The COVID-19 pandemic has seen over one million deaths and millions of infections in the US since early 2020. In new research, Theologos Dergiades, Costas Milas and Theodore Panagiotidis find that many of the measures aimed at tackling the pandemic, such as mask-wearing and social distancing also had effects on unemployment in the states. They write interventions like lockdowns cause a spike in unemployment insurance claims for six weeks from when they begin and that economic support measures can help to mitigate these effects. They conclude that better coordination between economic support policies and interventions like mask wearing could have further reduced the increase in pandemic-related unemployment insurance claims.

The COVID-19 pandemic has seen over one million deaths and millions of infections in the US since early 2020. In new research, Theologos Dergiades, Costas Milas and Theodore Panagiotidis find that many of the measures aimed at tackling the pandemic, such as mask-wearing and social distancing also had effects on unemployment in the states. They write interventions like lockdowns cause a spike in unemployment insurance claims for six weeks from when they begin and that economic support measures can help to mitigate these effects. They conclude that better coordination between economic support policies and interventions like mask wearing could have further reduced the increase in pandemic-related unemployment insurance claims.

With more than 85 million COVID-19 cases and over one million deaths, the US has the highest number of confirmed infections and the highest official death toll in the world. At the beginning of the pandemic, local state governments in the US deployed drastic anti-contagion policy actions to shield public health in the form of social distancing measures and lockdowns. Such containment measures lowered US GDP by an annualized rate of 31 percent in the second quarter of 2020. Between mid-March and May 2020 more than 40 million initial unemployment claims were submitted in the US as a result of pandemic restrictions. To counteract the adverse economic fallout of the pandemic, the US federal government put in place (March 2020), a stimulus package of about $2 trillion; the so-called Coronavirus Aid, Relief, and Economic Security (CARES) Act which is the largest support package in history.

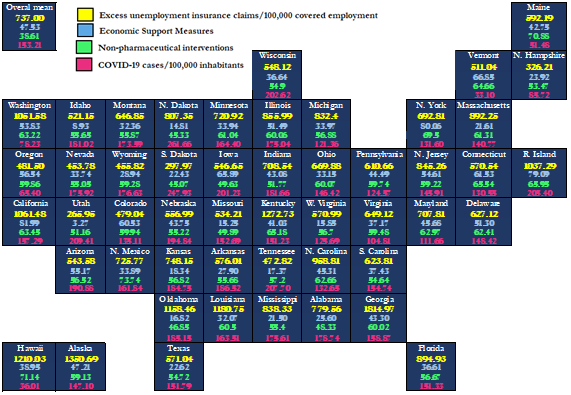

In new published work, we assess the impact of non-pharmaceutical interventions, like mask wearing and social distancing, and economic support measures on the number of unemployment insurance claims in the US, based on data from February 2020 to January 2021. For all US states, we use data on: (i) the excess initial unemployment insurance claims per 100,000 of the weekly reported covered employment, (ii) non-pharmaceutical interventions, (iii) economic support measures, and finally, (iv) the weekly change in confirmed COVID-19 cases per 100,000 inhabitants. Figure 1 shows the data sample mean values per state. Among the states, Washington State, for instance, recorded higher excess unemployment claims, higher economic support measures, stronger non-pharmaceutical interventions, and lower infections than the overall mean. New York State recorded lower excess insurance claims, higher economic support measures, stronger non-pharmaceutical interventions, and lower infections than the overall mean.

Figure 1 – State level data and the COVID-19 pandemic

Notes: Non-pharmaceutical interventions per state refer to an aggregate index (between 0 and 100) that considers nine normalized individual containment and closure policies (school closures, workplace closures, cancelation of public events, restrictions on gathering size, closure of public transport, stay-at-home requirements, restrictions on internal movement, restrictions on international travel, and public information campaign). Economic support measures per state refer to an aggregate index (between 0 and 100) that considers two normalized individual economic support policies: income support (salary coverage or provision of direct cash payments, universal basic income to those who lost their jobs or are unable to work) and debt/contract relief for households (facilitation in meeting financial obligations, such as loan repayment and payment of basic utilities bills). The raw data for the unemployment insurance claims and the covered employment come from the US Department of Labor. The source of the dataset on the confirmed COVID-19 cases is the Centers for Disease Control and Prevention. Population estimates in 2019 from the US Census Bureau were used to construct the confirmed COVID-19 cases per 100,000 inhabitants.

COVID-19 interventions are linked to rising unemployment claims across the US states

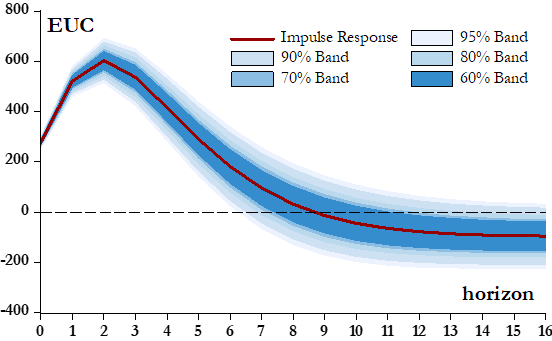

Using regression models, we first find that non-pharmaceutical interventions trigger an instantaneous increase in excess unemployment claims. As Figure 2 shows, the impact lasts for up to six weeks.

Figure 2 – Non-pharmaceutical interventions increase excess unemployment insurance claims for six weeks

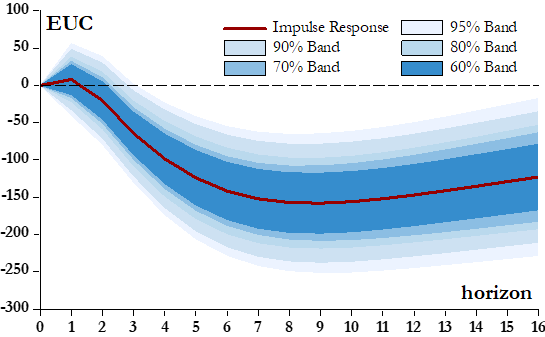

Second, the impact of economic support measures towards reducing unemployment is not felt immediately. Economic stimulus takes three weeks to become effective and only partially mitigates the negative impact of lockdowns on the labor market (see Figure 3). Indeed, as Figure 2 shows, non-pharmaceutical interventions led to a total of around 2800 excess unemployment claims per US state, after a period of six weeks. On the other hand, Figure 3 requires stronger economic support measures (than those in place) to fully mitigate the same labor market losses for each state within the same six-week period.

Photo by Martin Sanchez on Unsplash

Figure 3 – Economic support measures mean fewer excess unemployment insurance claims

Third, we find that the deployment of economic support is not driven by the state of the pandemic per se. This finding implies that policymakers decide on the implementation of economic support measures by paying attention to how the labor market reacts to the pandemic rather than the severity of the pandemic itself. This suggests that the economic cost of the pandemic might have been mitigated further by better coordination of policy, if, for instance, non-pharmaceutical interventions and economic support measures could have been synchronized more closely and, at the same time, economic support could have been even more generous than what was implemented. This is, of course, easier said than done because sovereign credit risk has increased since the COVID-19 pandemic making it more challenging to borrow in international markets in order to finance more generous economic support for the labor market.

Our work complements reporting from the Organisation for Economic Co-operation and Development (OECD) on policy responses to the COVID-19 virus which reviews all economic support measures of OECD countries towards workers and their families to argue that economic support measures preserve jobs.

Our work considers the pandemic effects on the labor market prior to the full rollout (in December 2020) of the vaccination program. Future work needs to assess the impact of vaccination programs on labor markets over and above the impact of non-pharmaceutical interventions and economic support measures. This is an important point to make because further waves of the pandemic remain a possibility. It is our belief that a sustainable exit strategy from future pandemics will rely primarily on additional vaccination programs and, to a lesser extent, on the implementation of lockdown restrictions that have been extremely challenging for the mental health and well-being of individuals.

- This article is based on the paper, ‘Unemployment claims during COVID-19 and economic support measures in the U.S’. in Economic Modelling.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: https://bit.ly/3H9FA1T

About the authors

Theologos Dergiades – University of Macedonia

Theologos Dergiades – University of Macedonia

Theologos Dergiades is an Assistant Professor of Applied Macrofinance and Information Demand at the Department of International and European Studies at the University of Macedonia. He received his Ph.D. in 2010 from the University of Macedonia in Economics. His research focuses on identifying and analysing statistical trends in order to make sense of economic policies.

Costas Milas – University of Liverpool

Costas Milas – University of Liverpool

Costas Milas is a Professor of Finance at the University of Liverpool. His research interests centre around Monetary Policy issues. He obtained his M.Sc. and Ph.D. in Economics from the University of Warwick. His research has examined the effects of monetary policies in Britain and in the Eurozone. Most recently, Professor Milas has been particularly interested in analysing the impact of the COVID-19 Pandemic on the American and British economies.

Theodore Panagiotidis – University of Macedonia

Theodore Panagiotidis – University of Macedonia

Theodore Panagiotidis is a Professor of Econometrics at the Department of Economics at the University of Macedonia. His research interests include Applied Economics and Financial Econometrics. He received his Ph.D. in 2003 in Economics from the University of Sheffield.