This blog outlines the economic consequences of limiting migration as proposed in the Conservative Manifesto. What it shows is the extent to which the UK economy has become dependent on migrant labour for growth and for tax revenues and the potential adjustment cost if the economy has to be weaned off migrant labour. If this does happen, both the growth and the fiscal consequences are alarming, writes Douglas McWilliams.

This blog outlines the economic consequences of limiting migration as proposed in the Conservative Manifesto. What it shows is the extent to which the UK economy has become dependent on migrant labour for growth and for tax revenues and the potential adjustment cost if the economy has to be weaned off migrant labour. If this does happen, both the growth and the fiscal consequences are alarming, writes Douglas McWilliams.

The Manifesto Promise

The precise text from the Conservative manifesto is set out below:

‘Britain is an open economy and a welcoming society and we will always ensure that our British businesses can recruit the brightest and best from around the world and Britain’s world-class universities can attract international students. We also believe that immigration should be controlled and reduced, because when immigration is too fast and too high, it is difficult to build a cohesive society.

Thanks to Conservatives in government, there is now more control in the system. The nature of the immigration we have – more skilled workers and university students, less abuse and fewer unskilled migrants – better suits the national interest. But with annual net migration standing at 273,000, immigration to Britain is still too high. It is our objective to reduce immigration to sustainable levels, by which we mean annual net migration in the tens of thousands, rather than the hundreds of thousands we have seen over the last two decades.

We will, therefore, continue to bear down on immigration from outside the European Union. We will increase the earnings thresholds for people wishing to sponsor migrants for family visas. We will toughen the visa requirements for students, to make sure that we maintain high standards. We will expect students to leave the country at the end of their course unless they meet new, higher requirements that allow them to work in Britain after their studies have concluded. Overseas students will remain in the immigration 55 statistics – in line with international definitions – and within the scope of the government’s policy to reduce annual net migration.

Leaving the European Union means, for the first time in decades, that we will be able to control immigration from the European Union too. We will, therefore, establish an immigration policy that allows us to reduce and control the number of people who come to Britain from the European Union, while still allowing us to attract the skilled workers our economy needs.’

The Flat White Economy

The Flat White Economy is the new digitally-based economy heavily based in the East End of London that is described in the eponymous book. The economy has emerged from the mix of the creative economy that was already prevalent in East London and the tech economy that has emerged. Key elements are online retail (where the UK leads the world by some distance) and online marketing.

I describe the emergence of the Flat White Economy as the fortuitous accident of three phenomena – the UK’s strong lead in online retail and marketing, the maturing of online technology and the availability of very large amounts of digitally skilled relatively cheap labour as a result of Southern Europe’s economic weakness. ‘They can’t get jobs in their own countries, so they come to London, partly for fun and partly in hope of a job. Once there, they realise how expensive it is to stay in London and so are very keen to find work even if they have to live a backpacker’s existence in London.’ This very elastic supply of labour is a key element in the success of the Flat White Economy.

Chapter 7 of The Flat White Economy (Immigration, Britain’s Secret Economic Weapon) argues ‘To understand the full impact of immigration on economic growth, one needs to treat it as a dynamic process that not only has a direct effect, but a substantial enabling effect to boost other economic processes that are taking place at the same time.

Image (from Wikipedia) licenced under (CC BY-SA 4.0).

Image (from Wikipedia) licenced under (CC BY-SA 4.0).

‘My analysis of the economic impact of immigration suggests a threefold effect:

- First: migration alleviates skill bottlenecks and hence removes barriers to faster growth.

- Second: migration boosts diversity and also boosts creativity which enhances productivity with both direct and indirect effects on economic growth.

- Third: migration makes business more profitable, enhancing investment and hence growth. Even if the initial impact is to place downward pressure on wages through the enhanced supply of labour relative to demand, the secondary effect is to boost wages through faster growth’.

Because our analysis takes account of these dynamic effects of immigration, which are well supported by academic analysis, it suggests the effects of cutting immigration are greater than those estimated by conventional analysis.

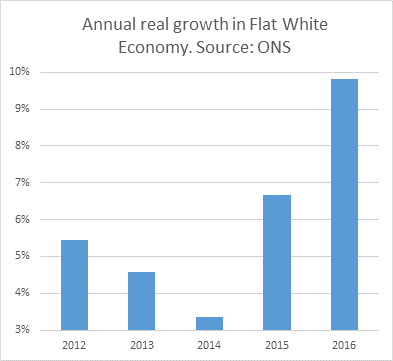

Source: ONS data for ONS Index of Services Components 58-60, 62 and 63

The latest data from the ONS Index of Services (using components 58-60, 62 and 63) show that the sector grew by 9.8% in 2016 to reach 9.7% of GDP, a strong acceleration from even the buoyant figures for the previous four years (see chart). Since 2011, this sector’s share of GDP has increased by a fifth, and it is now, other than construction, the largest single sector of the whole UK economy. As the economy adjusts to take account of its increasing dependence on this digital economy, there are implications.Had it not grown in 2016 and everything else had been unchanged, GDP growth would have been 0.9% rather than the 1.8% recorded.

The conventional analysis

The conventional analysis is best described in an excellent paper by Jonathan Portes and Giuseppe Forte in Vox. This assumes ‘our scenarios imply that net EU migration to the UK could fall by up to 91,000 on the central scenario, and up to 150,000 on a more extreme scenario. This is comparable to other estimates that employ different methodologies (Vargas-Silva 2016, Migration Watch 2016)’.

The conventional analysis assumes that a reduction in migrants would be associated with higher productivity for the remaining population. ‘Boubtane et al. find that migration in general boosts productivity in advanced economies, but by varying amounts; for the UK, the estimated impact is that a 1 percentage point in the migrant share of the working age population leads to a 0.4-0.5% increase in productivity.’

They argue that the central estimate of the impact of Brexit in leading to reduced migration on GDP 2020 is 0.63% to 1.19%. Their analysis suggests that the central impact for 2030 is 0.92% to 3.38% for GDP per capita. The OBR in its fiscal sustainability reports has also drawn attention to the positive impact of migration on the economy and hence the fiscal position.

To quote the Migration Observatory, ‘The Office for Budget Responsibility (OBR, 2016) forecasted fiscal aggregates—such as net government borrowing and debt as a percentage of GDP—under alternative scenarios of net migration. In their central forecast, they use the ONS principal population projection, which assumes net migration of 329,000 in 2015 and 256,000 in 2016, declining to 185,000 in 2021. In the ‘high migration’ scenario, net migration falls to 265,000 by 2021. In the ‘low migration’ scenario, net migration falls to 105,000 by 2021.

The OBR estimates suggest that the government budget surplus in 2020-2021 would be higher under the high migration scenario and lower in the low migration scenario: it projected a £16.9bn surplus in 2010-2021 under the high migration scenario, compared to £5.2bn in the low migration scenario. Debt as a share of GDP would also be lower under the high migration scenario (73.3% vs. 76.1% by 2020-2021).’

Cebr’s analysis

The Cebr analysis is carried out on two assumptions. Both reduce net migration (operating only on inward migration) by 200,000 from the 273,000 figure. This is done either quickly over a two-year period on the first scenario or slowly over an 8 year period on the second scenario. The period starts in 2019. Thus on the slow reduction scenario, migration only reaches its target level in 2027. On the fast reduction scenario, it reaches its target in 2021.

The final level of migration at 73,000 per annum is assumed to be consistent with the pledge to reduce migration to ‘tens of thousands’. We have built a small model to analyse the economic impact based on Cebr’s UK Economic Model UKMOD9. One of its weaknesses is that it is linear, whereas in the real world this is clearly unlikely to be the case for the relationships that are being modelled. But it gives a rough and ready set of estimates that probably get as close to reality as is easily feasible without excessive expenditure.

The key assumption is the impact on productivity. Comments from leading Conservatives indicate that they would expect some creaming off with the bulk of the restriction on migrants being restrictions on low-skilled migrants, which would imply an intention of using migration restrictions to boost productivity. However, certainly for the Flat White Economy, the migrants tend to come into the UK without a job and then get one. It would be difficult to cherry pick these migrants.

When The Flat White Economy was updated in 2016, it was calculated that just under 40% of the increase in employment in the sector since 2008 had reflected EU migrants compared with 28% for the City of London, the other main high skill occupation associated with the employment of migrants.

This is backed up by the data from the Migration Observatory at the Oxford University. For occupations, the category ‘IT and telecoms professionals’ accounting for 3.1% of employed migrants is the occupation 9th most dependent on migrants. For sectors, computer programming and consultancy with 26% of its workforce being migrants is the 7th most migrant intensive sector. The proportions in London would be substantially higher – 36% of all migrant employees and 45% of all migrant self-employed worked in London in 2015.

The Cebr analysis suggests that, far from productivity rising if migration is reduced for knowledge intensive sectors, that there are plenty of factors that will reduce it because of the loss of creativity from the loss of diversity in the workforce and for the other reasons listed above. On the other hand, outside the City of London and the Flat White Economy, many of the migrant workers are working in relatively low-skilled jobs such as the hospitality sector. In the circumstances, our calculations only allow for a minor net increase in productivity from a reduction in migration of 0.05% per 1% increase in the share of migrants in the labour force.

The results

The results show that both GDP and GDP per capita are significantly reduced.

- By 2025, GDP is reduced by 1.5% on the slow reduction scenario and by 3.1% on the faster reduction scenario.

- By 2030 GDP is reduced by 4.1% on the slow reduction scenario and by 5.7% on the faster reduction scenario.

- By 2040, although one should be very cautious about numbers from an extrapolation that goes so far, GDP is reduced by 8.9% on the slow reduction scenario and by 10.4% on the faster reduction scenario.

- Similarly, for GDP per capita, by 2025, GDP/capita is reduced by 0.9% on the slow reduction scenario and by 1.5% on the faster reduction scenario.

- By 2030 GDP/capita is reduced by 1.9% on the slow reduction scenario and by 2.7% on the faster reduction scenario.

- By 2040, although one should be very cautious about numbers from an extrapolation that goes so far, GDP/capita is reduced by 4.1% on the slow reduction scenario and by 4.9% on the faster reduction scenario.

Impact on public finances

Of course reductions in GDP on this scale have a knock-on effect on tax collection. The analysis of the slow reduction scenario shows tax receipts down by £15.6 billion in 2025; £43.0 billion in 2030 and £93.3 billion in 2040. However, these numbers exaggerate the impact on the deficit since with fewer people in the country the need for public services would be reduced. Assuming public spending would be scaled to the population, the net impact on the deficit is £9.5 billion in 2025; £25.9 billion in 2030 and £57.7 billion in 2040.

The analysis of the fast reduction scenario shows tax receipts down by £32.7 billion in 2025; £60.2 billion in 2030 and £109.3 billion in 2040. Allowing for the reduced need for public services the net impact on the deficit is £20.0 billion in 2025; £36.3 billion in 2030 and £64.5 billion in 2040.

Conclusion

The numbers here are quite shocking – they display the extent to which the UK economic model has become based on migration and show the scale of the potential negative consequences if migration slows to a very small amount compared with the current pace. The numbers themselves should be seen as illustrative. It is highly unlikely that changes in migration on this scale would take place without major adjustments elsewhere which would, of course, change the numbers. But what they do show is that if the UK cuts off migration without making adjustments to boost productivity, especially productivity in the public sector, the scale of the economic damage could be huge.

This article is based on the CEBR SPECIAL REPORT – ECONOMIC CONSEQUENCES OF LIMITING MIGRATION and it gives the views of the author, and not the position of LSE Brexit, nor of the London School of Economics.

Douglas McWilliams is Cebr President and the author of the bestselling book on the new digital economy ‘The Flat White Economy’.

There’s no economic rule that immigration creates growth. It may. It may not. Immigration may be caused by growth, growth being a pull factor, or by push factors, as with refugees, but in either case there must be some unused asset for the immigrant to turn to productive use to create additional growth, and it may be an asset that the immigrant brings himself. If all assets are in use, and he brings no new asset, then he cannot contribute to growth.

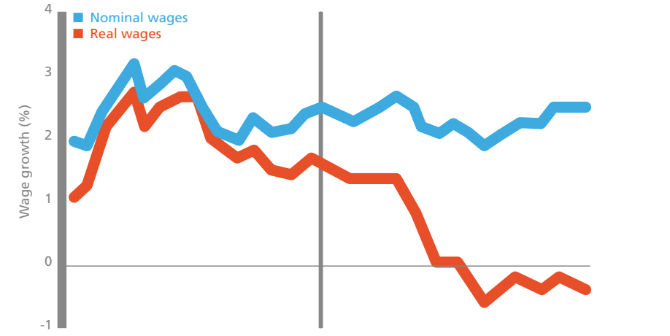

Then classic macro-economic theory kicks in. The immigrant increases the available supply of labour and dampens wage levels. Usually the dampening is invisible, wages rise, but at a lesser rate than they would have otherwise. In extreme cases, it is visible, wages will actually fall. This is what has happened in the UK between 2006 and 2015, as the Eurostat figures show.

Between 2006 and 2015 the Median Income in the UK fell by about -1% pa pps. Only two countries in the EU had a falling MIpps, the other being Greece. There’s no reason to believe this effect has not continued. This period correlates with the entry of 2,000,000 immigrants. Other countries received more immigrants, and more immigrants per capita, but their MIppp grew, some very dramatically. This alone cautions against assuming immigration has the same effect on all economies.

The crash occurred toward the beginning of this period, buy after GDP growth equiliberated at about 2%pa, substantially less than the decade before the crash when levels of immigration were much lower. Over this period UK rose from 5.5% to 8.5% then back to 5.5% For most of this period of high immigration the unemployment rate was rising or abnormally high. The clear inference from all this is that the immigrants displaced existing workers, and the decline in MIpps indicates that they displaced them by accepting lower wages. The knock on effect has been that growth has grown been much lower than it was before comparable periods before mass migration.

This is merely a caution against taking an off-the-shelf assumption that immigration will stimulate growth, it can have a dampening effect on growth and there is clear evidence that it has on the UK economy in circumstances it as in the period 2006 to 2015 – a full decade. We’re 2 years on and things may or may not have changed. If that is suggested it would be nice to see evidence.

Another caution. The predictive interval for economic models is very short, about 3 months. The predictions are in fact contingency analyses, based on assumptions, which often beg the question, the algorithm produces no result independent of the assumptions. These assumptions often reflect emotional or political or ideological beliefs. As a matter of courtesy one does not laugh at contingency analysis which purport to look 5 years or less into the future. Anything beyond that, you are entitled to laugh politely.