The reduction of greenhouse gas (GHG) emissions is an increasingly important policy objective for many governments, both in developed and developing economies. This is reflected, among other things, in the emergence of energy efficiency as a high-priority topic on the policy agenda.

In manufacturing – one of the key sectors from the point of view of GHG emissions and energy intensity – improvements in energy efficiency can come about from upgrading or closing existing plants or adding new production capacity that uses more modern technology. Moreover, recent research has found that management practices – such as those focused on how a firm handles a process-related problem, collection of production indicators, the timescale and difficulty of its targets and incentives – also play a significant role in reducing the energy intensity of firms.

In our paper we take the analysis beyond the relationship between management quality and energy intensity by considering how fossil fuel prices might affect energy intensity, in particular in combination with the quality of management practices. We expand the analysis to almost 2,250 manufacturing firms in 38 economies in central and eastern Europe, Central Asia and Middle East and North Africa, using firm-level data on management practices and energy costs from the fifth round of the European Bank for Reconstruction and Development (EBRD) – World Bank (WB) Business Environment and Enterprise Performance Survey (BEEPS) and the EBRD, European Investment Bank (EIB) and WB Middle East and North Africa (MENA) Enterprise Survey (ES) combined with the supply cost, consumer prices and environmental cost of fossil fuels data from the IMF.

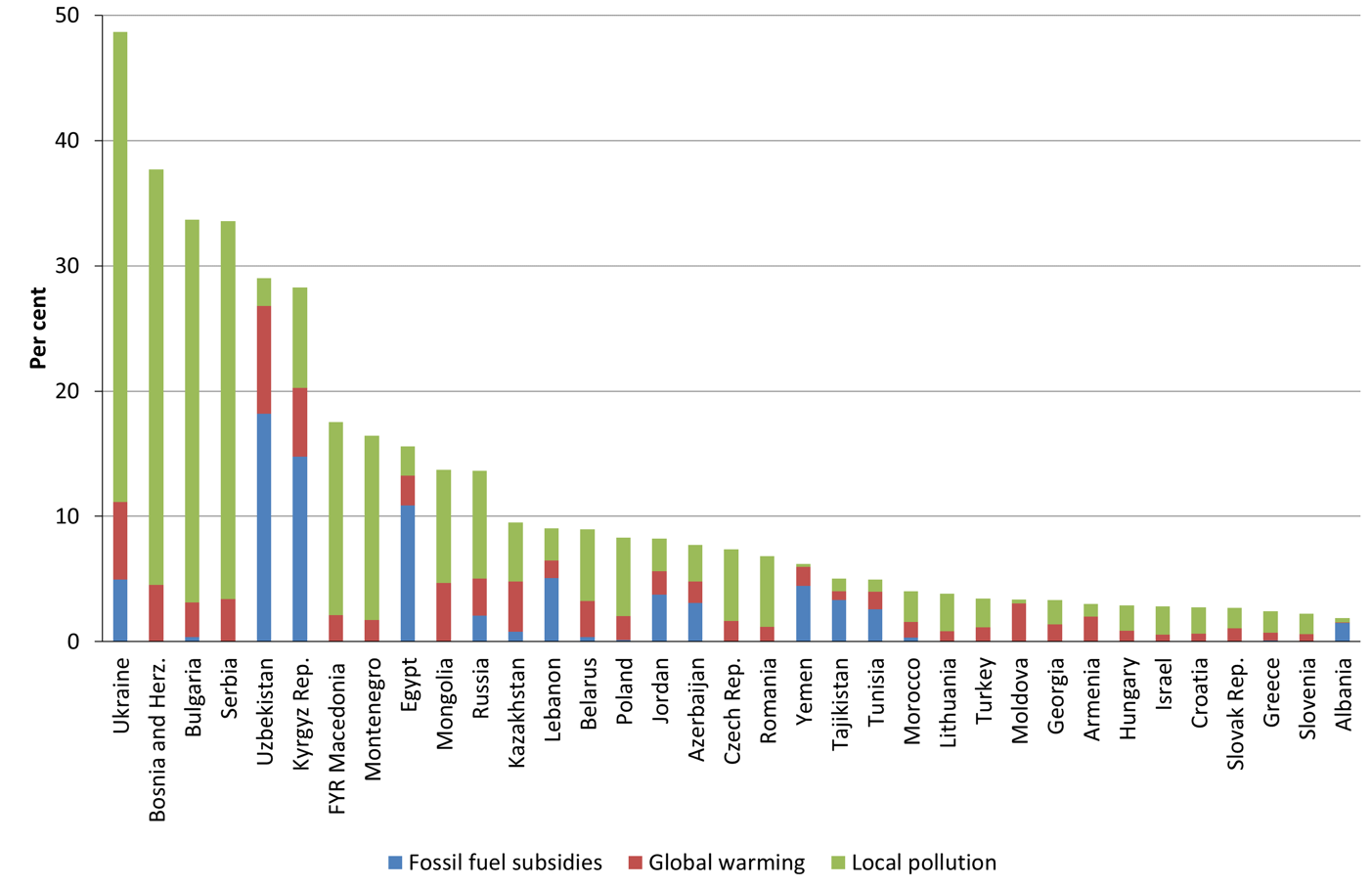

Accounting for fossil fuel subsidies (difference between the supply cost and the consumer price) is important: together with environmental costs they amounted to US$ 4.9 trillion worldwide in 2013, equivalent to 6.5 per cent of global GDP. As illustrated in figure 1, several countries in our sample (such as Uzbekistan, Kyrgyz Republic and Egypt) had substantial fossil fuel subsidies. Moreover, environmental costs – the monetary equivalent of global warming and local pollution caused by fossil fuel combustion – are present in virtually all of them and is equivalent to more than 40 per cent of GDP in Ukraine. In addition, most of the countries in central and eastern Europe and Central Asia have the legacy of energy-intensive production, making them particularly interesting and relevant for our analysis.

Figure 1: Economic value of fossil fuel subsidies in 2013

Source: IMF energy subsidies template. Note: in countries where the benchmark price of fossil fuels is lower than the real price, the value of fossil fuel subsidies is set to zero.

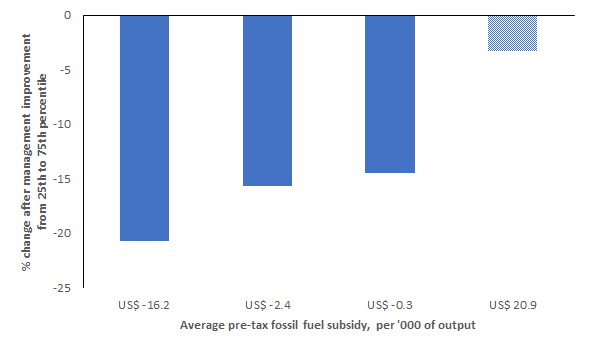

Our results show that fossil fuel subsidies matter. Better managed firms respond to incentives and increase their energy intensity if fossil fuel subsidy is relatively large. The magnitude is substantial: an improvement in management practices quality from the 25th to the 75th percentile of their distribution is associated with a 21 per cent fuel intensity reduction when fossil fuel subsidies are low (or negative) and with a 3 per cent fuel intensity reduction when fossil fuel subsidies are high (see figure 2). The relationship is stronger in high energy-intensive sectors, such as manufacturing of textiles or basic metals, where the same improvement in management practices when fossil fuel subsidies are high is associated with more than a third increase in fuel intensity. The findings suggest that firms where individual performance is the basis for managers’ bonuses and non-managers’ promotion are more likely to respond to incentives provided by fossil fuel prices.

Figure 2. Magnitude of the association between improvement in management practices quality and energy intensity at different levels of fossil fuel subsidies

Source: BEEPS V, MENA ES, IMF energy subsidies template and authors’ calculations. Note: Fuel intensity is calculated as the fuel cost per US dollar of sales. Solid bars denote estimates that are statistically significant at at least 10 per cent.

The relationship between fuel intensity and management practices quality does not change once we take into account environmental costs. However, higher environmental costs are associated with lower fuel intensity, indicating that better managed firms do consider the indirect effect of global warming and local pollution. On average, the effects of fossil fuel subsidies and environmental costs are similar in magnitude and opposite in direction, so the overall effect on the relationship between fuel intensity and management practices quality is negligible. However, in high energy-intensive sectors the “cleansing” effect of environmental costs does not compensate for advantage associated with the gap between consumer price and supply costs of fossil fuels.

Our analysis suggests that while better management practices are associated with improved productivity, they may also be linked to worse environmental performance in the absence of incentives to economise on energy use. Well-managed firms use energy inputs more efficiently and thereby increase their productivity while at the same time reducing their greenhouse gas emissions only when fossil fuel prices are not distorted by subsidies. In a similar vein, improving the quality of their management practices could help firms reduce their energy intensity further when they face fuel taxes, including carbon taxes. Governments wishing to reduce greenhouse gas emissions should carefully consider the impact fossil fuel prices have on firm behaviour.

♣♣♣

- This blog post is based on the authors’ paper When good managers face bad incentives: Management quality and energy intensity in the presence of price distortions, EBRD Working Paper No. 224, 2019, presented at the 2019 annual congress of the European Economic Association (EEA) in Manchester.

- The post gives the views of its author(s), not the position of the European Bank for Reconstruction and Development, LSE Business Review or the London School of Economics and Political Science.

- Featured image via PublicDomainPictures, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Helena Schweiger is a senior economist at the EBRD office of the chief economist. She has a PhD in economics from University of Maryland, College Park and her main research interests include applying empirical analysis to try to understand the causes of differences in productivity and growth across countries, businesses and time, and their policy implications with a focus on innovation, management practices and green growth. She is currently working on the EBRD-EIB-World Bank Enterprise Surveys and a few papers looking at the relationship between firm performance and the environment/climate change.

Helena Schweiger is a senior economist at the EBRD office of the chief economist. She has a PhD in economics from University of Maryland, College Park and her main research interests include applying empirical analysis to try to understand the causes of differences in productivity and growth across countries, businesses and time, and their policy implications with a focus on innovation, management practices and green growth. She is currently working on the EBRD-EIB-World Bank Enterprise Surveys and a few papers looking at the relationship between firm performance and the environment/climate change.

Alexander Stepanov is an associate economist at the EBRD office of the chief economist. Alexander holds a masters’ degree in international economic policy from the Paris Institute of Political Studies (Sciences Po). His main research interests cover evaluation of public policies and state intervention in the areas of innovation, green growth and finance. Alexander is also engaged in the implementation of the joint EBRD-EIB-World Bank Enterprise Surveys covering 42 countries in Central and Eastern Europe, Central Asia and Middle East and North Africa.

Alexander Stepanov is an associate economist at the EBRD office of the chief economist. Alexander holds a masters’ degree in international economic policy from the Paris Institute of Political Studies (Sciences Po). His main research interests cover evaluation of public policies and state intervention in the areas of innovation, green growth and finance. Alexander is also engaged in the implementation of the joint EBRD-EIB-World Bank Enterprise Surveys covering 42 countries in Central and Eastern Europe, Central Asia and Middle East and North Africa.