Conventional wisdom contends that promoting and maintaining economic diversity is an important way in which economies can build resilience against external economic shocks such as recessions. In new research, Robert T. Greenbaum and Lathania Brown put this idea to the test, with a study of employment data from Ohio from 1977 to 2011. They find that while diversity does help buffer economies from national or local employment shocks, this can come at the cost of relatively higher levels of unemployment during times that are more prosperous.

Conventional wisdom contends that promoting and maintaining economic diversity is an important way in which economies can build resilience against external economic shocks such as recessions. In new research, Robert T. Greenbaum and Lathania Brown put this idea to the test, with a study of employment data from Ohio from 1977 to 2011. They find that while diversity does help buffer economies from national or local employment shocks, this can come at the cost of relatively higher levels of unemployment during times that are more prosperous.

Major economic blows, natural disasters, and the loss of a major employer remind us that economic conditions can change rapidly, sometimes literally overnight. Other threats to economic stability, such as those due to typical business cycle fluctuations, may be only slightly more predictable. Because of the serious damage these shocks impart on economies, policymakers, academics, and the media have recently been focusing on examining factors that may increase economic resilience.

While people have defined resilience in multiple ways, our research examined factors that affect the ability of economy to withstand a shock in the first place. Using employment data from Ohio’s 88 counties between 1977 and 2011, our work focuses on whether counties that have greater industrial diversity are more resilient. By examining a state that has such large geographic variation in urbanization, industry composition and levels of specialization over such a long period (that spans seven national recessions), we were able explore the impact of industrial concentration on changes in unemployment rates both overall and during times of economic distress. Thus, in addition to measuring whether high concentration made economies less able to absorb shocks, we were curious about the effects of less concentrated economies during times of prosperity. Our analysis found that, indeed, more diverse counties were able better withstand shocks. However, the increased resilience came at the cost of higher unemployment rates during better economic times.

Industrial Diversity

More specialized/less diverse economies can be a boon to the local businesses, which can benefit for economies of scale, greater access to industry specific inputs (such as a workforce trained in a particular field) and services (such as financial and legal), and better access to relevant shared markets. While such companies may be competing with one another, the benefits make the close proximity a net gain.

While many firms thrive when located close to others that are technologically similar or somehow related, there are also risks to having a concentrated economy. Regions such as Silicon Valley are still thriving, but this example should be balanced against the cautionary tales of other once-thriving economics in cities such as Detroit, Cleveland, and Youngstown. When conditions change rapidly such that demand drops for the specialized industry(ies), it is often impossible for these concentrated economies to adequately adapt to those changes quickly. Thus, a region’s industrial diversity has been found to serve as one of the factors that help to build resilience and economic stability.

Examining the relationship between industrial diversity, resilience, and economic growth

Based on Bureau of Labor Statistics (BLS) data, Ohio had similar trends in unemployment rates between 1977 and 2011 to the overall U.S. economy, with the state unemployment typically exceeding the national rate (Figure 1).

Figure 1 – National and Ohio Unemployment Rates, 1977-2011

Sources: Bureau of Labor Statistics

For the statistical analysis, we coded the years with peak unemployment rates as “national shock” years: 1982, 1983, 1992, 2002, 2003, 2009, and 2010. We also created indexes that measured both industry diversity and concentration.

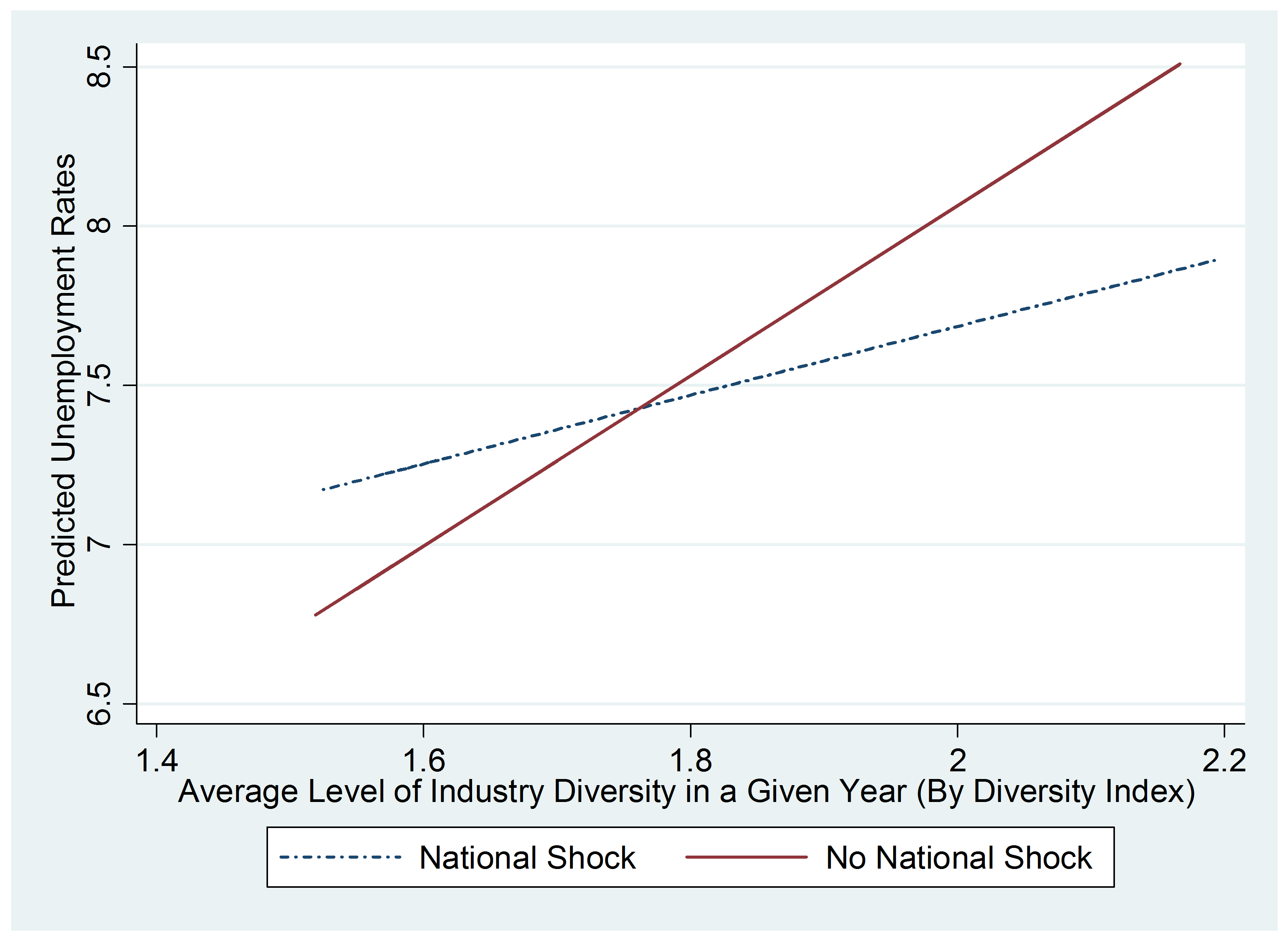

Our findings suggest greater industry diversity did indeed lead to lower unemployment rates when the national economy experienced employment shocks, but that those more diverse counties faced higher unemployment rates when the national economy was doing well. These patterns are shown in Figure 2.

Figure 2 – The Role of Diversity during National Shocks

During years that did not experience a shock, the slope on the predicted unemployment rate (the solid red line) is positive and relatively steep. This indicates that, all else equal, counties with greater diversity had higher unemployment rates. During shock years (the dashed blue line), the intercept is higher, which represents higher average unemployment rates, but the slope is much flatter. This indicates the benefit of diverse industrial concentrations during shocks in that the diversity helps buffer against the effects of the shocks.

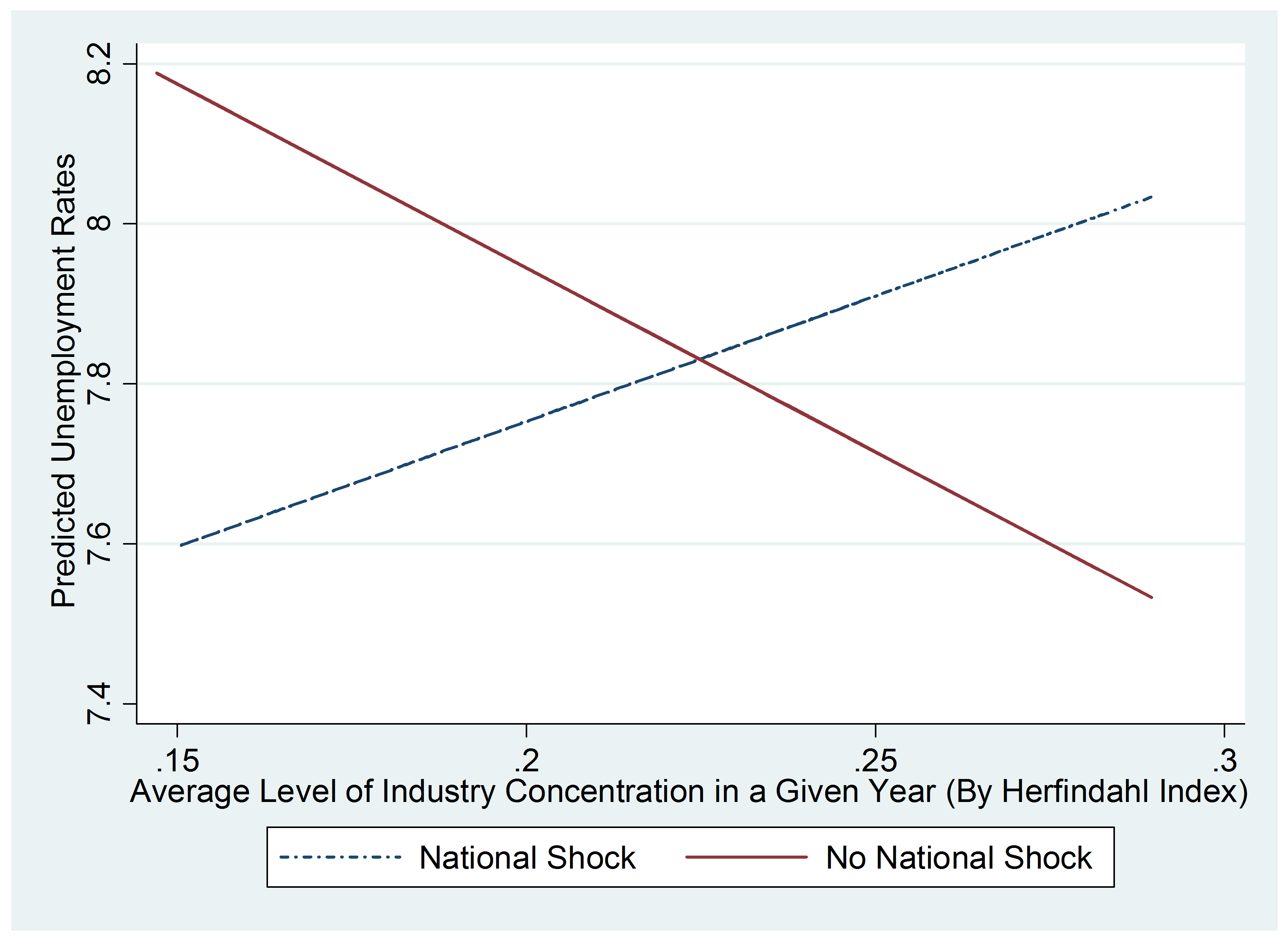

We also examined the role of concentration (as measured by a Herfindahl Concentration Index), which is the absence of diversity. The effects of concentration are even starker, as is seen in Figure 3.

Figure 3 – Display of Herfindahl Concentration Index and National Shock Interaction

When there is no shock (the solid red line), the slope on the predicted unemployment rate is negative and relatively steep, again indicating that less concentrated counties have higher unemployment rates on average (similar to the higher unemployment rates in more diverse counties in Figure 2). During shock years (the dashed blue line), the slope is positive, such that counties with higher industrial concentrations clearly have higher unemployment rates. Thus, while industrial concentration helps to lower unemployment rates most years, it leads to higher unemployment rates during downturns.

Rethinking resilience

A better understanding of a region’s industry concentration levels and corresponding vulnerabilities to shocks may lead policymakers to adopt buffering policies. It is unlikely that regions would be able to quickly alter their industrial diversity in the short term, and it may also be difficult to attract and retain firms in more peripheral industries in the longer run, but they may be able to implement strategies to offset the threats of high concentration in the face of shocks. These strategies range from developing a skilled workforce to ensure that workers can more easily adjust to changing opportunities to strategies to minimize potential negative fiscal impacts of downturns. Consideration of larger rainy day funds for less diverse counties or investigation of more aggressive growth strategies for more diverse counties may be warranted. Leaders in concentrated counties may also wish to seek to ensure a more stable tax base that varies less with the overall economy than those in counties with a more diverse industrial mix. To improve resilience, policymakers may further need to think of resilience in a more dynamic or adaptive fashion, thus being flexible enough to structure processes that are conducive to positive outcomes even after shocks occur. Better recognition of the potential tradeoffs highlighted in research such as this can lead to more effective planning.

This article is based on the paper, ‘The role of industrial diversity in economic resilience: An empirical examination across 35 years’, in Urban Studies.

Featured image credit: Chris Miller (Flickr, CC-BY-2.0)

Please read our comments policy before commenting

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/23ZQT2v

______________________

Robert T. Greenbaum – The Ohio State University

Robert T. Greenbaum – The Ohio State University

Robert T. Greenbaum is an Associate Professor at the John Glenn College of Public Affairs at The Ohio State University. His research focuses on economic resilience and urban and regional economic development. He analyzes the interactions of policy, the characteristics of a local population and the structure of industry and economic activity. His work examines economic development policies that are targeted spatially, and he studies how local economies are affected by serious disruptions like terrorism, natural disasters and recessions.

Lathania Brown – The Ohio State University

Lathania Brown – The Ohio State University

Lathania Brown is a doctoral candidate at the John Glenn College of Public Affairs at The Ohio State University. Her research explores the role that the private sector plays in addressing matters of the public good and the extent to which the public sector is able to drive sustainable economic growth. Her dissertation work explores the role of public policy in terms of helping to make local economies more resilient to rare events.