Arctic ice cover has been shrinking as a result of global warming. Besides the important and critical environmental and economic effects of melting ice caps, a side effect is to open the northern sea route for high volume commercial traffic. This shipping route will connect East Asia – Japan, South Korea, Taiwan and China – with North-western Europe through the Arctic Ocean. This route along the Arctic Ocean is shorter than the currently used southern sea route between Europe and Asia through the Suez Canal.

In practical terms, average shipping distances fall by around one third compared with the currently used southern sea route through the Suez Canal. Figure 1 illustrates the shipping distance reductions using the example of the route between Yokohama (Japan) and Rotterdam (Netherlands). This particular route is reduced by 7.200km, while typical shipping routes between South Korea and the Netherlands are reduced on average by 6.300km and between China and the Netherlands by 4.500km.

Figure 1. The northern and southern seas’ shipping routes

These much shorter shipping distances lead to fuel and other transport cost savings, but also to transport time savings, which are crucial in modern global supply chains. With lower transport costs and shorter shipping times, trade between Asia and North-western Europe will be significantly boosted.

In a new study, we examine how international trade patterns may change as a result of the opening of the northern sea route. The lower shipping times and costs will intensify the trade between East Asia and Europe, but also disrupt the internal trade flows within Europe. In particular, we find a remarkable increase in trade flows between Asia and Europe, diversion of trade within Europe, heavy shipping traffic in the Arctic and a substantial drop in Suez traffic. Projected shifts in trade also imply substantial pressure on an already threatened Arctic ecosystem.

The study uses a computer-based model of the global economy. We have four core findings:

- First, trade through the Suez Canal, currently 8 per cent of global trade, will fall by about two thirds.

- Second, as many as 10,000 ships could cross the Arctic yearly when the northern sea route becomes fully viable. Such an outcome would introduce yet another source of stress on a threatened ecosystem.

- Third, increased trade between East Asia and Europe will reduce trade within Europe. Trade between East Asia and North-western Europe will increase by 6 per cent.

- Fourth, incomes and GDP will decline in Southern and Eastern Europe and rise in North-western Europe. Hence, the disruption in the structure of European value chains caused by the opening of the northern sea route will have a negative effect on the southern and eastern members of the European Union. For the affected countries, the impacts are in a range comparable to the effects of the Uruguay Rounds of multilateral trade negotiations.

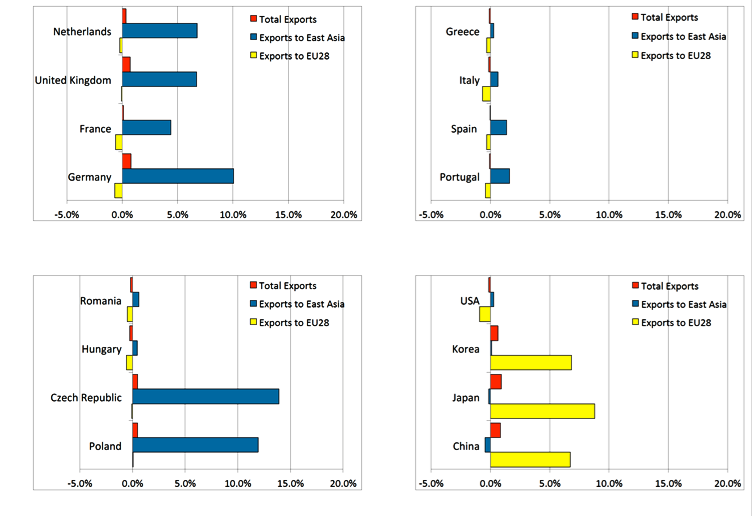

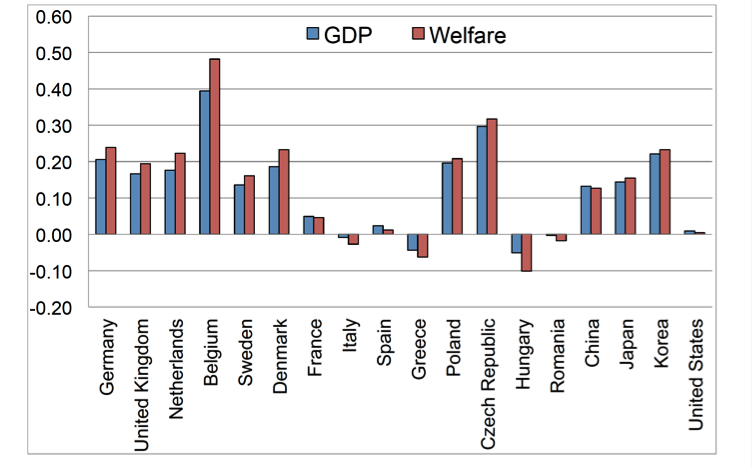

In Figures 2 and 3 the asymmetric trade and GDP results between a selected group of European and Asian countries are shown. East Asian and North-western European countries experience a sharp increase in their bilateral trade. But Southern European countries have very limited trade shifts, while Eastern European countries display trade benefits only if they are closer to the Baltic Sea (e.g. Poland and Czech Republic). These trade effects are translated into permanent gains in GDP and welfare for the countries where trade increases, whereas the welfare effects are close to zero or even negative for countries showing a reduction in their total trade. The United States is barely affected by the intensive use of the northern sea route: its trade with Europe is decreased, but overall US trade and GDP do not change significantly.

Figure 2. Trade flows after opening the NSR: percentage changes in exports by selected countries

Source: Own estimations using the GTAP database

Figure 3. GDP and welfare changes associated with the opening of the NSR for selected countries, in %

Notes: Welfare is measured as per capita utility. Source: Own estimations using the GTAP database.

It is important to note that the timing of large-scale use of the northern sea route is uncertain and depends on the speed at which climate change unfolds and how Arctic transport logistics develop. In 2016, about 300 vessels worked on the northern sea route with 20 ships transiting in August and September.

We generate scenarios for the year 2030 but this year is tentative, and we find similar effects if use of the northern sea route were to take place later. Follow-up studies project that shipping for small bulk ships will become viable in 2030 and for small container ships in 2050. But projections on climate change are regularly updated and the speed of climate change is highly uncertain. More rapid loss of ice cover would move these effects forward.

The uncertain but progressive use of the northern sea route will also allow industries and production processes to gradually adjust to the trade potential of this new shipping route. In this respect, even when the potential trade and economic disruptions expected from the opening of the northern sea route can be substantial, they can also be anticipated and better assimilated over time.

♣♣♣

Notes:

- This blog post is based on the authors’ paper Melting Ice Caps and the Economic Impact of Opening the Northern Sea Route, The Economic Journal, May 2018

- The post gives the views of its authors, not the position of the institutions they represent, the LSE Business Review or the London School of Economics.

- Featured image credit: Photo by Jacques Descloitres, MODIS Rapid Response Team, NASA/GSFC, Public Domain, via Wikimedia

- When you leave a comment, you’re agreeing to our Comment Policy.

Eddy Bekkers is a research economist at the World Trade Organization, focusing on quantitative trade modelling. Before that he worked for three years as a Postdoctoral researcher at the WTI primarily on the EU-funded project PRONTO project on nontariff measures. Previously he was assistant professor at the Johannes Kepler University in Linz for six years. Eddy holds a PhD from Erasmus University Rotterdam and a Master’s in economics and econometrics from the University of Amsterdam.

Eddy Bekkers is a research economist at the World Trade Organization, focusing on quantitative trade modelling. Before that he worked for three years as a Postdoctoral researcher at the WTI primarily on the EU-funded project PRONTO project on nontariff measures. Previously he was assistant professor at the Johannes Kepler University in Linz for six years. Eddy holds a PhD from Erasmus University Rotterdam and a Master’s in economics and econometrics from the University of Amsterdam.

Joseph Francois is managing director and professor of economics at the World Trade Institute. He served as deputy director of the NCCR Trade Regulation from 2015 to 2017. Previously he was professor of economics (with a chair in economic theory) at the Johannes Kepler Universität Linz. He is a fellow of the Centre for Economic Policy Research (London), director of the European Trade Study Group and the Institute for International and Development Economics, senior research fellow with the Vienna Institute for International Economic Studies, and a board member of the Global Trade Analysis Project. He serves on the editorial board of the Review of Development Economics, and the World Trade Review.

Joseph Francois is managing director and professor of economics at the World Trade Institute. He served as deputy director of the NCCR Trade Regulation from 2015 to 2017. Previously he was professor of economics (with a chair in economic theory) at the Johannes Kepler Universität Linz. He is a fellow of the Centre for Economic Policy Research (London), director of the European Trade Study Group and the Institute for International and Development Economics, senior research fellow with the Vienna Institute for International Economic Studies, and a board member of the Global Trade Analysis Project. He serves on the editorial board of the Review of Development Economics, and the World Trade Review.

Hugo Rojas-Romagosa is a research economist at the CPB Netherlands Bureau of Economic Policy Analysis and a senior research fellow at the World Trade Institute. He has done short term and consultancy projects for the World Bank Group, OECD, UNCTAD, UNDP, Inter-American Development Bank (IADB), ECLAC (Economic Commission for Latin America and the Caribbean), WIIW (Vienna Institute for International Economic Studies) and the INCAE Business School (Costa Rica). He obtained his PhD in economics from the Erasmus University Rotterdam. His research interests include: quantitative trade policy analyses, trade liberalisation and income distribution, globalisation and labour markets, and trade in value-added and global supply chains.

Hugo Rojas-Romagosa is a research economist at the CPB Netherlands Bureau of Economic Policy Analysis and a senior research fellow at the World Trade Institute. He has done short term and consultancy projects for the World Bank Group, OECD, UNCTAD, UNDP, Inter-American Development Bank (IADB), ECLAC (Economic Commission for Latin America and the Caribbean), WIIW (Vienna Institute for International Economic Studies) and the INCAE Business School (Costa Rica). He obtained his PhD in economics from the Erasmus University Rotterdam. His research interests include: quantitative trade policy analyses, trade liberalisation and income distribution, globalisation and labour markets, and trade in value-added and global supply chains.