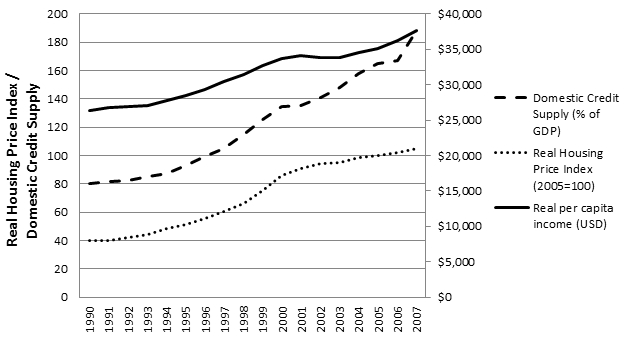

It was not credit supply that explains the divergence in house prices between Ireland and the Netherlands, but wage restraint. From 2002-2005 the Dutch government, in coalition with export-led employers and reluctant unions, negotiated centralised wage agreements which, at first, imposed a 2.5 per cent nominal wage ceiling, followed by two years of nominal wage freezes. These wage pacts slowed income growth considerably. This slowdown in income growth conspicuously overlaps with the lull in Dutch housing price growth from 2001 (see Figure 2). Though Dutch banks continued to expand the availability of credit, their housing prices were moderated in line with the national wage agreements.

Figure 2: House prices, credit supply and income growth in the Netherlands (1990-2007)

Source: OECD, Bank of International Settlements and the World Bank

The opposite occurred in Ireland. In order to buy industrial peace and build electoral support, the government granted a series of wage rises (in addition to the country’s national headline wage pacts) to the public sector in the 2000s, which led to an average increase in public sector nominal wages of 50 per cent between 2000 and 2004. These payments, along with cuts in income taxes, fuelled wage spirals that conspicuously overlapped with the rapid expansion of credit that funded Ireland’s housing bubble from 2005 onwards (see Figure 3).

Figure 3: House prices, credit supply and income growth in Ireland (1990-2007)

Source: OECD, Bank of International Settlements and the World Bank

Our results suggest that income growth, and the wage-setting institutions that govern it, may be more important in explaining housing price growth than broader financial variables. While income growth’s impact on housing prices is minimal in the US, it is strongly correlated with housing price increases in other OECD countries.

This is not to suggest credit expansion does not matter, but that housing price increases are amplified, and turn into a bubble, in the presence of a complementary income shock. In the midst of international financial trends, which have made mortgage debt instruments more plentiful and cheaper, countries with wage setting institutions led by the export sector or the state, continued to remain insulated from the external risks of globalised capital.

Featured image credit: woodleywonderworks, Flickr, CC-BY-2.0

This article originally appeared at the EUROPP – European Politics and Policy at LSE blog.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1DfZ4NK

_________________________________

Alison Johnston – Oregon State University

Alison Johnston – Oregon State University

Alison Johnston is Assistant Professor in Comparative Political Economy at Oregon State University.

_

–

Aidan Regan – University College Dublin

Aidan Regan – University College Dublin

Aidan Regan is Lecturer in European political economy at the School of Politics and International Relations (SPIRe) in University College Dublin (UCD), and Co-Director of the Dublin European Institute (DEI).