A global race over 5G is raging, but there has been little systematic exploration of the telecom sector with a global perspective. Rabah Arezki, Vianney Dequiedt, Rachel Yuting Fan, and Carlo Maria Rossotto use a novel ranking in the adoption of telecom technology standards around the world, documenting the complementarity between telecom liberalisation and regulatory independence in driving a sustained pace of technology adoption. They also show a positive and economically significant effect of telecom adoption on stock returns, pointing to significant spillovers of telecom to the rest of the economy.

A global race over 5G is raging, with important ramifications over domestic internet connectivity and global hegemony over technology. Economists have long studied cross-country differences in technology adoption and their consequences on economic growth (see Barro and Sala-i-Martin, 1997). However, there has been little systematic exploration of the telecom sector with a global perspective. Unlike with other general-purpose technologies, the standardised nature of telecom technology allows us, to rigorously analyse the historical patterns of technology adoption in our recent research (Arezki et al, 2021).

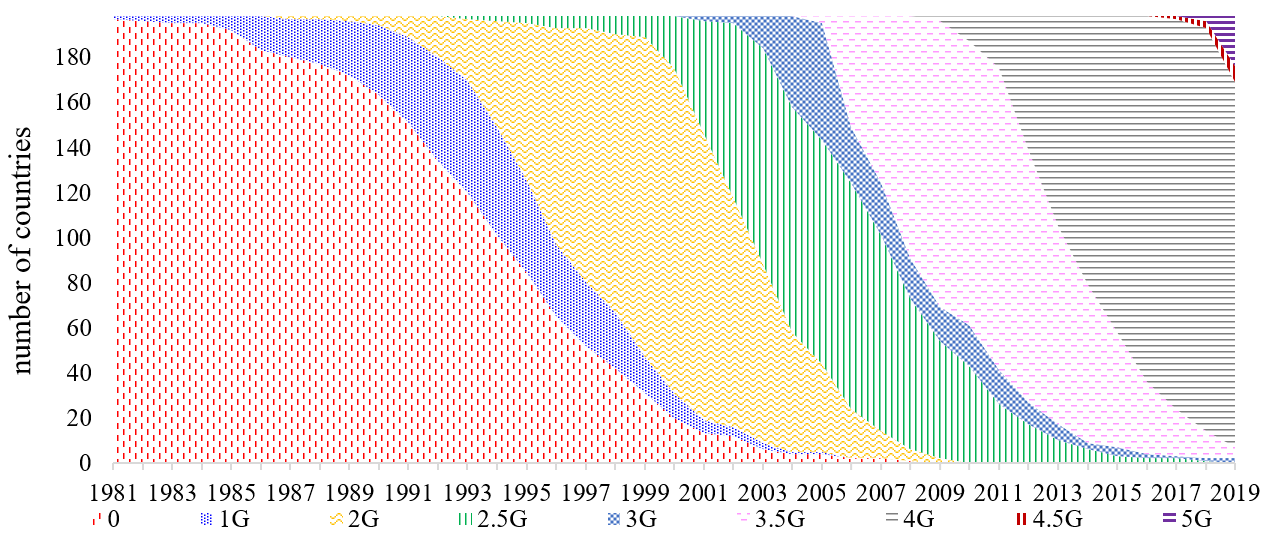

Telecom technology standards come in waves, going from 1G to 5G. Figure 1 plots the number of countries that have adopted each technology standard. It starts in 1981, when 1G technology standard (the purple area) was first adopted in Sweden. It took 14 years for the group of 1G adopters to reach 50 countries, while it took the group adopting 2G (the orange area) ten years to reach hundred countries. It took only six years for the group having adopted 4G (the grey area) to reach more than one hundred countries. The standards that cover most countries and years (largest area in Figure 1) are 2G and 4G.

Figure 1. Global evolution of telecom technology adoption

Notes: The indicator is constructed as the count of the number of countries that have adopted each technology standard over the years. Source: Authors’ own calculations; Spectrum Launched Timeline from Telegeography.

Interestingly, waves of telecom liberalisation have led to different country outcomes in terms of the degree of sustained technology adoption and economic benefits. In our paper (Arezki et al, 2021), we construct a novel ranking of the adoption of telecom technology standards around the world. It allows us to document that very few countries have achieved a sustained pace of technology adoption in telecom following the liberalisation of the sector.

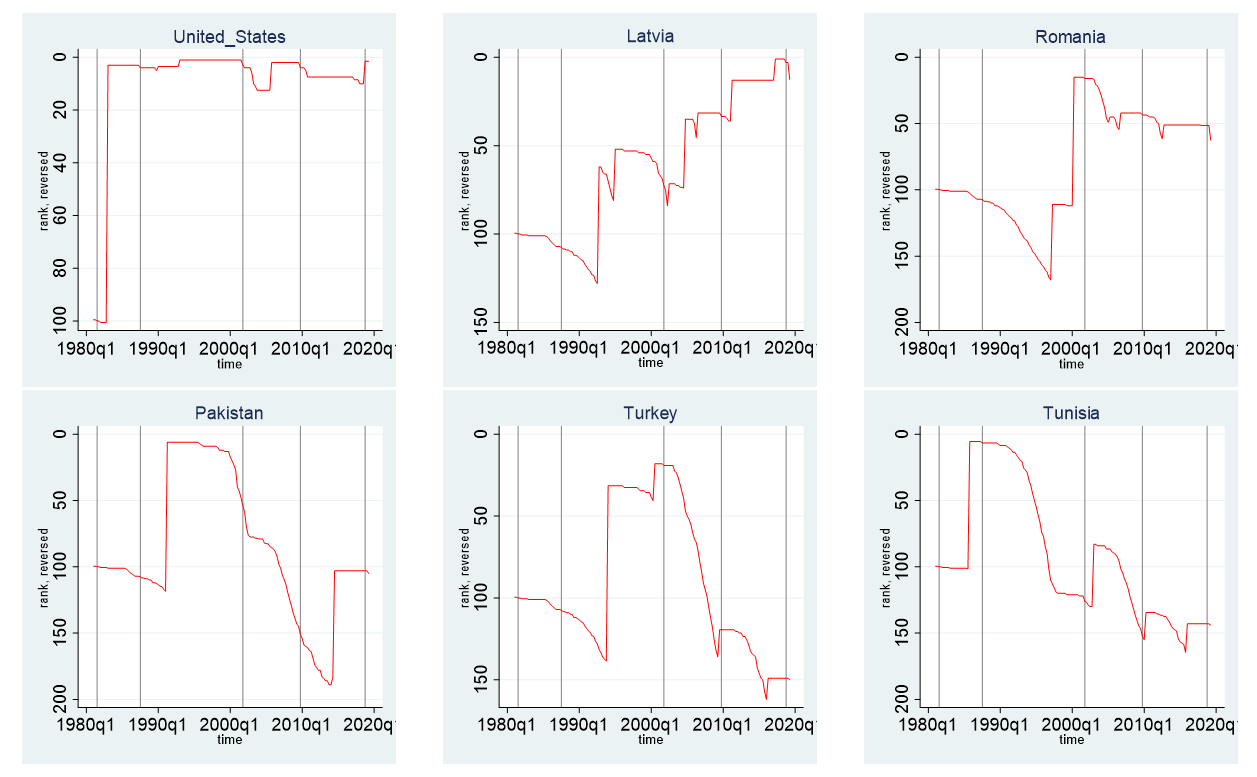

Figure 2 shows that the United States has experienced a sustained pace of adoption in telecom technology standards over time. The US has indeed consistently ranked at the very top over the past decades by adopting new standards as early as they were released. Interestingly, Latvia has been constantly improving in its ranking of technology adoption after a late start. In contrast, most other countries shown in Figure 2 have been “swinging” in terms of rankings. Indeed, most countries have been falling behind gradually after the liberalisation waves of the 1990s, which have led to initial jumps in rankings—the initial jump capturing the relatively early adoption of a given telecom technology standard.

Figure 2. Evolution of country ranking in adoption of telecom standards

Notes: The panels show the evolution of the indicator of the ranking of technology adoption. A higher value for the indicator for a given country indicates a higher ranking among all countries for a given year in telecom technology adoption. The times of the launch of 1G, 2G, 3G, 4G, and 5G are marked as grey vertical lines for readers’ reference. Sources: Authors’ own calculations; Spectrum Launched Timeline, Telegeography.

Notes: The panels show the evolution of the indicator of the ranking of technology adoption. A higher value for the indicator for a given country indicates a higher ranking among all countries for a given year in telecom technology adoption. The times of the launch of 1G, 2G, 3G, 4G, and 5G are marked as grey vertical lines for readers’ reference. Sources: Authors’ own calculations; Spectrum Launched Timeline, Telegeography.

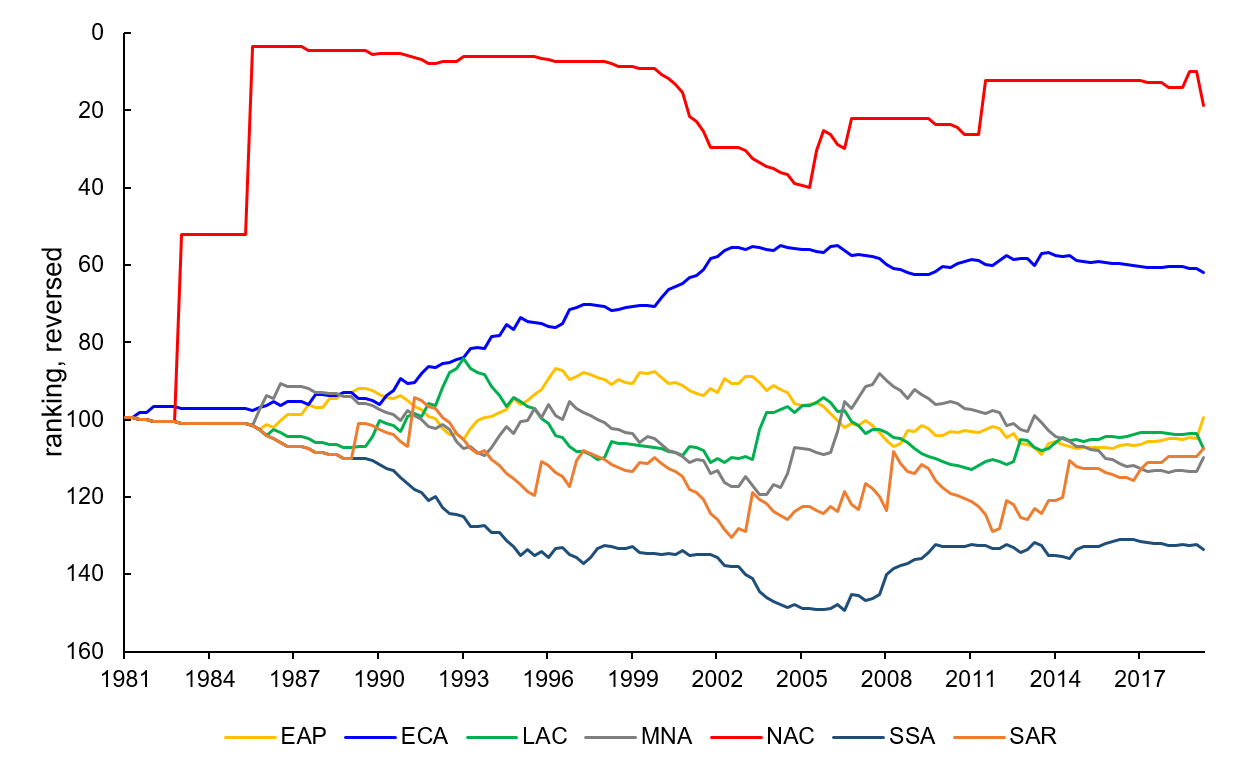

Turning to the regional perspective, Figure 3 shows the evolution of the ranking of technology standard adoption based on simple averages of countries in each region. North America (NAC) namely US and Canada, are leading in terms of the pace of technology adoption and have been steadily at the top of the ranking. Europe and Central Asia region (ECA) had risen in rankings until they steadily reached, on average, the 60th place. Interestingly, both NAC and ECA have liberalised early and have independent regulatory apparatuses. The Middle East and North Africa region (MNA) has instead been swinging in the rankings. The region has fallen behind since 2008. The Sub-Saharan Africa region (SSA) had been stagnant in terms of rankings. The ranking has improved since late 2000s.

Figure 3. Regional evolution of technology adoption

Notes: The lines show the evolution of the simple average of rankings from all member countries. EAP stands for East Asia and Pacific, ECA stands for Europe and Central Asia, LAC stands for Latin America and the Caribbean, MNA stands for Middle East and North Africa, NAC stands for North America, SAR stands for South Asia, and SSA stands for Sub-Saharan Africa. Sources: Authors’ own calculations; Spectrum Launched Timeline from Telegeography.

With this novel dataset, we explore the role of policies and institutional frameworks in driving the pace of telecom technology adoption. Results from cross-country panel regressions show the complementarity between liberalisation and regulatory independence in driving a sustained pace of technology adoption, while, taken individually, their effects are either not statistically significant or not robust over the different specification.

Using foreign participation to capture effective liberalisation instead of the dummy for the (de jure) liberalisation episode, we found that, when taken individually, foreign participation per se does not foster technology adoption. Only when combined with regulatory independence does foreign participation increase technology adoption. Our finding is related to Faccio and Zingales (2017) who find that pro-competition regulation reduces prices but does not hurt quality of services or investments. They also find, interestingly, that more democratic governments tend to design more competitive rules, while more politically connected operators are able to distort the rules in their favour, restricting competition.

Our research also found that adopting a new generation of technology is associated with a significant increase in stock returns. We have further shown that this technology adoption aggregate stock return is not driven exclusively by the IT sector, which points to significant spillovers of telecom to the rest of the economy. Consistent with theory and empirical tests, this shows that a more generic liberalisation has a significant effect on the cost of capital, investment, and economic growth. Most prominently, Henry (2000) and Bekaert et al. (2000; 2005) provide evidence of revaluation of stock prices in a natural experiment of liberalisation using a sample of emerging market economies.

The adoption of 5G standards is accelerating. 5G is the fifth-generation technology standard for broadband cellular networks, which cellular phone companies began deploying worldwide in 2019, and is the planned successor to the 4G networks which provide connectivity to most current mobiles. The degree of connectivity that 5G brings about sets that technology apart. We are indeed at the very onset of radical changes in the technology landscape with ramifications well beyond economics. Further research in the interplay between the geopolitics around 5G and its economic implications would shed light on how technology will matter differently going forward.

♣♣♣

Notes:

- This blog post is based on “Liberalization, Technology Adoption, and Stock Returns: Evidence from Telecom”, World Bank Policy Research Working Paper Series, forthcoming

- This blog post expresses the views of its author(s), and do not necessarily represent those of LSE Business Review or the London School of Economics.

- Featured image by Frederik Lipfert on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy