Government funding for innovation related to military uses represents a key channel through which governments all over the world shape innovation. In the US, for example, annual government defence-related research and development (R&D) expenditures were $78 billion in 2016, over 57% of all government-funded R&D (Congressional Research Service, 2018). While defence-related R&D is motivated by goals that are not mainly economic, it is often the most important de facto industrial policy used by central governments to affect the speed and direction of innovation in the economy. The amount of public money flowing into defence R&D dwarfs the amount spent on other prominent innovation policy tools in the US. For example, the total budget of the National Science Foundation or the overall value of the federal R&D tax credit in a typical year are less than one tenth of federal outlays for defence-related R&D (NSF, 2006). Defence R&D is the single most important component of government-funded R&D in the UK and France as well, and a major component of government-sponsored R&D in many other developed economies.

The effect of defence R&D expenditures on private sector innovation and economic growth has been a hotly debated topic for many years (e.g., see surveys by Mowery, 2010, and Lichtenberg, 1995). Proponents of the benefits of defence R&D point to the commercial success of major innovations such as jet engines, computers, radar, nuclear power, semiconductors, GPS, and the Internet as evidence that military R&D has been a crucial source of technological development with civilian applications (see Lichtenberg, 1984, 1988; Ruttan, 2006, Mazzucato, 2013). Some even argue that the Pentagon’s role as the world’s most generous investor in technological innovation during the Cold War—ultimately resulting in superior technologies for American companies and enduring gains in their competitiveness (Braddon, 1999*)—was an important reason that US manufacturing became so dominant after World War II. More recently, defence R&D has been viewed as an important contributor to national economic growth through private sector spinoffs and agglomeration economies. Proponents of this view often point to Israel as an example of how defence spending has spawned a multitude of commercially successful high tech startups (e.g. Senor and Singer, 2009).

On the other hand, critics argue that the benefits of defence R&D are meagre, primarily because military secrecy inhibits the scope of spillovers to civilian firms. Even more fundamentally, critics argue that defence-related R&D might displace private R&D and therefore could even have a negative impact on the total amount of innovation. Overall, there is much anecdotal evidence of some of the positive and negative effects that defence R&D might have on growth, but little systematic econometric evidence.

In a recent paper (Moretti et al., 2019) we study the effect of government-funded R&D on private R&D—namely, R&D conducted and financed by private businesses. We use a unique dataset on government-funded and private R&D in multiple industries in every OECD country over 23 years. There was a lot of variation over time across countries (and across industries) in the degree of defence spending over this period (see Figure 1). We complement the international industry data with a sample of all R&D performing firms in France together with their R&D subsidies – broken down into defence and other ministries. This longitudinal data allows us to compare the same firm before and after the public R&D award.

The effect of government-funded R&D on privately funded R&D could be positive or negative, depending on whether there is “crowd out” or “crowd in”. Crowding out may occur if the supply of inputs to the R&D process (specialised engineers, for example) is in short supply within an industry and country (Goolsbee, 1998). In this case, the only effect of an increase in government-funded R&D is to displace private R&D with no net gains for total R&D. On the other hand, crowding in may occur if (i) R&D activity involves large fixed costs and, by covering some of the fixed costs, government-funded R&D makes some marginal private sector projects profitable; (ii) government-funded R&D in an industry generates technological spillovers that benefit other private firms in the same industry; and/or (iii) firms face credit constraints. Empirically, we find strong evidence of crowding in in both the OECD and French datasets. Increases in government-funded R&D generated by variation in predicted defence R&D translate into significant increases in privately funded R&D expenditures.

Figure 1. Defence R&D as a percentage of GDP in the US, Germany, Japan and France

Notes: This figure shows the defence related, government funded total R&D as a share of GDP. The defence R&D in this figure refers to “all public R&D” which includes all government budget appropriations or outlays of total R&D, i.e. not just the government-funded part of business conducted R&D, but also the government funded part of R&D conducted outside of enterprises

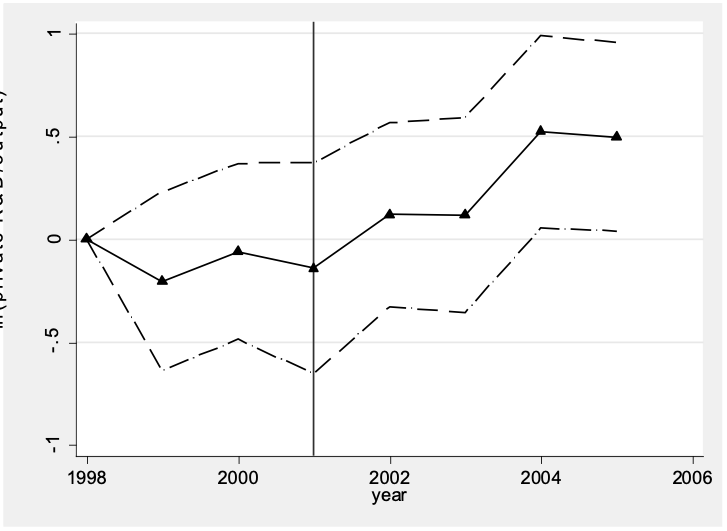

To illustrate this, consider the following case study: As can be seen in Figure 1, the 9/11 terrorist attacks induced the Bush administration to suddenly increase military R&D spending in the US. We are interested in what happened to private R&D following 9/11. Figure 2 shows the differential change in private R&D intensity experienced by two “defence sensitive” industries—namely aerospace and ICT—compared to the change experienced by industries that are less dependent on defence R&D. Before 9/11 there is no obvious differential trend in private R&D intensity. However, after 9/11, the figure shows a rapid increase in private R&D intensity in the defence-sensitive sector compared to other sectors. The effect of 9/11 appears both statistically significant and economically sizeable.

Figure 2. Private R&D intensity in defence-sensitive sectors relative to other sectors before and after 9/11 2001 – US data

Notes: These coefficients are based on difference in difference regressions 1998-2005. “Defence sensitive sectors” are aerospace and other transport; information technology; and Communication Technologies (Radio, TV and Communications Equipment). We run OLS regressions with industry dummies and time dummies and an interaction between the defence sensitive sectors and different year dummies pre and post 2001. Solid line is the OLS coefficient (base period is 1998) and 95% confidence intervals based on robust standard errors.

In our systematic analysis across all OECD countries, our estimates imply that a 10% increase in defence R&D results in a 4% increase in private R&D. They imply that defence-related R&D is responsible for an important part of private R&D investment in some industries. For example, in the US “aerospace products and parts” industry, defence-related R&D amounted to $3,026 million in 2002. Our estimates suggest that this public investment results in $1,632 million of additional private investment in R&D. Our estimates also indicate that cross-country differences in defence R&D might play an important role in determining cross-country differences in overall private sector R&D investment. For example, we estimate that if France increased its defence R&D to the level of the US as a fraction of its GDP (admittedly, a large increase) private R&D in France would increase by 8.7%.

We also find evidence of spillovers between countries. In the OECD data, increases in government funded R&D in one country appear to increase private R&D spending in the same industry in other countries. For example, an increase in government-funded R&D in the US chemical industry induced by an increase in US defence spending in the chemical industry raises the industry’s private R&D in the US, but it also raises private R&D in the German chemical industry. This type of cross-border spillover is consistent with the presence of industry-wide technological or human capital externalities.

When we turn to the effect of investment in R&D on productivity, we find a positive effect on productivity. For example, defence R&D in the US increased by just over half between 2001 and 2004 following the 9/11 attack. We estimate that, holding taxes constant, this translated into a 0.006 percentage point increase of the annual TFP growth rate in the US in the affected years—about a 1.8% increase. Since in reality, this defence R&D spending had to be financed by increased taxes or cuts in other government expenditures, the ultimate impact is almost certainly smaller.

Overall, our estimates suggest that cross-country differences in defence R&D play a role in explaining cross-country differences in private R&D investment, speed of innovation, and ultimately in the productivity of private sector firms. We caution that our estimates do not necessarily imply that it is desirable for all countries to raise defence R&D across the board. Our finding that government-funded R&D results in increased private R&D does not necessarily imply that defence R&D is the most efficient way for a government to stimulate private sector innovation and productivity. However, it does suggest that it has had some positive effects on civilian innovation (Bloom, Van Reenen, and Williams, 2019).

* Braddon, (1999) “Commercial Applications of Military R&D: US and EU Programs Compared”, mimeo, University of the West of England

♣♣♣

- This blog post appeared first on VoxEu. It is based on the authors’ paper The Intellectual Spoils of War? Defense R&D, Productivity and International Spillovers, NBER Working Paper No. 26483

- The post gives the views of its author(s), not the position of LSE Business Review or the London School of Economics and Political Science.

- Featured image by skeeze, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy

Enrico Moretti is the Michael Peevey and Donald Vial professor of economics at the University of California, Berkeley. He serves as the editor in chief of the Journal of Economic Perspectives and is a visiting scholar at the Federal Reserve Bank of San Francisco. He is also research associate at the National Bureau of Economic Research (Cambridge), research fellow at the Centre for Economic Policy Research (London) and the Institute for the Study of Labor (Bonn).

Enrico Moretti is the Michael Peevey and Donald Vial professor of economics at the University of California, Berkeley. He serves as the editor in chief of the Journal of Economic Perspectives and is a visiting scholar at the Federal Reserve Bank of San Francisco. He is also research associate at the National Bureau of Economic Research (Cambridge), research fellow at the Centre for Economic Policy Research (London) and the Institute for the Study of Labor (Bonn).

Claudia Steinwender is an assistant professor of applied economics at the MIT Sloan School of Management and is affiliated with the National Bureau of Economic Research (NBER), Center for Economic and Policy Research (CEPR), and Centre for Economic Performance at LSE (CEP).

Claudia Steinwender is an assistant professor of applied economics at the MIT Sloan School of Management and is affiliated with the National Bureau of Economic Research (NBER), Center for Economic and Policy Research (CEPR), and Centre for Economic Performance at LSE (CEP).

John Van Reenen is a professor at MIT’s department of economics and Sloan School of Management. From October 2003 to July 2016 he was professor of economics and the director of the Centre for Economic Performance (CEP) at LSE. He has published widely on the economics of innovation, labour markets and productivity. In 2009 he received the Yrjö Jahnsson Award, the European equivalent to the US Bates Clark Medal, awarded every two years to the best economist in Europe under the age of 45. In 2014 he won the European Investment Bank prize for excellence in economic and social research.

John Van Reenen is a professor at MIT’s department of economics and Sloan School of Management. From October 2003 to July 2016 he was professor of economics and the director of the Centre for Economic Performance (CEP) at LSE. He has published widely on the economics of innovation, labour markets and productivity. In 2009 he received the Yrjö Jahnsson Award, the European equivalent to the US Bates Clark Medal, awarded every two years to the best economist in Europe under the age of 45. In 2014 he won the European Investment Bank prize for excellence in economic and social research.