In a new survey of UK businesses, we report large-scale adoption of new technologies and practices during the first few months of the COVID-19 crisis, as firms transformed to survive. Will these innovations be permanent and productivity-enhancing, and how can policy support continued adoption into the recovery?

During the 2008 crisis, a sharp fall in innovative activities occurred in almost every sector and region of the UK. Longer term investments in innovation – such as research and development activities – have been disrupted due to COVID-19 and financing constraints are likely to harm these into the future. But the unique nature of this current crisis has forced many firms to rapidly change their ways of working, and adopt new digital technologies or management practices considered to be productivity enhancing in normal times. If such innovation persists, it could induce lasting impacts on business performance and productivity.

We present new data from a survey of 375 UK businesses conducted in July 2020 in partnership with the Confederation of British Industry (CBI). Our survey sheds light on three main questions:

- To what extent have businesses adopted new technologies, capabilities and management practices, or introduced new products in response to the COVID-19 crisis – and how do these vary by type of business?

- Where firms have discovered new ways to harness technologies, what have been the impacts on business performance so far, and how do firms expect these to affect their workforces over time?

- What policies are viewed by businesses as being valuable for supporting continued innovation into recovery?

A majority of firms have adopted productivity-enhancing technologies and practices, or introduced new products/services in response to the pandemic

We asked firms whether they had engaged in four different types of innovation in the period from the end of March to end of July 2020. The first three relate to “process innovation”: the adoption of new digital technologies (e.g. customer relationship, remote working technologies), digital capabilities (e.g. e-commerce, cyber security) or management practices within the organisation (e.g. new HR and people management practices). We also asked firms if they had introduced any new product or services, which we refer to as “product/service innovation”.

We find a strong business innovation response to the COVID-19 crisis across four innovation categories (Figure 1). Over 60% of respondents have adopted digital technologies and new management practices during the crisis and 38% adopted new digital capabilities. Of those who have not adopted, a third plan to adopt new digital technologies or capabilities in the near future, and 20% plan to adopt new management practices.

Figure 1. Innovation response (March – July 2020)

Note: N=375, N=374, N=371 and N=365 responded to each question, respectively.

With respect to product innovation, 45% have introduced a new product or service, with 75% of these stating that they had introduced entirely new products or services, and nearly 60% improving existing products or services.

These innovation rates appear to be greater than what we might have expected in the absence of the COVID-19 crisis – with the most recent UK Innovation Survey finding that around 13% of businesses were process innovators and 18% were product innovators over the 3 years to December 2018. Moreover, the technological response to COVID-19 so far appears to be larger than that following the financial crisis: data from the Workplace Employment Relations Study in 2011 showed that 48% of employers had introduced or upgraded technologies, 38% had introduced changes in workplace organisation and a third had introduced new products and services over the two years prior to the survey.

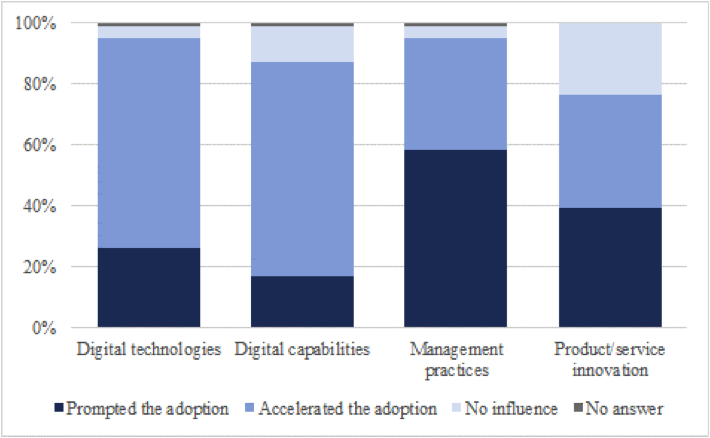

Of the innovating firms in our survey, the vast majority state that COVID-19 accelerated or prompted these activities (Figure 2).

Figure 2. Influence of COVID-19 on innovation

Notes: N=231, N=139, N=225, N=163 (those who adopted) in each column, respectively.

We also explore how adoption patters vary by firm type. In general, smaller firms (with fewer than 50 employees) were less likely to innovate (Figure 3). In a regression analysis where we control for key business characteristics including size, we find that firms that had previously adopted digital technologies were significantly more likely to adopt new technologies, capabilities and practices, and introduce new products. London-based businesses were more likely to have adopted digital technologies, but there is no clear regional pattern to innovation in other measures.

Figure 3. Innovation rates by firm size band

Notes: N=375, N=374, N=371 and N=365 responded to each question.

Firms anticipate that innovations introduced during the pandemic will outlive the crisis, and raise the productivity of workers or allow a reallocation of tasks, rather than substitute workers

The question is whether such changes will be temporary or whether they represent more permanent changes that could improve performance beyond the immediate crisis. We find that over 90% of adopting firms, across the four types of innovation, reported that they intend to continue with these innovations. In addition, across the four types of innovation, around three quarters of innovating firms considered that innovation had a positive impact on profitability. Only a small minority (between 1-10%) reported a negative impact.

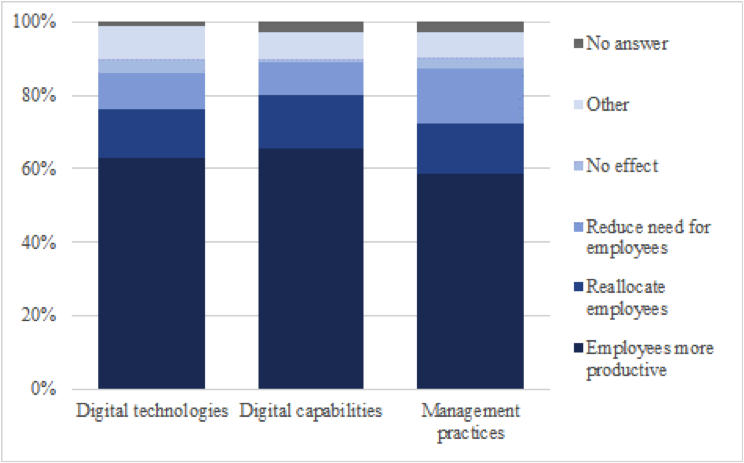

In the case of the adoption of new technologies, capabilities or management practices, we also asked about business expectations on the impact of continued adoption on their existing workforce. Most firms expect that continuing to employ such process innovations will increase the productivity of employees in their current tasks or allow employees to be allocated to more productive tasks (Figure 4). Only a minority (10-15%) consider that such process innovation will imply a reduced need for employees over time. This suggests that the types of technologies or practices in question are not, for the most part, considered by firms to be labour replacing. Amongst those that answered “other”, many highlighted benefits for employees due to the increased workforce flexibility resulting from technology adoption.

Figure 4. Expected workforce impacts of continuing process innovation

New financial incentives are the most popular policy to support continued innovation adoption

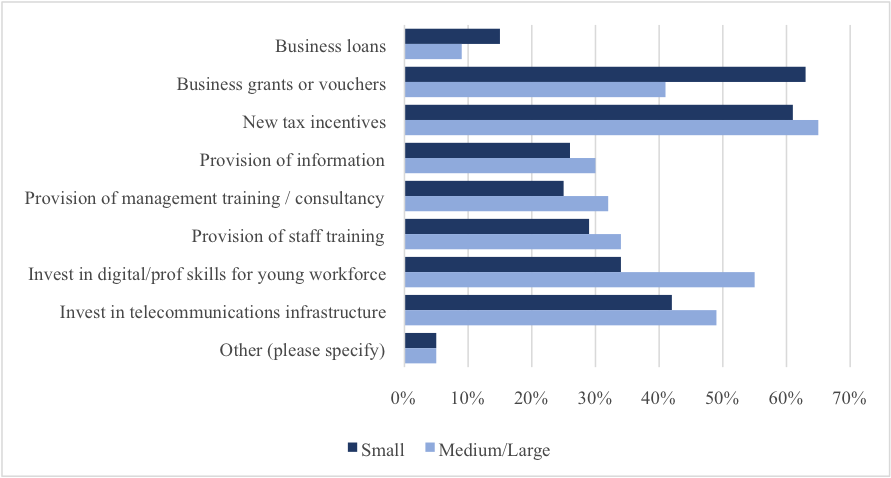

Firms ranked macroeconomic uncertainty and financing constraints as the two largest barriers to investment in new technologies and practices. The two policies considered most useful to support innovation adoption were new tax incentives and business grants or vouchers (Figure 5). Smaller firms in particular welcomed the latter, as well as improvements in telecommunication infrastructure. Larger firms highlight the importance of investments in the digital and professional skills of younger people entering the workforce.

Figure 5. Potential new government assistance schemes for adopting new technologies, capabilities or practices

Notes: N=346 (firms that responded to this question). Firms could select more than one option, so the bars do not sum to 100%.

Looking to the future

The nature of the COVID-19 crisis appears to have accelerated certain types of innovation in a way that previous crises might not have done. Our results highlight a number of positive messages: firms that were forced to adopt innovations during the pandemic expect these to persist after the crisis, to have a positive impact on firm performance and to augment productivity, without substituting workers. Will these innovation activities indeed lead to higher productivity, business growth and hence increased employment? Will businesses continue to seek out and adopt new technologies and practices during the next phase of the COVID-19 crisis and beyond? We will investigate these questions further in our survey and analysis of secondary data one year on.

Authors’ note: This research is funded by the Economic and Social Research Council (ESRC) as part of the UK Research and Innovation’s rapid response to COVID-19. We gratefully acknowledge this funding under grant number ES/V011286/1, together with financial support from the CEP and the ESRC under grants ES/T007702/1 and ES/S001735/1. We also thank CBI Economics for the collaboration.

♣♣♣

Notes:

- This blog post is based on The business response to Covid-19: The CEP-CBI survey on technology adoption, A CEP Covid-19 analysis, Paper No.009.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Timothy Muza on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Capucine Riom is a PhD candidate in economic geography at LSE.

Capucine Riom is a PhD candidate in economic geography at LSE.

Anna Valero is ESRC innovation fellow at LSE’s Centre for Economic Performance (CEP).

Anna Valero is ESRC innovation fellow at LSE’s Centre for Economic Performance (CEP).

Hi, where might the survery be availble to view? I am interested in this very much