In recent decades, spending on healthcare in the U.S. has continued to rise to unprecedented levels, raising questions over the sustainability of an ageing population. Kai Zhao investigates why this increase has been so dramatic, and using new research, argues that the dramatic expansion of Social Security may be one of the main causes. He explains that Social Security’s expansion means more money is redistributed towards the elderly, who are also more likely to spend more on healthcare than younger groups. The growth in Social Security also means that health spending growth has been much faster among the elderly than among the non-elderly.

In recent decades, spending on healthcare in the U.S. has continued to rise to unprecedented levels, raising questions over the sustainability of an ageing population. Kai Zhao investigates why this increase has been so dramatic, and using new research, argues that the dramatic expansion of Social Security may be one of the main causes. He explains that Social Security’s expansion means more money is redistributed towards the elderly, who are also more likely to spend more on healthcare than younger groups. The growth in Social Security also means that health spending growth has been much faster among the elderly than among the non-elderly.

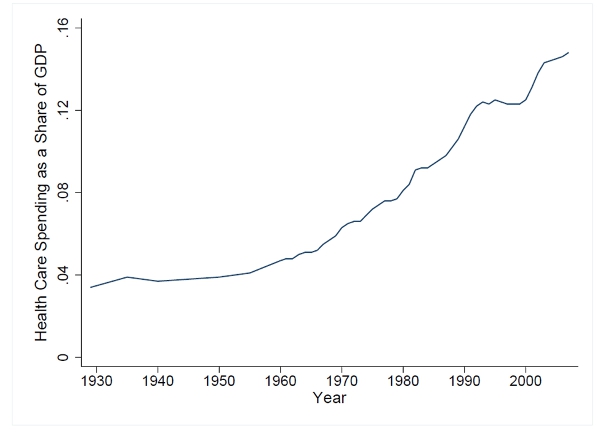

Aggregate health care spending as a share of GDP has more than tripled over the last half century in the United States, from approximately 4 percent in 1950 to 13 percent in 2000 (see Figure 1). Why has U.S. health spending as a share of GDP increased by so much? This question has attracted growing attention in the literature. Several explanations have been proposed, such as increased health insurance and economic growth. However, the Congressional Budget Office (2008) has shown that these existing explanations together only account for up to half of the rise in US health spending over the last half century, suggesting that there is still a large portion of the rise in health spending remaining unexplained.

Figure 1: Health Spending (as a share of GDP) in the United States: 1929-2005

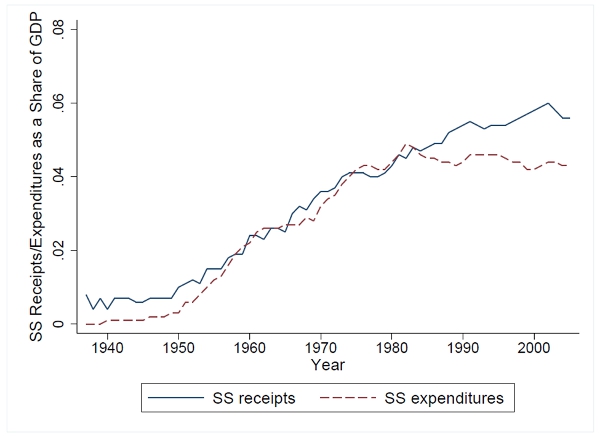

In new research, I propose a new explanation for the dramatic rise in U.S. health spending. I argue that the expansion of the U.S. Social Security program may be another important cause of the rise in health spending. Over the last several decades, the size of the U.S. Social Security program has also dramatically expanded (as shown in Figure 2). Total Social Security expenditures were only 0.3 percent of GDP in 1950, and jumped to 4.2 percent of GDP in 2000. Social Security can increase aggregate health spending as a share of GDP via two channels. First, Social Security transfers resources from the young to the elderly (age 65+), whose marginal propensity to spend on health care (the amount of health care bought per extra dollar of income) is much higher than the young, thus raising aggregate health spending. For example, if the marginal propensities to spend on health care for the young and for the elderly are 0.09 and 0.4 respectively, then transferring one dollar from the young to the elderly would increase aggregate health spending by 31 cents. Second, Social Security raises expected future utility by providing annuities in the later stage of life and insuring for an uncertain lifetime. As a result, it increases the marginal benefit from investing in health to increase longevity, and thus induces people to spend more on health care.

Figure 2: US Social Security: Total Expenditures/Receipts as a Share of GDP

The impact of Social Security on aggregate health spending is quantitatively large. My numerical simulation analysis suggests that an increase in the size of Social Security which is similar in magnitude to the expansion of US Social Security from 1950 to 2000 can generate a significant rise in aggregate health spending, which accounts for over a third of the rise in U.S. health spending as a share of GDP from 1950 to 2000. In addition, when the analysis is extended to include the main existing explanations for the rise in health spending, i.e. the introduction of Medicare and income growth, the model can account for most of the rise in US health spending from 1950 to 2000.

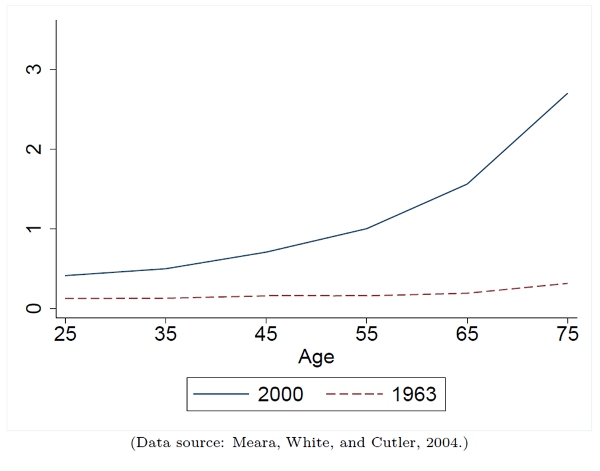

The Social Security hypothesis is also consistent with another relevant empirical observation over the same period: the change in life-cycle profile of average health spending (per person). Meara, White, and Cutler (2004) find that health spending growth was much faster among the elderly than among the non-elderly from 1963 to 2000. As a result, the life-cycle profile of health spending has become much steeper over the last several decades (see Figure 3). I find that the effects of Social Security on health spending are highly unequal across the age distribution. The change in the size of Social Security affects the elderly much more than the young. As a result, the expansion of Social Security does not only increase aggregate health spending, but also makes the life-cycle profile of health spending steeper. The numerical simulation analysis shows that the expansion of Social Security does not only account for a large portion of the rise in aggregate US health spending from 1950 to 2000, but also plays a key role in matching the change in life-cycle profile of health spending over the last several decades.

Figure 3: Health Spending (per capita) By Age

Note: The age group 55-64 in 2000 is normalized to one

My findings also have some interesting policy implications. For instance, they suggest that Social Security has a significant spill-over effect on public health insurance programs (e.g. U.S. Medicare) via its impact on health spending. Medicare covers a fixed fraction of health spending for the elderly. Therefore, as Social Security induces the elderly to spend more on health care, it also increases the insurance payments from Medicare, thus raising its financial burden. My analysis shows that the payroll tax rate required to finance the Medicare program would drop from 3.1 percent to 1.0 percent if Social Security were eliminated in the economy. This finding is particularly interesting because Social Security and Medicare are the two largest public programs in the United States and both are currently under discussion for reforms. It suggests that the spill-over effect of Social Security on Medicare may be large, and thus should be taken into account by future studies on policy reforms.

This article is based on the paper, ‘Social security and the rise in health spending’, in the Journal of Monetary Economics.

Featured image credit: SalFalko (Creative Commons BY NC)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1gOUcoI

_________________________________________

Kai Zhao – University of Connecticut

Kai Zhao – University of Connecticut

Kai Zhao is an Assistant Professor in the Department of Economics at the University of Connecticut. He is a macroeconomist who specializes in examining the linkages between the health care market and the macroeconomy.