Fear has escalated that China is taking over and hollowing Africa. With $43.39 billion in Chinese foreign direct investment (by stock) in Africa in 2020, what is China’s end game? Mainstream perception indicates that China aims at resource exploitation, reminiscent of neo-colonialism. However, Professor Shirley Ze Yu contends that this perception only captures the utilitarian but not the egalitarian aspect of Chinese FDIs in Africa.

China imports massive quantities of vital natural resources from sub-Saharan Africa. These include oil, liquefied natural gas, timber, gold and copper, uranium, and precious base metals such as cobalt and lithium. Yet, in the public domain, we rarely identify how much of the Chinese trades are pure product imports vs. equity investments and offtakes.

Equity investment enables China to control upstream production, guarantee supply priority to the home market, operate vital transport links, and in some instances, monopolise the global supply – powers that an importer is limited to exercise. Rarely do we also examine China’s investment behaviour in countries that are not richly endowed with natural resources compared to the resource-rich ones. How much Chinese investments are embedded in non-resource-producing African countries, and to serve what purpose?

I strive to answer the above questions by initially examining the obvious: the connection between Chinese Foreign Direct Investments (FDIs) and Africa’s resource footprint. If Chinese investments solely aim at resource exploitation, one may assume that resource-rich African countries should receive abundant Chinese investments and resource-poor countries receive little.

China’s FDI correlates with China’s resource interest in Africa

Twelve resource-rich African countries – South Africa, DR Congo, Zambia, Ethiopia, Angola, Nigeria, Kenya, Zimbabwe, Algeria, Ghana, Tanzania, and Mozambique – housed nearly three-quarters of China’s FDI by stock in 2020, as seen in figure 1. If we separate African countries into two groups – the resource-rich countries and the resource-poor countries – the nature of resource endowment (rich or poor) is a strong explainer of the divergent distribution of Chinese FDIs across Africa. The resource-rich countries receive an overwhelming share of Chinese FDIs in Africa.

However, if we were to examine Chinese FDIs across African countries on a country level, not a systemic level, resource endowment alone does not sufficiently explain the discordance that lie between the degree of African countries’ natural resources reliance and the level of Chinese FDIs received.

For example, the resource-based investment theorem does not explain why Libya, with resource rents of 44%, does not receive a high level of Chinese FDI. It does not explain why South Africa, with resource rents of 3.9%, relatively low in Africa and far lower than DR Congo’s 46%, receives the highest share of Chinese FDIs by stock.

Six resource-rich countries – Nigeria, South Africa, Ethiopia, Kenya, Ghana, and Tanzania – are also among some of Africa’s largest economies by GDP in 2020. The high levels of Chinese FDIs in these countries can be partially attributed to the attractiveness of rich resources. It can also be partly explained by the fact that larger economies with more sophisticated industrial infrastructure and economies of scale tend to receive higher levels of foreign direct investments.

Do Chinese FDIs favour larger economies in Africa?

To further examine whether a country’s economic vibrancy and scale are drivers for Chinese FDIs, we assume Chinese FDI share (Chinese FDI in a particular African country as a share of Chinese aggregate FDI in Africa) correlates to a country’s GDP share (GDP for a particular African country as a share of Africa’s continental GDP).

In figure 2, we observe that Chinese FDI allocation is more evenly distributed – more egalitarian – than countries’ natural GDP divergence. Smaller African economies received a higher Chinese FDI share relative to their GDP share than larger economies.

Therefore, it is ascertained that Chinese FDIs in Africa embody characteristics that are both egalitarian and utilitarian. It is egalitarian because smaller African economies receive a favourable share of Chinese investment than their natural economic scale would otherwise suggest. It is utilitarian because of the clear resource-based motivation behind Chinese FDIs.

Research suggests that higher growth and larger economies tend to have an advantage over lower growth and smaller economies in attracting foreign direct investments. The egalitarian nature of Chinese FDIs in Africa enlightens that these investments are motivated not just by economic incentives but non-economic ones.

The non-economic factors that drive Chinese FDIs in Africa

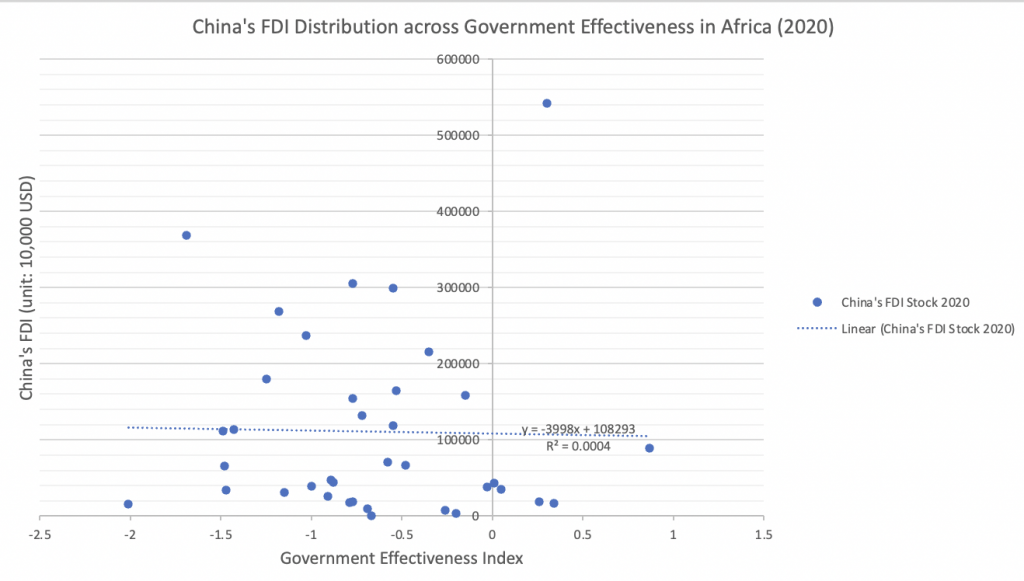

We are inclined to speculate that China prefers investing in countries with an efficient and effective government in order to maximise return on investment and minimise government red tape. Yet, in figure 3, we see no clear tendency that Chinese investments favour more politically effective governments in Africa. Chinese FDIs have spread across African governments over a wide spectrum of political effectiveness rankings, with no significant trend in favouring “government effectiveness” or the contrary.

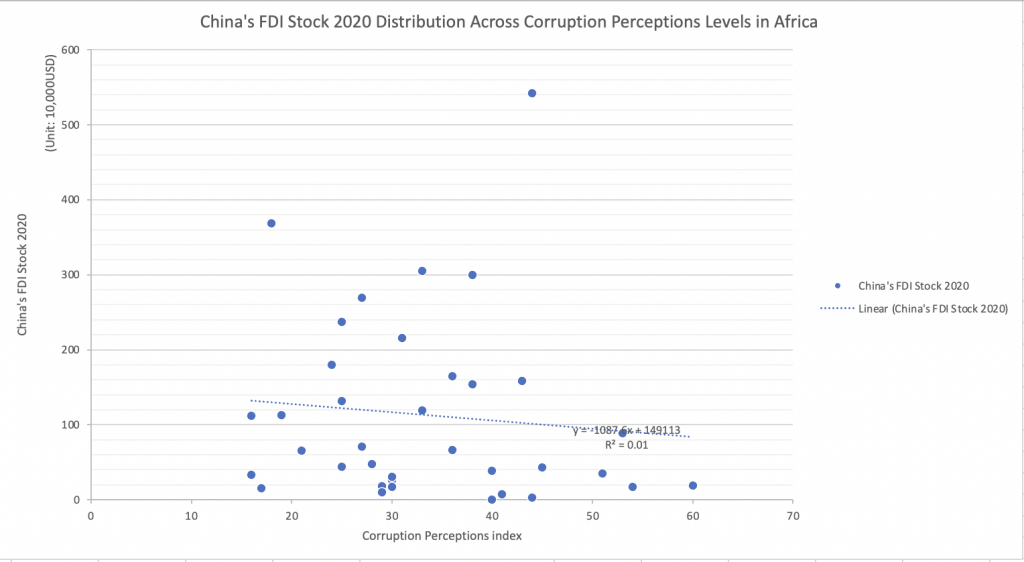

We are also inclined to assume that China favours investments in transparent governments over corrupt ones. After all, corruption erodes investment returns at both the micro- and macro-economic levels.

Figure 4 suggests no robust trend that Chinese FDIs favour cleaner governments. Chinese FDIs spread across African countries over a broad spectrum of corruption level rankings. Although the general trend points out that more corrupt African countries receive less Chinese investments, the R2 value (R2=0.01) indicates the trend is very weak.

The dilemma of Chinese utilitarianism

The egalitarian characteristic of Chinese FDIs in Africa paradoxically embody its utilitarianism. Chinese FDIs are not driven by the motivation to ensure the economic prosperity of nations with ideological likeness. The Western investment commitment to like-minded allies and partners in Africa could further exacerbate the existing economic divide between Africa’s rich and emerging nations. As the emerging African economies are oftentimes not like-minded partners of the West, they will be deprived of investment from the West and risk sliding further behind in development.

Meanwhile, Chinese investments are often coupled with large sums of lending for African countries. Countries that have neither the fiscal capacity nor the growth potential to service the debt may run into a chronic “financing curse.”

What is Chinese investment’s end game?

All these lead us to a final consideration – China is seeking a political alliance with African nations. China invests rather evenly across African nations with varying economic sizes, varying degrees of government effectiveness, corruption, and varying degrees of resource endowments. Surely, China understands some of these investments will be poorly utilised and shy of return potential.

From a Chinese perspective, China’s African investment strategy can be considered geopolitical risk hedging. As a significant investor on the continent, China must hedge against many consequential but unforeseeable risks: the risks of a country’s fiscal default, regime change, military coup, a sudden hostile turn against China, infrastructure, climate, or public health insecurity, etc. By diversifying the investments across the continent, country-specific risks are effectively mitigated.

China seeks the support of African countries as it strives to legitimise its global aspirations through the UN-based international system. China’s recalibration of its new global value chain as it painstakingly decouples from the US also places Africa as a central component. China can no longer secure reliable resources from North America, Australia, and the rest of the West. Africa has become ever more essential to China’s strategic security.

Therefore, China’s investment end game in Africa is resource security, mutual economic dependence, and political solidarity delivered in a whole-of-state strategy. The mainstream perception that China simply aims at resource exploitation captures only the utilitarian but not the egalitarian aspect of Chinese investments in Africa. It is the egalitarian characteristic that illuminates China’s political objective and manifests China’s strategic vulnerability secured only through geopolitical risk “hedging.” For lack of an alternative continental investor of comparable commitment, a heavy reliance on Chinese investments will continue and may one day turn into Africa’s new “China Addiction.”

Photo: Opening ceremony of the FOCAC Summit | Beijing, 3 September 2018. Credit: Paul Kagame on Flickr. Licensed under CC BY-NC-ND 2.0

The conference was held more than six months ago. We are happy to note that China and Africa have maintained our course in strengthening solidarity and putting a priority on cooperation despite the changing global circumstances, emerging global problems, geometry dash and frequent foreign shocks. In putting the conference’s recommendations into practice, we have made good strides. Africa’s population is actually benefiting.