Though the reactions of economic activities in the US and globally to FED policy are well documented, the global impacts of unexpected changes in the US monetary policy uncertainty are still less understood. Povilas Lastauskas and Anh D. M. Nguyen highlight the role of uncertainty in generating synchronised worldwide contraction and rationalising the global economy’s slow recovery from global financial crisis. Despite the common wisdom that the US is a large economy with ignorable effects from the rest of the world, the spillback effects are non-trivial.

Uncertainty about the COVID pandemic, trade wars, Brexit-related consequences, the nature and forms of policy interventions, among many other factors, affects the everyday decision-making process of consumers (incentivizes precautionary saving), businesses (leads to lower investment), and policymakers (increases errors and deviations from expected interventions). One of the key safeguards to withstand adverse shocks among advanced economies has been active central bank policy. However, uncertainty regarding monetary policy, especially during turbulent times, can be a source of the problem.

As evidenced in our new paper, an increase in uncertainty about the US policy rate leads to a recessionary and deflationary effect on the US economy, as well as increases in the volatility of output and inflation. In such an environment, as shown by Bloom (2009), firms tend to hold back on investment, thus risking productivity slowdown and lower future growth. In fact, only recently a feedback loop has been documented empirically, when negative shocks to economic activity led to increases in macroeconomic uncertainty, but not the other way around (Lastauskas and Nguyen, 2020, Ludvigson et al., forthcoming). Once in recession, both output and inflation volatilities increase, whereas interest rate volatility is barely affected. It is a source of, not a response to, business cycles.

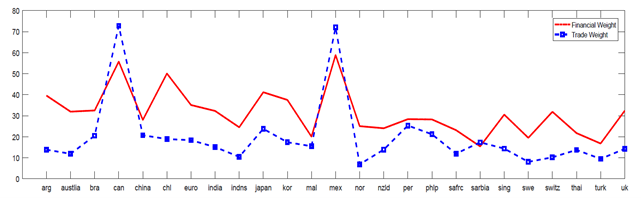

Figure 1. Countries’ bilateral trade weight and financial weight (%) with the US

Notes: Trade weight is the fraction of bilateral trade flows with US. Financial weight is the average of main facets of financial integration (fraction of bilateral financial flows with US) namely, portfolio investment, foreign direct investment, banking claims. The trade data are obtained from Mohaddes and Raissi (2018) and the financial data from Eickmeier and Ng (2015).

Given the US global importance, as shown in Figure 1, a natural question is whether monetary policy volatility shocks can be the source of global business cycles. The answer is a clear yes. Although the magnitudes of US impacts vary by country, the negative effect of increased monetary policy uncertainty prevails. The euro area responds similarly to the US economy, illustrating the importance of US policy for the euro area. The effect on the British economy is more limited when it comes to output and the interest rate. There is also less gravity of the US shock to Japan but a very substantial impact on growth rates in Canada and the Latin American region, which is expected, given geographical proximity and the size of the US economy. Interestingly, though exchange rates do not react significantly across countries, this notion is not true for the Chinese economy. There is evidence that the renminbi has depreciated against the US dollar, lending empirical support to claims that Chinese decision-makers are devaluating China’s currency to make its exports more attractive.

The source of cross-country interdependencies also matters. Financial—rather than goods trade—linkages make the impacts of US monetary policy uncertainty stronger for all economies but Canada and Mexico (Figure 1). For emerging markets, particularly Chile and Argentina, the difference is substantial, but even among advanced economies, like the euro area, Japan, or the UK, the US plays a key role when it comes to financial flows, considerably exceeding linkages through international trade in goods. In particular, financial channels lead to larger adjustments in the euro area’s inflation and output growth, as well as a more aggressive interest rate reaction to the external uncertainty shock from the US. The US economy still dominates the global financial network, and its monetary policy volatility effects reach even those economies that are further away geographically and are less integrated trade-wise.

A global perspective on the different effects of US policy uncertainty on economic fluctuations also enables shedding new light on the possibility of not only spillovers but also spillbacks on the US economy, recently put forward by Obstfeld (2020) and Carney (2019), among others. Given the disproportionate US weight in the global economy and strong spillovers worldwide, adjustments in the rest of the world might fire back to the source of those changes, the US economy. An ECB paper finds that absent global linkages, a substantially smaller effect on output growth, barely any effect on inflation, and a less pronounced reaction in interest rates would have been observed. These spillback effects may thus impact the tradeoffs between price level control and low unemployment or financial stability goals.

Monetary policy in a heavily interdependent world in times of uncertainty can be not only a solution but also a part of the problem. An increase in the uncertainty of interest rates in the US not only does induce a slowdown in the US economy but also generates synchronized global contraction once transmitted through financial channels and strengthens US domestic reaction due to large spillback effects.

♣♣♣

Notes:

- This blog post is based on Global Impacts of US Monetary Policy Uncertainty Shocks ECB Working Paper Series No 2513 / January 2021

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image by Federalreserve, Public domain