Peter Lambert and John Van Reenen use Office for National Statistics (ONS) data to track how UK businesses view their risks of bankruptcy over the next three months. They find that one in eight businesses – covering 1.9 million jobs – are at risk of failure by July 2021. One-third fewer businesses report having “low” or “no” chance of survival today (mid-April 2021), compared to the January 2021 peak. The extensions to COVID business support schemes have helped avert a wave of bankruptcies, but risks remain.

To look at business perceptions of survival, we use survey data collected by the Office of National Statistics (ONS). We focus on the question in the Business Impact of COVID-19 Survey (BICS), which is collected roughly every two weeks. It asks: “How much confidence does your business have that it will survive the next three months?” We classify the proportion of businesses who respond with “low” or “no” chance of survival as being at risk of closing down permanently.

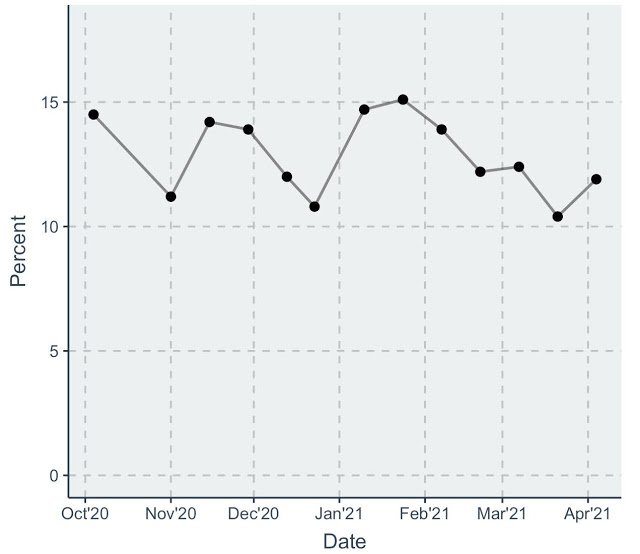

The survey question has been asked since mid-October 2020 and Figure 1 shows that between 10% and 15% of businesses see themselves at risk of failure over the next three months. The numbers jumped up to 15% at the height of the second wave of the pandemic, from mid-December to mid- January, but have been in decline since then.

Figure 1: Percentage of businesses at risk of exit

Note: Data comes from the Business Impact of COVID-19 Survey (BICS). Our measure of “at-risk” firms is defined as those businesses answering that they had “low” or “no confidence” to the question “How much confidence does your business have that it will survive the next three months?” The BICS survey samples roughly 10,000 businesses every two weeks. We take the closing date of the survey sample window as the date. This question was included in the survey from Wave-collected responses to this question from Wave 14 (21st Sept 2020 – 4th Oct 2020) to the most recent Wave 27 (22nd March 2021 – 4th Apr 2021) (excluding Wave 15). The responses are weighted to make them representative (based on the Inter-Departmental Business Register, the sampling frame for the BICS).

This downward trend since January is encouraging. While it is possible the numbers improved precisely because of a large wave of bankruptcies, through a sample selection effect, on balance we see the fall in at-risk businesses as a positive outcome. But recent data (Wave 27 of BICS) suggests 315,000 registered businesses are at risk of exit by July 2021. (This figure is derived based on the most recent Business Population Estimates (BPE), from January 2020. For an outline of the methodology applied, see Appendix A in our earlier report.) These 315,000 businesses represent around one in eight UK firms. If we extrapolate out these data to cover all businesses (both registered and unregistered) then over 740,000 businesses are at risk. Should all these businesses exit, roughly 1.9 million jobs would be lost. The knock-on effects of this would be severe in terms of financial and macroeconomic stability.

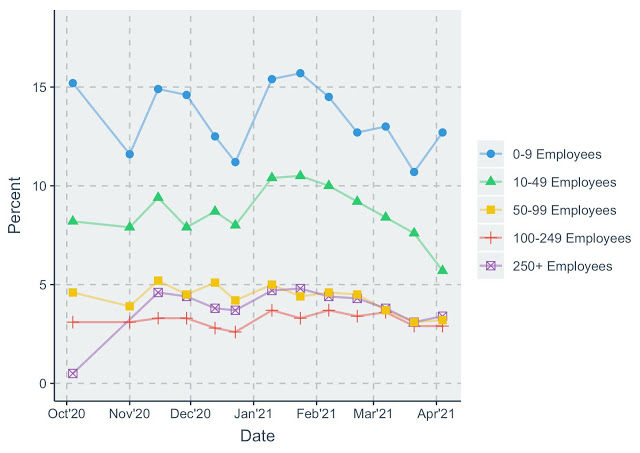

Figure 2 shows how the risk of failure breaks down depending on the size of the firm. Unsurprisingly, the smaller the firm the greater the risk of failure. Indeed, the recent improvement in survival chances is led by firms with under 50 employees (particularly in the 10-50 size range).

Figure 2: Percentage of businesses at risk of exit, broken down by firm size

Note: Data comes from the Business Impact of COVID-19 Survey (BICS). Our measure of “at-risk” firms is defined as those businesses answering that they had “low” or “no confidence” to the question “How much confidence does your business have that it will survive the next three months?” The BICS survey samples roughly 10,000 businesses every two weeks. We take the closing date of the survey sample window as the date. This question was included in the survey from Wave-collected responses to this question from Wave 14 (21st Sept 2020 – 4th Oct 2020) to the recent Wave 27 (22nd March 2021 – 4th Apr 2021) (excluding Wave 15). The responses within each firm size band are weighted to make them representative, based on the Inter-Departmental Business Register (IDBR).

Changes since our last report

In January 2021, together with the Alliance for Full Employment, we published a report on the extent of the crisis facing UK businesses due to the COVID-19 pandemic. Based on the latest data available at the time, we reported that one in seven businesses had low prospects of surviving to April (covering 2.5 million workers in registered and unregistered businesses) at which time many of the policy support schemes were set to end. Two scenarios were possible: extend policy support well into 2021 or else risk a huge wave of bankruptcies. Fortunately, the second path was taken. In the lead up to the March 2021 budget, the UK government announced that the policies keeping business afloat would be extended.

The furlough scheme—which was originally to end in April 2021—was extended through to September 2021 (with co-contributions by employers commencing in July). The payment of VAT balances can now be spread over eleven interest-free instalments culminating in Feb 2022. Various publicly backed loan schemes were also bolstered and extended.

The extensions were welcome, although waiting until weeks before the cliff-edge was too late for many businesses and the uncertainty is likely to have chilled investment and hiring. It is still too early to tell whether a wave of businesses did indeed exit already. Even in normal times, business deaths (i.e., permanent closures) do not show up in the data until around three months after the event.

What lesson can we learn?

While the vast vaccine rollout and diminished COVID case numbers are cause for optimism, and the extensions to various policy lifelines supporting UK businesses seems to have reduced the number of businesses currently at risk of bankruptcy, we are far from out of the woods.

Should further measures be needed to avoid a large wave of bankruptcies, the government ought to be prepared to announce these well in advance of any policy cliff edges to reduce uncertainty as much as is feasible.

♣♣♣

Notes:

- This blog post appeared first on the blog of the Programme on Innovation and Diffusion.

- The post expresses the views of its author(s), and do not necessarily represent those of LSE Business Review or the London School of Economics.

- Featured image by Juan Sisinni on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy