The shortage in software/IT workers drove US firms to countries with an abundant supply of tech talent, like China, India and Israel, write Lee Branstetter, Britta Glennon and J. Bradford Jensen.

The shortage in software/IT workers drove US firms to countries with an abundant supply of tech talent, like China, India and Israel, write Lee Branstetter, Britta Glennon and J. Bradford Jensen.

The globalisation of research and development (R&D) has long lagged far behind the globalisation of production, but since the late 1990s, the distribution of US multinational R&D investment across countries and industries has undergone a dramatic shift towards unlikely R&D destinations like China, India, and Israel. Today’s leading US multinationals have developed a global innovation system that increasingly relies on emerging market talent to propel innovation for the global frontier. Why these emerging markets – and why now?

In new research, we argue that the rising importance of software and information technology as drivers of innovation and new product development across a wide range of industries led to a shortage in software/IT-related human capital within the US, and drove US multinationals abroad in a search for talent. To support this argument, we document (1) the growing importance of software and IT in firm innovation across industries, which led to (2) a shortage in software/IT-related human capital in the US, leading to (3) the rise of new R&D hubs that have large quantities of STEM workers.

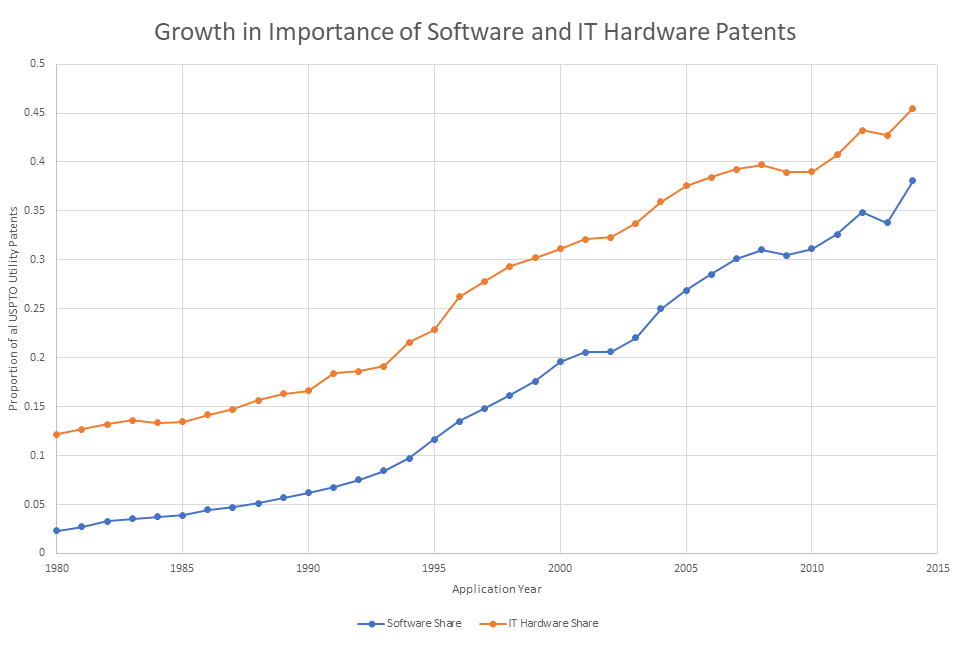

Software and IT patents have been growing in importance since the 1990s; as Figure 1 shows, the share of all US Patent and Trademark Office (USPTO) patents that are software grew from 5 per cent in 1990 to nearly 40 per cent by 2015. Arora, Branstetter, and Drev (2013) and Branstetter, Drev, and Kwon (2018) see the rise in IT-intensity as evidence of the emergence of a “general purpose technology” in new product development that applies across manufacturing industries. The advent of powerful microprocessors, memory chips, sensors, and digital control systems enabled new generations of devices to become “smarter” and more responsive to their environment. Increasingly, improvements in product functionality could be achieved through better software alone. This has made IT and, especially, software engineering capabilities a more central driver of success in innovation, increasing demand for IT and software-engineering talent. Arora, Branstetter, and Drev (2013) present evidence that superior access to software engineering human resources enabled U.S. IT firms to out-innovate their Japanese rivals in the 1990s and 2000s. Branstetter, Drev, and Kwon (2018) find evidence that firms better positioned to exploit these technological opportunities realise higher returns to their R&D investments across a range of traditional manufacturing industries outside IT.

Figure 1 – The growing IT/software-intensiveness of US MNCs’ invention

Some of the increase in demand for IT and software-specialised workers has been met by importing talent from abroad – and particularly from China and India. The foreign share of IT workers grew from 16 per cent in 1993 to 32 per cent by 2010, a phenomenon well-documented by Bound et al. (2015). Applications for Indian and Chinese high-skilled workers made up 85 per cent of H-1B visa applications in 2017, and Indian and Chinese students combined made up 18 per cent of doctorates in science and engineering from US universities in 2016; this share is even larger for some key disciplines. These changes suggest an extremely large increase in demand that was partially met by importing talent from abroad, through mechanisms like the H-1B program and the American higher education system.

However, data from the BEA and other sources are consistent with the view that the foreign influx of software and IT engineers has not fully met demand. Relative compensation in these domains appears to be high and rising over time. Our interviews with R&D managers also support the view that firms experienced a shortage of IT/software talent and needed to move abroad to gain access to large foreign supplies of skilled engineers.

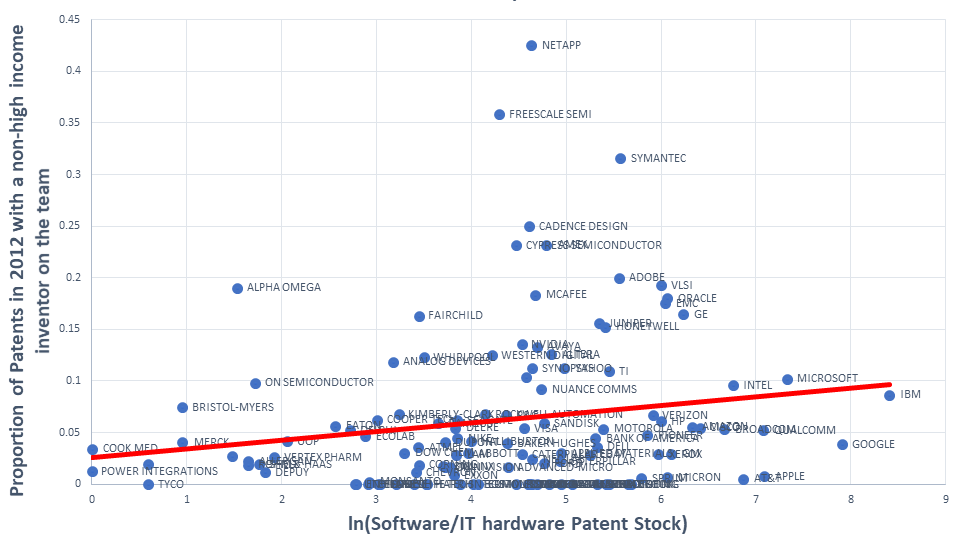

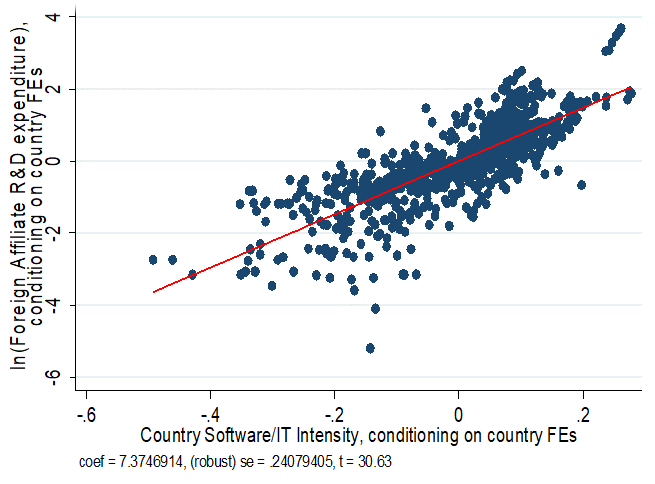

Countries like China, India, and Israel with an abundant supply of IT/software-specific human capital thus became attractive R&D destinations for US multinational firms. An examination of the types of activity done in these countries further underscores the idea that the need for raw human capital to meet the demand of software- and IT-intensive US multinationals has been a significant motivator in US MNC decisions to open R&D facilities: Bureau of Economic Analysis data shows that R&D-performing affiliates in China, India, and Israel are concentrated in computer and electronic manufacturing and professional, scientific, and technical services, while the activities in more traditional R&D destinations like Germany, Japan, Canada, the UK, and France are concentrated in traditional manufacturing. Figures 2 and 3 provide additional support and suggest together that foreign R&D is most pronounced in IT/software-intensive countries, and that it is most intensively done by IT/software-intensive firms.

Figure 2 – Correlation between a firm’s software and IT hardware patent stock and the proportion of patents with a non-high income foreign inventor in 2012, for firms with >=100 patent stock

Source: USPTO

Figure 3

Our analysis suggests that the increasing reliance on IT and software in innovation and the growing endowments of specialised human capital in countries like India and China induced US MNCs to conduct more R&D in these locations. These findings have important implications. First and foremost, they suggest that there is a constraint on the supply of IT and software human capital in the US, and that these human resource constraints are limiting the invention possibilities for U.S.-based multinational firms, even in the domains where innovative activity and technological opportunity seem to be at the highest levels. This is consistent with research by Jones (2009) and Bloom et al. (2017), documenting the rising human resource requirements of innovation. Second, these constraints can be relaxed through open immigration policies, liberal trade and FDI policies, and support of the globalisation of R&D activity. When successful, the global flows of investment, people, and ideas can raise growth, productivity, and consumption possibilities around the world. Policies that constrain these flows could slow the rate of inventive activity, and, in the longer run, the global rate of technological progress. Our work therefore provides a new argument in defence of an open trading, investment, and immigration regime.

Authors’ note: We gratefully acknowledge financial support from the National Science Foundation through two grants: 1360165 and 1360170. The statistical analysis of firm-level data on U.S. multinational companies was conducted at the Bureau of Economic Analysis (BEA), United States Department of Commerce under arrangements that maintain legal confidentiality requirements. The views expressed do not reflect official positions of the U.S. Department of Commerce or the NSF.

- This blog post appeared previously at LSE Business Review and is based on the authors’s paper “The IT Revolution and the Globalization of R&D.” Innovation Policy and the Economy 19:1–37

- Featured image by Sylvain Kalache, under a CC-BY-2.0 licence

Please read our comments policy before commenting

Note: This article gives the views of the author, and not the position of USAPP– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/2vB7Ruc

About the authors

Lee Branstetter – Carnegie Mellon University

Lee Branstetter is professor of economics and public policy at Carnegie Mellon University’s Heinz College, a joint appointment with the social and decision sciences department. He is also a research associate of the National Bureau of Economic Research and non-resident senior fellow at the Peterson Institute for International Economics. From 2011-2012, he served as the senior economist for international trade and investment for the President’s Council of Economic Advisors. He previously taught at Columbia University, and the University of California, Davis. He has served as a consultant to the OECD science and technology directorate, the advanced technology programme of the US Department of Commerce, and the World Bank. In recent years, Branstetter has been a research fellow of the Keio University Global Security Research Institute and a visiting fellow of the Research Institute of Economy, Trade, and Industry in Japan. He earned his Ph.D. in economics at Harvard in 1996.

Britta Glennon- Carnegie Mellon University

Britta Glennon- Carnegie Mellon University

Britta Glennon is a PhD candidate at Carnegie Mellon University. In July 2019, she will be joining the Wharton School of Business as an Assistant Professor. She studies innovation and technological change, with a special focus on the changing structure of the R&D activities of multinational firms. Her current research examines the impact of restrictive high-skilled immigration policies on the globalization of high-skilled activity.

J. Bradford Jensen – Georgetown University

J. Bradford Jensen – Georgetown University

J. Bradford Jensen is the McCrane/Shaker chair in international business at the McDonough School of Business at Georgetown University, a senior fellow at the Peterson Institute for International Economics, and a research associate of the National Bureau of Economic Research. Jensen pioneered the use of plant-level microdata to investigate the impact of international trade and investment on the economy. His recent work examines the relationship between trade and firm performance and the impact of trade in services on the economy. Prior to joining Georgetown in 2007, Jensen served as deputy director at the Peterson Institute. Jensen also has served as director of the Center for Economic Studies at the U.S. Census Bureau, on the faculty at Carnegie Mellon University, and as a visiting professor at the Tuck School of Business at Dartmouth College. Jensen received his Ph.D. in economics from Stanford University.