The Covid-19 pandemic and lockdown have highlighted the need for real-time data to understand the spread of the disease, identify vulnerable groups and design policies to mitigate the health and economic fallout of the crisis. While several new efforts to collect individual data are being made (Adams et al., 2020), data on businesses is more limited.

A relatively under-utilised source of information on businesses comes from industry groups and business organisations that collect information from businesses to provide insights into the state of the economy. Drawing on the latest survey data from the Confederation of British Industry (CBI) – the UK’s premier business organisation that speaks for 190,000 businesses in the UK – we examine how businesses fared as the lockdown went into full force in the UK in April 2020.

For decades the CBI has been conducting monthly and quarterly surveys of businesses, including but not limited to its members. The surveys provide a wealth of information on the experiences of these businesses during the lockdown. Our analysis used data for all sectors (except financial services, which is not surveyed monthly).

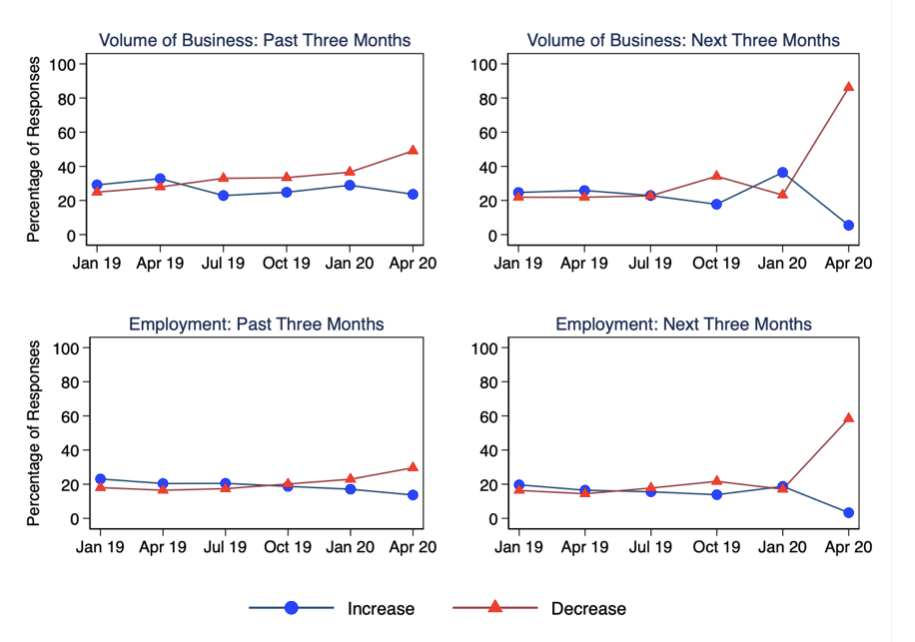

Figure 1. Business and employment trends and expectations

The share of businesses that reported a drop in their present volume of business in the last three months has risen to 50%, compared to a much smaller 30% in the same month in 2019. The shares of businesses reporting a reduction in employment is more muted, but still high at 30% compared to under 20% in April 2019.

Businesses think that there isn’t going to be much relenting on the drop in economic activity and jobs any time soon. In short, they worry it’s going to get worse. The share of firms that expect business and jobs to drop in the next three months has jumped to 80% and 60%, compared to January 2020 which saw smaller numbers of around 20%. These numbers are higher than what the firms reported on business and jobs at any point during the 2008 financial crisis.

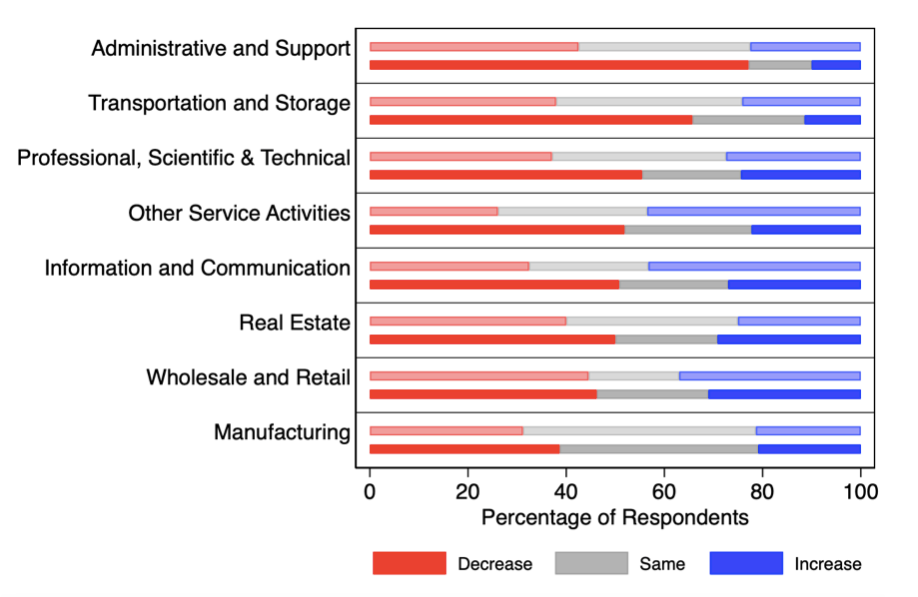

Looking across different sectors of the economy, service sectors, other than wholesale and retail, seem to be faring much worse than they did at the start of the year. Manufacturing firms appear to have not been hit too hard in April 2020. But the proportion of firms reporting a fall in their volume of business has risen in all sectors compared to January 2020, and this is not driven by seasonal variation, which is accounted for in the responses.

Figure 2. Volume of business in the past three months by industry

Note: The top bars (faded) for each industry are for January 2020 and the bottom bars (bolder) are for April 2020.

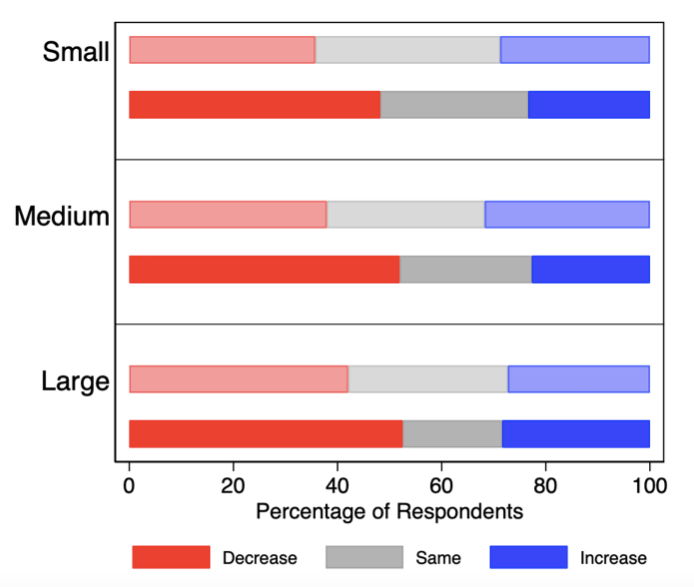

All firms are doing worse on average, irrespective of size as measured by employment. Smaller firms started with slightly better performance but more of them also expect reductions in their volume of business in April relative to January.

Figure 3. Volume of business in the past three months by firm size

Note: The top bars (faded) for each firm size are for January 2020 and the bottom bars (bolder) are for April 2020

Phone call data and the Decision-Maker’s Panel have recently provided much needed information on the view of the crisis from the point of view of businesses (Hassan et al., 2020; Bloom et al., 2020). The CBI surveys aim to collect information on changes in business trends and they provide a timely service which can be used to supplement nationally representative data from statistical agencies, which are likely to be more accurate but slower in delivery, collection and analysis. The sneak preview that they provide us of business under lockdown shows prospects are even bleaker now, and it remains to be seen which sectors and types of firms will be able to recover in due course.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of the CBI, LSE Business Review or the London School of Economics.

- Featured image by It’s No Game, under a CC-BY-2.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy

Swati Dhingra is associate professor of economics and research fellow at the Centre for Economic Performance at LSE’s department of economics.

Swati Dhingra is associate professor of economics and research fellow at the Centre for Economic Performance at LSE’s department of economics.

Josh De Lyon is a PhD student in economics at Oxford University. He is also a research assistant in trade at LSE. He tweets @joshdelyon

Josh De Lyon is a PhD student in economics at Oxford University. He is also a research assistant in trade at LSE. He tweets @joshdelyon