Just two weeks ago, the likelihood of a major US recession as a consequence of the public health challenge was still in doubt. In the past few days, the number of claims filed for unemployment insurance hit record levels; the total number of Covid-19 cases in the United States went past 100,000, already substantially higher than the totals in Italy and China; and parts of the country have imposed lockdowns – closing non-essential businesses and requiring people to stay at home as much as possible.

We invited our panel to express their views on the policy response to the Covid-19 crisis, in particular the interactions between containment measures and economic activity, and the need for investment to support the medical response to the health emergency. We asked the experts whether they agreed or disagreed with three statements, and, if so, how strongly and with what degree of confidence.

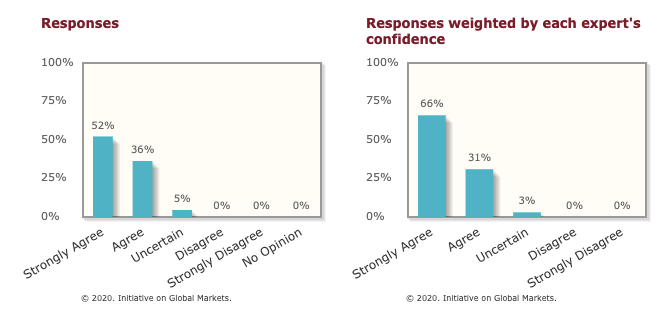

Statement 1. A comprehensive policy response to the coronavirus will involve tolerating a very large contraction in economic activity until the spread of infections has dropped significantly.

Source: IGM Economic Experts Panel

On the first statement, weighted by each expert’s confidence in their response, 66% of the panel strongly agreed, 31% agreed, 3% were uncertain, and none disagreed.

Among the comments, Larry Samuelson at Yale notes: ‘We have already seen one of the quickest and most severe contractions in history, with no immediate end in sight.’ Bengt Holmstrom at MIT concurs: ‘Economic activity already down and will hardly pick up until pandemic under control and fear abates.’

Angus Deaton at Princeton says: ‘We don’t quite know how bad it will be, or exactly what “very large” means. But spirit is right’; while Kenneth Judd at Stanford is more optimistic: ‘Yes, there will be a “very large” contraction, but with a short duration, hopefully just several weeks.’

Aaron Edlin at Berkeley alludes to the link between the public health crisis and the economy: ‘We need a lockdown and random testing until we know either A. that the virus is under control or B. that mortality is low.’ Similarly, Anil Kashyap at Chicago comments: ‘Slowing the disease spread requires social distancing and less labor supply – we don’t want to fully offset this’, adding a link to his analysis with three colleagues of three pillars of the economic policy response to the Covid-19 crisis.

Several panelists refer to the appropriate policy response when tolerating an economic contraction is necessary for public health reasons. Alberto Alesina at Harvard, for example, states: ‘Fiscal policy will be needed to support the weakest during the recession.’ Jose Scheinkman at Columbia says: ‘It is crucial to preserve capacity of firms of all sizes to return rapidly once social distancing is no longer necessary.’ Christopher Udry at Northwestern adds: ‘There are many steps we can take that both will reduce the contraction and reduce lives lost. Most obviously vastly improved testing.’

Others express further caveats. James Stock at Harvard argues that: ‘Spread of infections must drop to point health system can handle; will be contraction; but not clear suppression is desirable goal.’ Robert Shimer at Chicago says: ‘There are other reasons to stop tolerating the contraction, e.g. effective treatments, evidence that mortality rates are not too high, etc.’ And Daron Acemoglu at MIT notes: ‘Containment doesn’t mean complete elimination. May be optimal to stagger return to work for low-risk groups once peak-disease is gone.’

Sustaining severe lockdowns

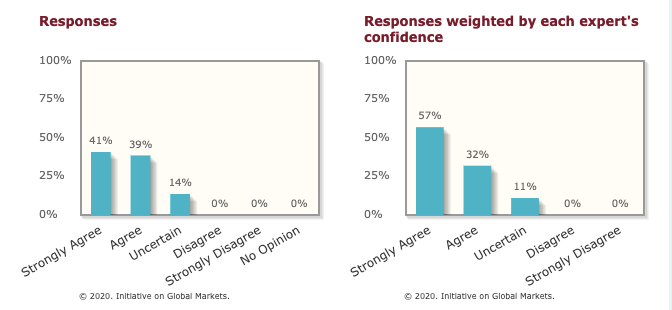

Statement 2. Abandoning severe lockdowns at a time when the likelihood of a resurgence in infections remains high will lead to greater total economic damage than sustaining the lockdowns to eliminate the resurgence risk.

Source: IGM Economic Experts Panel

On the second statement about the potential impact of the length and severity of lockdowns on total economic damage, again weighted by each expert’s confidence in their response, 57% of the panel strongly agreed, 32% agreed; 11% were uncertain, and none disagreed.

In comments, several panelists mention the evidence from epidemiology. Darrell Duffie at Stanford links to the widely discussed Imperial College report on strategies for mitigation and suppression, saying: ‘The epidemiology studies imply severe economic damage in the form of additional loss of human life (to which I assign high economic damage).’

Michael Greenstone at Chicago also refers to evidence on the benefits and costs of ‘flattening the curve’ for Covid-19: ‘Taking available epi models at face value suggests there are large welfare/economic benefits to social distancing/slowing spread of COVID-19.’ Anil Kashyap adds: ‘Everything I read suggests that premature cessation will backfire – see Andy Atkeson’s analysis.

Jose Scheinkman comments: ‘Without vaccine, likelihood recurrence is high till very high percentage infected. Optimal strategy involves multiple waves of contact reduction.’ Christopher Udry points out that: ‘The key is to reduce the likelihood of resurgence by better targeting of preventative measures. Until then, strict social distancing needed.’

But Penny Goldberg at Yale, who replied to the poll to indicate that she is uncertain on both this and the first question, argues that: ‘We need to know the true infection and asymptomatic rates before deciding on local lockdowns. If everyone is already infected, lockdowns will not make a difference.’ Both she and James Stock emphasize the need for data to inform the policy response – and he argues strongly for random testing: ‘We have insufficient data to assess and need random testing of population to ascertain true infection and death rates.’

Pete Klenow at Stanford provides links to preliminary evidence on the optimal length of a total economic lockdown, and the role of testing and case-dependent quarantine.

Government investment in expanding treatment capacity

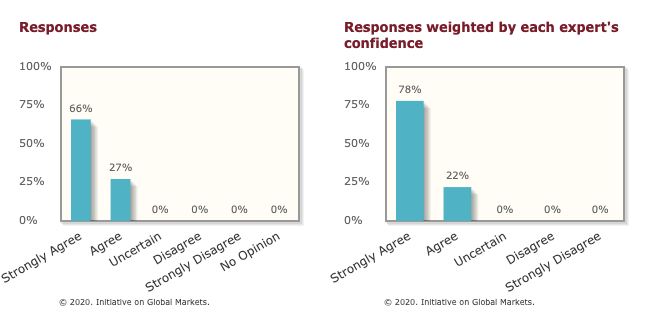

Statement 3. Optimally, the government would invest more than it is currently doing in expanding treatment capacity through steps such as building temporary hospitals, accelerating testing, making more masks and ventilators, and providing financial incentives for the production of a successful vaccine.

Source: IGM Economic Experts Panel

On the third statement on public investment in temporary hospitals, testing, masks and ventilators, and efforts to find a vaccine, weighted by each expert’s confidence in their response, 78% of the US panel strongly agreed, 22% agreed, and none were uncertain or disagreed.

Among this unanimity, panelists pass comment on a number of different policy issues. Daron Acemoglu says: ‘US federal response has been incoherent and counterproductive. Hard to understand lack of investment ahead of current situation.’ Larry Samuelson adds: ‘A timely response could have less vigorous and less expensive, but we must now intervene all the more to compensate for wasted time.’

David Autor at MIT notes: ‘The fiscal response is awesome, but the federal health response has been abysmal.’ But Aaron Edlin warns: ‘Compare the spending in the stimulus package on these necessities vs. stimulus that spreads virus’, linking to his policy advice: don’t just flatten the curve: raise the line.

William Nordhaus at Yale is emphatic: ‘Given the potential length and depth of downturn, it is hard to imagine overinvesting in pandemic-related investment.’ Similarly, Kenneth Judd comments: ‘Absolutely! Hard to imagine overspending on vaccine development, given likely spillovers to future work.’

He adds a link to his policy proposal to get cash to corporations quickly by the government buying newly issued preferred stock. Another innovative policy proposal on the IGM web page is a Covid-19 vaccine price guarantee suggested by a team of researchers at Stanford.

Several panelists refer to US policy failures in response to the Covid-19 crisis. Jose Scheinkman notes: ‘Though hard to measure current investment rates, government greatly underinvested when a serious epidemic became apparent in China.’ Richard Thaler at Chicago mentions: ‘Massive incompetence in delayed testing and supplies acquisition. Thankfully some governors are stepping up.’

Robert Hall at Stanford states: ‘The failure of executive leadership in government, especially the White House, is tragic.’ And Richard Schmalensee at MIT concludes: ‘Some state governments are flat out, others asleep; the federal government should do more now and should prepare for the NEXT pandemic.’

Of our 44 US experts, 41 participated in this survey. More details on the experts’ views come through in the short comments that they are able to make when they participate in the survey. Several provide links to relevant research evidence, including the web page set up to collect policy proposals for mitigating the economic fallout from COVID-19, written by the network of economists associated with the IGM Forum. All comments made by the experts are in the full survey results.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image (empty street in Milan) by Mick De Paola on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.

Romesh Vaitilingam is a writer and media consultant, and the editor of CentrePiece, the magazine of LSE’s Centre for Economic Performance. He is also a member of the editorial board of VoxEu. Romesh is the author of numerous articles and several successful books, including The Financial Times Guide to Using the Financial Pages (FT-Prentice Hall), now in its sixth edition (2011). As a specialist in translating economic and financial concepts into everyday language, Romesh has advised a number of institutions, including the Royal Economic Society, the Centre for Economic Performance at LSE and the Centre for Economic Policy Research. In 2003, he was awarded an MBE for services to economic and social science. He tweets at @econromesh.

Romesh Vaitilingam is a writer and media consultant, and the editor of CentrePiece, the magazine of LSE’s Centre for Economic Performance. He is also a member of the editorial board of VoxEu. Romesh is the author of numerous articles and several successful books, including The Financial Times Guide to Using the Financial Pages (FT-Prentice Hall), now in its sixth edition (2011). As a specialist in translating economic and financial concepts into everyday language, Romesh has advised a number of institutions, including the Royal Economic Society, the Centre for Economic Performance at LSE and the Centre for Economic Policy Research. In 2003, he was awarded an MBE for services to economic and social science. He tweets at @econromesh.

1 Comments