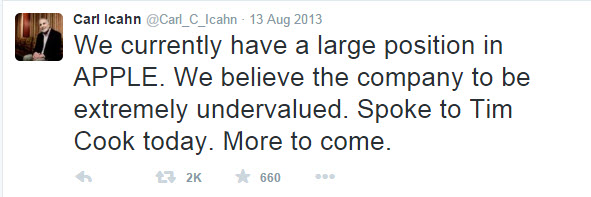

Not long ago, any conversation about social media on trading floors was mere curiosity. That started to change when on April of 2013 the U.S. Securities and Exchange Commission issued guidance permitting companies to use social media to communicate their announcements. If investors were still shaking their heads about this development, four months later billionaire investor Carl Icahn refocused their attention with a single tweet.

The now ‘classic’ Icahn tweet, which stated “We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today” was enough to move the then $445 billion stock by as much as $17 billion. Apple closed that day, 13 August 2013, with its market capitalisation increased by $12.5 billion, as counted from the time of Icahn’s first tweet of the day. Financial markets started to pay serious attention.

In the almost three years since, social media seems to have entrenched itself into every corner of the financial markets. Concepts like social sentiment, velocity and trading signal or predictive postings quickly became regular terms on financial spheres. Companies elaborate investor relations strategies, communicate with investors and even post earnings results via Twitter, ditching the traditional business wire mechanism. Earlier this month, even Goldman Sachs released third-quarter earnings via Twitter and its website, opening yet another new chapter.

Central Banks are also going to social media to communicate with markets. The Bank of England, for example, tweets since 2009, and releases data, shares working papers, coordinates polls and publishes speeches via Twitter. The European Central Bank and the US Federal Reserve are on Twitter and even the People’s Bank of China posts to Weibo, the predominant micro-blogging platform in mainland China.

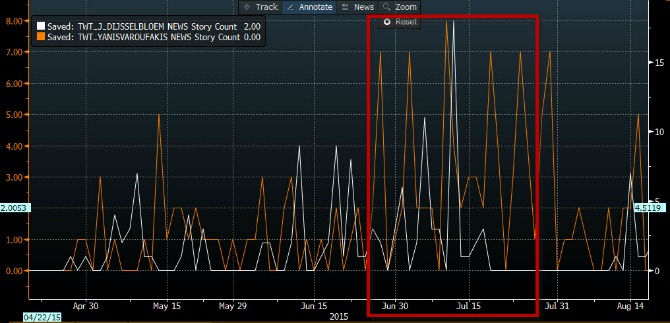

Government officials are not an exception. On 13 July at 07:43:31 GMT, Belgium Prime Minister @CharlesMichel tweeted ‘Agreement’, giving the Eurozone a respite after weeks or months of exhausting negotiations on the terms of the Greek bailout agreement. With Dutch Finance Minister and Eurogroup President Jeroen Dijsselbloem and then Greek finance minister Yanis Varoufakis actively tweeting to send signals to the markets, the latest instalment of the Greek crisis unfolded on Twitter. The graph below shows how both Varoufakis and Dijsselbloem increased their twitter activities on the days leading to the agreement. Financial markets were hooked.

Note: white line represents tweets by Yanis Varoufakis and orange line shows number of tweets by Dijsselbloem. Source: Bloomberg

Note: white line represents tweets by Yanis Varoufakis and orange line shows number of tweets by Dijsselbloem. Source: Bloomberg

Adding to this already crowded scenario of high level sources, it’s in the ‘wisdom of the masses’, or the whispering numbers, that investors everywhere are mining for predictive signals. About 500 million tweets per day are posted around the world. Some 5,800 new bits of information are published each second. Of financial and economic relevance, Bloomberg estimates that every day there are about 500,000 tweets that are worth seeing. It’s clearly impossible for any human being to read, let alone absorb all this fragmented and unstructured information, so financial markets turned to algorithms to parse, group and determine sentiment to the apparently ever growing number of posts.

The challenge now is of a technological edge and lies on the ability to ingest and ‘make sense’ of the posts according to the desired criteria of individual investment strategies. It also lies in the ability to sort and emit alerts about relevant posts in real time. If there is an increased posting activity about a company at any given moment, investors want to know right away.

Source: Bloomberg

Source: Bloomberg

In a business environment of thin profit margins, the race for getting to market-moving news first is brutal, and social media seems to keep gaining momentum precisely for its ability to draw wisdom from the self-expression craze. It’s a ‘revolution in data’, to borrow the words of Bank of England Chief Economist Andy Haldane. On ‘Bank Underground‘, a BoE blog, a post from 18 August 2015 starts by asking ‘Could Twitter help predict a bank run?’, as it elaborates on a model the bank constructed to draw insights on the back of the Scottish Referendum’s social media activity. The conclusion, which pointed to ‘valuable live insights,’ mirrors the most broad range trend-seeking experiments and models mushrooming in all parts of the globe. When properly elaborated, they all seem to be pointing at a wealth of actionable information.

As the revolution continues and the landscape changes rapidly, the biggest challenge for financial market participants is not to miss the fast evolving trends.

♣♣♣

Notes:

- The post gives the views of the author, and not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Bloomberg Professional

Claudia Quinonez is the Global Head of the News & Social Media Market Specialist team at Bloomberg, with focus on positioning news and social monitoring tools for Bloomberg’s professional investors community across asset classes and geographies. Claudia has a deep understanding of news consumption patterns for financial markets in all major developed and emerging markets, helping guide news product adoption and audience engagement. Claudia studied Economics and Political Science at leading universities in Brazil. She occasionally finds the time to tweet at @cloquinonez.