I investigate a number of questions related to the drivers of per capita income levels for a large set of countries and a narrower set of OECD countries. First, I seek to figure out whether, and if so to what extent, product and labour market regulations and policies affect per capita income levels. Second, I aim to understand whether policy effects are different for developing, emerging and advanced economies. The final issue I sought to raise was to show how product and labour market regulations interact with each other.

In doing so, I use the OECD’s recently assembled Structural Policy Indicators Database for Economic Research (SPIDER) to gauge the impact of regulation and institutions on economic growth. The indicators collected in SPIDER comprise data with long-time series covering OECD countries, data covering a larger set of countries for a varying number of years, and a set of time-invariant indicators.

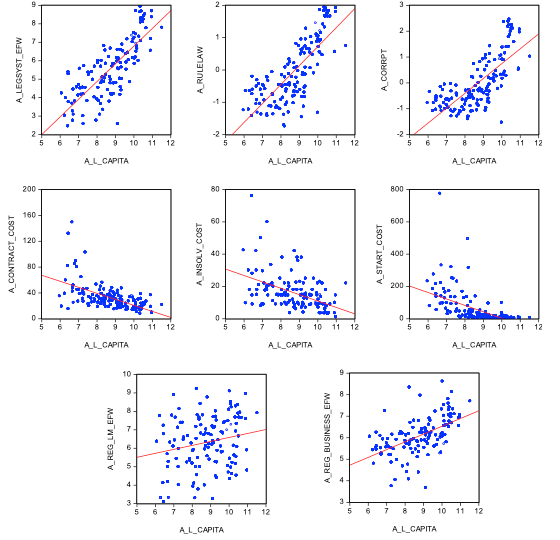

Eyeball econometrics applied to the charts below suggest that there is something going on between different types of regulation and economic outcomes. For instance, for a worldwide sample of countries, purely cross-sectional data shows a fairly convincing positive correlation between better institutions (the quality of the legal system, the strength of the rule of law and the level of corruption) and per capita income for the worldwide sample. Also, more business-friendly regulations (captured by lower costs of contract enforcement, insolvency procedures and starting a business) appear to go hand in hand with higher per capita income. But the correlation between labour market regulation (the Economic Freedom of the World’s labour market regulation indicator) and economic development is not very appealing.

Figure 1. Per capita income (in logs) and selected policies, pure cross-section, worldwide sample

Notes: A_LEGSYST_EFW, A_RULELAW and A_CORRPT denote the quality of the legal system, the strength of the rule of law and the degree of corruption, respectively. Higher values indicate better quality legal systems, a stronger rule of law and less corruption. A_CONTRACT_COST, A_INSOLV_COST and A_START_COST are the cost of contract enforcement, the cost of insolvency procedures and the cost of starting a business. A_REG_LM_EFW and A_REG_BUSINESS_EFW refer to the EFW’s labour market regulation and business regulation indicators. Higher values indicate less regulation.

I look at three types of growth regressions: i.) growth regressions using annual data for a relatively small number of countries (Arnold et al., 2007); ii.) growth regressions using multi-year averages for a large number of countries such as in Barro (2015), who uses data for 89 countries at non-overlapping five-year averages; and iii.) growth regressions based on a large pure cross-sectional data (e.g. Sala-i-Martin et al. 2004).

The empirical findings can be summarised as follows. First, there is robust empirical evidence for the existence of a strong relationship between product market regulations and a country’s level of development. More precisely, more business-friendly product market regulations were found to be associated with higher per capita income levels. At the same time, it is difficult to identify precisely estimated effects of labour market regulation and policies, perhaps with the exception of spending on active labour market policies, which tend to have a positive relation to per capita income. Second, there is no clear answer as to whether policies have different effects for countries at different levels of development. But I was more successful in finding out how institutions relate to economic development and whether they interact with other policies. I find, as many earlier studies do, that on average, institutions are very strongly correlated with a country’s level of development. And importantly, institutions are shown to interact with product market regulations. Finally I uncover some policy interactions: labour market regulation and policies may attenuate or accentuate the impact of product market regulations on per capita income levels.

♣♣♣

- This blog post is based on the author’s chapter forthcoming in N. Campos, P. De Grauwe and Y. Ji (eds.), Structural Reforms and Economic Growth in Europe, Cambridge University Press.

- The post gives the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by guipanta21, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Balázs Égert is a senior economist in the Organisation for Economic Cooperation and Development’s structural surveillance division. He has a PhD in economics from the University of Paris X-Nanterre.

Balázs Égert is a senior economist in the Organisation for Economic Cooperation and Development’s structural surveillance division. He has a PhD in economics from the University of Paris X-Nanterre.