While most of the studies on Brexit have focused on its trade effects, very few have analysed the likely impact on foreign multinationals. Claudia Fernández-Pacheco Theurer (Universidad Autonoma de Madrid), Jose Luis López Ruiz and María C. Latorre (Universidad Complutense de Madrid, left) argue that this is an important omission. They show how data on trade and foreign multinationals affiliates’ sales underlines the different relationship between the UK and EU-27 on both fronts. They go on to explain the EU trade and investment regulatory regimes and analyse a few studies of Brexit, including its effect on multinationals.

While most of the studies on Brexit have focused on its trade effects, very few have analysed the likely impact on foreign multinationals. Claudia Fernández-Pacheco Theurer (Universidad Autonoma de Madrid), Jose Luis López Ruiz and María C. Latorre (Universidad Complutense de Madrid, left) argue that this is an important omission. They show how data on trade and foreign multinationals affiliates’ sales underlines the different relationship between the UK and EU-27 on both fronts. They go on to explain the EU trade and investment regulatory regimes and analyse a few studies of Brexit, including its effect on multinationals.

Data on trade and foreign multinationals’ affiliates

Trade relationships between the UK and the EU-27 are much stronger than the ties created by their foreign affiliates’ sales. The EU-27 accounts for 53.1% and 44.5% of total UK’s imports and exports, respectively, in 2017. By contrast, the EU-27 accounts for 36.6% of total foreign affiliate sales in the UK (12.8% of total sales within the UK), while the UK’s foreign affiliate sales in the EU-27 account for 25% of total UK’s foreign affiliate sales abroad in 2015. This has been a common trend in the last years (Figures 1 and 2).

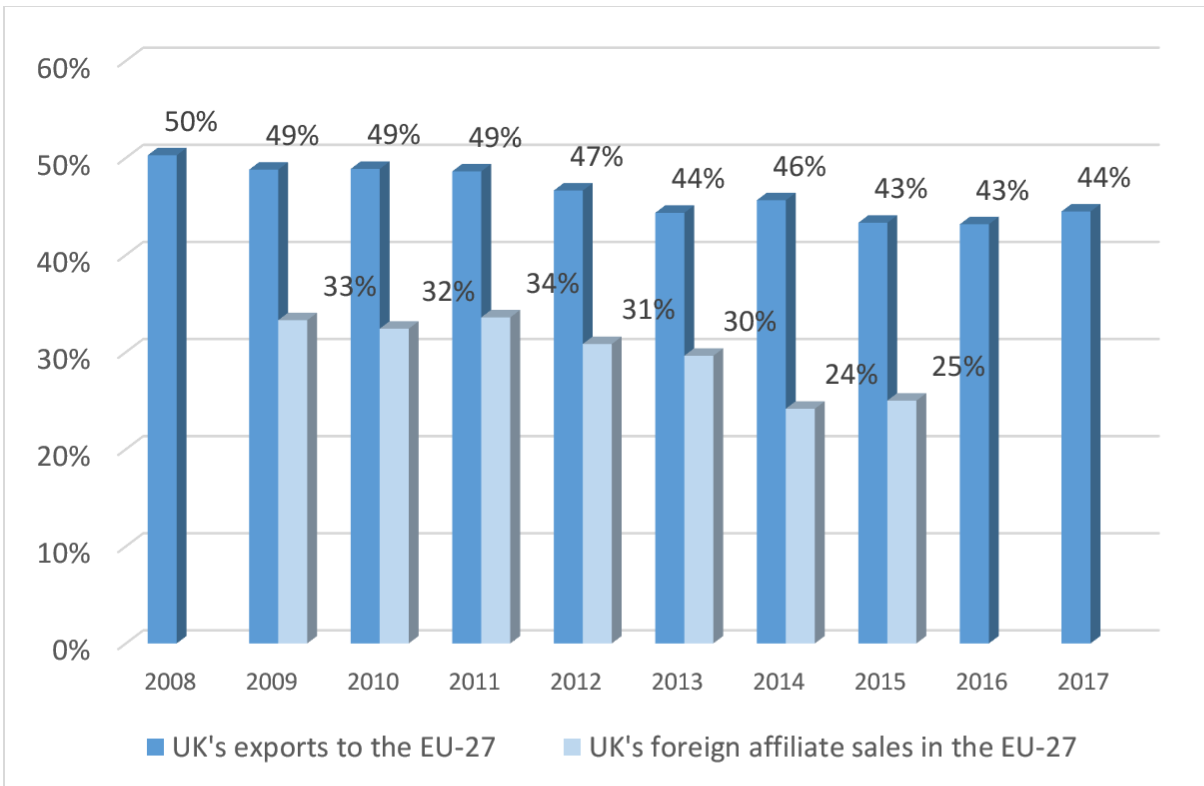

Figure 1. UK’s exports to the EU-27 over total UK’s exports and UK’s foreign affiliate sales in the EU-27 over total UK’s foreign affiliate abroad (in percentages)

Source: Updated from Fernández-Pacheco et al. (2018) © Emerald

Figure 1 shows that the EU-27 has lost importance as an investment destination for the UK, although the shares (around 25%) in 2014 and 2015 are still considerable. By contrast, the EU-27 is crucial for the UK’s exports, which are always well beyond 40%. Note that the UK’s foreign affiliate sales and the UK’s exports represent two different forms of provision of UK products in foreign markets.

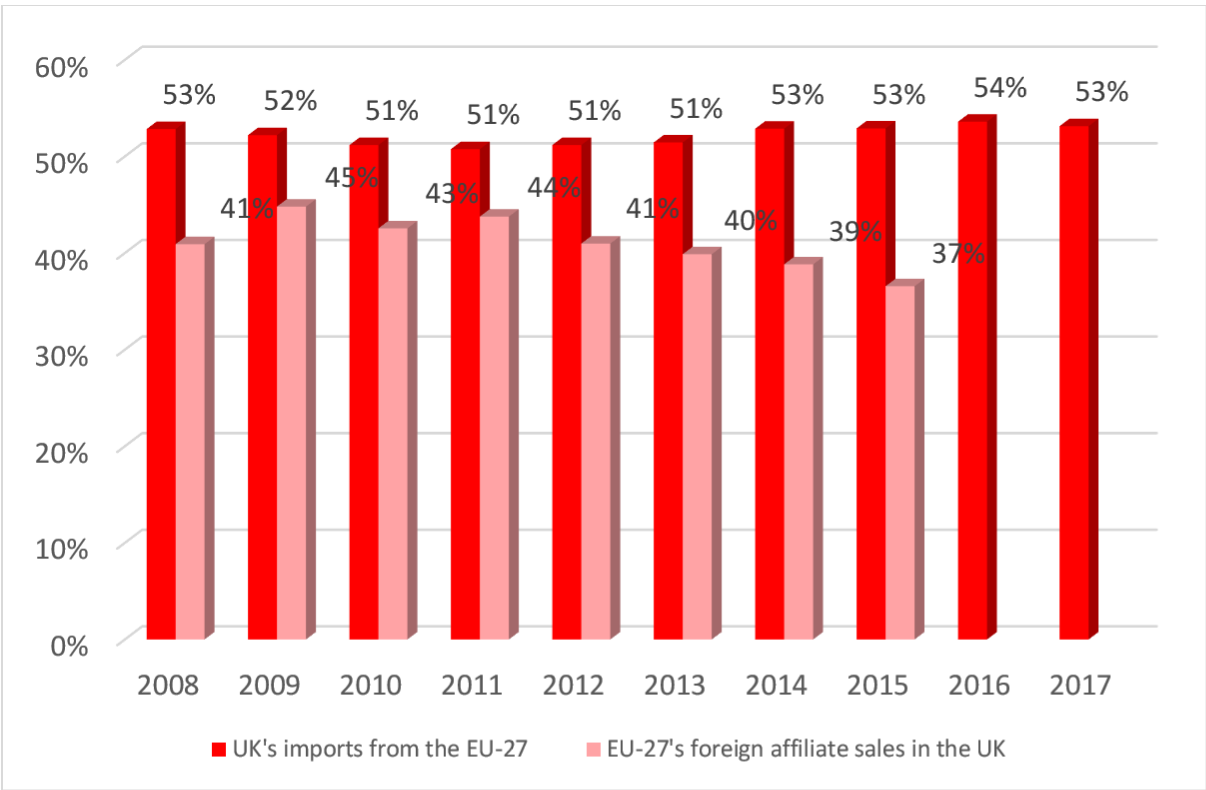

Figure 2. UK’s imports from the EU-27 over total UK’s imports and EU-27’s foreign affiliate sales in UK over total foreign affiliate sales in the UK (in percentages)

Source: Updated from Fernández-Pacheco et al. (2018) © Emerald

In Figure 2 we see the share in the UK’s imports from the EU-27 has been much larger than the share of EU-27’s foreign affiliate sales in total foreign affiliates operating in the UK since 2008. However, it is important to note that the operations of foreign affiliates in the UK are of great relevance.

Figure 3 makes clear that the share of total (EU-27 and non-EU-27) foreign affiliates in UK stands out with 37.4%, compared to other large economies, such as Germany (22.7 per cent), Spain (27.2%), France (20.4%) or Italy (18.1%) and also compared to the average of the EU-28 (28.6%) in 2014.

Fernández-Pacheco et al. (2018) show the shares of the top 15 UK trade and investment partners, of which the US is the main one in investment, apart from a key trade partner. The US is the first destination of the UK’s exports (18.2% in 2014) and second main importing source (with 11.9% of total UK imports following Germany, which accounts for 13.5% of them, in 2014). The US accounts for 30.3% of total UK foreign affiliates abroad and 26.5% of total foreign affiliates within the UK (in 2014).

Figure 3. Shares of national firms and foreign affiliates in total sales by EU country (%)

Source: Fernández-Pacheco et al. (2018) © Emerald

The EU foreign trade and investment legislative regime

While foreign trade policies have, since the Treaty of Rome (1957), been the exclusive competence of the European Commission, investment policies with third countries have been completely in the hands of EU sovereign states. However, after the entry into force of the 2009 Lisbon Treaty, foreign investment policies will also be transferred to the European Commission. The implementation of this new regime will take some time and its exact scope and content still remains a controversial issue (Fernández-Pacheco et al., 2018). But it seems that the UK will be able to continue its investment policies as it wishes, contrary to the situation in other EU member states. Nevertheless, the UK’s leveraging power will be reduced outside the EU.

In the past, EU members regulated their investment with third countries through the so called Bilateral Investment Treaties (BITs). The UK has signed over 1000 BITs since 1975. What is going to happen to them after Brexit? In principle, they will remain valid (Molinonuevo, 2017). As the UK negotiated and signed them in its own capacity and independently of the EU, Britain’s separation from the EU should not necessarily have any direct legal effect on these treaties. However, Brexit will mean that the UK-based firms, including foreign-owned firms, will no longer benefit from the UK’s access to the EU single market, which has the tiniest possible barriers between different countries to exist globally. Thus, third countries may seek some form of compensation. What is more, amendments to BITs would be possible even if those treaties do not expressly address this possibility by invoking the rebus sic stantibus doctrine of international law, which allows for a termination of an international agreement because of a fundamental change of circumstances (Molinonuevo, 2017).

Brexit studies including multinationals

In Fernández-Pacheco et al. (2018) we explain in depth why modelling foreign investment is challenging, and the problems with the data. Given these difficulties, we should be prudent regarding the effects on multinationals after Brexit. However, a few studies suggest it is hard to overcome the negative impact of trade with multinationals’ operations. Latorre et al. (2018a) calculate the emergence of barriers to foreign affiliate sales in services sectors would account for one third of the overall negative impact of Brexit, with the remaining negative two thirds being explained by trade. To be more specific, in Latorre et al. (2018a) a hard (soft) Brexit would lead to a total decrease in UK’s GDP of -2.53% (-1.23%), while the foreign affiliates’ component alone would cause a reduction of -0.83% (-0.41%). By contrast, Ciuriak et al., (2015, Table 2, p. 14) obtain a negligible impact from multinationals effects after Brexit, although Brexit will continue to be quite harmful for the UK. According to Latorre et al. (2018b) a UK-US deep trade and FDI agreement would be far from compensating the harmful effects of Brexit. They further explore potential agreements with China, Japan and India and find their effects to be positive but very small. Latorre et al. (2018c) have also explored in more detail the potential expansion of UK investments in China and find its impact will be very limited. Finally, Latorre et al. (2018d) explore in more detail the impact of foreign multinationals operating in services sectors in UK after Brexit. They find that the barriers to investment rise the price of services and also reduce production not only in services but also in manufacturing. This latter effect may be surprising – since the barriers to investment affect only the service sector directly – but nonetheless manufacturing production is also harmed across the board because services provide important intermediates for manufacturing sectors.

Conclusions

For the UK, the EU is a much less important partner for investment than it is for trade. The implementation of the 2009 Lisbon Treaty implies that in the future the UK will be able to continue with its own investment policies after Brexit, contrary to other EU member states that will share a common investment regime similar to the EU’s common commercial policy. However, UK’s negotiation leverage will be reduced compared to when it was as a member of the EU. Although modelling economy-wide impact of multinationals’ affiliates and investment is challenging and there are difficulties with the data, a few studies suggest that their effect will not be able to compensate for the sizeable negative impact of trade after Brexit – and will even exacerbate its harmful impact.

References

Ciuriak, D., Xiao, J., Ciuriak, N., Dadkhah, A., Lysenko, D. and Narayanan G. B. (2015) “The trade-related impact of a UK exit from the EU single market”, Ciuriak Consulting, April.

Fernández-Pacheco, C., Lopez, J.L. and Latorre, M.C. (2018) “Multinationals’ effects: A nearly unexplored aspect of Brexit”, Journal of International Trade Law and Policy, vol. 17, issue: 1/2, pp.2-18.

Latorre, M.C. Olekseyuk, Z. and Yonezawa, H. (2018a) “Trade and FDI-related impacts of Brexit”, ssrn working paper, April 25.

Latorre, M.C. Olekseyuk, Z. and Yonezawa, H. (2018b) “Can Brexit be overturned by other Trade and FDI agreements?”, Paper presented at the 21th Annual Conference on Global Economic Analysis, Cartagena de Indias, Colombia, June 13-15.

Latorre, M.C., Yonezawa, H. and Zhou, J. (2018c) “A general equilibrium analysis of FDI growth in Chinese services’ sectors”, China Economic Review, vol. 47, pp. 172-188.

Latorre, M.C. Olekseyuk, Z. and Yonezawa, H. (2018d) “On the nature of foreign multinationals in services sectors: A general equilibrium analysis applied to the impact of Brexit”, mimeo, available upon request.

Molinonuevo, M. (2017) “Brexit: Trade governance and legal implications for third countries”, Policy Research Working Paper No. 8010, Trade and Competitiveness Global Practice Group,

March.

This post represents the views of the authors and not those of the Brexit blog, nor the LSE. It relies heavily on Fernández-Pacheco et al. (2018).

Claudia Fernández-Pacheco Theurer is a researcher at Universidad Autonoma de Madrid.

Jose Luis López Ruiz is a researcher at Universidad Complutense de Madrid.

María C. Latorre is Assistant Professor at Universidad Complutense de Madrid (UCM) and Vice Dean for Research, Postgraduate Studies and International Affairs of the Faculty of Statistical Studies, UCM.