In 2018, only 28% of adults were eating the recommended five portions of fruit and vegetables per day in the UK – and the average was 3.7 portions per day. Fewer men than women meet the five-a-day guideline, and young people aged 16 to 24 are also less likely than other adults to get their five-a-day. In 2018, 18% of children aged 5 to 15 ate five standard portions of fruit and vegetables per day (NHS Digital, 2020; BBC News, 2017). The five-a-day campaign is dependent on imports of vegetables and fruit. Are there any threats to the availability of fresh fruits and vegetables?

We examine the evidence from COVID-19 and a no-deal Brexit scenario, where the UK would need to procure its produce imports elsewhere. We illustrate the trade status of most vegetables and fruit products in the UK, and how they could change under COVID-19 and a potential scenario of a no-deal Brexit. We show that whilst COVID-19 already had an impact on prices and imports, a no-deal Brexit may have far more severe effects on the food chain.

Has COVID-19 affected the market for major vegetables and fruits?

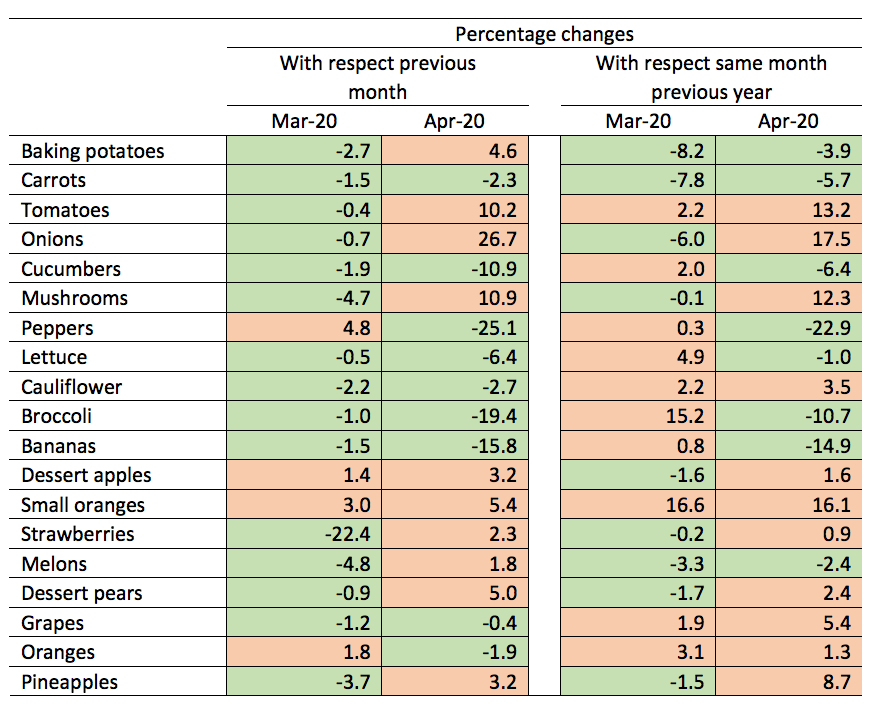

COVID-19 exerted a disruption on the food chain as we discussed in a previous post. However, has it affected prices and availability of imported fresh products? If we look at the change in price of the top 10 consumed fruits and vegetables relative both to the previous month and last year (to consider potential seasonal effects), we can identify significant price differences.

Table 1 reveals a product-specific price increase of some vegetables such as tomatoes, onions and mushrooms, which are mainly sourced from the EU. When we look at fruit, oranges and pineapples are the ones that have suffered the largest price increase.

Table 1. Change in retail prices of selected vegetables and fruits

Source: Own elaboration based on ONS data. Note: Green cells show a decrease in price and pink an increase.

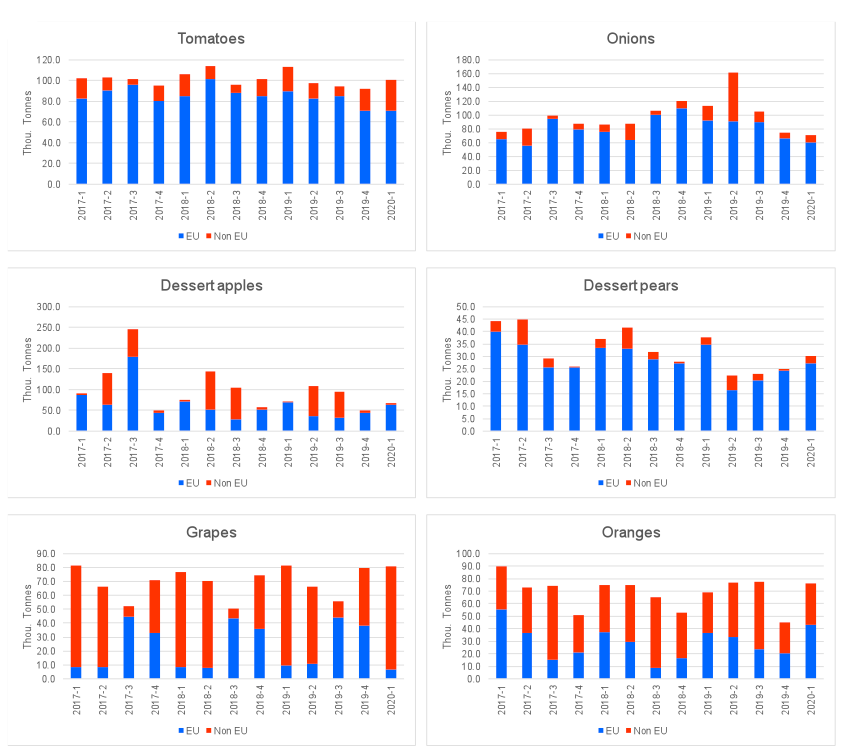

Figure 1 presents the evolution of imports of some of the products with price increase during the COVID-19 situation. It shows a reduction in the quantity of EU imports for all the vegetables and fruits considered, compared to the same period in the three previous years. Especially important is the case of onions, with an overall reduction of imports, which for the EU origin represents a reduction of 31 tonnes compared to the first quarter of 2019. Hence, we can conclude that small disruptions in the fruit chain may exert very important effect on the prices and the source of the fruits and vegetables consumed in the UK.

Figure 1. Evolution of imports of selected of fresh vegetables and fruit by origin

Source: Own elaboration based on HMRC Trade Info

How dependent is the UK on EU vegetables and fruit?

The focus on the attention during the COVID-19 crisis has been on those products associated with panic buying, especially non-perishables such as dry pasta, canned food, and of course, toiletries. However, Andrew Opie (speaking to the Environment, Food and Rural Affairs Select Committee), pointed out that the largest threat to the British food system is a no-deal Brexit, which could lead to fresh food shortages never experienced before, not even after the recent coronavirus panic buying crisis (Quinn, 2020).

The UK fruit and vegetable markets are highly dependent on imports of vegetables (47.5% of the supply) and fruits (84%). To understand the effect of Brexit, one could look at which share of these products comes from the EU.

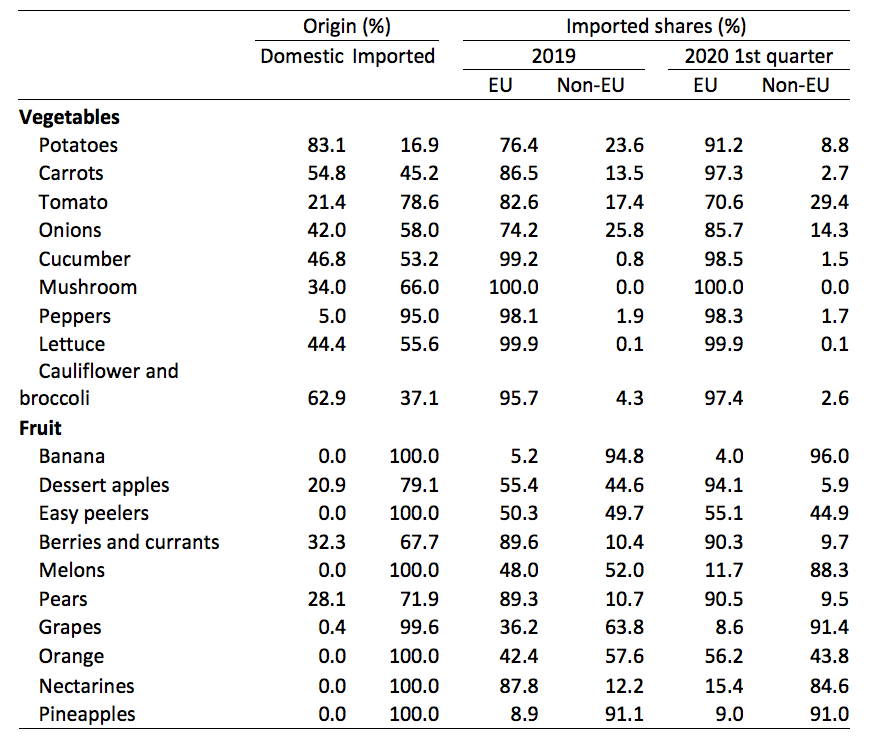

As seen in Table 2, Kantar data on domestic consumption of the top fruits and vegetables consumed in the UK for 2018 suggest a heavy reliance on imported produce. Since in many cases the data do not state the origin of the products, the proportion between EU/non-EU imports was computed based on HMRC trade information data, which also allow us to see the most recent dates.

On vegetables, the UK imports more than half of the tomatoes, onions, cucumbers, mushrooms, peppers and lettuce it consumes. Between 75% and 100% of these products were imported from the EU in 2019. This share did not vary much during COVID-19, except in the case of tomatoes and onions, where we do observe a reduction of EU imports during the first quarter of 2020.

When looking at the fruit sector, we see several cases in which the UK is also highly dependent on EU imports but the distribution between EU and non-EU origin is more variable. For instance, the most consumed fruit, bananas, is mainly imported from non-EU countries, whilst the EU share of melons, citric fruits, grapes, nectarines and pineapples is more evenly distributed between EU and non-EU sources. In contrast, apples, berries, and pears are mainly sourced from the UK and the EU.

Table 2 shows the top 10 vegetables and fruits sold by retailers, ranked according to their importance in terms of quantities and origin (domestic, EU and non-EU).

Table 2. Origin of top 10 vegetables and fruits sold in the UK, 2018-19

Source: Own elaboration based on Kantar Worldpanel data and HMRC Trade Info. Notes: Vegetables and fruits ranked based on quantities sold. Breakdown domestic/import is for 2018 (Kantar) and the imports shares are from HMRC.

Source: Own elaboration based on Kantar Worldpanel data and HMRC Trade Info. Notes: Vegetables and fruits ranked based on quantities sold. Breakdown domestic/import is for 2018 (Kantar) and the imports shares are from HMRC.

Implications of COVID-19 and Brexit for the food supply of fruits and vegetables

The data indicate that disruptions in the fruit and vegetable supply chain may exert important effects on their price and, potentially, consumption in the UK. This can have important effects on the nutrition of the UK population, particularly for those with limited income, hampering any improvement towards the five-a-day goal.

We have shown that COVID-19 has led to an increase in prices of imported fruits and vegetables. The effect of a non-deal Brexit may disrupt the fruit and vegetable supply in multiple ways. The most obvious one is the potential requirement to substitute our import sources (not just produce but also raw material for further transformation by the domestic food industry). It should be noted that this is not as trivial as picking a different stall in the global market, as it implies establishing relationships with reputable suppliers that are able to provide products of the same reliable quality (and for this, quality standards are going to be important), at the best prices, not to mention the changes in all the import regime (e.g., customs checks).

COVID-19 has created issues regarding the availability of workers to the domestic food sector. As to Brexit, in addition to the stability of established, integrated supply chains, almost from the beginning of the breakup discussions it was clear that it was going to affect the supply of seasonal workers for the food sector, particularly for agriculture. As part of this, we have seen the government aiming at quadrupling the number of farm workers recruited on a temporary basis from outside the EU (The Pig Site, 2020) and UK farmers organising the urgent coming of seasonal workers from the EU (O’Carroll, 2020).

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Garry Knight, under a CC-BY-2.o licence

- When you leave a comment, you’re agreeing to our Comment Policy

Cesar Revoredo-Giha is a senior economist and food marketing research team leader, and a reader in food supply chain economics at Scotland’s Rural College (SRUC).

Cesar Revoredo-Giha is a senior economist and food marketing research team leader, and a reader in food supply chain economics at Scotland’s Rural College (SRUC).

Montserrat Costa-Font is the programme director for the MSc in food security at the University of Edinburgh, and a food supply chain economist at Scotland’s Rural College (SRUC).

Montserrat Costa-Font is the programme director for the MSc in food security at the University of Edinburgh, and a food supply chain economist at Scotland’s Rural College (SRUC).

1 Comments