Economic distress caused by the COVID-19 pandemic prompted governments to think about crisis alleviating policies. In an earlier blog, we showed that fiscal policy interventions, such as enhanced value-added tax (VAT) refunds, VAT payment deferrals and VAT filing extensions, increase the liquidity of businesses. Another related measure, documented in OECD data, is the reduction of VAT rates. This measure serves as a temporary demand boost, by promoting consumption.

Most countries have reduced VAT rates on protective equipment, sanitary products, and respiratory devices as an immediate response to the health care crisis. In early crisis response, Austria, Bulgaria, Colombia and the Netherlands all announced VAT exemptions on medical supplies and other goods necessary to prevent further outbreaks of the pandemic. However, these measures have little effect on overall domestic consumption. This gap has incentivised governments to implement VAT reduction measures focused on promoting consumption by either targeting certain sectors and industries or the economy as a whole.

Kenya, Jamaica, Ireland, Cyprus and Germany have since reduced VAT rates across the board. For example, Kenya reduced its standard VAT rate from 16% to 14% effective April 1, 2020. This measure benefits all consumers as it makes taxable services and goods more affordable. Germany’s response was comprehensive and included the reduction of the standard VAT rate from 19% to 16% and of the reduced VAT rate, which applies to items like foods, books and domestic transport, from 7% to 5%, for six months to the end of 2020. Reduction of VAT rates will cost Germany EUR 20 billion – perhaps somewhat less when taking into account the slowdown in economic activity – a significant portion of the 130-billion-euro recovery plan adopted in June and intended to combat the economic consequences of the pandemic. The importance of this VAT rate reduction is highlighted by the fact that VAT contributed 18.2% of total tax revenue in 2018 in Germany.

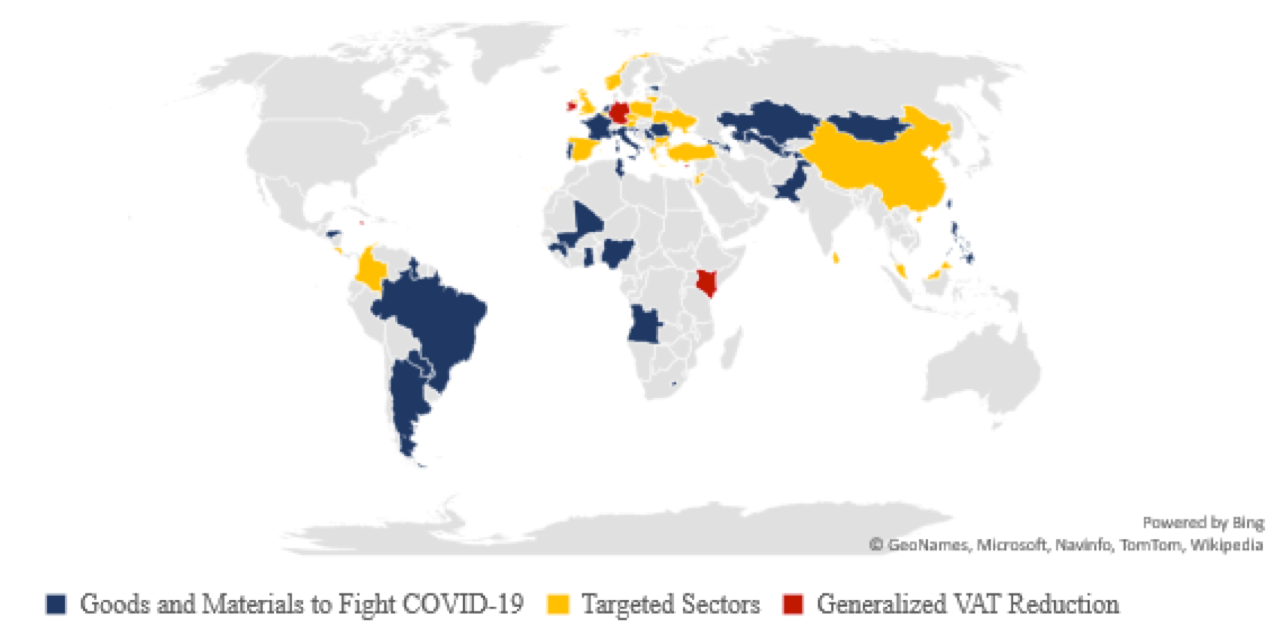

Figure 1. VAT rate reductions and exemptions around the world

Sources: OECD Tax Policy Responses to COVID-19, PWC Global VAT Online, and Tax Foundation – Tracking Economic Relief Plans Around the World during the Coronavirus Outbreak

A large number of countries have adopted targeted VAT reductions or exemptions to encourage consumption in certain sectors. Among European economies, a common focus has been the tourism industry, covering accommodation, gastronomic services, and cultural activities. For example, Belgium reduced the VAT rate for the hospitality sector from 12% to 6%, while the Czech Republic reduced the rate from 15% to 10% on accommodations, sporting, wellness, and cultural activities. In both cases the reductions will last through the end of December 2020. The People’s Republic of China has granted a VAT exemption for “lifestyle services” (normally 6%), which include medical, catering and accommodation, hairdressing, public transportation, and express delivery. Turkey has cut the VAT rate on domestic flights from 18% to 1% for three months, in a bid to support the national carrier. Spain and the UK have also focused on the publishing industry, specifically on digital publications (e-books, magazines, and newspapers), lowering the VAT rate to 4% and 0% respectively.

So far countries still focus on dealing with the impact of the pandemic, protecting livelihoods and helping businesses overcome the decline in demand. Kickstarting consumption by lowering VAT rates may still be a too expensive measure for some, as Saudi Arabia illustrates. The Saudi Ministry of Finance has increased the VAT rate across the board, from 5% to 15%, in order to support government spending needed to address the impact of the COVID-19 pandemic, in the face of low oil prices.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Thiébaud Faix on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Erica Bosio is a researcher at the World Bank Group, where her work focuses on public procurement. Previously, she worked in the arbitration and litigation department of Cleary Gottlieb Steen & Hamilton in Milan. She holds a Master of Laws from Georgetown University and a degree in law from the University of Turin (Italy).

Erica Bosio is a researcher at the World Bank Group, where her work focuses on public procurement. Previously, she worked in the arbitration and litigation department of Cleary Gottlieb Steen & Hamilton in Milan. She holds a Master of Laws from Georgetown University and a degree in law from the University of Turin (Italy).

Emilia Galiano is an economist at the World Bank, where she focuses on private sector development in the context of public procurement. Previously she worked in the microfinance sector and then started her career at the World Bank as a knowledge professional. She holds an M.A. in international development from Johns Hopkins University School of Advanced International Studies and an M.A. in international relations and diplomacy from Bologna University (Italy).

Emilia Galiano is an economist at the World Bank, where she focuses on private sector development in the context of public procurement. Previously she worked in the microfinance sector and then started her career at the World Bank as a knowledge professional. She holds an M.A. in international development from Johns Hopkins University School of Advanced International Studies and an M.A. in international relations and diplomacy from Bologna University (Italy).

Marko Grujicic is a lawyer with the World Bank focused on government procurement, business regulation and private sector growth. Prior to joining the World Bank, he practiced law in a leading law firm in Serbia and was involved in civil society activism. Marko holds a law degree and an LL.M. from the University of Belgrade as well as an M.A. in International Relations and International Economics from Johns Hopkins University’s School of Advanced International Studies.

Marko Grujicic is a lawyer with the World Bank focused on government procurement, business regulation and private sector growth. Prior to joining the World Bank, he practiced law in a leading law firm in Serbia and was involved in civil society activism. Marko holds a law degree and an LL.M. from the University of Belgrade as well as an M.A. in International Relations and International Economics from Johns Hopkins University’s School of Advanced International Studies.