With Brexit looming, the What Works Centre for Local Economic Growth has been running a series of workshops with local areas to think about different policy responses and consider what the evidence says on effectiveness. One thing that local areas wanted to know was what the evaluation evidence said on export support and inward investment promotion. In response, we have surveyed the available evaluations and launched three new business advice toolkits that consider what we can learn.

The first toolkit looks at inward investment promotion and how local areas can attract greater levels of foreign direct investment (FDI). The second and third toolkits focus on supporting exports through export promotion agencies (EPA) that provide services to help firms sell products overseas, and through export credit agencies (ECA) that provide direct credit, credit guarantees, or credit insurances. So how effective is inward investment promotion in attracting FDI? And what are the key insights that we can learn from all three toolkits?

Inward investment promotion: what are they?

Investment promotion agencies (IPAs) aim to increase inward flows of FDI. Increased FDI may bring both direct and indirect local economic benefits (for example, by directly providing employment or indirectly improving productivity of domestic firms). IPAs may fund image building activities such as advertisements, PR, etc.; undertake investment generation by identifying and encouraging potential investors; provide investor servicing/facilitation to help investors find business opportunities or navigate bureaucracy; or engage in policy advocacy – such as lobbying government. IPAs can be based domestically or abroad and may target specific sectors. In the UK, the Department for International Trade, or DIT (Formerly UK Trade & Investment, or UKTI) provide IPA services for foreign firms.

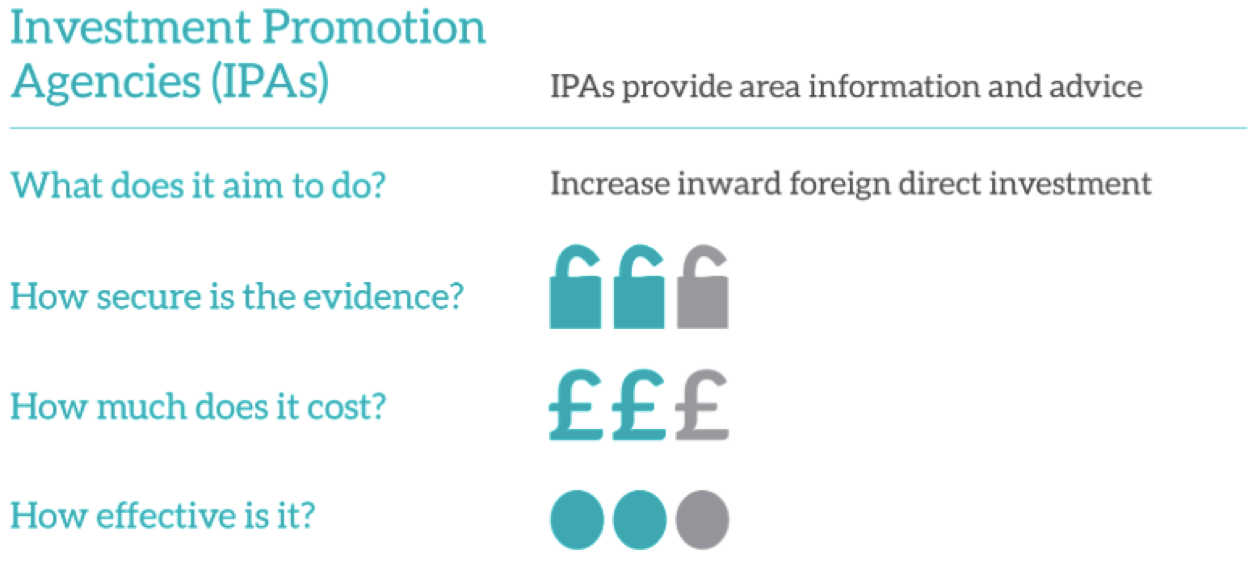

Figure 1. Investment Promotion Agencies toolkit

Key findings

A review of the five available studies evaluating inward investment promotion suggests the following findings:

- Do IPAs increase FDI inflows? Evidence suggests that IPAs may increase FDI inflows although in some cases support has no effect.

- Should regions establish IPAs overseas? The available evidence suggests that regional IPAs are no more or less effective than national support.

- Can IPAs improve other aspects of firm performance? IPA support may sometimes improve other aspects of firm performance, but most of the evidence suggests that schemes have little or no effect.

- Which types of IPA support are most effective? We don’t know. We need to do more to understand cost-effectiveness of different types of support.

- Should IPAs target specific sectors? We don’t know, which suggests that targeting would need to be based on theoretical considerations (such as barriers to entry) and may not necessarily improve scheme performance.

- Could private sector involvement improve effectiveness? Only one study looks at this, suggesting that IPAs are more effective when they are public-private partnerships and have members of the private sector on their supervisory board. Reporting directly to the head of government helps too.

How effective are they?

Three of five studies find a positive relationship between IPA activity and FDI. Two studies find no effect. Two of these studies look specifically at regional IPAs located overseas, one finding a positive effect on FDI inflows to the region, and the other finding no effect.

IPA support may sometimes improve other aspects of firm performance, but most of the evidence suggests that schemes have little or no effect. One study looking at UK Aftercare, finds no impact on employment, profit, wages value added, total factor productivity or export activity for supported foreign firms operating in the UK. Another study considers total productivity at the country level finding a positive effect for countries that have an IPA, while a final study considers total exports at the industry level finding no effect for industries targeted by IPAs.

Two studies evaluate the impact of IPAs targeted at specific industries, with one finding that FDI increases in targeted industries compared with non-targeted industries, and the other finding no effect on exports.

One study looks at whether IPA characteristics change effectiveness. It finds that sole ownership by government reduces effectiveness, although reporting directly to the countries head of government helps partially offsets this. Private sector membership on the advisory board has a positive effect.

The three toolkits: what can we learn?

When considering the three toolkits together, a number of things stand out.

The first, which comes through clearly in the EPA and ECA toolkits, is that lighter touch interventions might be more cost effective in increasing exports. When it comes to which types of EPA or ECA support are most effective there’s not a lot of evidence available. What evidence there is suggests that for EPAs, limited resources may be most productively spent educating and informing businesses about exporting; and for ECAs, (cheaper) insurance provision may be more cost-effective than (more expensive) credit provision. We know even less for what kind of IPA support might be most effective. The WWC toolkits flag that more piloting and testing is needed to figure out what interventions are cost effective. Brexit might be a good moment to start.

The second observation builds on this point. Despite all the arguments about UKTI and the need to regionalise export support or inward investment agencies, the evidence doesn’t really make the case either way. On EPA there is some evidence that UK support arrangements are at least as effective as support in other countries. For both IPA and EPA the available evidence suggests that regional agencies are no more or less effective than national support; this is also the case for sector targeting. We simply don’t know if this helps with effectiveness. As is so often the case, arguments about the structure of the support and who has control distract from efforts to focus on the nitty gritty of the most cost-effective ways to provide support.

The third point concerns evidence on whether EPAs improve other aspects of firm performance. The broader evidence base suggests that firms can ‘learn by exporting’. However, while some EPA schemes may improve firm performance the evidence suggests that most don’t. This suggests that other forms of direct business support might be better at delivering general improvements in firm performance.

♣♣♣

Notes:

- This blog post appeared originally on the LSE Global Investments & Local Development (GILD) blog. It is based on ‘The good news about exports’ and ‘Business Advice Toolkit: Investment Promotion Agencies’ published on the What Works Centre website.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Battersea Power Station Cranes, by Loco Steve, under a CC-BY-SA-2.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy

Henry Overman is professor of economic geography in LSE’s Department of Geography and Environment. From 2008 to 2013 he directed the Spatial Economics Research Centre (SERC). From September 2013 he is director of the new What Works Centre for Local Economic Growth. His current research interests include the causes and consequences of spatial disparities and the impact of urban and regional policy. He has provided policy advice to, amongst others, the European Commission, Department for International Development, Department for Business Innovation and Skills, Department for Communities and Local Government, HS2 and the Department for Transport, HM Treasury, the Manchester Independent Economic Review, and the North East Independent Economic Review.

Henry Overman is professor of economic geography in LSE’s Department of Geography and Environment. From 2008 to 2013 he directed the Spatial Economics Research Centre (SERC). From September 2013 he is director of the new What Works Centre for Local Economic Growth. His current research interests include the causes and consequences of spatial disparities and the impact of urban and regional policy. He has provided policy advice to, amongst others, the European Commission, Department for International Development, Department for Business Innovation and Skills, Department for Communities and Local Government, HS2 and the Department for Transport, HM Treasury, the Manchester Independent Economic Review, and the North East Independent Economic Review.