Germany depends on Russia for about one-third of total energy consumption. If it is cut off from Russian energy imports, it will need to compensate either through alternative supply sources, fuel shifting and economic reallocation, or demand reduction. In this scenario, the macroeconomic effects highly depend on how much the production structure can adjust to the reduction of fossil energy imports and on how substitutable these imports from Russia are by imports from other suppliers. Benjamin Moll analyses the situation and makes policy recommendations.

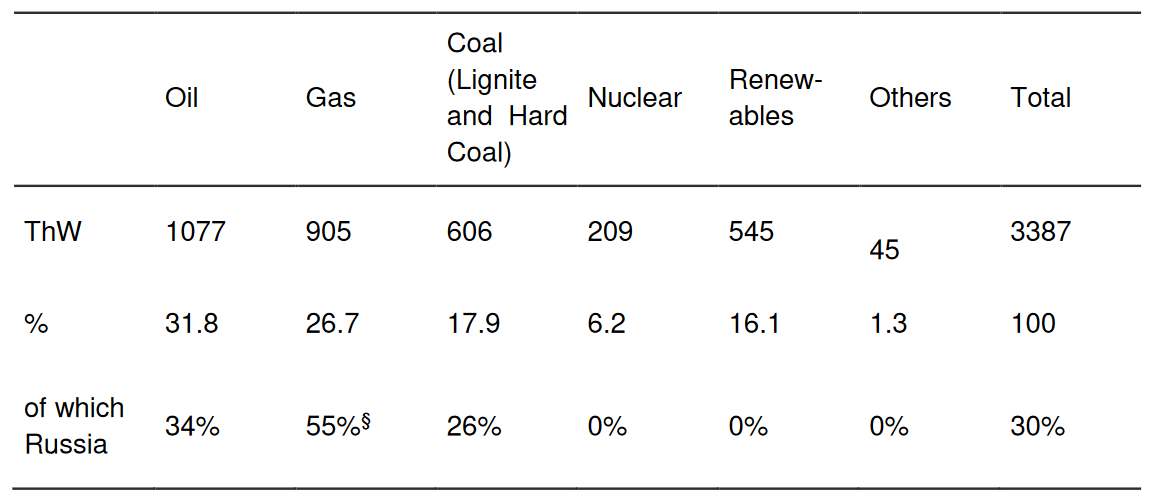

Germany imports about 60% of the energy it uses (World Bank 2022), with import quotas between 94% and 100% for oil, gas, and hard coal (Umweltbundesamt 2022). In 2021, the value of fossil fuel and electricity imports amounted to about 80 billion euros, or slightly over 2% of GDP (Statistisches Bundesamt (2022b). About half of German imports of gas and hard coal, and about one third of its oil imports originate from Russia. Germany depends on Russia for about 1/3 of total energy consumption (Table 1).

Total goods imports from Russia in 2021, including other products, stood at 33 billion euros (Statistisches Bundesamt 2022a). Trade with Russia accounts for only 2.3% of total German trade. In the German economy, gas is predominantly used by industries (36%), households (31%), and trade and commerce (13%), in the case of the last two, predominantly for heating purposes (BDEW 2019, 2021). The usage of gas for electricity production is comparatively small. In industry, about three quarters of the gas are used for heating and cooling, as well as for material use. About a third of industrial use comes from the chemical industry (Zukunft Gas 2022). Regarding the use of hard coal, about ⅗ went to the steel industry and ⅝ to public electricity generation in 2018 (Sandau et al. 2021). Oil was predominantly (about 75% in 2017) used in the form of gasoline and diesel fuels (Wissenschaftliche Dienste des Deutschen Bundestages 2019).

Table 1. German primary energy usage 2021

Notes: § in 2020 – already lower in 2021 and 2022. Source: Agora Energiewende (2022); Eckert, and Abnett (2022)

If Germany is cut off from Russian energy imports, it will need to compensate either through alternative supply sources, fuel shifting and economic reallocation, or demand reduction. The different channels are likely to operate differently in the short and long term. In the short run, a stop of imports from Russia has to be compensated through alternative energy sources from other countries and domestic sources to meet electricity, transport, heating and industrial demand, or through substituting energy-intense production of certain products by direct imports. In the medium and long term, increased use of renewable energy and energy efficiency improvements can contribute significantly to lowering energy demand.

To start with, substituting Russian imports of oil and coal will likely not pose a major problem. Sufficient world market capacity exists from other oil and coal exporting countries to make up the shortfall. The greater challenge is to find short-run substitutes for Russian gas, which accounts for about 15% of Germany’s total energy consumption. While oil and coal can be shipped from other countries, the situation in the gas market is more complex. Owing to the existing pipeline network and ultimately limited terminal capacities, a short-term substitution via LNG is challenging, while raising pipeline imports from other countries is also subject to limitations.

The IEA estimates that imports via pipeline to the EU from Norway, Algeria and Azerbaijan could be increased by 10 billion cubic meters (bcm) compared to 155 bcm imports from Russia in 2021, and LNG imports theoretically by 60 bmc (up from 110 bcm in 2021 (Rashad, and Binnie 2022)). The IEA considers 20 bcm additional LNG more realistic in the current market (IEA 2022). Some of this gas would have to be stored pre-winter to compensate for missing Russian gas in the cold months. Moreover, switching from comparatively cheap contracts with Russia to world market spot prices would imply a currently five-fold increase in gas prices.

A recent study by Bruegel (2022) concludes that it will be possible, through substitution and European cooperation, to meet demand in electricity generation, transport, and heating in the EU without encountering physical shortages (McWilliams et al. 2022a, 2022b). In its 10-point-plan to reduce the European dependency on Russian gas, the IEA (2022) also lists increasing coal and nuclear power production and renewables deployment as well as a number of demand-related measures that could theoretically contribute another 33 bmc reduction of gas usage in the EU. While switching to coal or nuclear can be considered plannable options, it remains uncertain to which extent potentials from changing consumer heating habits, increasing renewables deployment and energy efficiency of buildings can be raised. Most likely, at least the later two options will play a minor role in the very short run.

Fukushima

There are few historic examples of energy supply disruptions on the scale of a potential Russian energy import stop. Comparisons might be drawn to the shutdown of nuclear power plants in Japan following Fukushima. Nuclear power at the time generated about 30% of electricity in Japan, which was almost driven to zero in a time span of one year. Estimates show that the shutdown of nuclear power plants increased electricity prices, depending on the initial energy mix of a region, between 10% and 40% (Neidell, Uchida, and Veronesi 2019). This being said, with respect to overall energy consumption, nuclear energy accounted for only 13% in 2010 and due to previous overinvestment in LNG import capacities, substitution by natural gas was not subject to physical limits (Nesheiwat, and Cross 2013).

Germany’s imports of Russian gas already decreased substantially in the second half of 2021 and especially in the first months of 2022. In the EU, the share of Russian imports of gas fell from about 40% to 20-30% (McWilliams, Sgaravatti, and Zachmann 2021). Liquified natural gas (LNG) surpassed Russian imports, although capacity for further increases of LNG imports are limited (Rashad and Binnie 2022). During the last few months, prices for coal, oil and gas have already increased dramatically. It remains hard to pin down to what extent gas, hard coal and oil prices will rise further in the short term and what scenarios are priced in.

It is clear that prices had already increased before the Ukraine war broke out due to the revitalisation of the world economy when COVID restrictions were lifted, the appreciation of the US dollar, and, in the case of oil, the reluctance of OPEC to increase extraction substantially. Taken together, the available evidence suggests at this point in time that other gas producers will only be partially able to make up the shortfall from Russia. Substitution and reallocation will thus be crucial.

Macroeconomic effects

Using a state-of-the-art multi-sector macro model with production networks based on work by Baqaae and Farhi (2021), we estimate the economic costs for the German economy of stopping Russian energy imports. The size of economic losses depends crucially on the time frame over which adjustments take place.

It is implausible to assume that even in the short run the elasticity of substitution is zero. Producers and households will switch to other inputs to some extent, change their consumption baskets, or outrightly import energy, especially gas, or products with high energy content that can be transported in bulk.

In the estimated model, for low elasticities of substitution, the Baqaee-Farhi multi-sector model predicts modest losses of around 0.2-0.3% of German Gross National Expenditure (GNE), or around €80-120 per year per German citizen. GNE is about 94% of German GDP so that the corresponding GDP effects are somewhat smaller and remain firmly below 1%.

Given its potential to increase the profit share of foreign energy importers, the shock has some elements of a shock to markups, which are more difficult to deal with for the central bank as they raise a conflict between stabilising output and inflation.

At the same time, fiscal policy needs and can in principle take care of second-round demand effects through insurance mechanisms (like short-term work). With appropriately calibrated demand-side stabilization policies, it should in principle be possible to avoid additional costs.

This being said, it is important to note that our estimations assume that such second round effects can be avoided and potential problems in the financial sector through bad loans or house price declines in specific regions and industries can be dealt with without further amplification. We also assume that central bank policy avoids a potentially costly inflation surge that unanchors the inflation expectations of the public. If such costs are important in reality, e.g. because of a suboptimal policy response, they need to be added to the economic costs identified by our analysis. Preliminary analysis suggests that such effects would still keep the total costs easily within the 3% worst case scenario identified by our analysis.

Policy implications

The macroeconomic effects highly depend on how much the production structure can adjust to the reduction of fossil energy imports and on how substitutable these imports from Russia are by imports from other suppliers. In the very short run, this substitutability is of course limited and depends on the final usage of these fossil resources. Electricity production can adjust quickly and at relatively low costs while replacing their material use, for example, will be more difficult, up to impossible. However, the overall economic costs can be affected by targeted policy measures and their timing.

Here are ten policy suggestions:

1. Incentives to substitute: Policy measures should aim at strategically increasing incentives to substitute and save fossil energies as soon as possible even if an embargo is not imminent. Beginning to take action immediately avoids even harsher adjustments later this year or in 2023 should push come to shove.

2. Insurance schemes delay adjustments: Existing insurance schemes (e.g., emergency rationing plans for gas to favour households, expected bail outs for affected industries), have a tendency to lull decision makers in industry and households into not fully internalising potential costs of delaying their adjustments. They might be induced to gamble on a no-embargo scenario with a normalisation of energy prices. This, in turn, might severely limit political options to strengthen the sanctions regime down the road.

3. The earlier the better: If an embargo of Russian energy turns into a political necessity in the short run, such action has the lowest economic costs if it is taken as early as possible. The main reason is the seasonality of gas demand. A cut-off from Russian gas over the summer months could be substituted from Norwegian and other sources, keeping industrial supply going. An early move would immediately trigger the substitution and reallocation dynamics that are central to reducing economic costs. One caveat: it is not clear whether it will be possible to fill up storage capacities during the summer if Russian imports are stopped now. A continuation of Russian gas imports today might reduce uncertainty of whether this will be feasible. Otherwise, the economic costs of an embargo might be considerably higher and give additional leverage to Russia.

4. Extended periods of higher fossil prices: Governments should commit to elevated fossil energy prices for an extended period of time even if no embargo realises. This could include, for example, some sort of “energy security levy” on natural gas. It also means that there should be a firm commitment to climate policy-driven increases in energy prices. This implies support for tightening the EU emission trading scheme as planned in the EU’s Fit for 55 Package. More importantly, however, this also makes a case for increasing German CO2-prices that are predominantly levied on mobility and heating. This would also prepare these sectors for the introduction of a EU emission trading system as intended in the EU Fit for 55 package.

5. Distribution effects: Of course, a persistent increase in energy prices would have implications for households as well as industry. As we have seen, the costs are distributed relatively evenly across households but would still need to be addressed with respect to the poor. In case of no embargo realising, CO2-pricing and/or a “energy security levy” would create government revenues that can be used to finance such measures.

6. Targeted policies to accelerate the transition: Regarding industry, a blanket compensation for higher energy prices cannot be efficient. However, targeted policies can help adjustment in the short-term if the long-term outlook for an industry under lower energy use or a fuel switch is positive. This way, such policies have the potential to accelerate the transition to a carbon-neutral economy.

7. Energy infrastructure: Given the higher costs of adjustment in the short compared to the long run, it makes a difference if an LNG terminal is ready by autumn 2023 or 2026. Government subsidies and contracts should therefore create clear incentives here as well, providing substantially higher payments under early completion. This includes encouraging private investors to privately assume risks, like when Tesla builds a factory without all constructions being finally approved by the public authorities. This will increase costs, but it is important to view these as an insurance premium. If no embargo realises, having LNG terminals ready earlier serves little purpose, but in case of an embargo, they are of great value. This also needs to be taken into account when designing the public processes of approval.

8. Consequences for households: While power shortages or cold homes are highly unlikely, rising energy prices will be felt acutely. One concrete remedy could be to rebate (artificially) increased gas, oil and electricity prices through lump-sum payments. If not only poor households are targeted, these payments could be made independent of income purely on a per capita basis. This still would have regressive effects without impeding the incentives to reduce energy consumption. Alternatively, such a scheme could be carried out by gas or power providers who would then be compensated by the state. This would allow for the lump-sum payments to be based on actual past energy consumption, which would, however, also imply that higher income households, on average having higher absolute heating and electricity expenditures, would receive more.

9. Other policies targeting poor households: One option would be to increase the basic amount of social assistance payments (“Hartz IV Regelsatz”), or the housing allowance. Also, lowering electricity prices through a reduction of the electricity tax would help poor households most and, at the same time, incentivise the use of increasingly green electricity in mobility and heating. Furthermore, regarding adjustments of the tax system, raising the basic allowance of the personal income tax is one of the measures suggested by the German government. Increasing Hartz IV and the basic allowance of the personal income tax both by 5% (10%) each could result in total fiscal costs of approximately 5 (10) billion euro per year while slightly reducing inequality and poverty. This being said, a more targeted policy towards low-income households would likely be more cost effective and hence preferred – not only from an efficiency point of view but also a redistributive one.

10. Adjusting energy price increases: In case of an actual embargo and consequently rising energy prices, additional measures raising energy prices should be dropped or adjusted. Payments to households would still be necessary to avoid economic hardship but should be decreased over time to induce investments and behavioural adjustments. Given their temporary nature, these payments could in the meantime be financed through government debt.

♣♣♣

Notes:

- This blog post is a slightly edited excerpt of “What if? The Economic Effects for Germany of a Stop of Energy Imports from Russia”, by Rüdiger Bachmann, David Baqaee, Christian Bayer, Moritz Kuhn, Andreas Löschel, Benjamin Moll, Andreas Peichl, Karen Pittel, and Moritz Schularick*, Econtribute Policy Brief N. 28, March 2022

- The post represents the views of its author(s), not necessarily those of the Grantham Research Institute, LSE Business Review or the London School of Economics and Political Science.

- Featured image by Robzor, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Why do you not explain the mechanism by which Germany became so dependant on Russian gas?

Mark Austin