Private equity (PE) firms typically raise capital to establish limited life funds of 10-14 years duration. They use these funds to acquire a portfolio of existing firms. Each portfolio firm is acquired in a transaction which combines capital from the fund with third party debt finance. The debt is secured against portfolio firms’ assets and/or future cash flows. PE firms aim to increase the value of the businesses acquired, before selling it to realise a capital gain.

Impact on private equity activity

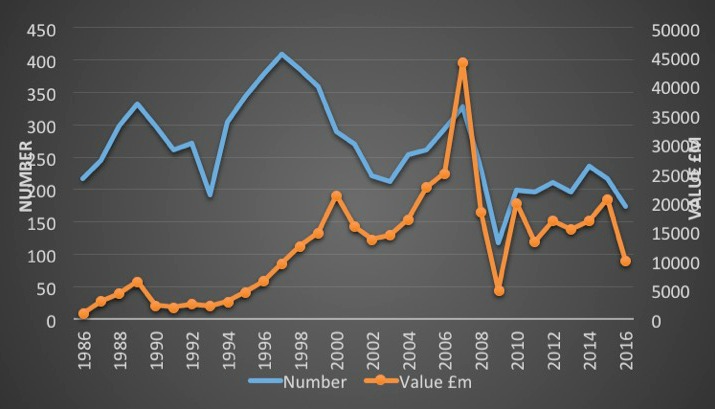

The UK has the largest private equity market in Europe (Figure 1). Over the period 2005-2015 the UK accounted for about one third of all deals and one fourth of all deal value in Europe[1]. Although the market had been recovering since the financial crash, during 2016 it fell sharply.

Figure 1: The UK’s private equity-backed buyout market

Source: CMBOR/Equistone/Investec

A number of Brexit related factors could negatively impact on private equity firms’ abilities to conduct deals. First, many debt funds are foreign-owned and may exit the UK in the light of Brexit. Reduced debt availability makes it more difficult to put the finances together to fund acquisitions. Indeed, in the six months since the referendum, average leverage in buyouts has fallen[2]. Second, the UK will no longer have access to European Investment Fund (EIF) funds. The EIF has been a prolific investor in private equity funds and its leadership role also attracts private capital into funds. Third, the UK will not be able to influence any new Alternative Investment Funds Management Directive (AIFMD), which might inhibit the ability of UK PE firms to access the EU institutional and retail investment markets.

On the positive side, however, Brexit will allow the UK to develop its own policies on private equity operations within the UK. For instance, the UK government would be able to re-introduce more flexibility concerning state aid to stimulate PE investment in growth finance and the buyout sector.

The macroeconomic impact of Brexit is yet to be felt as the UK has not yet exited the EU and at the time of writing it is not clear what form this will take. To the extent that there may be an economic slowdown this is expected to create an increase in the number of firms bought from insolvency. In addition, private equity firms are looking to buy corporate assets that are undervalued due to economic uncertainty. However, if asset prices are reduced, corporations and family owners of private businesses may be reluctant to sell. Although the overall market value fell in the first six months since the referendum, buyouts of family businesses have held up[3], which may signal a desire on the part of owners to sell now before prices fall.

Impact on portfolio firms

Any restrictions on labour mobility may have important implications for portfolio firms operating in sectors that rely on EU labour e.g. healthcare. Difficulties in recruiting employees could lead to wage inflation due to firms competing for workers in a smaller labour market.

Several areas of employment legislation most relevant for portfolio firms pre-dated the UK’s entry into Europe, including redundancy law and protection against dismissal. Nevertheless, Brexit offers the opportunity to reduce the regulatory burden on firms, making it easier for portfolio firms to cut costs. This would add to controversy surrounding private equity and buyouts that have previously been criticised for transferring wealth from employees to PE investors. If the UK were to maintain access to the European Economic Area (EEA), it is likely it would be required to maintain these labour laws.

While PE firms take a long term perspective and sometimes conduct acquisitions in order to exploit entrepreneurial opportunities and increase employment, Brexit may contribute to economic uncertainty, deterring these deal types. However, those private equity-backed acquisitions that focus on improving efficiency and creating sustainable businesses might preserve jobs that would otherwise be lost in an uncertain macroeconomic environment. There is evidence that PE-backed buyouts are more resilient during recessions.

Reconfiguring of global trading relationships following Brexit could provide access to new export market opportunities; however, uncertainty regarding the terms of trade with the EU and elsewhere could deter PE investment in export-oriented businesses in the short to medium term, worsening the UK’s balance of payments current account deficit.

Government policy to tackle regional and sectoral imbalances could draw on PE experience to play a significant role, taking advantage of the potential removal of EU ‘state aid’ rules in tailoring incentives for investors to support specific sectors, regions and export markets.

Summary

Brexit creates threats and opportunities for both private equity firms and their portfolio companies. It will be some time before the dust settles regarding the future relationship of the UK with the EU. It is therefore important to distinguish between short-term effects arising from political uncertainty from the longer-term implications of a certain negotiated Brexit outcome. The forecast economic downturn creates a challenging environment; however, UK PE funds have been more adaptable than other types of UK funds and portfolio firms have shown performance resilience. Throughout the cycles of the PE market over the last three decades, changing economic conditions have always generated opportunities to create new types of deals and new ways to generate returns. It is going to be interesting to see how the market evolves in the presence of these new challenges.

[1] CMBOR (2016) European Management Buyouts, Centre for Management Buyout Research, Autumn.[2] CMBOR (2016) UK Management Buyouts, Centre for Management Buyout Research, Winter.[3] CMBOR (2016), European Management Buyouts, Centre for Management Buyout Research, Winter.

♣♣♣

Notes:

- This blog post is based on the authors’ paper Brexit, Private Equity and Management, in British Journal of Management, Volume 27, Issue 4, October 2016, Pages 682–686

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Canary Wharf – One Canada Square, by Bob Bob, under a CC-BY-2.0 licence

- Before commenting, please read our Comment Policy.

Mike Wright is Professor of Entrepreneurship at Imperial College Business School and Director of the Centre for Management Buyout Research (CMBOR) which is sponsored by Equistone Partners Europe and Investec Bank. Email: mike.wright@imperial.ac.uk

Mike Wright is Professor of Entrepreneurship at Imperial College Business School and Director of the Centre for Management Buyout Research (CMBOR) which is sponsored by Equistone Partners Europe and Investec Bank. Email: mike.wright@imperial.ac.uk

Kevin Amess is Associate Professor at Nottingham University Business School and a fellow of CMBOR; Email: kevin.amess@nottingham.ac.uk

Kevin Amess is Associate Professor at Nottingham University Business School and a fellow of CMBOR; Email: kevin.amess@nottingham.ac.uk

Nick Bacon is Professor of HRM at Cass Business School and a fellow of CMBOR; Email: Nick.Bacon.1@city.ac.uk

Nick Bacon is Professor of HRM at Cass Business School and a fellow of CMBOR; Email: Nick.Bacon.1@city.ac.uk

John Gilligan is visiting professor at Imperial College Business School and a fellow of CMBOR; Email: rjmghome@hotmail.com

John Gilligan is visiting professor at Imperial College Business School and a fellow of CMBOR; Email: rjmghome@hotmail.com

Nick Wilson is Professor of Credit Management, Director of the Credit Management Research Centre at Leeds University Business School and a fellow of CMBOR; Email: nw@lubs.leeds.ac.uk

Nick Wilson is Professor of Credit Management, Director of the Credit Management Research Centre at Leeds University Business School and a fellow of CMBOR; Email: nw@lubs.leeds.ac.uk

Two small points: it is not the case that private equity funds will no longer have access to EIF funds. The EIF has a mandate to, and does, invest in non-EU countries. Admittedly it is unlikely to maintain the same allocation to the UK as presently, but for those that rely on EIF funding, it becomes a structuring issue.

It is also not entirely accurate to say the UK will not be able to influence any new AIFMD. Larger third countries had an influence in the original Directive. Anyone can try and influence regulation, admittedly indirectly and no doubt less effectively.

Thanks for the clarifications. Are the non-EU countries the EIF invests in mainly EFTA countries and countries with the potential to join the EU? I am not sure why a fund set up to promote technology funding and growth in small and medium sized firms in the EU would make investments outside of those countries.