As concerns increase over the prospects for a positive post-Brexit agreement with the EU on the terms of exit, much attention continues to be focused on the attractiveness and viability of UK trade diversification. Our first post concluded that physical distance still matters in economic relations between countries and that the role of gravity when considering trade in goods, while diminishing slightly, is still paramount. This suggests that the EU’s role as the UK’s most proximate and natural trading partner will be difficult to replace with countries at a greater physical distance. While distance still matters for trade in goods, can the same be said for trade in services? Can the UK capitalise on its service-based economy for trade diversification post-Brexit, ask Saul Estrin, Christine Cote, and Daniel Shapiro?

A further elaboration of the concept of distance which captures geographic distance, but also administrative, economic and cultural distance (Ghemawat 2014) paints a slightly more positive picture in the sense that the UK also has relatively lower “psychic distance” with many members of the Commonwealth, including Canada. Ghemawat’s CAGE distance theory, therefore, lends greater weight to the attractiveness and fit of trade and investment diversification with certain administratively and culturally similar markets to the UK, such as Canada. However, the prospect of trade diversification beyond the EU appears even more attractive when we consider trade in services, a sector which accounts for 80% of the UK economy and 45% of total UK exports (Office of National Statistics (ONS)). The balance of empirical studies suggests that physical distance matters less when it comes to trade in services than it does for goods, though some of the evidence is mixed. Moreover, it is unclear to what extent such economic relationships might replace the magnitude of returns currently achieved through EU membership. Nonetheless, as the UK contemplates alternative markets with which it might pursue trade and investment post-Brexit, the idea of focusing on trade in services with a country like Canada seems potentially promising.

But Services by their very nature are typically more intangible and complex than physical goods hence the rules needed to ensure that the barriers to trade in services are low are often very difficult to craft. Can the UK and Canada develop an Agreement for trade in services which provides the maximum market access, generating the maximum benefits for business and consumers? Furthermore, what are the challenges or barriers to trade such an agreement would need to address? In particular, to what extent do the state-of-the-art service agreements recently negotiated or under discussion, namely the EU-Canada Comprehensive Economic and Trade Agreement (CETA), the formally named Transpacific Partnership (now CPTPP), and the WTO Trade in Services Agreement (TISA), provide guidance for the crafting of new Agreements? Answers must take account of the fact that in some ways even these Agreements remain deficient in recognizing the new reality of the fragmentation of production, the proliferation of global value chains and the greater integration of manufacturing, services and investment activity?

Image by , CC BY-SA 4.0.

Image by , CC BY-SA 4.0.

Distance matters less for trade in services

It is clear from gravity model studies which posit that a country’s trade patterns depend on the size of the exporting and recipient economies and the distance between them, that trade with neighbors will be greater than trade with countries located further away. Additionally, distance appears to play an even more marked role for intermediate than final goods, ‘an important component of supply chains’ (Freeman and Pienknajura 2018). When we turn however to services, the story is slightly different. While gravity models have been shown to fit the flow of trade in services in a similar manner to that of goods, demonstrating that issues such as the income of a country and a common language positively influence trade in services, distance per se has not been found to be a significant factor (Walsh 2008; Kandilov and Grennes 2012).

Gravity model studies also show for example that trade barriers and thus costs resulting from geographic distance are much lower in online services (Alaveras and Martens 2015) and that trade in services is significantly greater in virtually-proximate countries, especially, trade in financial, communication and insurance services. Therefore, where services are information-intensive, they have been found to be ‘highly responsive to online bilateral information flows’ (Hellmanzik and Schmitz 2016). Moreover, where services are traded through a commercial presence, such as R&D based foreign direct investment (FDI), and involve the ‘international transfer, absorption and use of knowledge’, their sensitivity to distance is significantly less than with manufacturing FDI (Castellani et al 2013).

However, as yet, the empirical evidence is not definitive and is contingent on the nature of the services in question. Some studies find that physical distance still matters for trade in services because it raises the costs for example of operating across differences in time zones (Christen 2018); of employing foreign service workers; or it increases complexity due to the need for proximity in the provision of many services. Even in these studies however, either while costs of distance were present, they were declining (Christen 2017; Head, Mayer and Ries 2009), or while the effect of distance on trade in goods and services were both significant, the impact is lower in the case of services (Eaton and Kortum 2018).

Services are a growing component of global and UK economic activity

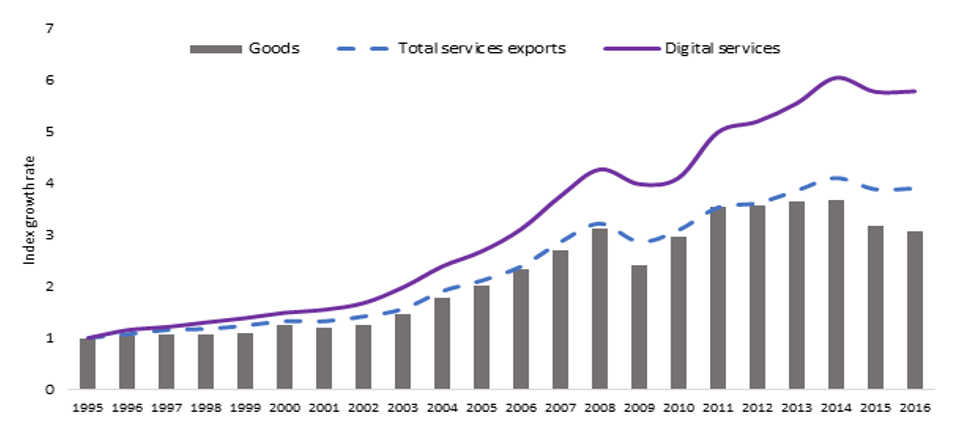

Thus, distance appears to matter less when establishing economic trade relations focused on services, particularly those which rely on virtual connectedness between countries or the international transfer and absorption of information. How might this benefit the UK post-Brexit? First, evidence suggests that there has been considerable growth in trade in services, the fastest growing sector of the global economy. Such growth is also more recent, with liberalization in services under the General Agreement on Trade in Services (GATS) taking off in the 1990s and in particular in the area of digital services as outlined in Figure 1. The importance of services to developed and many emerging market economies is therefore on the rise. However, while the services component of output or GDP is quite high in many developed countries, the services share of total world trade is still only between 20-25% according to a 2016 HSBC Commercial Banking Report, with much room for future growth.

Figure 1: Trade in services is increasing rapidly

Source: Erik van der Marel, https://sites.google.com/site/erikvandermarel/What-s-on

Second, this is all good news for the UK. The UK is a predominantly service driven economy where 80% of output is services based. As a trading nation, 45% of UK exports are in services with the largest share in professional services such as financial, management consulting and R&D services.

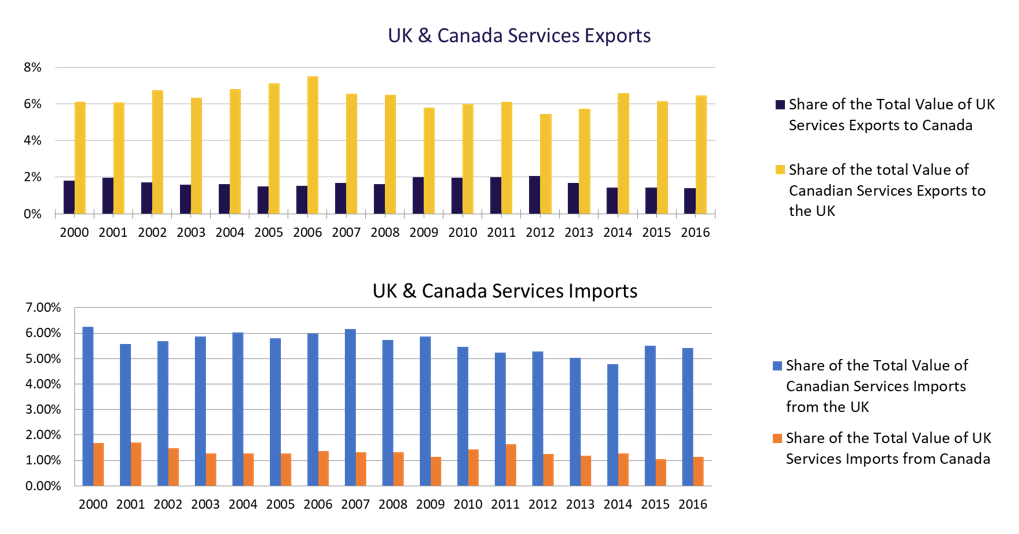

Third, when considering the issue of trade diversification and opportunities with countries further afield such as Canada, the potential is evident. For example, Canada’s economy is also highly service based at 70% of GDP, with exports and imports in services similarly focused on knowledge-intensive industries such as management consulting, engineering, architecture, R&D and financial services. To date, however, the overall level of trade between the UK and Canada is quite low at under 2% of the total value, in the case of the UK and around 6-7% for Canada (Figure 2). Not surprisingly the majority of services trade for the UK and Canada remains with their immediate neighbors. 50% of the UK services exports are with the EU, led by Germany as the main recipient. The US currently accounts for over 50% of Canada’s services trade. However, this could change under a concerted strategy of trade diversification by the UK in the wake of Brexit.

Figure 2: Trade in services is more important to Canada

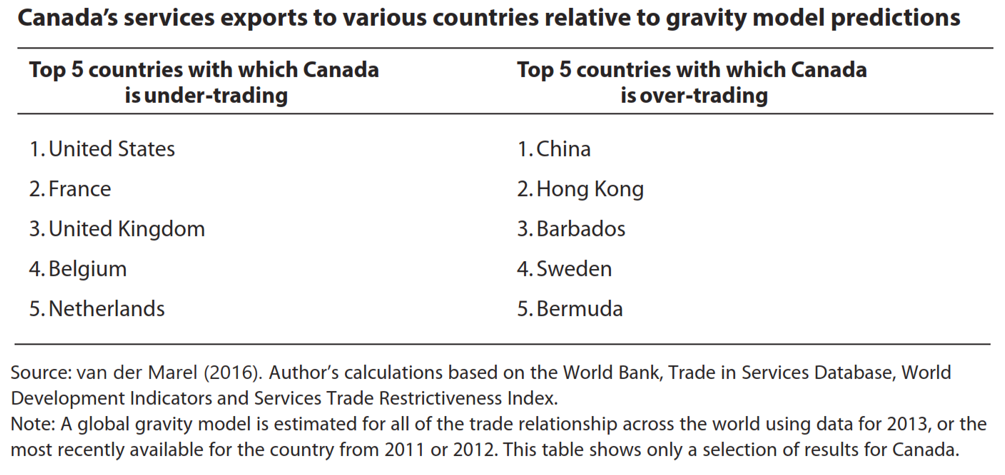

The gravity model provides an appropriate starting point to consider the untapped potential of the UK-Canada trading relationship. In a recent study, van der Marel considered the extent to which Canada’s existing services exports differed from predictions made by a global gravity model, which was estimated based on the World Bank, Trade in Services Database, World Development Indicators and Services Trade Restrictiveness Index. Based on his analysis of factors such as distance, size of a country’s GDP and other institutional indicators, he found evidence (as outlined in Figure 3), that Canada is currently under-trading in services with a number of key trading partners including the UK (van der Marel 2016).

Figure 3

Overcoming barriers to trade in services with countries outside the EU

Given the potential opportunity for the UK in the diversification of its services trade, what are the challenges? The first type of challenge relates to the character of the service sector. For example, services as a product are often subject to specific constraints such as the requirements for close physical proximity of service provider and consumer (e.g. after sales services in traditional machine building such as aircraft engines); the different manner in which services are regulated (e.g. professional services qualifications differ between countries and even across provinces within Canada); and the role of the public sector in the supply of some services such as health and education (Sauve and Roy 2016).

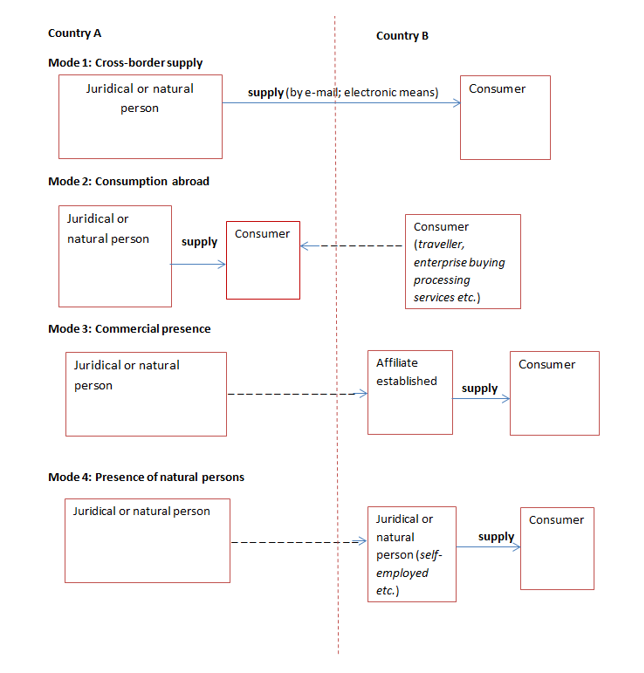

Furthermore, understanding what we mean by services can be challenging as services can involve a range of activities which make it difficult to provide an exact definition. The World Trade Organization (WTO) has classified services into four modes of supply including those supplied cross-border such as computer services (mode 1), those consumed abroad such as through tourism (mode 2), those supplied through a commercial presence such as an automotive branch plant or MNE subsidiary (mode 3) and those supplied through the presence of a natural person such as a touring rock band performing a concert in a foreign country (mode 4). Figure 4 outlines the way in which the different types of services are supplied.

Figure 4: Under WTO GATS, services are supplied under four modes

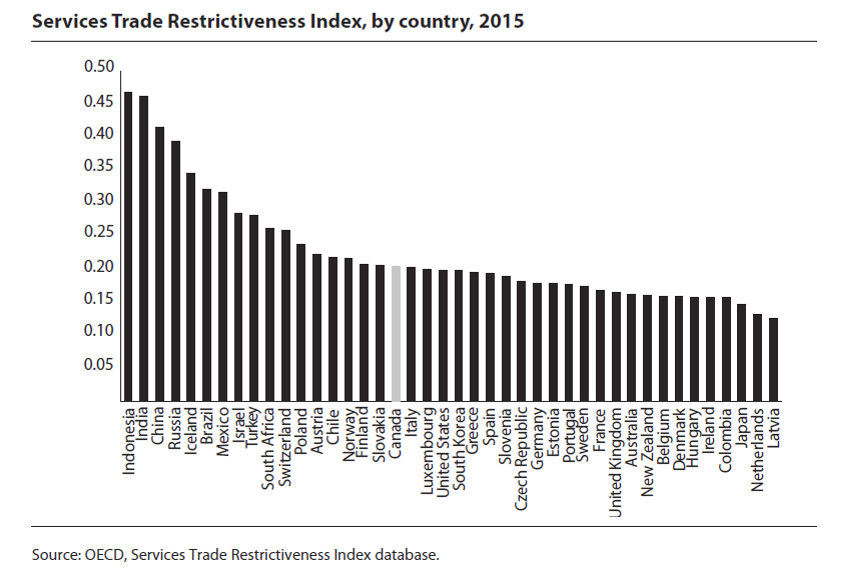

The second challenge relates to the way services are regulated. Trade costs in services are two to three times higher than in the goods sector. They have remained high while trade costs in goods have fallen. This is due to the regulatory burdens facing the services sector even in the single market of the EU (Miroudot, Sauvage and Shepherd 2013). Policy barriers or regulations as measured by the World Bank Services Trade Restrictiveness Indices have a negative and significant impact on total services trade (van der Marel and Shepherd 2013), and remain high in countries like the UK and Canada (Figure 5).

Figure 5

The third challenge is that service liberalisation agreements are much harder to achieve than with trade in goods. The impact of trade policy on services trade is complicated by the fact that services transactions are harder to measure than with goods and the data are not as good. Furthermore, production and trade in goods and services are often quite integrated, even inseparable. (Egger, Larch and Staub 2012). Therefore, crafting trade in services agreements which can overcome barriers effectively is very difficult.

Policy implications

Just as trade in services has increased at a rapid pace in the last few decades, so have the rules governing it. These have been negotiated at the regional or bilateral level as well as multilaterally at the WTO under GATS and the ongoing TISA. The WTO currently lists 285 active regional trade agreements, many negotiated during the period of rapid growth in the 1990s. The majority of these would have provisions dealing with the trade in services. At the same time, the nature of global services activity has been changing. The way that services flow across borders has been fundamentally altered by the fragmentation of production and the associated emergence of global value chains, as well as the integration of production networks facilitated by services including transport, logistics, telecoms, marketing and R&D. Cross-border service activity has also become more significant because of the rise in the digital economy, with staggering increases in the number of internet and mobile phone users and the explosion in data flows.

In considering an effective set of policies aimed at facilitating trade in services in the context of the UK-Canada relationship, what lessons can we take from existing state-of-the-art services trade agreements such as CETA, TPP and TISA and to what extent have these instruments been rendered irrelevant by their inability to address these changing service sector dynamics? New trade agreements and in particular CETA, which is considered the gold standard, have provisions aimed at liberalizing services through market access and non-discriminatory treatment for service providers. Sector-specific provisions deal directly with sectors such as financial services, telecommunications and air transport but also address new areas such as e-commerce and maritime transport services. Furthermore, CETA seeks to facilitate the provision of services once they cross the border through rules on domestic regulation as well as by tackling regulatory cooperation and coherence and addressing the mutual recognition of professional qualifications.

The problem is that CETA and other services agreements continue to provide for special treatment for countries’ sensitive sectors, allowing them to maintain market access restrictions which inhibit trade and investment flows. Canada, for example, has preserved costly restrictions in the transport, finance and telecoms sectors, including restrictions and regulatory barriers which hinder foreign market entry and competition (van der Marel 2016). Furthermore, and perhaps more importantly, existing rules have been designed to address the exportation of services as a final activity from a national firm and not as an intermediate input in the context of multiple suppliers and locations (Stephenson 2012). The current trading rules for services found within even the newest regional agreements or at the WTO, are therefore being rendered irrelevant by the role played by services within global value chains.

So where does this leave the UK as it seeks to capitalise on new and diversified opportunities in the trade in services with economies such as Canada? A number of possible policy approaches will need to be considered.

First, any new trade agreements the UK seeks to negotiate should address services trade in greater breadth and depth than has traditionally been the case, reflecting the more recent achievements under CETA and the TPP. The UK should ensure that they achieve more comprehensive coverage of the new issues discussed above which recognise the role of services in global value chains, as well as that of technology and information, flows in the provision of services. Ensuring new areas such as e-commerce are covered alongside provisions on domestic regulation and commitments to achieve regulatory cooperation is essential.

Second, any trade agreements negotiated on services market access should be based on a negative list approach, covering all services unless explicitly indicated. Additionally, they should seek to allow for fewer exemptions and restrictions than for example under CETA, particularly in sectors where the UK has a comparative advantage such as management consulting and financial and R&D services. They should also be seeking to restrict regulations which raise costs and affect sectors where services are important inputs such as transport, telecoms and financial services.

Third, because traditional trade rules do not fully recognise the reality of cross-border service activity in which services act as important intermediary inputs in global value chains, the UK must consider other complementary policy levers for reducing regulatory barriers to service market access. To this end, the UK should seek sectoral, regional and multilateral cooperation initiatives with the goal of achieving coherence in regulations and avoiding bottlenecks in GVCs. Such cooperation initiatives might take the form of ‘supply chain councils’ (Hoekman 2014) or regulatory councils modelled on CETA’s Regulatory Cooperation Forum (van der Marel 2016).

Our next post will look in some detail at how the opportunities of trade in services can best be addressed in the context of global cities and the extent to which a focus on cities might help address some of the challenges raised in this blog.

This post represents the views of the author and not those of the Brexit blog, nor the LSE. The authors gratefully acknowledge financial support from the ESRC under the recent international Knowledge Synthesis Grant competition on Understanding the future of Canada-UK trade relationships, grant number 872-2018-0018. Our work has drawn heavily on excellent research assistance by Angelina Borovinskaya.

Saul Estrin is Professor of Management at the London School of Economics.

Christine Cote is Senior Lecturer in Practice at the Department of Management (LSE).

Daniel Shapiro is Professor of Global Business Strategy at the Beedie School of Business, Simon Fraser University, and co-editor, Multinational Business Review.

TheFfrench will still want to sell us their wine We imoort so much great food from the EU. Why would they not want to sell to us II cannot think of a time when I was not able to work in the Europe. Strudents went off to pick grapes.in France long befor the EU came into being..Builders went to work in Germany where the wages were very good compared to the UK.( All on USA loans so that the German economy could be rebuilt after the war.) I worked in Florence for at least 3 months when I was 17. I do not see why anything should change when we leave because it is in the EU countries economic interest to carry trading as it always has done..Being a member of the EU is a great idea but spoilt bythe ghastly people who run it> They are behaving like little Hitlers. Mrs May can bend with Checkers as much as she likes but such is the arrogance of these people that only us remaining in the EU stranglehold will satisfy them.

A service economy needs several things. Equivalence of qualifications, a minimum market size, time zones accorded to business models.

Diploms and professional qualifications must be mutually recognized. Or you’re just a limited supplier.

Market size: whatever the merits of Canzuk, this market is limited by demography. A service economy needs to attain more people to strive.

Time zone: you can deliver a contract or several contracts without hindrance if you’re not in the same time zone. It will be more complicated to organize a financial market daily serving Japan from London. It means people having a totally different life cycle from their close family, children, and neighbour’s. It will be easier to relocate near that market.