Conventional wisdom holds that the impact of COVID-19 on the UK economy dwarfs the potential consequences of Brexit. This has led some Brexiteers to argue there is nothing to fear about a no-deal Brexit. Yet, data show that a no-deal Brexit may not be less costly than the longterm economic fallout from COVID-19, argues Thomas Sampson (LSE).

As Tim Shipman put it “In the midst of the worst recession in living memory, the downsides of red tape and potential tariffs seem to many in Johnson’s team like a thimble of spit in a tsunami.” There is an obvious flaw in advocating Brexit on the basis that it’s less costly than the worst pandemic the world has faced in a hundred years. But this aside, the claim COVID-19 is a bigger economic shock than Brexit deserves further interrogation. It places undue weight on the dramatic, but mostly temporary, impacts of COVID-19, compared to the larger, long-term costs of Brexit. In fact, when measured in terms of their impact on the present value of UK GDP, the Brexit shock is forecast to be two to three times greater than the impact of COVID-19.

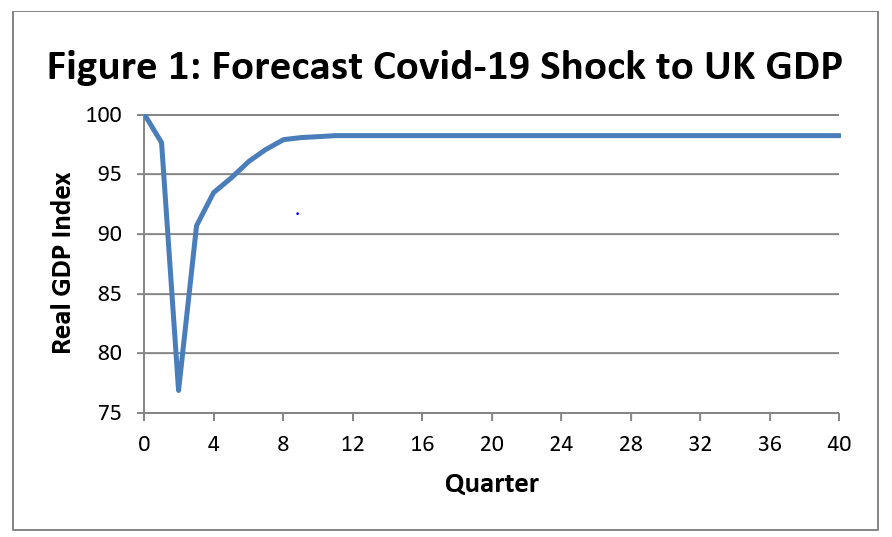

COVID-19 sharply reduced output in the first half of 2020. However, the economy is expected to recover quickly over the next eighteen months and the pandemic is likely to have few, if any, long term effects on GDP. Figure 1 shows a representative forecast of the effect of COVID-19on UK output. It is calculated by comparing the Bank of England’s quarterly GDP projections in the January 2020 Monetary Policy Report with the same projections from the August report. The projections only cover three years, so it is also assumed that the 1.7% decline in the fourth quarter of 2022 gives the permanent output loss due to COVID-19. This leads to an interrupted-V profile for output, as shown in Figure 1.

Notes: Author’s calculations using UK real GDP projections from the Bank of England. The Covid-19 shock is calculated as the percentage difference between the GDP projections in the January and August 2020 Monetary Policy Reports using the projections based on market interest rate expectations and including the backcast. Output normalised to 100 in quarter zero, which represents Q4 2019. The forecast decline in quarter two is 23%. The permanent decline from quarter 12 onwards is 1.7%.

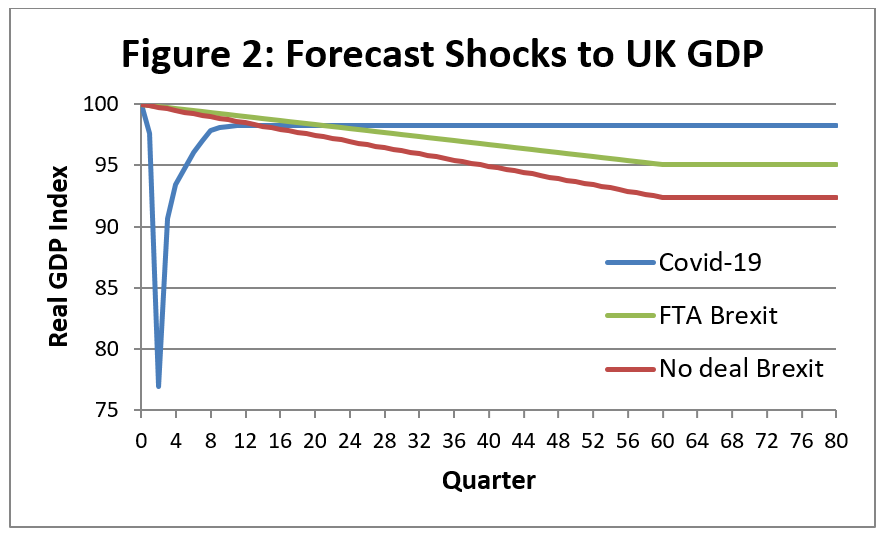

In contrast, the effects of Brexit on GDP are expected to emerge slowly, but to be permanent. The government’s own analysis forecasts that a no-deal Brexit would reduce UK GDP by 7.6% after 15 years, while reaching a free trade agreement (FTA) with the EU would lead to a 4.9% decline. There is considerable uncertainty over how quickly these costs would be felt. Let us make the optimistic assumption that short-term disruption is minimal and the decline in output occurs gradually over 15 years. Figure 2 shows how the effect of an FTA or no-deal Brexit on GDP compares to the Covid-19 shock. Covid-19 leads to much bigger short-term reductions in output, but eventually the ranking is reversed and Brexit leads to larger losses.

Notes: Covid-19 shock is the same as in Figure 1. The long-run effects of FTA and No deal Brexit on GDP are taken from HM Government’s ‘EU Exit: Long Term Economic Analysis’ paper using the central estimates. The Brexit shocks are assumed to phase in linearly over 15 years.

Which of these events constitutes a bigger economic shock? There are many ways to answer this question, depending upon the outcome of interest, the timeframe and how changes in output are valued.

Covid-19 is likely to cause more job losses than Brexit and greater swings in output, but the economy in 2035 may bear more scars from Brexit than from Covid-19.

One way to compare the output paths in Figure 2 is to add up the value of output produced in all quarters, but giving less weight to output produced further in the future. Economists call this the present discounted value of future output.

Giving less weight to future output captures the reality that most people would prefer to receive £100 pounds today than in 10 years’ time. The weights depend upon the interest rate, with a higher rate reducing the weight given to future output.

Suppose we calculate the present value of the GDP paths shown in Figure 2. Comparing the present values with a baseline where output remains constant over time, gives an estimate of the change in the present value of GDP caused by each shock.

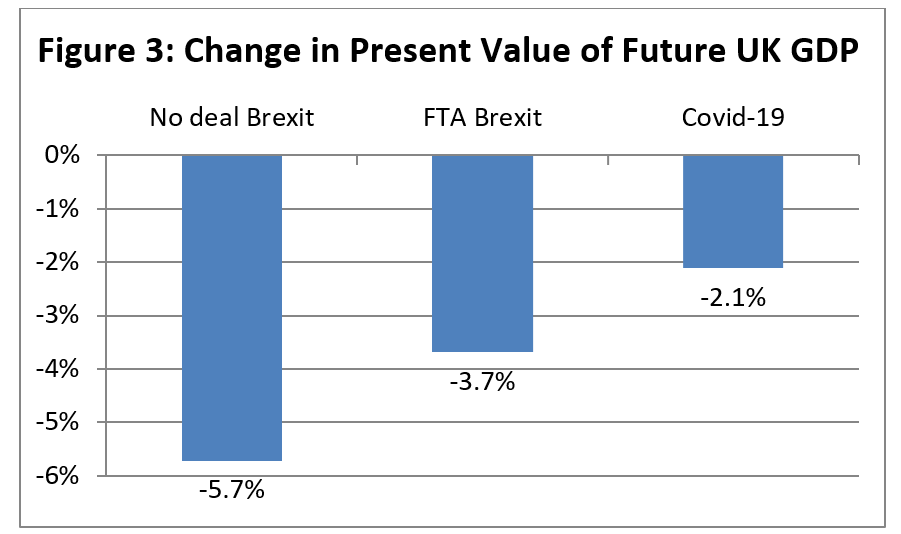

Figure 3 shows the results of this exercise assuming an annualised real interest rate of 4%. Using an interest rate that is greater than current UK rates increases the importance of Covid-19 relative to Brexit, because it puts less weight on future output changes.

Notes: Author’s calculations of the present discounted value of the real GDP paths shown in Figure 2 relative to a baseline where real GDP is constant over time. Future GDP is discounted assuming the annualised real interest rate equals 4%.

In present value terms, COVID-19 reduces UK GDP by 2.1%. However, Brexit reduces the present value of GDP by 3.7% under an FTA scenario and 5.7% if there is no deal. In this sense, Brexit is expected to be a substantially bigger economic shock than COVID-19. We cannot know exactly how COVID-19 and Brexit will affect GDP in the years ahead. COVID-19 may reduce long-run output by more than 1.7%. But the forecasts shown in Figure 2 would have to be drastically wrong to overturn the conclusion that Brexit has a bigger effect on the present value of output than COVID-19. Even under the pessimistic assumption that Covid-19 reduces long-run output by 5%, its impact on the present value of output is still slightly smaller than no-deal Brexit.

After COVID-19 shut down much of the economy, UK GDP fell by 22% in the first half of 2020. It is hard to see this number without concluding that the effects of Brexit pale in comparison. However, the importance of an economic shock depends upon its duration as well as its size. And simple arithmetic shows that, in present value terms, Brexit is expected to be by far the bigger shock. In cash terms, no-deal Brexit corresponds to a £3.3 trillion decline in the present value of output, even assuming there is no future GDP growth. The Prime Minister may wish to reflect on this fact before concluding that the shadow cast by COVID-19 makes no deal a small cost to bear.

This post represents the views of the author and not those of the Brexit blog, nor the LSE. It also appeared on UKinEU.

‘Could, ‘might’, ‘forecast’, ‘predicted to’….

First of all, we had a Brexit in January that took place with a deal that was signed in 2019.

So all predictions of a ‘no deal Brexit’ are untrue.

What you are talking about is a possible failure by the EU to agree a free trade arrangement with the UK once the transition period ends in December.

The Political declaration signed by both parties is very clear on its objectives and guarantees. Clause 3 states:

“…this declaration establishes the parameters of an ambitious, broad, deep and flexible partnership across trade and economic cooperation with a comprehensive and balanced Free Trade Agreement at its core.”

Clause 4 states:

“The future relationship……..must also ensure the sovereignty of the United Kingdom.”

The EU is refusing to comply with the above, insisting that the UK must accept the rule of the ECJ and various Treaty requirements. All previous EU Treaties do not have effect in the UK.

As for the predicted ‘costs’ of a failure to reach an FTA, they are surely impossible to calculate. True, we have a rough idea how much extra BMW cars will cost in the UK, but will the price rise be reflected in the number of cars BMW sell? Further, the economy will recover in the next few years, with or without an FTA.

No. We are in the transition period of exiting having signed a withdrawal agreement in January 2020. That is not the ‘deal’. We are currently on course for no deal when the transition ends in December. You are wrong on almost every detail.

Dear Gary,

Still brexiteering the LSE blog? You never can’t get enough of Brexit, don’t you? You should start your Merry 2021 New Year’s Eve at the brand new Ashford lorry park, in Kent: just 125 days to go and seek your admission to HMRS as customs officer checking the oh-so-new pre-filled-out import-exports forms made by order of HE the RH Chancellor of the Duchy of Lancaster, your future PM…

The consequences of Brexit are more important in the longer term, provided short-term disruption at the point of departure (Jan 2021) is managed well. Sure the economy will recover and growth will return – but the consequences of Brexit will remain as a permanent economic impediment. Trade with our largest nearby market will be for ever hampered – so compounded economic growth will over time represent a growing ‘shrinkage’ compared to continuing as we were. Functioing well in the global context will remain dependent on developing home-grown skills, esepcially in technology, and attracting ‘the world’s brightest and best’ (who may or may not want to take a punt on the UK in a competitive world offering plenty of other opportunities).

There may be other hidden downsides in losing other aspects of EU membership such as freedom of movement. Inevitably this will result in a more hermetic UK and low-paid work undertaken by willing and generally very hard working EU migrants will have to be picked up by Britain’s young – as well as the overhead of ‘training-up’ for essential high-tech roles. Very hard to quantify and predict in hard economin terms – but it will be there.

Gary, we “left” the EU in January…

Except we didn’t.

The real damage will come at the end of the year when things actually do change, you might be living under the rock and not noticing our freedom of movement and goods is still in place but write back to us this time next year and do tell me how magnificent it is that your kids are back home living with you because they can barely afford rent yet alone eat with the Universal Credit.

It will just be more complicated to make transborder transaction. So why bother doing those if they are too expensive? Why bother designing products with UK only conformity if they don’t comply with EU’s rules? Why bother complying cost’y customs rules? Those same rules so beloved by Gove and al ? They will allow you to be sovereign, don’t forget.

The fact that you had a Brexit referendum was proof enough that you were sovereign whatever the results.

The fact the German constitutional Court regularly strikes down EU rules is proof enough that even a EU core member is sovereign.

Brexit is done since January 31. But the economical effects are not yet there as UK is still an effective member of EU till December 31. So wait till next year to get the full effect. You’re still ” shacled”, don’ t forget. You will be free in four months.

The political declaration states a common aim. EU red lines were known as the UK agrred to the Political Declaration. Seriously, not even IDS recently discovered those red lines and tried to renege. Didn’t you notice that Mr Rees moog is very absent from any Brexit debate? How strange! These red lines were known 3 years ago read the Sun, Express, Guardian, EU info or Times, Lse. Were you living elsewhere?

Regards

After reading that why bother to be a country lets just roll over and do as were told you obviously have no idea of the damage the EU and some compliant PMs have done to this country ;You have no pride in being British you have no desire to own your own fishing resources and culture ;I’m all for forward thinking and co-operation just not for subjugation and control by unelected unknown people from another country ;some people really scare me you must be one of them, to EU brainwashed to even consider that you are wrong

Kieth, you know they are elected though? You can see who all the members are and who elected them. They have elections, we voted (or used to vote) in the eu elections for our representatives (the 2nd most seats). The EU has flaws, but know way near as many as our current crop, our press have made it out to be more of a problem than the alternatives, mainly because they are incentised to do so, just follow the money . Will be interesting to see how it plays out but its not looking great. Once businesses leave they won’t come back without serious incentives. One of the first rules of business is don’t piss off you biggest and best customer….

This is basic rule 1, elementary stuff.

I hope you are well off because you will be safer than most.

Beg to dissagree without freedom to choose without the ability to have a reasonably direct vote without the ability to make our own decisions and yes mistakes the country is doomed the EU will just dilute us with imports;I’m neither pro EU or racist I am a pure Brexiteer as we have been labeled ;Once free with our sovereignty and democracy in tacks the country will thrive and never look back ,The first 12 months may well throw up lots of challenges ;But we are a strong country unique in that we generate most of our GDP in house ; and inport significant amounts of product while short term that will help in time we will produce our own crops etc lessening our dependence on others ;Meanwhile the EU will stumble on into more chaos until eventually it sinks

I don’t understand your words they make no logical sense.

Think about it. What If the financial sector starts to leave the UK? Trade is crucial. China and the US will eat us alive.

These business won’t wait they have set up strategies and plan b’s. In house gdp is based on passporting etc

Our gdp and growth before covid was the lowest of the G7. We had the fifth biggest economy in the world, soon we will be the 7th….what is the control you seek? Our goverment don’t have a handle on this, it’s quite scary we have handed more power to those who don’t care about us.

Most of our laws are set by our goverment not the EU. We can’t even follow laws anymore. Crazy.

I really want to understand this. If the EU failed we would leave anyway so that’s a wierd argument….???

Please enlighten me….