The increasing concentration of wealth and economic power calls for policy action to tame the rise of “private leviathans”. Rabah Arezki, Asif Islam and Grégoire Rota-Graziosi argue that, following commodity booms, regulation, especially pertaining to competition, is found to limit concentration of wealth while taxation has little effect. This is consistent with the primacy of ex-ante (preventive) interventions over ex-post (after-the-fact) ones for addressing wealth inequality.

In the late 19th century United States, rising inequality, social tensions and oligarchy led the federal government to reinvent itself as a regulator. The Sherman Antitrust Act of 1890 is the foundational federal statute in the development of U.S. competition law. At the time, the gilded age called for a forceful response by the federal government to curb the rising power of the so-called robber barons, including Cornelius Vanderbilt, John D. Rockefeller and Andrew Carnegie.

Fast forward to today, the global rise of a class of billionaires coupled with heightened social tensions raises important questions about what to do about top wealth and income inequality (Wu, 2018). Concentration of wealth threatens political power, and that is irrespective of political systems. From public auditions in the United States to imprisonment in Saudi-Arabia and Russia, and disappearance in China, billionaires have been in the line of sight of the powers that be.

In a recent paper (Arezki, Islam and Rota-Graziosi, 2021), we explore the interplay between top wealth and policies, namely regulation and taxation, exploiting variation in exposure to international commodity prices.

Commodity booms and billionaires

Several factors drive top income and wealth inequality, namely globalisation, technology, labour market institutions, decline in competition and fiscal policy—or, generally, social norms regarding pay inequality. There are also legal roots to top income inequalities that might explain the pervasive higher returns to capital compared to the rate of GDP growth. On the normative front, there is a heated debate on the best approach to address the rise in top incomes. The dominant approach is either to address institutional factors favouring the ability of top income earners to channel rents their way or to reduce the returns to rent seeking by increasing marginal rates of taxation on high incomes. More recently, a debate has been raging on the use of a wealth tax as an instrument to reduce top incomes (Saez and Zucman, 2019).

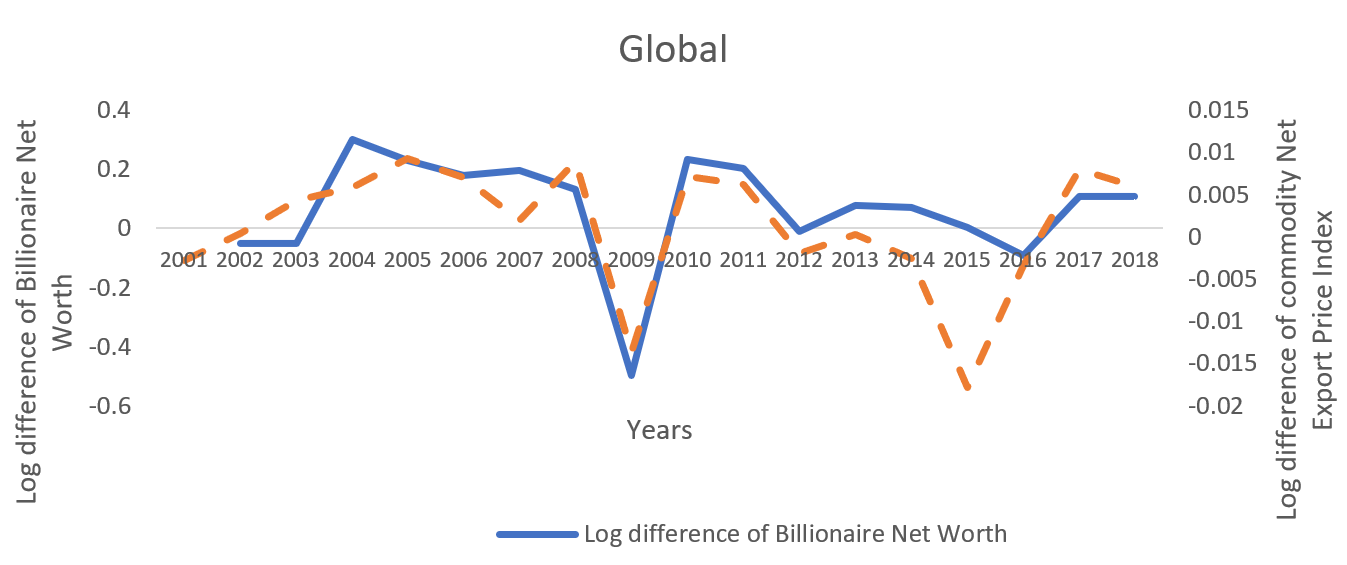

We document that different institutional arrangements lead to a differentiated effect of (plausibly) exogenous commodity price fluctuations on top incomes. To do so, we combine a global panel data set from Forbes magazine on billionaires’ net worth with an index of (country-specific) commodity terms of trade shocks. Commodity shocks are significant sources of macroeconomic variation but also have important sectoral implications that elucidate linkages with concentration of income at the top. Results show that commodity booms lead to top income concentration, and the effect is economically large. Figure 1(a) globally traces the patterns of commodity shocks and the log differences of billionaire net worth and shows that they co-move. Figure 1(b) replicates the same pattern for developed (left panel) and developing economies (right panel) and shows the positive relationship between commodity price shocks and top incomes stand, regardless of the level of development.

This finding is robust to accounting for sector of activity as well as the individual characteristics of billionaires as captured by billionaire fixed effects. The evidence is also suggestive that competition policy weakens the relationship between commodity booms and top incomes, and tax policy has no effect.

Indeed, competition policies and antitrust laws combined with strong enforcement mechanisms have a potentially powerful role to play in shaping the structure of an economy and society over and beyond taxation and redistribution policies. Indeed, protected sectors, cartels or collusion limit the impetus for investment, innovation, and growth (see Aghion and Griffiths, 2005).

Figure 1a. Log differences of billionaire net worth and commodity shocks

Figure 1b. Log differences of billionaire net worth and commodity shocks – developing vs developed economies

Sources: Forbes Magazine Database (2001 to 2018); Gruss et al. (2019).

Resource curse and top wealth

The “resource curse” literature has provided (mixed) empirical evidence that countries with large dependence on natural resources grow slower and are also more unequal. Importantly, Mehlum, et al (2006) provide evidence that the effect of natural resources on the economy depends on the quality of institutions. Furthermore, the type of natural resource matters, with hydrocarbon and mineral resources categorised as “point source” resources, having a more detrimental impact on growth than “diffuse” resources such as agriculture. We contribute to this literature by focusing on the top incomes as opposed to general income inequality while exploring the role of different policy/institutional frameworks. We also find that commodity price shocks emanating from point-source resources lead to more top income concentration than shocks stemming from diffuse resources.

Further, we find that commodity price shocks reduce non-resource taxes, both direct and indirect. Our findings relate to the volatility of public budgets due to commodity price volatility and the resource curse in terms of public finances. James (2015) establishes a negative relationship between resource and non-resource revenues as the expression of a crowding out effect between these sources of revenue in US states. Our findings further document that certain institutional arrangements such as competition policy framework can help curb the rise in the concentration of wealth.

Capital mobility and tax havens as the main sources of leakages

Globalisation has led to a significant decrease in the cost of international capital mobility. In turn, this has fuelled intense tax competition, which offers multiple opportunities to shift profits to wealth in tax-accommodating countries or tax havens. Any tax coordination at the international level is rendered difficult or nearly impossible. This may explain why taxation appears less efficient than regulation to tame top wealth inequalities. Ten per cent of world wealth is held in tax havens. Andersen et al. (2017) find that around 15% of the windfall gains accruing to petroleum-producing countries with autocratic rulers is diverted to secret accounts.

The emerging debate on curbing top incomes has centred around the wealth tax. There is indeed a strong theoretical case for a wealth tax especially after calamities such as wars and pandemics, yet its implementation and effectiveness have been challenged. Indeed, with the advent of financial globalization, capital markets provide multiple options of tax avoidance or evasion. We find empirically that (both resource and non-resource) taxation do not moderate the effect of commodity booms on top incomes.

♣♣♣

Notes:

- This blog post is based on “Taming Private Leviathans: Regulation versus Taxation,” OxCarre Working Papers 226, Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image by CHUTTERSNAP on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy