Much like infrastructure in general, drinking water infrastructure in the US needs investment, with for-profit firms which can seek investment increasingly seen as one solution. Jaivime Evaristo examines the role of environmental, social, and governance (ESG) ratings for water utilities in determining how investors make their decisions, a role which is complicated by often divergent ratings across providers. He finds that ESG ratings diverge more strongly in the water technologies subsector compared to water utilities and that larger utility firms are linked to better ESG performance.

Much like infrastructure in general, drinking water infrastructure in the US needs investment, with for-profit firms which can seek investment increasingly seen as one solution. Jaivime Evaristo examines the role of environmental, social, and governance (ESG) ratings for water utilities in determining how investors make their decisions, a role which is complicated by often divergent ratings across providers. He finds that ESG ratings diverge more strongly in the water technologies subsector compared to water utilities and that larger utility firms are linked to better ESG performance.

More than $470 billion are needed to repair and replace the country’s drinking water infrastructure. Overstretched public finances, however, mean that government spending can only achieve so much. Capital flows (i.e., investments) to and by private for-profit firms in the water sector are increasingly becoming important.

Water, water, everywhere, Capital, capital, is there somewhere.

At least 10 percent of the US population gets their drinking water from privately-owned water utilities. A 2021 US Government Accountability Office (GAO) report identified 14 publicly traded firms, providing for-profit drinking water to customers in 33 states. These firms exist to generate profits. And their fuel is investments.

Investments in firms are typically a combination of debt (loans and bonds) and equity (stocks). These investments provide capital that a for-profit firm can then use to grow its business. Recent examples include American Water’s announcement seeking $2 billion of equity to fund its capital expenditures, and Essential Utilities’ acquisition of wastewater assets in Pennsylvania. For-profit firms, in turn, distribute profits (dividends) to their investors.

The growing importance of environmental, social, and governance ratings

Capital flows towards for-profit firms across all sectors, however, are becoming more and more influenced by the ESG [environmental, social, and governance] ratings that they receive. A US GAO’s interview of 12 (out of 14) institutional investors in 2020 revealed that these investors used ESG information to, among others, ‘make stock purchasing decisions’.

ESG ratings – informed partly by a firm’s own sustainability reports and provided by ratings agencies – evaluate a firm’s performance with respect to ESG issues. ESG ratings aim to measure a firm’s impact on the broader society, such as emissions, resource use, biodiversity, human rights, workforce diversity, working conditions, health and safety, management structure, executive compensation, etc.

Nonetheless, the evidence is now clear that the ESG ratings of various providers diverge (i.e., disagree) significantly with each other. Around 94 percent of the divergence in ESG ratings is due to differences in scope (the attributes the ratings agencies attempt to measure) and measurement (the measures used to evaluate the same attributes). In other words, ESG ratings agencies differ in what and how they measure. Thus, it should not be surprising that ESG ratings disagree. We should be alarmed if they don’t.

©iStock/Water drop phive2015

ESG ratings and the US water subsectors

Given the growing demand for ESG information, it is conceivable that the divergence of ESG ratings could confuse investment decisions. Moreover, in the US water sector, it is unclear if and how ESG ratings diverge in its subsectors. That is, do ESG ratings diverge between firms that supply water (Utilities) and those that provide technologies for supplying that water (Technologies)?

Using publicly available data from two prominent ESG ratings agencies for publicly traded companies in the US, I first find that ESG ratings diverge more strongly in the Technologies than in the Utilities subsector (Figure 1). Visually, this divergence is indicated by the departure of a firm from the 1:1 line. That is, the farther a firm is from the 1:1 line the greater the disagreement in the ratings of the two providers for that firm.

Figure 1- The divergence in ESG ratings of two ratings agencies, Refinitiv and Sustainalytics, for publicly traded companies in the Utilities and Technologies subsectors in the US water sector

Sustainalytics’ scores were multiplied by -1 and added 100 to allow for comparison. That is, higher values correspond to better ESG performance. I then normalized the scores to have zero mean and unit variance. Ratings were retrieved between Nov 1 and Dec 2, 2022. Krippendorff’s alpha is a measure of inter-rater reliability. Krippendorff suggests α ≥ 0.80 as a customary threshold that the raters’ assessments are reliable; whereas α ≥ 0.667 is the lowest limit where tentative conclusions may be made. Following the taxonomy of Global Water Intelligence, the Utilities subsector includes companies that provide bulk or retail water supply and wastewater treatment services for cities. Technology subsector includes companies that manufacture and assemble water and wastewater treatment systems, including companies that provide components for these systems. Ticker symbols of some stocks are shown. (Author’s analysis)

The first finding suggests that the strength of disagreement of ESG ratings in part depends on the nature of a firm’s business. The ESG issues confronting a firm that provides water supply and wastewater treatment services may be different from the ESG issues confronting a firm that provides the technologies for those services.

The second finding is that ESG ratings are associated with firm size (here using market capitalization as proxy). This is true for Utilities but not so for the Technologies subsector. The second finding raises caution in suggesting sweeping implications between ESG performance and firm size at the subsector level. In other words, better ESG performance is associated with large firms that provide water supply and wastewater treatment services. The same could not be suggested regarding large firms that provide the technologies for those same services. At least for the subsectors and the two ESG ratings agencies examined here.

ESG ratings and firm-level characteristics

It is not uncommon for ESG ratings agencies to release research reports on a wide range of topics that users of their data might find useful. Using a global sample of over 4,000 firms for the year 2020, a March 2022 report by Sustainalytics, for example, showed that firms with high water intensity (as measured by the volume of water withdrawal per revenue unit in millions of dollars) are correlated with high ESG risks and high returns, but only weakly correlated with alpha (a measure of an investment strategy’s ‘ability to beat the market’).

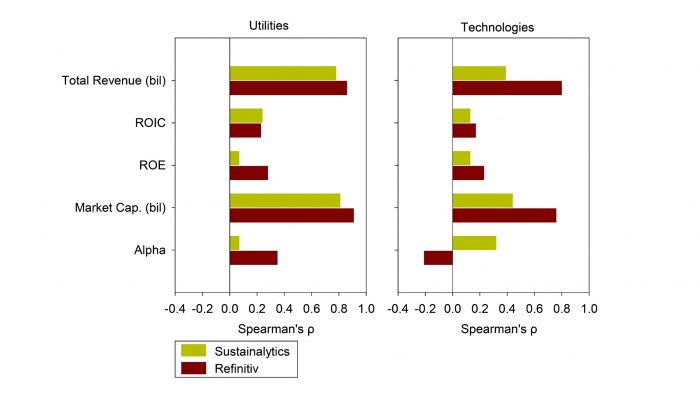

Using a much smaller sample of firms in the US water sector, I show in Figure 2 that ESG ratings of the two ratings agencies are positively correlated with indicators of firm size (total revenue and market capitalization) and management effectiveness (ROIC and ROE). The strengths of these correlations, however, vary between the two ESG ratings agencies. Because ESG ratings agencies differ in what and how they measure, this is not at all surprising.

Figure 2 – Correlations between ESG ratings of two ratings agencies, Refinitiv and Sustainalytics, and firm characteristics – total revenue (in $ billion), Return on Invested Capital (ROIC), Return on Equity (ROE), Market Capitalization (in $ billion), and Alpha.

Data for the first four firm characteristics were retrieved from Investopedia Stock Market Simulator (Nov 2022). Alpha was calculated using financial data from Compustat’s Capital IQ, retrieved from Wharton Research Data Services (Nov 2022). (Author’s analysis)

The two ratings providers, however, disagree in the direction of the correlations between ESG ratings and alpha in the Technologies subsector (Figure 2). Sustainalytics shows positive correlation with alpha whereas Refinitiv shows negative correlation. This suggests that better ESG performance in the Technologies subsector is associated with negative value for investors when using Refinitiv ESG ratings. The opposite is the case when using Sustainalytics ESG ratings. Whilst this result is also not surprising – again, considering that ESG ratings agencies differ in what and how they measure – the opposing results raise caution in relying on one ESG provider over another. Most importantly, given the limited time horizons considered in this analysis, as with others, these correlations should be treated with even more serious caution.

Disagreement is diversity

The interpretations of these findings assume that there is meaningful information in the ratings despite their disagreement. And that US water sector players could and should still find value in using ESG information for their purposes. Indeed, as Professor of Finance Alex Edmans wrote: “[..] another word for disagreement is ‘diversity’[..] and “[..] this diversity is to be embraced rather than lambasted as inconsistent.”

The US water sector has approximately 50,000 utility providers. But only a tiny fraction of these is publicly listed. As the sector consolidates, against the backdrop of growing importance being placed on ESG ratings, these findings point to the need for greater scrutiny over how the data behind ESG ratings are generated. It also underlines some nuances between different subsectors. If for-profit firms are to maximize their success and their contributions to repairing and replacing the country’s drinking water infrastructure, then paying close attention to these nuances may be all worth the effort.

- Please read our comments policy before commenting.

- Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

- Shortened URL for this post: https://bit.ly/3kudGGx