The majority of firms saw business grow between April and October 2021, after the shocks of COVID-19 and Brexit in 2020. But a new analysis by Swati Dhingra and Josh De Lyon into firms’ experiences and expectations for the British economy shows confidence for the coming months is dipping. They find extensive labour shortages prevalent across all industries. Prices and wages are rising, but the growth rate of prices is catching up with nominal wage growth.

The UK economy is experiencing turbulence. Numerous shocks – some global and some specific to the UK – could be driving these rapid economic changes.

After the pandemic-induced recession in 2020, economic activity has been on the rise as vaccines have been rolled out. Yet the recovery has been restricted. Global supply chains have been disrupted by factory closures, fractured transport networks, labour disruptions and rising energy prices. The experience of the UK in dealing with these issues has been made harder by Brexit, which significantly increased barriers to trade, investment, and migration with its closest and largest economic partner.

In its monthly survey of members and non-members, the Confederation of British Industry (CBI) – the UK’s largest business organisation – asks firms about the factors affecting their performance, and their expectations for the next three months. The data covers most sectors of the economy, though manufacturing is oversampled in the results presented below.

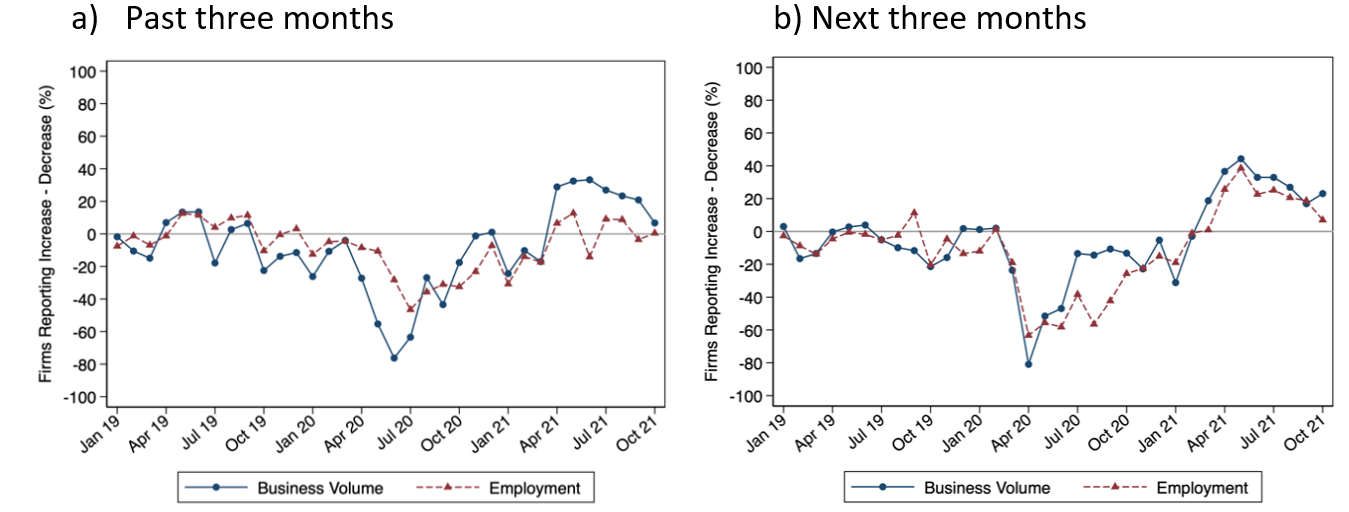

Our analysis of this survey’s data shows that the majority of firms have been increasing their volume of business every month since April 2021 (Figure 1a). But this trend is in decline and in October 2021 the shares of firms increasing and decreasing their business volumes are roughly equal. The decline is mirrored in expectations, shown in Figure 1b, which are also becoming less optimistic.

Figure 1. A high share of firms reported increased business volumes throughout the summer but this has slowed

We also find the average growth in firms’ prices reflects their average wage growth, and that firms are expecting these price increases to continue, alongside rising wages – potentially creating some persistent inflation. The rate of growth in prices is catching up with growth of nominal wages, putting a squeeze on real wage growth.

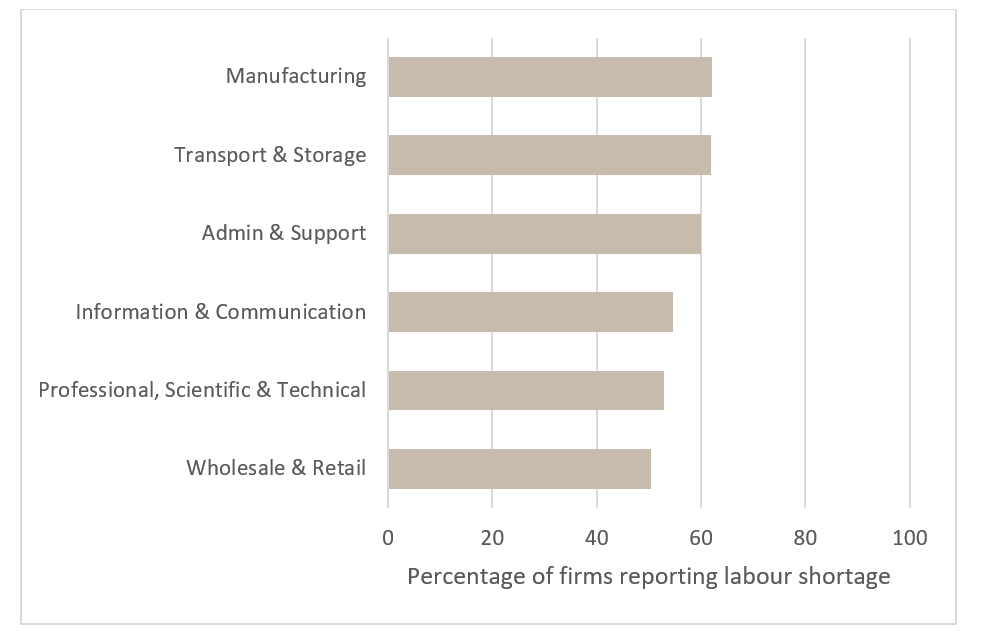

Firms are now less optimistic about future growth than they were over the summer of 2021. The survey data suggests that firms across all sectors of the economy are reporting labour shortages at the pay rates that they are offering, with at least half of all businesses experiencing a shortage of workers in each sector (Figure 2).

Figure 2. A high share of firms in all sectors and of all sizes are reporting labour shortages

Approximately half of firms are having difficulty recruiting new workers while around one in five firms are having issues retaining existing staff. One reason for these labour shortages is simply that the pandemic and, in part, Brexit have caused a major restructuring of economic activity. The shocks hitting the economy have been substantial and rapid, and labour markets are still adjusting to them.

For some sectors, particularly those that rely on short term or seasonal migrant workers, Brexit appears to be having an effect. Government data shows that the proportion of short-term migrant visas given to workers from the EU is now close to 0 per cent. Before Brexit, almost all short-term workers came from the EU. But, overall, migration is unlikely to be the main cause of labour shortages. Approximately one in 10 firms in our sample report that the UK’s point-based immigration regime is causing labour shortages

The furlough scheme is unlikely to have contributed significantly to labour shortages. At the end of September, approximately four per cent of the workforce was on furlough. The majority of those who leave furlough return to their previous jobs (Tomlinson, 2021).

Around a third of firms say that they have responded to labour shortages by raising wages, and around 20 per cent of firms have responded to labour shortages by investing in new technologies.

Nearly half of firms expect labour shortages to last more than one year, and 21 per cent say more than two years.

One in five businesses have also reported that long term skills gaps are affecting their ability to recruit workers. Relative to other OECD countries, a high share of the UK workforce has university degrees, but the UK clearly lags on technical and vocational skills, and the share of the workforce considered to be underqualified for work is well above the OECD average

Policymakers can support the economy in adjusting to these large shocks. Employment in the UK is back to pre-pandemic levels, yet total hours worked and output are not. Vacancies have been high, and a lack of specific skills can restrict the ability of firms to fill vacancies.

Policies could encourage firms to invest in training workers. There are already tax credits provided to firms that invest in physical capital but not for those investing in human capital (Costa et al 2018). Providing human capital tax credits will help to incentivise firms to hire workers and train them in-house, reducing the emphasis on other forms of training

There are concerns that the current apprenticeship levy does not sufficiently incentivise firms to offer apprenticeships to younger workers, for whom the returns are higher, so the fund could be repurposed to specifically address this (Major and Machin 2020, CBI 2020). Improving skills will address labour shortages although this may be a more long-term fix, promoting productivity, wages and social mobility.

Migration policy can provide a short-term fix to labour shortages that are localised to particular sectors. But it needs to be nuanced and integrated into an overall economic strategy.

♣♣♣

Notes:

- This blog post is based on Real-time updates on the UK economy: trends, expectations and implications from business survey data, CEP Covid-19 analysis No 26

- The post expresses the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image by CHUTTERSNAP on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.