CEO turnovers are significant organisational events that typically mark a discontinuity in firm strategy and operations. These likely changes are visible in internal communication flows. Stephen Michael Impink, Andrea Prat, and Raffaella Sadun study these flows in a novel way: they explore the evolution of internal communications metadata on emails and meetings for 102 firms that experienced a CEO change.

Employee communication is essential to developing knowledge, creating organisational memory, and for decision-making within firms. Information flows enable firms to develop and execute their strategies and have been considered critical to the functioning of organisations at least since Coase’s seminal paper. However, characterising communication flows is typically a difficult challenge within a single firm and even more difficult in a comparable and rigorous way across multiple organisations. But the recent availability of rich within-firm communications metadata relative to the intensity of emails and meetings may be able to provide new insights into these previously unobservable aspects of firm behaviour.

In our paper, we partnered with an email provider to explore the evolution of internal communications metadata on emails and meetings for 102 firms that experienced a CEO change. CEO turnovers are significant organisational events that typically mark a discontinuity in firm strategy and operations. The new CEO enters with fresh ideas and often changes top management teams to align with her objectives and vision of success. We were interested in understanding whether and how these likely changes would be visible in internal communication flows. To study this question, we set up an event study approach that allows us to document the evolution of internal communication flows over time. The study is novel in two ways: it relies on firm-level objective and passively captured communications metadata from a large number of firms, and it explores these data in light of a similar type of organisational event.

Communication declines directly after a CEO changes and returns to normal around four months later

After a CEO change, within-firm communication (emails and meetings) decreases across all management levels in the short term (within four months from the CEO transition). In the medium term, beginning four months after the CEO change, communication recovers and then increases to higher levels relative to pre-CEO change levels.

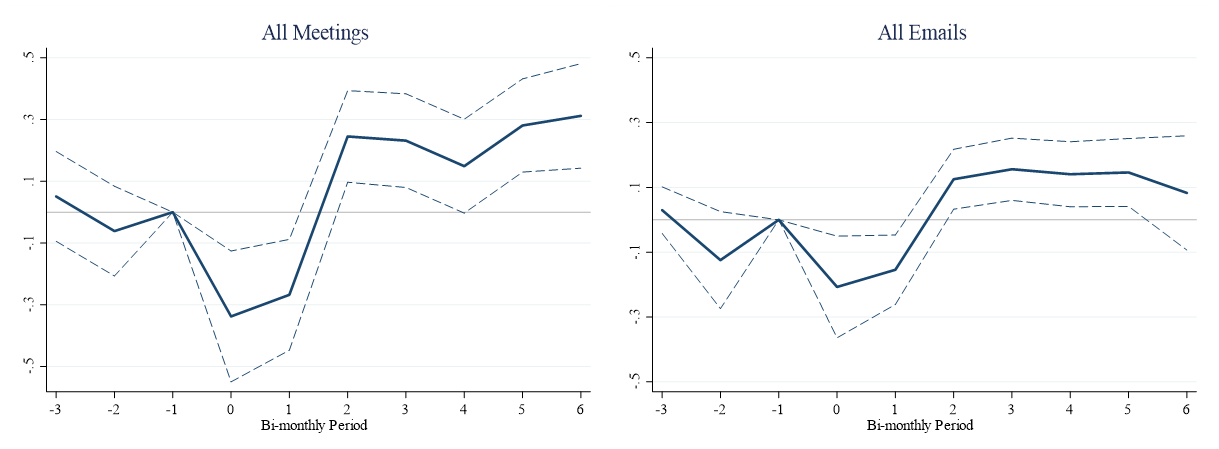

Figure 1. OLS regression coefficients on bimonthly dummies for total meeting count (left) and email count (right) in the full sample of 102 firms

Notes: The graphs plot the OLS regression coefficients on bimonthly dummies for total meeting count (left) and email count (right) in the full sample of 102 firms. The CEO change occurs in Period 0. We use the period before the transition, Period -1, as the event study’s base period. These results include firm-level fixed effects and standard errors clustered at the firm level.

The increase in communication in the medium run stems from greater interactions between managers and independent workers

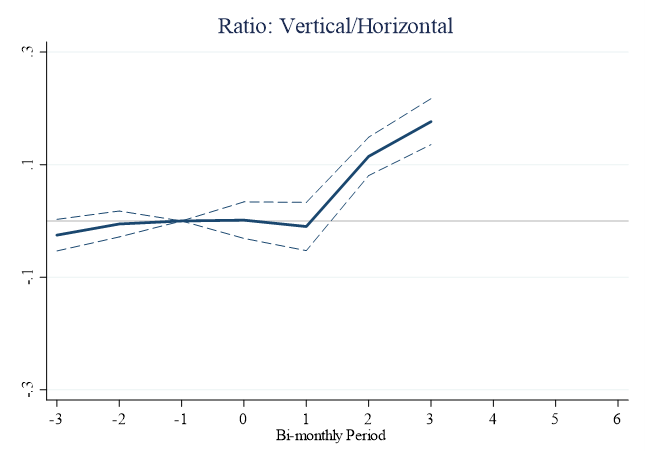

We develop horizontal and vertical communication measures to explore how the nature of communication flows evolved over time. In this classification, horizontal communication occurs between peers, such as manager to manager or individual contributor to individual contributor, while vertical communication occurs when information flows across levels of the hierarchy, such as meetings between managers and individual contributors. The data show that vertical communication increases faster than horizontal communication in the medium run. We interpret these findings within the context of a seminal theoretical model developed by Alonso, Dessein, and Matouchek: to the extent that a leadership change increases misalignment within the firm (for example, if there is uncertainty about future priorities chosen by the new CEO), vertical communication, which mimics aspects of a more centralised information flow, may be a more efficient way to re-establish efficient coordination patterns.

Figure 2. Ratio of vertical to horizontal meeting counts over time

Note: The graph shows the evolution of the ratio of vertical to horizontal meeting counts over time. The sample consists of 88 firms.

Firms that overcome the decline in communication more quickly perform better than those that do not

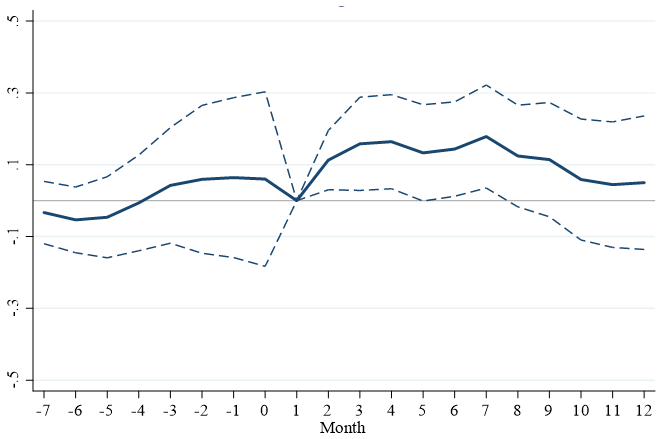

Lastly, we correlate changes in communication in the earlier months of the CEO change (months 2-6) to French-Fama cumulative stock market returns for public firms gained during the year after CEO change. In a subsample of firms (52 publicly traded firms), firms that experience a greater increase in communication after the CEO change also perform better a year later. We do not interpret this correlation causally. Instead, the types of CEOs that can overcome the initial lull in communication have other unmeasured capabilities that allow them also to influence firm performance positively.

Figure 3. Low and high communication firms

Notes: Firms are divided into low and high communication, each including 26 firms, based on whether the change in communication between month two and month six after the CEO change was above or below the sample median.

In summary, communications metadata represent a new way to explore how organisational events map into differences in internal communication flows. We see promise in using email and meetings metadata—typically already passively collected by firms—to study unobserved aspects of the inner workings of organisations. We hope that our study can provide a possible blueprint to advance the exploration of these data, while at the same preserving the confidentiality of employees and firms.

♣♣♣

Notes:

- This blog post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Christina @ wocintechchat.com on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.